Macro Theme:

Key dates ahead:

- 4/30: Earnings: META, MSFT

- 5/1: ISM

- 5/2: NFP

4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a market decline, as much as we see the potential for that outcome, and the price to play it seems reasonable. This is true particularly given next weeks earnings and macro prints.

Per the last few weeks: To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades.

On 4/24 we marked upside resistance at >=5,500, we are now seeing call skew lift, and no material positive gamma >=5,500. Given that, we will not look to short additional calls into future rallies until/unless positive upside gamma appears.

4/24 Update: The upside ~5,450 range was tested on 4/23, and rejected. We are now shifting max resistance to >=5,500, as that is where larger positive gamma strikes are now appearing.

With the SPX back near 5,300, we do not have strong conviction. Into SPX rallies near 5,500, we would look to re-engage in short call strategies. To the downside, first support is at 5,000, with more material support at 4,800. Into those downside zones we would look to initiate short put strategies. Additionally, with earnings picking up into the end of April, we will be looking closely for single stock trades. (Incorporated/updated into 4/25 note)

Key SG levels for the SPX are:

- Resistance: 5,500

- Support: 5,000, 4,800

Founder’s Note:

Futures are -20bps, with no major data on the tape for today. PM earnings are from: GM, UPS, PYPL, PFE, KO.

There is some decent positive gamma (+94th %ile) at the non-0DTE 5,500 strike. Below there we do not see a major level until 5,400. The same “no major levels” is also true to for the upside until ~5,800.

“No levels”? Well, why are you even bothering to read this then?

Because “no levels” is a signal in and of itself.

In Friday’s PM note, and in the Sunday Note we made the case for buying puts into this rally. The summary is:

- The daily range expands the day after a >=20k Captain Condor lot “win” on 5/5 occasions. 4 of those 5 include drawdowns larger than -1%.

- Negative gamma still dominates, particularly in the SPY. This implies price action should remain influenced by directional hedging pressure. When the “vol event” is actually over, we’d see positive gamma come in, which forms trading levels.

- IV is now trading under RV, and we think RV is near a short term floor.

- Major earnings, plus ISM, PCE & NFP this week should generate an implied vol premium – but they, as of yet, are not.

- Liquidity stinks.

The five points above suggest traders future expectations about volatility (implied volatility) may be too low.

What is the problem with the market discounting volatility?

The risk here is that if & when volatility spikes, those who are “too short” of volatility have to first run for cover before getting long. This adds extra downside hedging pressure.

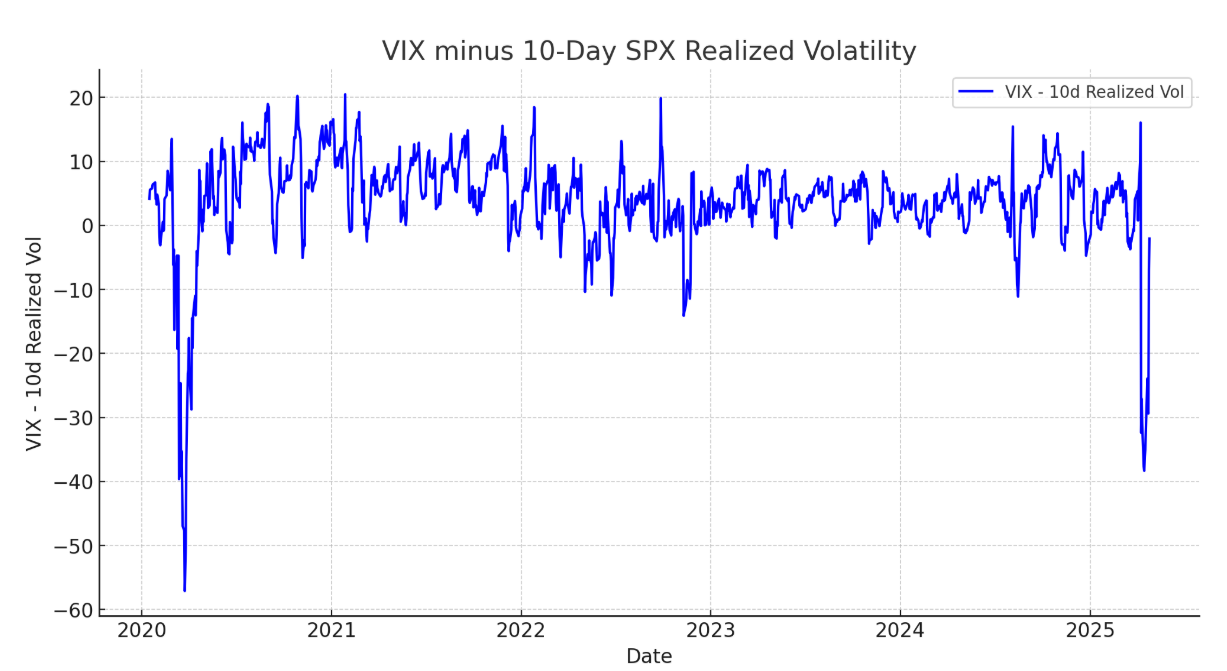

This plot is the VIX – 10-day realized SPX volatility (RV). That is tells us the spread between how much traders think the market is going to move in the future (VIX) vs how much it has been moving (RV). We chose 10 days (vs 1-month RV) as to remove the “edge of the abyss” crisis days of April 3rd and 4th (SPX -12% in 2 days).

What generates the biggest negative spreads between VIX & RV? The resolution of crisis’. Fed bailouts, wars ending, etc. In this case, what has happened is the tariff antagonist has simply stepped back from previous “end of the global financial system” fears. As far as we can tell, its still an agent of uncertainty which should command a vol premium.

Before we move on, note that the VIX typically carries a 0-10 point premium to RV. This makes sense, as traders want to generally hedge the uncertainty of upcoming events – i.e. insurance.

If the tariff threat is subsiding, then where is the liquidity?

Shown here is ES liquidity from the CME. Earlier this month there were several banks noting this was some of the poorest liquidity ever (black arrow), and we’ve now only slightly recovered from those depths. This informs us that traders with an axe are going to move the market more as they have to grab liquidity across wider spreads. That increases volatility.

This plot shows forward 1-day returns for the SPX when the vol premium is <=current levels. As you can see, 2020 & 2022 are the most comparable periods – and those periods are marked with some very wide swings. They also include some very nasty negative returns. While we run a bit short on time the point is this:

- If you think the deals are done, and normalcy has returned, then the vol premium should return as price action normalizes/stabilizes. This means the VIX ~5pt premium comes due to SPX realized volatility moving toward 15% (vs 30% now) and VIX is ~20. Long puts in this scenario likely perform poorly.

- If you think that this is only the start and/or more bumps are imminent, then they vol premium should return as the VIX spikes up toward 30-35, which provides a premium to the 25-50% RV we have now. Long puts/put spreads make sense.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5551.36 | $5525 | $550 | $19432 | $472 | $1957 | $194 |

| SG Gamma Index™: |

| -0.599 | -0.155 |

|

|

|

|

| SG Implied 1-Day Move: | 0.80% | 0.80% | 0.80% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5526.36 | $5500 | $547 | $18190 | $467 | $1950 | $220 |

| Absolute Gamma Strike: | $5026.36 | $5000 | $550 | $18200 | $470 | $2000 | $190 |

| Call Wall: | $5626.36 | $5600 | $560 | $18200 | $485 | $1865 | $196 |

| Put Wall: | $5226.36 | $5200 | $545 | $18000 | $450 | $1850 | $190 |

| Zero Gamma Level: | $5560.36 | $5534 | $553 | $18667 | $471 | $1982 | $214 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.903 | 0.786 | 1.376 | 0.954 | 0.827 | 0.432 |

| Gamma Notional (MM): | ‑$142.149M | ‑$319.626M | $6.361M | $46.009M | ‑$11.53M | ‑$894.878M |

| 25 Delta Risk Reversal: | -0.068 | 0.00 | -0.064 | -0.058 | -0.069 | -0.051 |

| Call Volume: | 417.936K | 1.48M | 6.673K | 786.823K | 20.902K | 197.371K |

| Put Volume: | 973.452K | 2.033M | 6.372K | 929.814K | 26.126K | 617.159K |

| Call Open Interest: | 7.708M | 6.772M | 67.207K | 3.804M | 289.572K | 3.622M |

| Put Open Interest: | 12.553M | 10.633M | 62.624K | 5.405M | 426.526K | 7.584M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5500, 5700] |

| SPY Levels: [550, 540, 545, 560] |

| NDX Levels: [18200, 19500, 20000, 19000] |

| QQQ Levels: [470, 460, 480, 450] |

| SPX Combos: [(5702,71.65), (5652,83.04), (5625,71.22), (5619,79.77), (5603,86.38), (5470,68.34), (5420,68.87), (5398,91.22), (5371,71.11), (5348,84.68), (5310,80.59), (5299,88.48)] |

| SPY Combos: [552.7, 553.25, 539.58, 539.04] |

| NDX Combos: [19938, 18500, 19122, 18908] |

| QQQ Combos: [450.06, 485.11, 477.16, 489.78] |

0 comentarios