Macro Theme:

Key dates ahead:

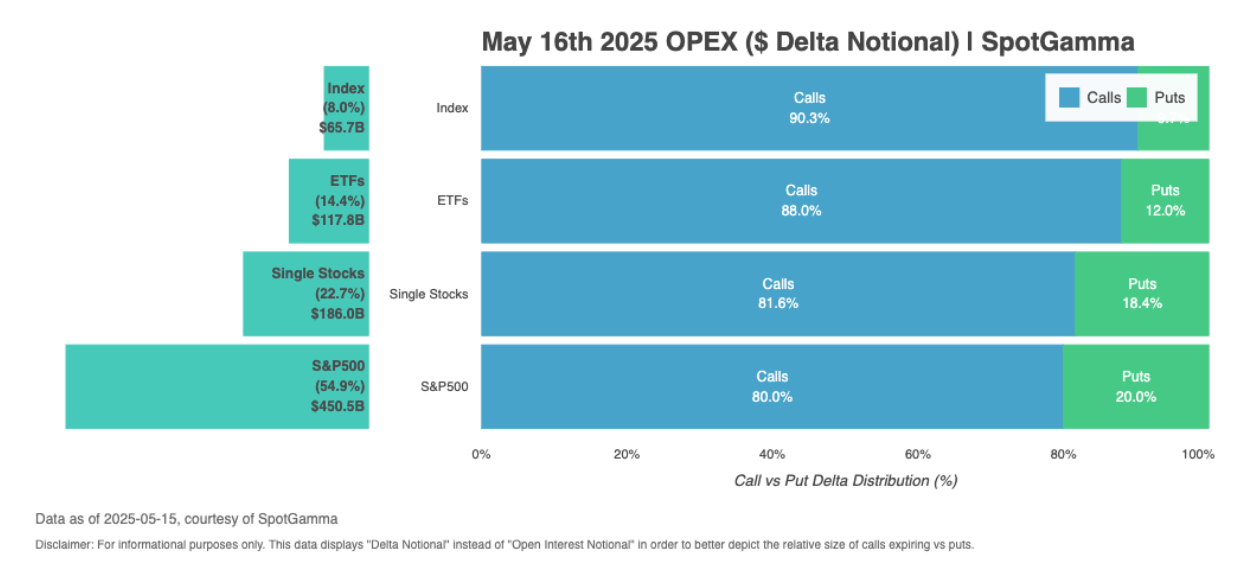

- 5/16 OPEX

- 5/21 VIX Exp

5/13: With the SPX >=5,825, we see Friday’s OPEX (5/16) as one of the most call-lopsided expirations ever. We think this may lead to a market correction next week.

5/12: Following the US/China trade advancements, we are looking at an overhead target of 5,900 (ref 5,831), and we seek to play that via short dated call spreads and/or call flies.

Re: Downside protection: Recent put hedges were eviscerated with the 5/12 rally, but we are going to continue wanting to hold a bit of insurance until the SPX shifts from a negative gamma regime to a positive gamma regime, which is unlikely to happen soon due to this Friday’s OPEX.

Key SG levels for the SPX are:

- Resistance: 5925, 6,000 (We see a long term top in the 5,900 – 6k area)

- Support: 5,900, 5,800, 5,700, 5,600, 5,500, 5,300 (Lack of major support levels below. Negative gamma as of 5/8 wanes <5,300)

Founder’s Note:

Futures are +25bps for today – expiration day.

The bulk of SPX Index options roll off at 9:30AM EST, with all other options expiring at 4pm ET. We see in total about 1/2-1/3 of total gamma being removed across the major indexes – with single stocks being more idiosyncratic. As we have been highlighting, call values ($ delta) is trouncing puts at rates we’ve never seen. These relative values are even higher than that of Feb OPEX, which was when the SPX hit all time highs.

The overall size of this expiration similar in size to April & Feb (see $ values in the teal bars, left side) – so not as large as quarterly OPEX like March or upcoming June.

For today, we note there is a 99’th %ile positive gamma strike at 5,925 (hover over the 5,925 strike in TRACE to see the stats) – and those 99’ers tend to be sticky. Below 5,900, we see some additional positive gamma which likely offers support for today. Above 5,950 there is quite frankly nothing – and so while we don’t expect a rally – we would not attempt to short a break above 5,950 unless we see positive gamma fill in and/or

HIRO

values turn negative.

It feels like quite some time since we’ve seen a pin-inducing 99’th %’ile positive gamma strike, and quite frankly today’s SPX positions seem to speak to lower volatility for today. Having said that, the 0DTE straddle is at $34/57bps/22%IV (ref 5,925), which is the lowest price we’ve seen all week. Given the gamma we have a harder time railing against that daily move expectation of 57bps – that said we sure don’t want to short a 57bps straddle.

Big picture we are not moving from our view that this expiration may lead to equity consolidation next week (see previous notes this week, like y’day).

While traders seem to be pricing in lower volatility & lower risk in the future – they are pricing in a healthy continuation of upside. Below we flipped the Compass to show Call Skew %’ile on the Y axis vs IV on the X. As you can see, many of the top names are in the upper half of this chart, showing that call skew (25 delta call IV vs ATM IV) is high relative to levels seen in the last year. This speaks to having to buy seemingly expensive calls after stocks have rallied +20% over the last several weeks.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5935.98 | $5916 | $590 | $21335 | $519 | $2094 | $208 |

| SG Gamma Index™: |

| 1.584 | 0.076 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5864.98 | $5845 | $588 | $20440 | $517 | $2055 | $207 |

| Absolute Gamma Strike: | $6019.98 | $6000 | $590 | $21300 | $500 | $2100 | $205 |

| Call Wall: | $6019.98 | $6000 | $600 | $21300 | $525 | $2100 | $210 |

| Put Wall: | $5219.98 | $5200 | $585 | $18000 | $450 | $2000 | $200 |

| Zero Gamma Level: | $5857.98 | $5838 | $585 | $20650 | $510 | $2058 | $209 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.197 | 1.091 | 1.408 | 1.176 | 1.16 | 0.754 |

| Gamma Notional (MM): | $649.811M | $681.413M | $10.41M | $347.666M | $18.796M | ‑$251.85M |

| 25 Delta Risk Reversal: | -0.044 | -0.024 | -0.04 | -0.024 | -0.03 | -0.012 |

| Call Volume: | 646.912K | 1.75M | 15.402K | 709.90K | 17.74K | 207.044K |

| Put Volume: | 838.394K | 2.502M | 8.585K | 1.082M | 18.603K | 651.385K |

| Call Open Interest: | 8.422M | 6.871M | 72.667K | 4.216M | 311.867K | 4.097M |

| Put Open Interest: | 13.826M | 12.637M | 81.42K | 6.506M | 455.70K | 9.067M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5800, 5850] |

| SPY Levels: [590, 585, 580, 600] |

| NDX Levels: [21300, 21000, 21500, 21325] |

| QQQ Levels: [500, 510, 520, 515] |

| SPX Combos: [(6201,94.12), (6148,85.97), (6100,98.04), (6065,74.03), (6047,92.49), (6023,69.56), (6012,91.24), (6000,99.36), (5988,79.67), (5982,72.92), (5976,87.63), (5970,76.41), (5964,89.52), (5958,76.53), (5952,98.54), (5941,90.23), (5935,90.92), (5929,73.07), (5923,88.90), (5911,90.15), (5905,96.92), (5899,92.04), (5876,80.46), (5870,72.41), (5864,72.77), (5852,79.63), (5822,71.79)] |

| SPY Combos: [598.17, 608.16, 588.18, 593.47] |

| NDX Combos: [21571, 21293, 21357, 21507] |

| QQQ Combos: [524.9, 523.35, 520.24, 534.76] |

0 comentarios