Macro Theme:

Key dates ahead:

- 4/23: New Homes Sales, Earnings: BA, CMG, VRT, LVS, IBM

- 4/24: Durable Goods, Jobless Claims, Earnings: INTC, GOOGL, AAL, PG, FCX

4/23: ES futures were up +2.5% pushing the SPX into our target resistance zone of 5,400 – 5,500. As such, we will be looking to sell <=20 delta calls in the 4-6 week tenor (this is in accordance with our 4/17 update).

4/21: In addition to the 4/17 view(below), we will this week look to structure cheap tail risk positions in the QQQ and/or SPY, to play the market possibly underpricing a sharp ±5-10% move (Monday AM data suggests this is underpriced). Additionally we will be watching single names into & out of earnings for opportunities. ✅

4/17: With the SPX near 5,300, we do not have strong conviction. Into SPX rallies >=5,400, we would look to re-engage in short call strategies. To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades.

Key SG levels for the SPX are:

- Resistance: 5,500

- Support: 5,400, 5,000, 4,800

Founder’s Note:

Futures are up more that 2.5% after Trump cooled rhetoric related to firing Powell & China. US10Y has dropped sharply to 4.3%

TSLA +6%, with Elon stating he is focusing less on DOGE and more on TSLA. While we are not fundamental analysts, their actual numbers looked quite bad. We bring this up as the TSLA bid seems to be as much about “hope” as the equity bid (i.e. Trump “yeah, a deal is coming”)…

TLDR: We are going to be looking to sell index calls into this rally. Specifically targeting <=20 delta calls with 4-6 weeks to expiration. This view is driven by the SPX plowing into our key resistance zone, and IV’s remaining elevated.

GLD call skew/vol has come in sharply on the recent reversal, and so we’ve largely closed up that short term trade. We continue to hold the BTC/IBIT calls. Lastly, if you we’re long weekly calls per our 4/21 “Tail Risk” note, we would look to close/roll/fly those into this sharp AM move.

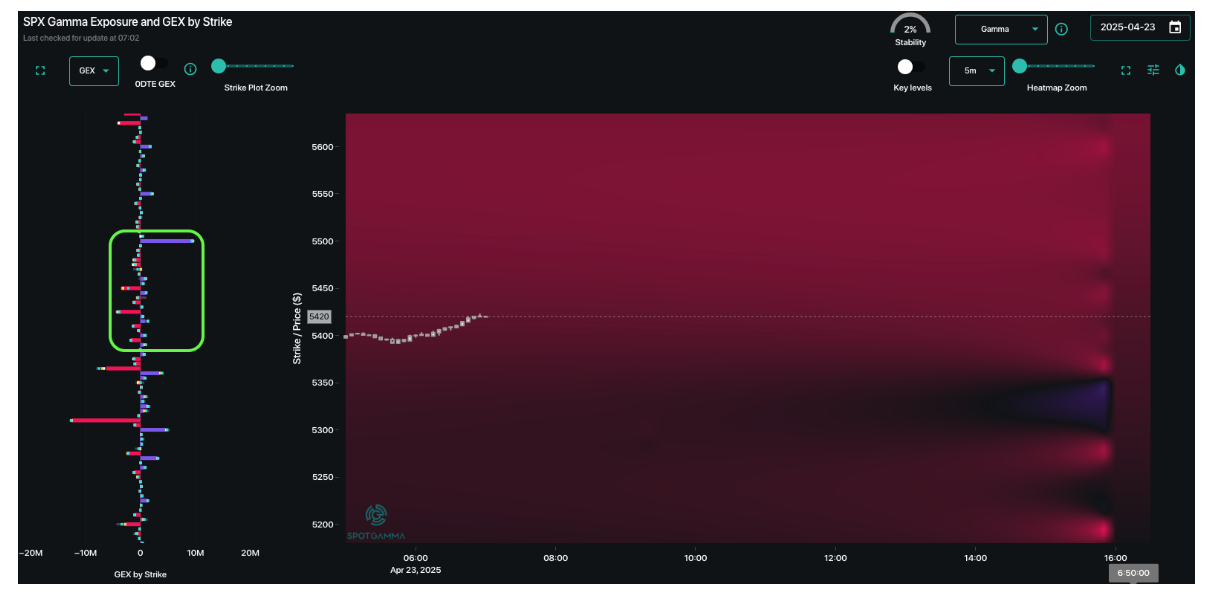

This move has pushed the SPX up into our key resistance zone of 5,400 – 5,500. This resistance should be provided by an increase in dealer positive gamma as traders sell calls into strength. Currently we see light positive gamma strikes in the 54xx’s, and one fairly large positive gamma bar (blue) at 5,500. >5,500 is small, but predominantly positive gamma strikes. We will be looking for heavy call selling to pick up, particularly with 0DTE, after the market open to confirm resistance. With that we will be watching TRACE &

HIRO

carefully.

On this point – we see nothing <5,400 that offers any support. If anything, large negative gamma strikes should keep volatility high/prices fluid through that zone.

A lot of chatter will likely be on the sub 30 VIX, and an alleged vol crush. To that we say: “not really”. SPX fixed strike vols from last night to this AM do show a decrease, but only of about 1/2 a vol point. Its hard for IV’s to come down too fast when we’ve seen a 2.5% overnight gap higher. Because the tariff talk and fire Powell comments are being walked back, trades should be pricing in some lower volatility in the future. However, we continue to have 5-day SPX realized vol at +20%, which implies that ATM SPX IV/VIX should have a stop at 25. Further, there is a slew of data coming up that should keep some event vol premium (4/24 jobless claims, 5/1 ISM, 5/2 NFP).

Premarket there was one key earnings report from VRT which makes cooling equipment for data centers. The stock is up 18% on sales and higher guidance. Not bad.

Tonight key earnings are: CMG, LVS, TXN and IBM (you can see this grid on the SG dashboard homepage, bottom right quadrant).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5187.39 | $5158 | $527 | $17808 | $444 | $1840 | $187 |

| SG Gamma Index™: |

| -1.676 | -0.349 |

|

|

|

|

| SG Implied 1-Day Move: | 1.01% | 1.01% | 1.01% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5354.39 | $5325 | $545 | $18160 | $445 | $1900 | $220 |

| Absolute Gamma Strike: | $5029.39 | $5000 | $525 | $18200 | $450 | $2000 | $190 |

| Call Wall: | $6029.39 | $6000 | $580 | $18200 | $485 | $1920 | $230 |

| Put Wall: | $5229.39 | $5200 | $525 | $17500 | $430 | $1800 | $180 |

| Zero Gamma Level: | $5558.39 | $5529 | $546 | $18032 | $460 | $1964 | $206 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.702 | 0.540 | 1.015 | 0.605 | 0.756 | 0.407 |

| Gamma Notional (MM): | ‑$1.002B | ‑$1.15B | ‑$2.836M | ‑$437.675M | ‑$38.602M | ‑$918.743M |

| 25 Delta Risk Reversal: | -0.084 | -0.053 | -0.05 | -0.058 | -0.065 | -0.045 |

| Call Volume: | 538.313K | 1.921M | 8.026K | 932.752K | 24.628K | 305.306K |

| Put Volume: | 717.223K | 2.293M | 5.304K | 1.13M | 27.593K | 604.131K |

| Call Open Interest: | 7.52M | 6.77M | 68.077K | 3.699M | 296.396K | 3.586M |

| Put Open Interest: | 12.123M | 10.388M | 64.19K | 5.358M | 425.452K | 7.30M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5400, 5500] |

| SPY Levels: [525, 550, 530, 540] |

| NDX Levels: [18200, 18000, 19000, 19500] |

| QQQ Levels: [450, 430, 440, 420] |

| SPX Combos: [(5179,75.46), (5169,82.83), (5138,75.19), (5122,80.73), (5086,75.99), (5071,95.69), (5024,82.75), (4988,70.52), (4978,92.08), (4926,75.79)] |

| SPY Combos: [498.46, 508.23, 517.99, 503.09] |

| NDX Combos: [17737, 17221, 17025, 17630] |

| QQQ Combos: [420.12, 442.64, 430.08, 424.88] |

0 comentarios