Macro Theme:

Key dates ahead:

- 5/1: Jobless Claims, ISM, AAPL + AMZN earnings

- 5/2: NFP

4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls or call spreads. This does not invalidate the view of owning longer dated put hedges (per 4/25 update).

4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a market decline, as much as we see the potential for that outcome, and the price to play it seems reasonable. This is true particularly given next weeks earnings and macro prints.

Key SG levels for the SPX are:

- Resistance: 5,800 (no clear resistance level >5,500)

- Support: 5,500 (no clear support level <5,500)

Founder’s Note:

Futures are +1% higher after META (+5.8%) & MSFT (+9%) posted strong earnings. Note that MSFT’s move adds +60bps to the SPX price.

Jobless claims are at 8:30AM ET, followed by 10AM ET ISM. AAPL, AMZN & MSTR report tonight.

We start with today’s 0DTE straddle at $52 or 92bps IV 35% – incredibly the same price as yesterday even though: Jobless Claims and ISM on deck today, yesterdays cash session saw a -2% drawdown and +2.25% rally, and futures are up ~1% overnight.

Maybe you don’t want to buy that straddle, but we’d wager you don’t want to sell it. And if today reveals any data surprise, then traders will have to snap vol expectations higher (i.e. cover vol shorts), which induces more market movement.

Turning to levels – there remains no key SPX levels.

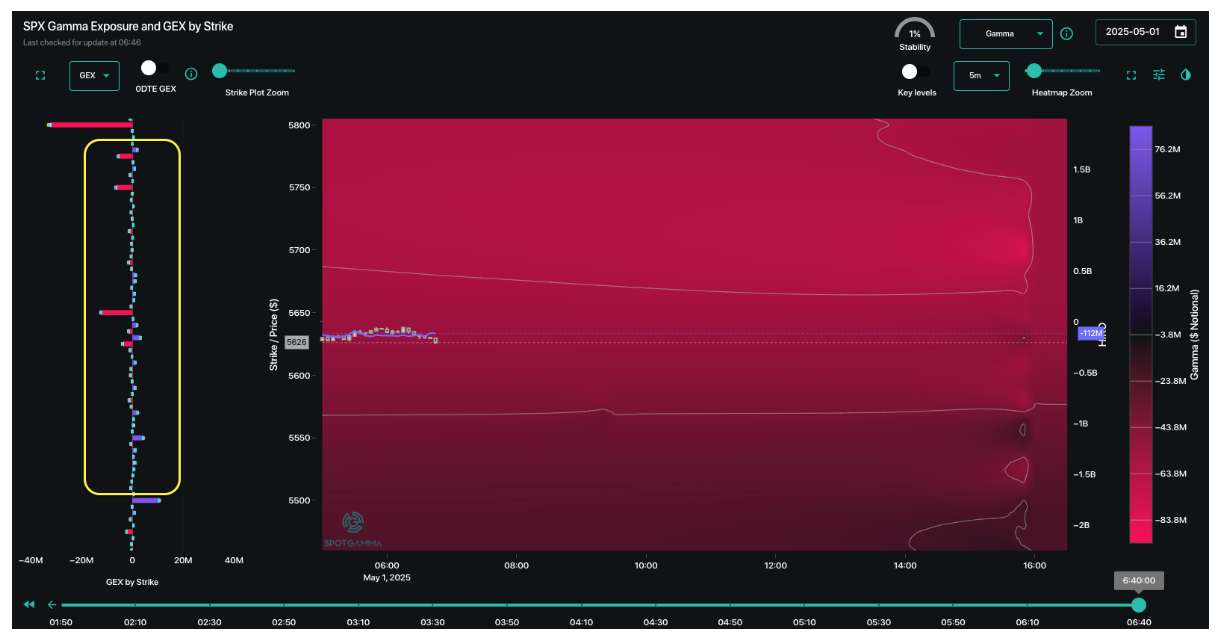

This is because gamma strikes are quite small (yellow box), and the overall picture depicts negative gamma as seen by the red TRACE map. Further, both SPY & QQQ show large negative gamma positions for ~5-10% around ATM levels. As yesterday showed, no price action is stable and things should remain quite fluid both to the upside & downside.

If the SPX pushes up into 5,800 then we see a sharp reduction in negative gamma, and we’d assume that IV’s would totally drained. To the downside you have large negative gamma clear into SPY 535.

As price remains swinging violently, we find fixed strike vol is higher for today vs Monday, suggesting yesterday’s move was not about vol selling. If ISM passes as benign today then we would expect a bit of IV contraction, which is supportive of equities. Attention would then turn to earnings tonight and NFP tomorrow. Should NFP pass without issue, trades are likely to push IV down into the weekend, which would be supportive of equities.

For this reason it may be worth looking at Friday PM 5800 calls spreads/flies, as a strong right tail risk remains given the negative gamma and potential for IV contraction.

Yesterday AM we outlined GEX positioning for MSFT, META & HOOD. META and HOOD came out near their implied moves – the standout is clearly MSFT which is at 430 +9%.

We viewed a band of positive gamma resistance at 405-425, and the stock is now sitting atop that 425 area. As you can see in the GEX plot below (from y’day), there are very few strikes above this level. While there could be a fundamental reason to now of MSFT here, we do not see an options-induced reason. However, the 400-420 area should function as support. If

HIRO

opens with call buying then we’d have to adjust these expectations.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5583.8 | $5560 | $554 | $19544 | $475 | $1976 | $194 |

| SG Gamma Index™: |

| -0.627 | -0.219 |

|

|

|

|

| SG Implied 1-Day Move: | 0.76% | 0.76% | 0.76% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5523.8 | $5500 | $550 | $19290 | $474 | $1950 | $205 |

| Absolute Gamma Strike: | $5023.8 | $5000 | $550 | $18200 | $470 | $2000 | $190 |

| Call Wall: | $5623.8 | $5600 | $580 | $18200 | $485 | $1980 | $196 |

| Put Wall: | $5223.8 | $5200 | $540 | $19000 | $450 | $1850 | $190 |

| Zero Gamma Level: | $5593.8 | $5570 | $557 | $18917 | $471 | $1971 | $214 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.900 | 0.712 | 1.282 | 0.958 | 0.871 | 0.428 |

| Gamma Notional (MM): | ‑$58.392M | ‑$324.674M | $5.798M | $126.59M | ‑$2.124M | ‑$967.612M |

| 25 Delta Risk Reversal: | -0.08 | -0.061 | -0.082 | -0.062 | -0.069 | -0.053 |

| Call Volume: | 465.942K | 1.589M | 7.174K | 886.755K | 11.40K | 207.33K |

| Put Volume: | 704.87K | 2.619M | 7.152K | 1.138M | 15.477K | 1.073M |

| Call Open Interest: | 7.712M | 6.42M | 67.499K | 3.818M | 293.086K | 3.702M |

| Put Open Interest: | 12.651M | 10.837M | 65.121K | 5.658M | 432.959K | 7.982M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 6000, 5700, 5500] |

| SPY Levels: [550, 540, 560, 545] |

| NDX Levels: [18200, 19500, 20000, 19000] |

| QQQ Levels: [470, 460, 450, 480] |

| SPX Combos: [(5794,83.43), (5694,76.61), (5644,83.45), (5622,73.11), (5616,72.27), (5605,69.40), (5594,88.29), (5578,69.06), (5494,69.42), (5444,83.57), (5416,78.24), (5394,91.65), (5366,78.17), (5344,84.74), (5316,73.30), (5305,79.70), (5294,91.07)] |

| SPY Combos: [563.19, 538.24, 558.2, 528.27] |

| NDX Combos: [19936, 18920, 19115, 19564] |

| QQQ Combos: [485.04, 459.84, 489.8, 479.81] |

0 comentarios