Macro Theme:

Key dates ahead:

- 4/16: VIX Exp

- 4/17: Jobs + OPEX

4/15: Wed 4/16 VIX Exp may mark a short term high in equity markets, as large VIX calls expire, and equity OPEX has become quite neutral in terms of put vs call positioning.

4/14: Fixed risk short volatility trades make sense to us this week, as realized volatility should come in, which allows implied volatility to come in. Further, Thursday’s OPEX adds supportive flows due to put decay.

4/10: Post tariff-pause, we look to sell put flies or ratio puts in the index and/or select single stocks. We will wait for bouts of weakness to initiate these positions, focusing on ~1-2 months to expiration. This trade expression stems from the fact that we do not see strong directional conviction in the data, as traders digest tariff updates, and focus shifts to China. 4/16 update: We will be generally looking to reduce downside “put vol” exposure tomorrow/Monday

Key SG levels for the SPX are:

- Resistance: 5,400, 5,500

- Support: 5,275

Founder’s Note:

Futures are off more that 1% after NVDA (-6%) took a tariff related drop overnight.

ALERT: VIX options expire on the cash open. Watch our for large sharp movements around 9:30AM ET.

Whats the trade? The bounce fuel that is/was OPEX appears to have lost its energy. We think the path of least resistance, particularly into early next week, is lower. This may have more to do with “no reason to rally” (shorting calls) vs “strong reason to sell” (wanting to buy puts). If there is one last prop for bulls its the 3-day weekend, which may induce some traders to offer supportive short gamma/vol flows.

Our view coming into today was that this AM’s VIX expiration + tomorrow’s OPEX would provide support, and possibly even rally fuel for stocks. That plan appeared to be under way before more tariff-talk zapped momentum. We now see VIX at 31, and while we think there is a chance for 30 VIX at 9:30AM, we do not see a solid reason for further VIX/IV decline. Tomorrow’s OPEX also seems to be lacking much supportive size.

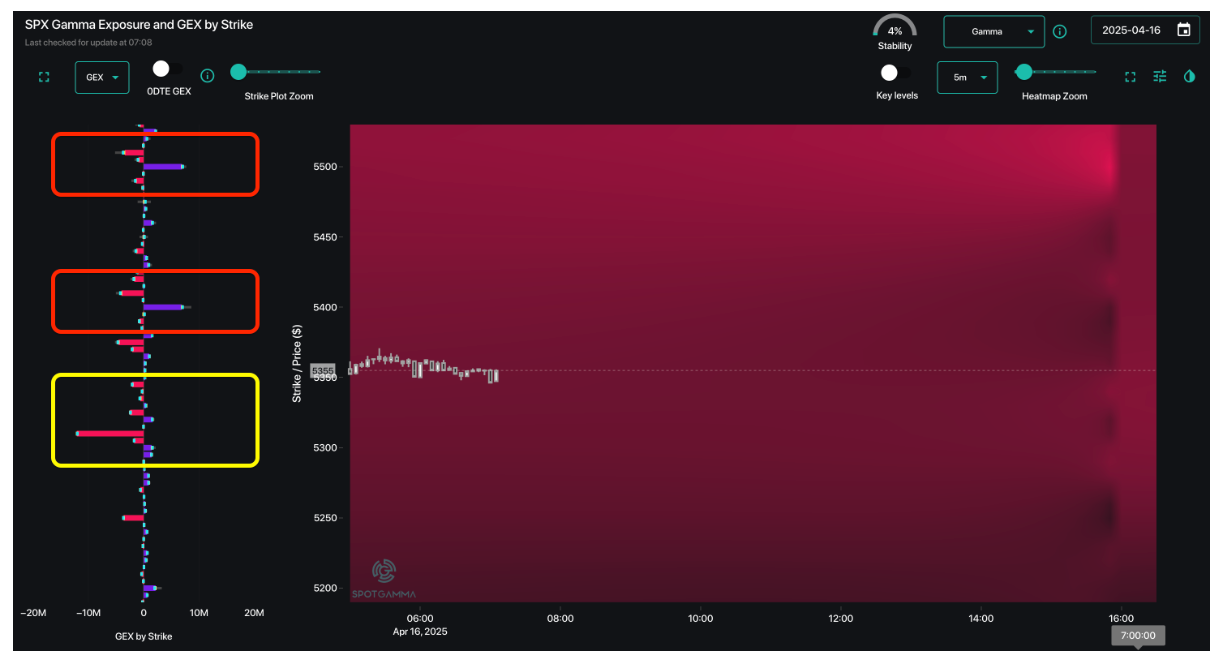

There are some clear resistance strikes above at 5,400, then 5,500 (red boxes, same as we’ve seen for +1 week). These are not massive clusters of positive gamma, but they are stakes in the ground in terms of upside resistance. To the downside, we see the opposite – some decently sized negative gamma strikes which would help to fuel downside into 5,275 (yellow box). We also note the map overall is red, indicating a core position of negative gamma. We don’t anticipate this to be a repeat of +50 VIX, but 1-2% moves are obviously par for this course.

Turning to NVDA and the new SGOI models, we see that there are some solid short puts (dealers long) <100 (blue bars in yellow box), and so we think any probe of the stock into that area may warrant selling of put spreads or put flies (depending on what put skew looks like).

Two other quick notes:

A CNBC story came out on 0DTE, suggesting it drives volatility. This is the headline: “Zero-day options are fueling the unprecedented volatility on Wall Street amid tariff chaos”

We have been of the view that 0DTE tends to bring mean reversion in stocks, and while we have not analyzed the flow from the last few weeks, we’ve never found the smoking gun of large directional volatility impacts. Needless to say, we wanted to see the data. The story offers no data, but does offer this odd quote from a UBS strategist:

““We find that 0DTE (+1DTE) have been instrumental in driving more intraday volatility, with this higher intraday activity not necessarily getting captured on a close-to-close basis,” Maxwell Grinacoff, UBS’ head of U.S. equity derivatives research…

We *think* the TLDR from UBS here is that short dated options bring mean reversion.

Finally, we have been working with the WSJ on a story related to Captain Condor. If you are curious who the Captain allegedly is, read here.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5438.54 | $5405 | $537 | $18796 | $457 | $1880 | $186 |

| SG Gamma Index™: |

| -1.961 | -0.462 |

|

|

|

|

| SG Implied 1-Day Move: | 0.82% | 0.82% | 0.82% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5858.54 | $5825 | $557 | $18860 | $464 | $1900 | $220 |

| Absolute Gamma Strike: | $5033.54 | $5000 | $550 | $19000 | $460 | $1890 | $190 |

| Call Wall: | $6033.54 | $6000 | $580 | $19600 | $500 | $1920 | $230 |

| Put Wall: | $5233.54 | $5200 | $525 | $18000 | $464 | $1800 | $190 |

| Zero Gamma Level: | $5656.54 | $5623 | $553 | $18748 | $464 | $2008 | $205 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.715 | 0.543 | 1.007 | 0.742 | 0.616 | 0.332 |

| Gamma Notional (MM): | ‑$677.654M | ‑$1.623B | ‑$125.293K | ‑$340.955M | ‑$39.42M | ‑$1.397B |

| 25 Delta Risk Reversal: | -0.098 | 0.00 | -0.108 | -0.089 | -0.091 | -0.07 |

| Call Volume: | 555.302K | 1.385M | 6.177K | 657.298K | 16.244K | 278.822K |

| Put Volume: | 986.225K | 2.485M | 5.757K | 911.241K | 29.71K | 600.786K |

| Call Open Interest: | 7.976M | 7.667M | 71.762K | 4.208M | 313.756K | 4.168M |

| Put Open Interest: | 13.133M | 12.38M | 69.602K | 6.033M | 446.689K | 8.254M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5500, 5400, 6000] |

| SPY Levels: [550, 540, 545, 530] |

| NDX Levels: [19000, 19600, 19500, 20000] |

| QQQ Levels: [460, 450, 470, 465] |

| SPX Combos: [(5536,68.88), (5509,79.48), (5428,78.95), (5411,93.00), (5384,84.93), (5379,78.19), (5357,92.52), (5336,77.01), (5330,81.44), (5319,86.41), (5309,93.73), (5287,72.63), (5282,81.56), (5260,87.61), (5233,68.38), (5228,71.38), (5211,94.45), (5157,81.62)] |

| SPY Combos: [518.63, 538.58, 528.34, 533.73] |

| NDX Combos: [18476, 19567, 19078, 18270] |

| QQQ Combos: [476.69, 450.16, 464.8, 445.13] |

0 comentarios