Macro Theme:

Key dates ahead:

- 4/2: Tariff Deadline

3/25: April 2 Tariff Scenario:

- In a positive outcome, we’d look for a move into 5,950, with major resistance at 6,000. This area is also where we believe vanna fuel would be totally “burned off” with VIX hitting 14’s

- In a negative outcome, the immediate downside support level to watch is 5,500. We see soft support <=5,500, with room for vol to increase. For this reason we look for a move to 5,400 in a risk-off move.

3/27: Vol continues to look cheap after the 3/26 ~1% SPX decline ahead of GDP/Jobs data today (3/27), Core PCE tomorrow (3/28), the JPM expiry (3/31) and an alleged tariff announcement on 4/2. This implies that “wingy” put structures (ex: put spreads, put flies) centered near the JPM 5,565 strike into 3/31 offer interesting risk/reward. Additionally, we like 1-month put spread hedges in case of a “no deal” or “hanging chad” tariff outcome (per the 3/25 update, below). ✅

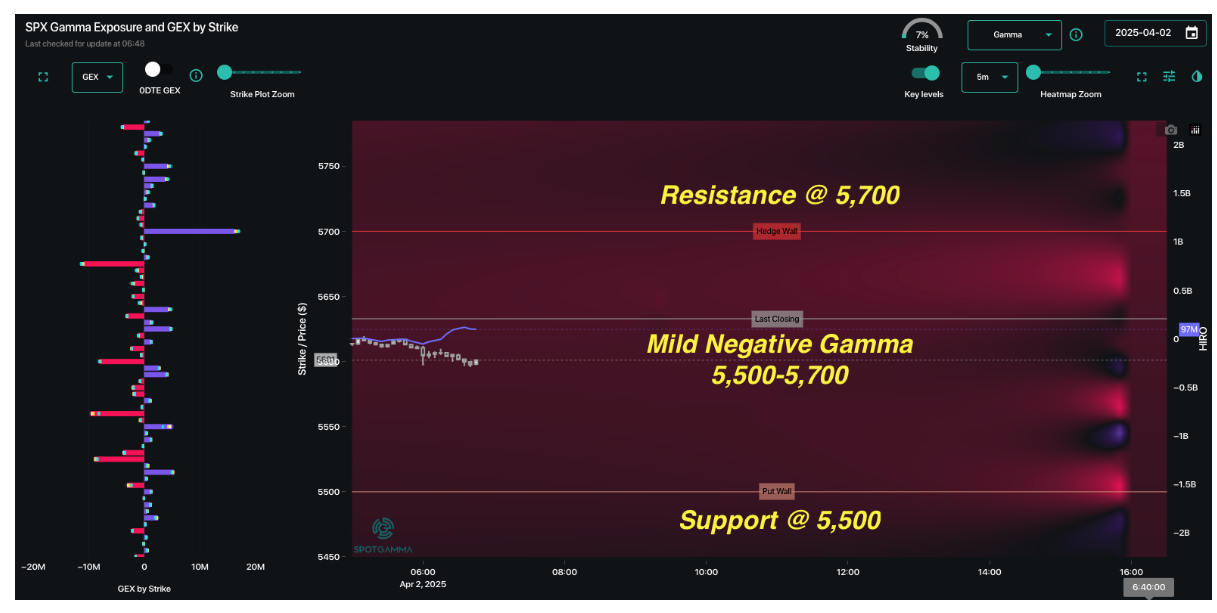

Key SG levels for the SPX are:

- Resistance: 5,700

- Support: 5,500, 5,400

Founder’s Note:

Futures are -50bps ahead of alleged tariff announcements. Per the WSJ, its not until 4pm ET that Trump will make announcements. That fact makes today more of a “waiting day”.

Given that, vols have perked up a bit after we last night noted that IV’s were decaying into tariff day. Along with mildly higher IV, we see that dealer gamma, which was last night projected to be slightly positive, holds a slightly negative stance. This suggests price could be rather fluid in and around 5,600, as it was yesterday (there were 3 moves of >1% y’day). Quite frankly, given the 4PM Trump appearance, we think direction today is whichever way the 0DTE traders want to swing it (much like yesterday).

Focus today may be better spent on zooming out – how do we position for post-deal flow?

It seems nearly impossible to state what a “good”, “bad”, or neutral outcome even is. With that in mind, its about pricing/positioning for however the market reacts to whatever the news is. Accordingly, we think that a cheap upside play (outlined below) makes sense, as the market zeitgeist is pretty negative. That likely means that a “good”, or even “not so bad” outcome generates a pretty strong rally, and as last week showed, traders are chomping to sell vol. For this reason, we think owning some right tail structures before the event has merit.

To the downside, our actual gut is to “do nothing”. We don’t think downside options are particularly cheap, and we think a lot of people are mispricing a “no clear outcome” perspective to this event. A tariff timeline extension would really zap vol premium, which is higher for puts vs calls. Instead, our downside stance would be to look to short stock/futures if a negative outcome is clearly in play (i.e. Trump has no deals and things escalate), with the idea that downside could escalate into 5,400.

The details:

Our current projections (under “Macro Theme”) is that a positive outcome can lead to a move up into the 5,950 area. We based that target off of large positions at the 6k strike, and estimated vanna flow (i.e. rally fuel from IV declining). We still think that +4-5% is a reasonable, short term upside target (1-2 weeks). Accordingly we want to play upside via 2 week – 1 month call spreads, or call flies into the 5950 area. Call spreads will cost a bit more, but look better on an initial pop higher. Call flies likely cost less premium, but will reflect a bit of negative PNL into an initial rally. The call fly PNL usually looks better when the move tires out, and the stock stalls into the short leg of the position.

To the downside, traders have been persistently selling puts <=5,500, which has brought SPX support on recent tests of that area.

The trick with downside is that vols are high enough to be not that attractive for put buying, but its reasonable to think that a bad outcome could easily push bearish options positioning to further extremes (i.e. its not like VIX is 50 and we’ve been crashing every day). The SPX actually has been fairly range bound over the last month, albeit with high volatility (large daily ranges). There are a fair number of puts at the 5,400 strike, which we view as the target strike in a negative escalation and/or a break <5,500.

If you need to hedge a stock portfolio, we think you can structure short dated (~1 week) put spreads long the 5,400 area strikes (vs short further downside strikes), with the idea that the market may be underprice the extreme potential volatility in a negative outcome. On this point, a break of 5,500 likely syncs with VIX 30, and that all happens faster than the market prices. If you are a lover of owning tails, something like Friday 5,400 x 5,300 x 5,200 put flies could be an interesting low risk/high reward idea (this is not advice, just an example).

But, again, if there is any “punt” or extension on tariff deal timelines…we’ll, then you just paid a fairly heavy event-vol tax. This is why we are recommending spreads/flies, to compensate for owning options into a high vol/high skew environment.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5654.25 | $5611 | $560 | $19278 | $472 | $2011 | $199 |

| SG Gamma Index™: |

| -2.16 | -0.499 |

|

|

|

|

| SG Implied 1-Day Move: | 0.78% | 0.78% | 0.78% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5743.25 | $5700 | $565 | $19510 | $480 | $2110 | $220 |

| Absolute Gamma Strike: | $6043.25 | $6000 | $550 | $19600 | $470 | $2000 | $205 |

| Call Wall: | $5948.25 | $5905 | $571 | $19600 | $490 | $2055 | $240 |

| Put Wall: | $5543.25 | $5500 | $550 | $18000 | $470 | $2000 | $190 |

| Zero Gamma Level: | $5792.25 | $5749 | $572 | $19229 | $482 | $2099 | $219 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.688 | 0.526 | 1.005 | 0.616 | 0.596 | 0.327 |

| Gamma Notional (MM): | ‑$795.043M | ‑$1.454B | ‑$1.619M | ‑$502.335M | ‑$38.255M | ‑$1.388B |

| 25 Delta Risk Reversal: | -0.062 | -0.043 | -0.043 | -0.046 | -0.048 | -0.025 |

| Call Volume: | 598.063K | 1.61M | 8.232K | 774.929K | 15.146K | 338.737K |

| Put Volume: | 1.012M | 2.248M | 7.146K | 842.942K | 21.224K | 752.025K |

| Call Open Interest: | 6.498M | 6.164M | 63.745K | 3.289M | 251.682K | 3.251M |

| Put Open Interest: | 11.668M | 10.633M | 71.84K | 5.268M | 385.90K | 7.238M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5000, 5700, 5600] |

| SPY Levels: [550, 560, 570, 555] |

| NDX Levels: [19600, 19500, 20000, 19000] |

| QQQ Levels: [470, 480, 490, 475] |

| SPX Combos: [(5881,82.91), (5876,73.07), (5831,75.51), (5679,85.89), (5651,88.31), (5629,87.21), (5606,87.90), (5601,86.46), (5578,95.86), (5561,80.50), (5556,78.98), (5550,82.09), (5528,93.61), (5522,76.07), (5511,72.41), (5505,89.83), (5500,94.11), (5477,98.21), (5455,92.62), (5432,91.84), (5404,88.90), (5382,95.91), (5354,87.11)] |

| SPY Combos: [548.2, 538.13, 558.27, 553.24] |

| NDX Combos: [19452, 18353, 19163, 18758] |

| QQQ Combos: [476.89, 450.16, 469.86, 460.01] |

0 comentarios