Macro Theme:

Key dates ahead:

- 6/4 ISM PMI

- 6/5 Jobless Claims

- 6/6 NFP

- 6/11 CPI

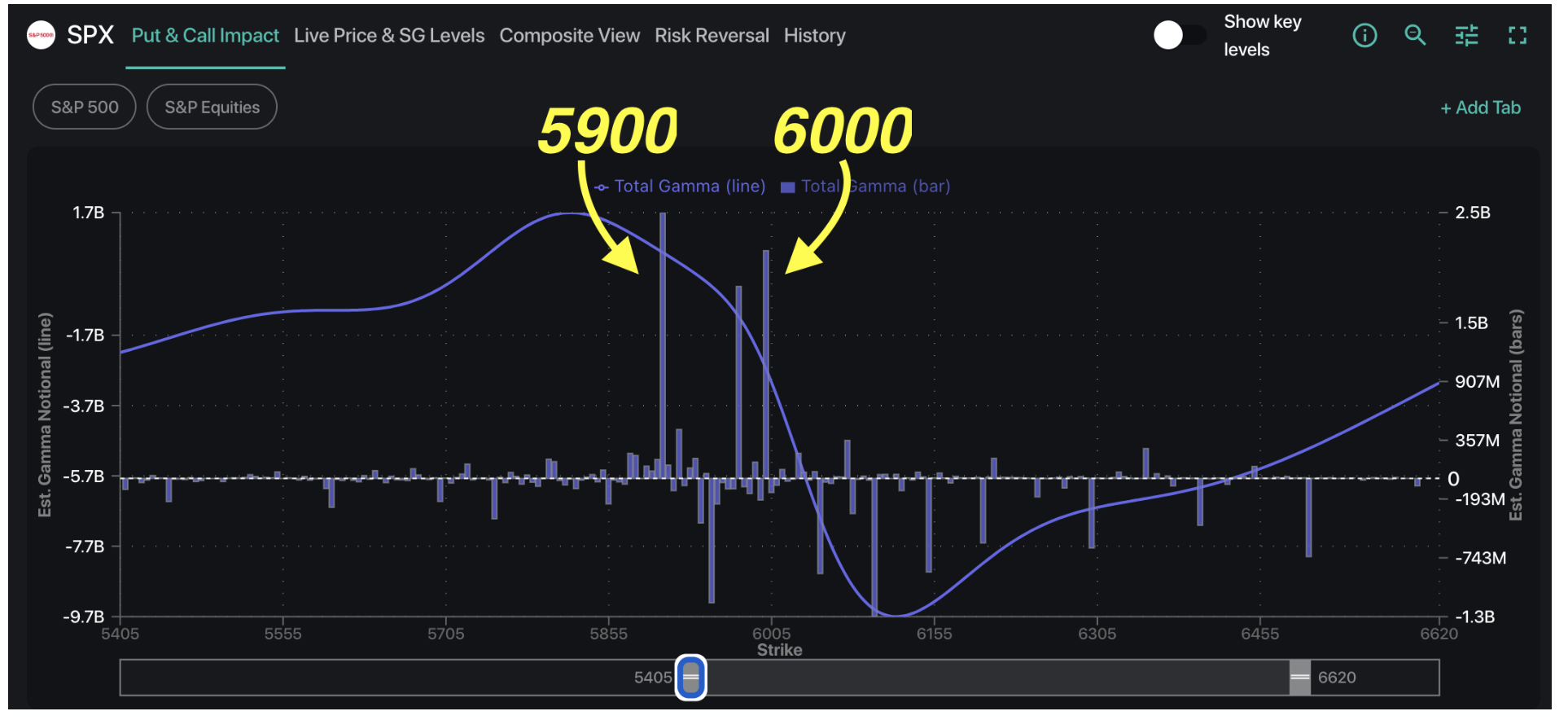

6/4: In line with the update from 5/27 – As the SPX has held >=5,900 we continue to favor upside equity plays, which syncs with looking for vol contraction into June monthly OPEX (6/20). We will operate from this position until/unless the SPX breaks <5,900. Under 5,900 we would expect negative gamma to increase, which could align with volatility spiking.

5/27: Our prime position here is maintaining rolling short dated tail positions, near the 5,750-5,700 zone, as the market consistently shows jump risk (ex: 20Y auction day and Friday 5/23). To the upside, if the SPX gets back >5,925 we would look to play June Exp call spreads/call flies into 6,000-6,100.

5,900 is the key pivot level due into 6/30 (5,905 JPM call).

Key SG levels for the SPX are:

- Resistance: 5,975, 6,000, 6,025 (We see a long term top in the 5,900 – 6k area)

- Pivot: 5,900

- Support: 5,775

Founder’s Note:

Futures are flat ahead of 10AM ET ISM.

The positive gamma keeps building – this time with the addition of some 0DTE calls at 6,000 (~3k contracts). Thats not huge, but big enough in this environment to draw some attention.

The other large strikes on the board remain the positive gamma at 5,975 and 5,900 – both of which should function to reduce volatility in the 5,9xxs.

We also should start to operate off of the assumption that if markets continue to rally then traders will be selling calls into upside strength – this if we get back into 6k and near all-time-highs. That adds positive gamma which should work volatility lower. Should SPX break back below <5,900 then negative gamma should re-take the reigns.

Running a volatility check – we see SPX realized at ~16% (both 1-month & 5-day). ATM SPX is at ~15%, implying that we have no real risk premium in this market. While we’ve been railing against this phenomenon, we’ve stepped down from this soap box while it seems positive gamma is building above 5,900. Further, as we push through June the JPM 5,905 strike will grow massively in gamma size, which should add a floor under the S&P.

If the positive gamma is real, and we avoid land mine headlines/data prints, then realized vol should continue to contract which pays off the short vol crew and adds additional support for stocks. What this all sums up to is that we think current S&P hedging flows are working in favor of bulls here, particularly as we get close to the monthly June expiration – and if we are near 5,900 after that then we have to favor a 5,900 pin into end-of-month. If the SPX moves <5,900 then we’d be looking to move back to core short positions.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5944.9 | $5935 | $596 | $21491 | $527 | $2070 | $209 |

| SG Gamma Index™: |

| 1.673 | 0.085 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $6028.22 | $6018.32 | $600.76 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5951.67 | $5941.78 | $593.12 |

|

|

|

|

| SG Volatility Trigger™: | $5904.9 | $5895 | $594 | $21240 | $524 | $2080 | $207 |

| Absolute Gamma Strike: | $6009.9 | $6000 | $600 | $21325 | $520 | $2100 | $200 |

| Call Wall: | $6009.9 | $6000 | $600 | $21325 | $530 | $2100 | $215 |

| Put Wall: | $5609.9 | $5600 | $550 | $21400 | $470 | $2000 | $200 |

| Zero Gamma Level: | $5910.9 | $5901 | $590 | $20801 | $518 | $2096 | $212 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.221 | 1.109 | 1.701 | 1.314 | 0.922 | 0.670 |

| Gamma Notional (MM): | $271.489M | $521.423M | $9.196M | $453.513M | ‑$37.345M | ‑$480.065M |

| 25 Delta Risk Reversal: | -0.049 | -0.043 | -0.05 | -0.039 | -0.038 | -0.035 |

| Call Volume: | 510.794K | 1.502M | 7.831K | 695.055K | 19.098K | 510.742K |

| Put Volume: | 837.338K | 2.389M | 11.55K | 901.926K | 35.275K | 651.72K |

| Call Open Interest: | 8.34M | 6.187M | 70.344K | 3.782M | 286.925K | 3.918M |

| Put Open Interest: | 13.00M | 11.037M | 81.267K | 5.246M | 462.843K | 8.475M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 5900, 5950, 5000] |

| SPY Levels: [600, 595, 590, 580] |

| NDX Levels: [21325, 21500, 22000, 21700] |

| QQQ Levels: [520, 510, 525, 530] |

| SPX Combos: [(6215,91.37), (6173,72.35), (6162,97.23), (6138,78.30), (6126,75.87), (6114,95.73), (6090,76.93), (6072,81.59), (6067,99.25), (6043,74.24), (6037,91.16), (6025,88.43), (6013,98.23), (6007,81.76), (5995,85.12), (5989,86.57), (5983,91.23), (5977,94.39), (5972,90.12), (5966,99.58), (5960,75.55), (5954,84.50), (5948,79.37), (5942,85.36), (5936,76.48), (5871,93.45), (5853,71.00), (5841,68.56), (5823,70.61), (5817,74.83), (5764,69.55), (5716,79.65), (5669,86.55)] |

| SPY Combos: [599.23, 609.31, 603.97, 618.79] |

| NDX Combos: [21148, 21599, 21728, 22008] |

| QQQ Combos: [519.02, 524.78, 539.95, 530.01] |

0 comentarios