Macro Theme:

Key dates ahead:

- 5/2: NFP

4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls or call spreads. This does not invalidate the view of owning longer dated put hedges (per 4/25 update).

4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a market decline, as much as we see the potential for that outcome, and the price to play it seems reasonable. This is true particularly given next weeks earnings and macro prints.

Key SG levels for the SPX are:

- Resistance: 5,800 (no clear resistance level >5,500)

- Support: 5,500 (no clear support level <5,500)

Founder’s Note:

Futures are 44bps higher ahead of 8:30AM ET NFP.

Post ER: AAPL -3%, AMZN flat.

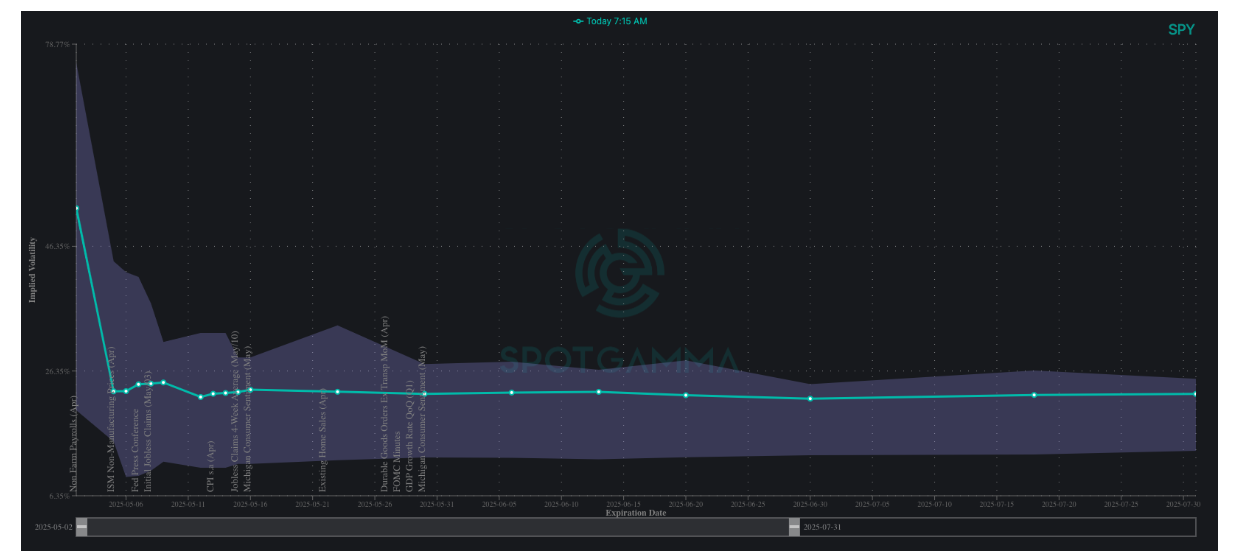

Today’s 0DTE straddle is a heavy $67/1.1% or 46% IV, which is a sharp departure from the underpriced 0DTE straddles into ISM & PCE.

This infers the market places a great deal of importance on this print, as any expiration out past today has a much lower, ~23% IV.

Should NFP come in hot, then we see little support until the 5,500 area. To the upside, there are quite frankly no material strikes of any kind until 5,800 – and 5,800 is large dealer short gamma strike. We’d estimate that a potential upside move would come in at the 0DTE straddle level of 1.1%, roughly aligning with 5,700. The other dynamic in a positive NFP would be trader looking to further sell vol into the weekend.

We don’t want to further belabor the point that volatility is underpriced. As per last nights note, we pointed out that IV now has seemed to hit a floor around 23%, and skew is twisting towards puts.

Both yesterday & today also had rather quiet close to close SPX performance, with +64bps and +10bps respectively. But that masked huge intraday moves of +2.3% on Wed and1.6% yesterday (i.e. there has been huge mean reversion masking intraday vol).

To place into context how epic the intraday swings have been, we plotted SPX intraday range (daily high-low / close) since Jan ’20. As you can see, April 9th intraday move of 10.7% was the largest intraday range in the past 5 years – including the Covid Crash!

We also see that the current level of intraday vol is essentially what we sustained in ’22 – and we think that level is a “fair value” for the period we are currently in. We’d make the case this is an environment of extended “uncertainty”/repricing, like ’22, but arguably not “panic” (panic was in early April).

The point here is that we expect volatility to remain at or above current levels, and that huge intraday rallies are just a feature of this current regime. That view stands until deals are signed, economic data is stable, and liquidity returns.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5592.61 | $5569 | $558 | $19571 | $481 | $1964 | $196 |

| SG Gamma Index™: |

| 0.190 | -0.074 |

|

|

|

|

| SG Implied 1-Day Move: | 0.79% | 0.79% | 0.79% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5598.61 | $5575 | $557 | $18175 | $482 | $1950 | $200 |

| Absolute Gamma Strike: | $6023.61 | $6000 | $550 | $20000 | $500 | $2000 | $190 |

| Call Wall: | $5823.61 | $5800 | $570 | $18200 | $485 | $1980 | $201 |

| Put Wall: | $5223.61 | $5200 | $535 | $19000 | $450 | $1850 | $190 |

| Zero Gamma Level: | $5601.61 | $5578 | $561 | $19085 | $477 | $1989 | $214 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.032 | 0.890 | 1.438 | 1.091 | 0.977 | 0.491 |

| Gamma Notional (MM): | ‑$160.911M | ‑$376.168M | $3.72M | $77.767M | ‑$9.755M | ‑$973.995M |

| 25 Delta Risk Reversal: | -0.074 | -0.054 | -0.071 | -0.053 | -0.069 | -0.05 |

| Call Volume: | 586.264K | 1.64M | 7.062K | 1.021M | 8.085K | 299.946K |

| Put Volume: | 902.162K | 2.50M | 6.718K | 1.294M | 22.133K | 772.238K |

| Call Open Interest: | 7.78M | 6.411M | 67.799K | 3.891M | 293.801K | 3.759M |

| Put Open Interest: | 12.753M | 11.114M | 66.151K | 5.831M | 438.884K | 8.174M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5000, 5700, 5800] |

| SPY Levels: [550, 570, 560, 555] |

| NDX Levels: [20000, 19500, 18200, 19000] |

| QQQ Levels: [500, 490, 470, 485] |

| SPX Combos: [(5814,78.92), (5764,92.60), (5736,69.88), (5714,80.34), (5692,83.83), (5686,77.89), (5675,69.65), (5669,91.21), (5636,72.53), (5625,73.44), (5619,90.19), (5591,72.15), (5575,72.40), (5569,81.18), (5486,68.41), (5469,73.73), (5435,71.47), (5419,76.38), (5369,88.84), (5318,75.33), (5296,68.63)] |

| SPY Combos: [537.72, 527.74, 557.68, 532.73] |

| NDX Combos: [19708, 20315, 19904, 20119] |

| QQQ Combos: [484.95, 460.23, 464.98, 475.92] |

0 comentarios