Macro Theme:

Key dates ahead:

- 4/22: Earnings: TSLA, MMM, LMT, PHM

- 4/23: New Homes Sales, Earnings: BA, CMG, VRT, LVS, IBM

- 4/24: Durable Goods, Jobless Claims, Earnings: INTC, GOOGL, AAL, PG, FCX

4/21: In addition to the 4/17 view(below), we will this week look to structure cheap tail risk positions in the QQQ and/or SPY, to play the market possibly underpricing a sharp ±5-10% move (Monday AM data suggests this is underpriced). Additionally we will be watching single names into & out of earnings for opportunities.

4/17: With the SPX near 5,300, we do not have strong conviction. Into SPX rallies >=5,400, we would look to re-engage in short call strategies. To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades.

Key SG levels for the SPX are:

- Resistance: 5,400, 5,500

- Support: 5,000, 4,800

Founder’s Note:

Futures are 1% lower, with no major data on deck for today.

As we noted on Friday, the equity market lost a source of support/buying power with last weeks expiration. This leaves the 5,000 – 5,400 largely a “no mans land” in terms of dealer flows, as light negative gamma persists through this range. Accordingly, we think price can move fluidly through this area.

That “no mans land” is the result of the utter lack material information that distributed to markets on a daily basis – just rumor & rhetoric.

In order to have material price/value levels form, traders & investors need either a source of truth for their forecasts, or they need “obvious value”.

Obvious value would be a strongly overbought or oversold equity market – areas where price is compelling even in this very uncertain environment. In this case, based on options selling, we see ~5,400 – 5,500 as the area wherein call sellers step up forming our prime resistance area. To the downside, we’ve been highlighting, and continue to highlight 4,600-4.800 as an area of large put selling, and possible support.

Both of these ranges are +200 handles away from current SPX prices…leaving us in no mans land, where price can easily slide 2-3% on a whim.

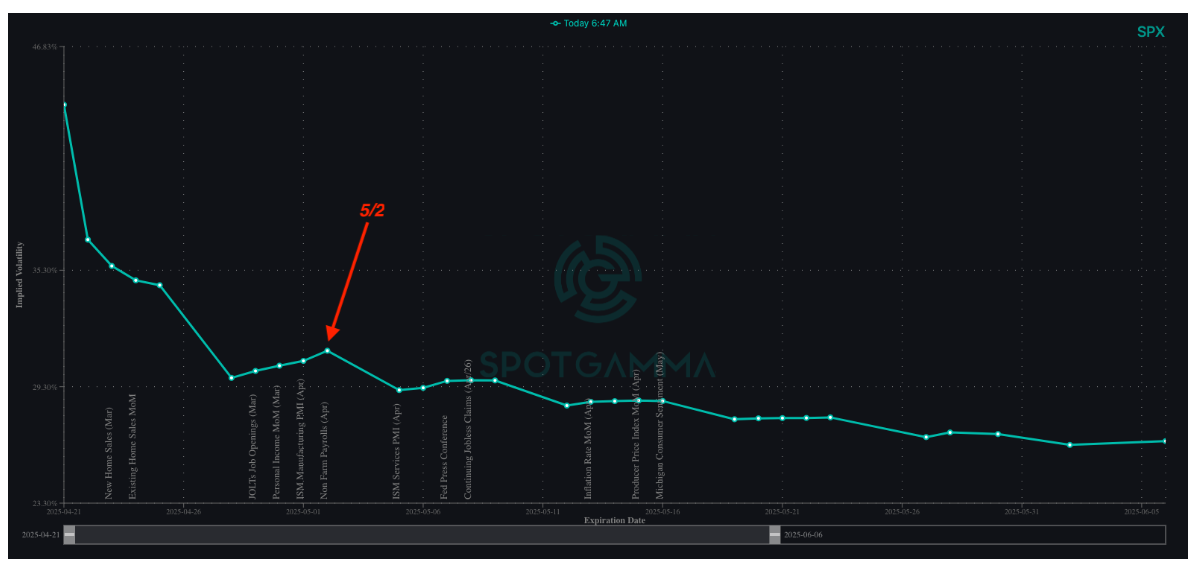

“Truth” should also start to come in the form of data – this data being the first that may shed some light on the impact of changing policy. As a barometer, we see that the SPX term structure has sharply shifted into contango this morning as equity markets have slid -1%, as the discussion around “fire Powell” picks up. Adding to this are jobless claims & durable goods reports on 4/24. But there is a noticeable kink in the term structure toward the tail end of next week related to ISM & NFP suggesting a heightened degree of importance on these macro prints.

Then we turn to earnings, which fire up this week. Today’s reports are predominantly banks, and then tomorrow we will start to see stocks which carry more macro implications, such as: TSLA, LMT, MMM, KMB, PHM.

These reports should put the tariff uncertainty into some quantifiable data/”truths”, which could allow the policy impact to be better priced. This matters because we think that index implied volatility could be underpricing the impact of earnings.

Consider 1-week QQQ skew. While this can admittedly be noisy, we’ve plotted each 1-week skew from Monday over the past month.

Today, Monday AM, features skew that is at the lows of any 1-week skew going back to March 31st (the week of the 4/2 tariff “deadline”). Further, when you look at the vols you get the impression that traders maybe short the downside tails (-10% ish) vs relatively long more near-the-money puts. Additionally, call skew seems to be relatively low. This view lines up with the positioning we see in the SGOI/EquityHub, which tells us that if any of this new data carries weight (good or bad), then the QQQ’s may have a volatility jump as this new information is priced in.

For this reason we are going to be looking to setup cheap “tail risk lotto” structures this week, seeking to profit if there is a 5-10% equity move in either direction (i.e. a move into the depressed IV pockets where traders seem relatively short options).

Zooming out, we will continue to look for the SPX to move to one of the aforementioned zones (<4,800, >5,400) before structuring some additional longer dated (+1 month) trades.

Lastly, we suspect that this earnings season will generate much larger single stock reactions, which could open the door for new trade setups. Again, this largely starts tomorrow.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5304.99 | $5275 | $526 | $18257 | $444 | $1863 | $186 |

| SG Gamma Index™: |

| -1.974 | -0.34 |

|

|

|

|

| SG Implied 1-Day Move: | 0.81% | 0.81% | 0.81% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5749.99 | $5720 | $545 | $18190 | $464 | $1900 | $220 |

| Absolute Gamma Strike: | $5029.99 | $5000 | $550 | $18200 | $450 | $2000 | $190 |

| Call Wall: | $6029.99 | $6000 | $580 | $18200 | $485 | $1920 | $230 |

| Put Wall: | $5229.99 | $5200 | $525 | $18000 | $420 | $1800 | $190 |

| Zero Gamma Level: | $5641.99 | $5612 | $549 | $18211 | $467 | $2019 | $205 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.654 | 0.514 | 0.974 | 0.584 | 0.673 | 0.371 |

| Gamma Notional (MM): | ‑$783.574M | ‑$1.284B | ‑$576.892K | ‑$497.091M | ‑$32.254M | ‑$934.159M |

| 25 Delta Risk Reversal: | -0.09 | -0.072 | -0.095 | -0.075 | -0.079 | -0.061 |

| Call Volume: | 469.013K | 1.28M | 14.075K | 720.884K | 14.375K | 256.552K |

| Put Volume: | 801.568K | 1.885M | 7.91K | 732.785K | 18.241K | 588.17K |

| Call Open Interest: | 7.231M | 6.432M | 66.259K | 3.453M | 275.23K | 3.473M |

| Put Open Interest: | 11.854M | 10.051M | 62.865K | 5.061M | 409.028K | 7.115M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5400, 5500] |

| SPY Levels: [550, 525, 540, 530] |

| NDX Levels: [18200, 19000, 20000, 19500] |

| QQQ Levels: [450, 440, 460, 430] |

| SPX Combos: [(5392,82.24), (5344,75.79), (5302,80.81), (5292,88.84), (5260,77.09), (5244,86.97), (5212,77.95), (5191,95.58), (5144,82.70), (5096,90.92), (5044,72.62)] |

| SPY Combos: [549.84, 518.3, 508.31, 528.29] |

| NDX Combos: [18203, 17673, 19116, 17473] |

| QQQ Combos: [429.97, 440.18, 449.95, 464.61] |

0 comentarios