Macro Theme:

Key dates ahead:

- 5/11: US/China Tariff Meeting

5/5: We continue to see a negative volatility premium in the S&P500, which validates owning 1-2 month put spreads as referenced on 4/25. Those puts were hedged with short dated/Friday exp long call structures, which profit if the SPX rallies >=5,700.

4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a market decline, as much as we see the potential for that outcome, and the price to play it seems reasonable. This is true particularly given next weeks earnings and macro prints.

4/29: Based on the formation of light positive gamma >5,500, we look to be net long of stocks while SPX holds that level. We recommend short dated (May exp) calls or call spreads. This does not invalidate the view of owning longer dated put hedges (per 4/25 update).✅

Key SG levels for the SPX are:

- Resistance: 5,725, 5,800, 5900 (we see a long term top in the 5,900 area)

- Support: 5,600, 5,500, 5,300 (negative gamma as of 5/8 wanes <5,300)

Founder’s Note:

Futures are +1% higher as Trump is set to announce a trade deal at 10AM EST.

TLDR: Resistance for today is showing as 0DTE driven in the 5,700-5,750 area due to the onset of positive gamma. Negative gamma and slippery downside is in place into 5,600.

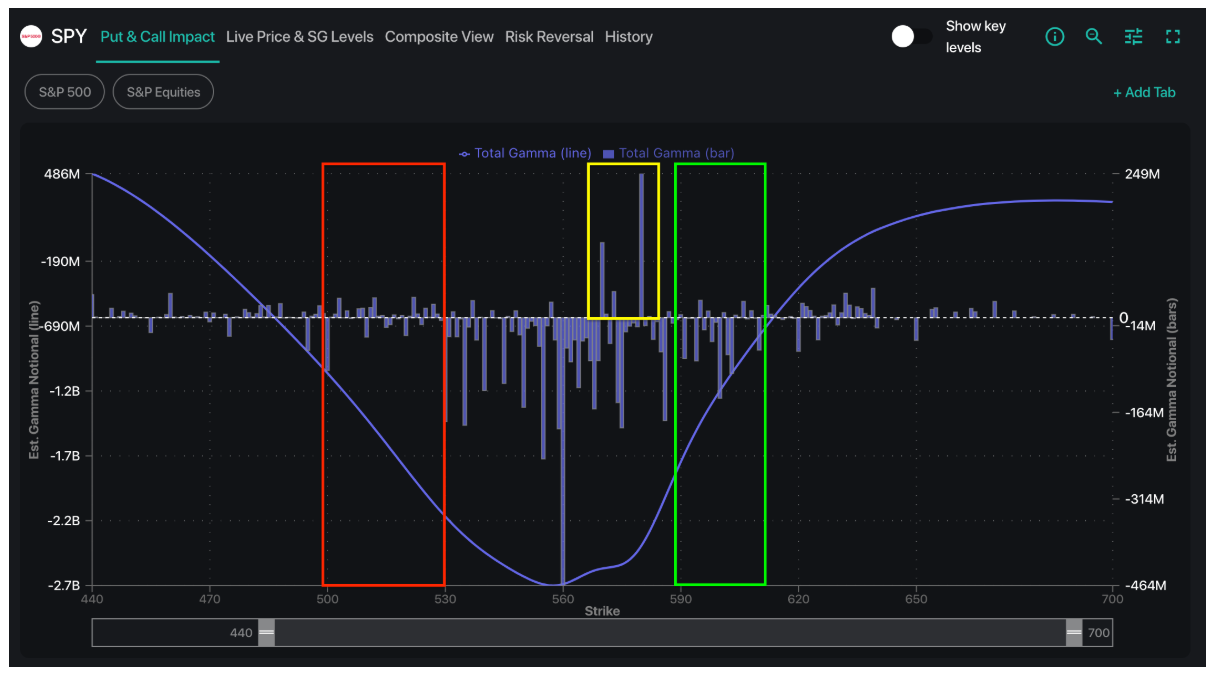

In yesterday’s note we set some clear upside & downside exhaustion zones, and we see little to shift those outer “major” bounds today (red <530 support, green >590) – with the exception that is seems like SPY 570 may line up for resistance today more due to SPX 0DTE gamma vs SPY positive gamma strikes.

Shown in TRACE is the early onset of positive 0DTE gamma in the SPX in the 5,700-5,750 level. Of course Trump is set to make an announcement at 10AM, which could add to market volatility. We would note that gamma remains rather negative through the 5,6xx’s, and so a negative reaction to Trump’s update could be quite slippery until <=5,600.

Turning to vol, we see that vol has lightly reduced (~1/3 vol pt) today (teal) from pre-FOMC levels (gray), with a more pronounced decline to upside tails (via 1-month SPX skew). Realized vols are trending lower, which does help to alleviate the negative risk premium we have been flagging – but we continue to believe this is a market that commands some risk premium. We certainly feel like a “boy who cried wolf” on the negative vol premium point, but it is the core positioning risk we see.

We think this risk can be offset with some longer dated put spread protection (~1-2 months out), while offsetting upside risk via weekly call spreads/call flies.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5625.76 | $5606 | $561 | $19791 | $483 | $1983 | $197 |

| SG Gamma Index™: |

| -0.243 | -0.131 |

|

|

|

|

| SG Implied 1-Day Move: | 0.72% | 0.72% | 0.72% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5654.76 | $5635 | $560 | $19640 | $484 | $2000 | $200 |

| Absolute Gamma Strike: | $6019.76 | $6000 | $550 | $20000 | $490 | $2000 | $190 |

| Call Wall: | $5819.76 | $5800 | $570 | $18200 | $500 | $2110 | $210 |

| Put Wall: | $5219.76 | $5200 | $550 | $19000 | $450 | $2000 | $190 |

| Zero Gamma Level: | $5635.76 | $5616 | $564 | $19593 | $482 | $2008 | $209 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.963 | 0.824 | 1.261 | 1.027 | 0.837 | 0.486 |

| Gamma Notional (MM): | ‑$246.191M | ‑$520.038M | $2.211M | ‑$19.784M | ‑$17.339M | ‑$989.639M |

| 25 Delta Risk Reversal: | -0.072 | -0.051 | -0.07 | -0.048 | -0.059 | -0.041 |

| Call Volume: | 356.226K | 1.557M | 5.187K | 758.982K | 10.573K | 256.611K |

| Put Volume: | 643.072K | 1.932M | 6.586K | 946.638K | 17.554K | 528.383K |

| Call Open Interest: | 7.902M | 6.426M | 67.933K | 3.876M | 297.326K | 3.943M |

| Put Open Interest: | 12.959M | 11.348M | 72.554K | 5.558M | 435.593K | 8.356M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5000, 5700, 5800] |

| SPY Levels: [550, 570, 560, 555] |

| NDX Levels: [20000, 19500, 21500, 21000] |

| QQQ Levels: [490, 480, 500, 470] |

| SPX Combos: [(5882,87.87), (5876,85.00), (5826,83.48), (5798,71.97), (5775,94.99), (5753,70.47), (5747,75.22), (5725,85.26), (5713,72.87), (5697,74.33), (5674,83.93), (5624,69.87), (5545,79.38), (5528,78.14), (5500,70.97), (5495,77.87), (5478,88.10), (5444,74.26), (5427,81.12), (5394,70.23), (5377,91.35), (5355,69.82)] |

| SPY Combos: [538.12, 578.36, 548.18, 568.3] |

| NDX Combos: [20484, 20068, 20266, 19871] |

| QQQ Combos: [500.18, 490.08, 494.89, 469.86] |

0 comentarios