Macro Theme:

Key dates ahead:

- 5/11: US/China Tariff Meeting

- 5/13 CPI

5/5: We continue to see a negative volatility premium in the S&P500, which validates owning 1-2 month put spreads as referenced on 4/25. Those puts were hedged with short dated/Friday exp long call structures, which profit if the SPX rallies >=5,700.

4/25: <=25 delta 1-month S&P500 puts/put spreads make sense on a risk/reward basis given ATM IV in SPX is ~25%, which is at or below short term realized vol. This is not a call for a market decline, as much as we see the potential for that outcome, and the price to play it seems reasonable. This is true particularly given next weeks earnings and macro prints.

Key SG levels for the SPX are:

- Resistance: 5,725, 5,800, 5900 (we see a long term top in the 5,900 area)

- Support: 5,600, 5,500, 5,300 (negative gamma as of 5/8 wanes <5,300)

Founder’s Note:

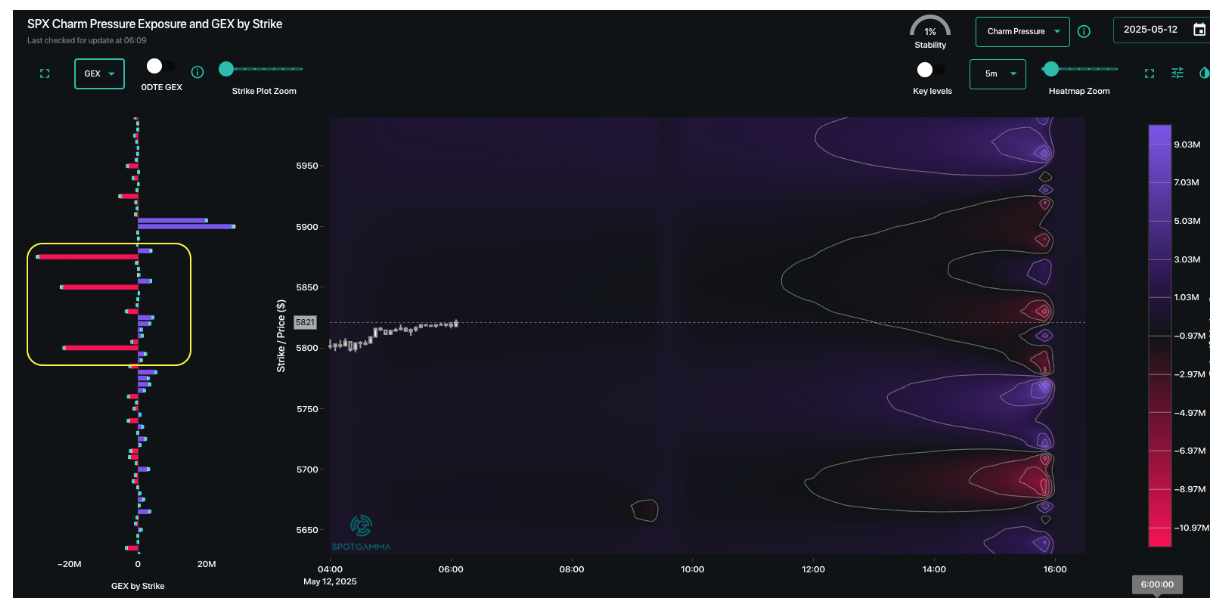

There is nothing but big negative gamma above, as seen in SPX TRACE (yellow box). There are some very large positive gamma strikes at 5,900, which is material resistance. 5,900 is also the area we we’ve been highlighting as “exhaustion” in recent notes (see Friday PM). SPX is at 5,830 premarket, and so the implication here is “more upside to go”.

This rally is eviscerating any long put insurance that traders held, and it may now make sense to roll some long gains into fresh insurance via put spreads and or VIX calls. We are going to continue wanting to hold a bit of insurance until we shift from a negative gamma regime to a positive gamma regime, which is unlikely to happen soon due to this Friday’s OPEX.

VIX & VIX futures are under pressure, with the VIX currently at 19.98 vs ~22 on Friday. However, futures are SPX +2.8%/NDX +3.75% and “thats still vol”, which reflects to us some interesting fixed strike vol (FSV) readings. Namely we near term SPX FSV around ATM as higher vs Friday for all strikes <=5,900. For strikes >5,900 FSV is down…recall we just talked about that fat positive gamma at 5,900 (above chart). The kink in the vol surface at this same area seems to confirm that these are price inflection points.

One would think that +3% futures jump presents the meat of the rally, meaning we can still move higher but likely without further 3% 1-day rallies. This means that there is likely some opportunity in holding long delta but short vega – possibly with some wide call flies centered around these large 5,900 gamma strikes.

There are also key CPI (tomorrow) & PPI (5/15) prints this week, which will keep some short dated IV’s a bit sticky.

Looking farther ahead, in this weekends installment of the OPEX Effect we discussed how call values were dominating this Friday’s expiration. Well – those call values are going to be much higher now due to this rally, which implies that this upcoming OPEX may be a consolidation point for equities.

Here is raw, unfiltered SPX gamma by strike, and you can see how much positions currently wane into 6,000 – with 6,000 as a massive gamma strike. We think a lot of the 6k positions are box type financing trades – but there is still likely a lot of other positions locked at that big round strike. We think makes it formidable resistance.

Rather than guess at future outcomes, if the SPX moves into the 5,900 area, and we see further signs of call selling into that >5,900 area (i.e. positive gamma and FSV lower), then that may sync up with the idea that the 5,900-6,000 is the interim top.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5677.79 | $5659 | $564 | $20061 | $488 | $2023 | $200 |

| SG Gamma Index™: |

| -0.26 | -0.074 |

|

|

|

|

| SG Implied 1-Day Move: | 0.71% | 0.71% | 0.71% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5663.79 | $5645 | $564 | $19940 | $484 | $2020 | $200 |

| Absolute Gamma Strike: | $6018.79 | $6000 | $550 | $20000 | $490 | $2000 | $200 |

| Call Wall: | $5818.79 | $5800 | $580 | $20700 | $500 | $2110 | $210 |

| Put Wall: | $5218.79 | $5200 | $555 | $18850 | $450 | $2000 | $190 |

| Zero Gamma Level: | $5687.79 | $5669 | $563 | $19711 | $483 | $2033 | $206 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.962 | 0.900 | 1.37 | 1.08 | 0.906 | 0.601 |

| Gamma Notional (MM): | ‑$76.651M | ‑$154.347M | $6.356M | $128.684M | ‑$6.341M | ‑$621.113M |

| 25 Delta Risk Reversal: | -0.066 | -0.045 | -0.061 | -0.044 | 0.00 | -0.031 |

| Call Volume: | 380.717K | 1.512M | 9.334K | 649.132K | 9.324K | 276.956K |

| Put Volume: | 661.661K | 1.692M | 5.83K | 809.213K | 18.402K | 345.532K |

| Call Open Interest: | 7.983M | 6.676M | 72.15K | 3.971M | 298.351K | 4.082M |

| Put Open Interest: | 12.944M | 11.29M | 71.703K | 5.701M | 432.551K | 8.453M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5000, 5700, 5800] |

| SPY Levels: [550, 570, 580, 560] |

| NDX Levels: [20000, 20100, 20700, 19500] |

| QQQ Levels: [490, 500, 480, 470] |

| SPX Combos: [(5903,96.07), (5852,87.03), (5818,85.31), (5801,95.61), (5773,82.03), (5767,80.11), (5750,86.06), (5728,84.08), (5717,74.05), (5700,72.96), (5615,73.64), (5603,74.90), (5569,79.94), (5558,70.20), (5552,86.88), (5524,72.64), (5518,78.42), (5501,88.54), (5473,69.66), (5450,80.15), (5417,68.93), (5400,90.19)] |

| SPY Combos: [578.62, 588.79, 583.71, 538.5] |

| NDX Combos: [20543, 20703, 20142, 20342] |

| QQQ Combos: [500.01, 490.24, 495.13, 504.89] |

0 comentarios