Macro Theme:

Key dates ahead:

- 6/25: Powell Testimony

- 6/26: Jobless Claims, GDP

- 6/27: PCE

- 6/30: Quarterly OPEX

June OPEX Playbook:

Update 6/25: The apparent resolution of the Middle East conflict put a bid into stocks, which has rendered the JPM Call for 6/30 irrelevant. SPX vols have since collapsed, and we now look for equity correlation to decline. This means we think SPX stays fairly sticky in the 6,100-6,120 area, and we look to play longs in top single stocks which currently reflect cheaper calls vs SPY/QQQ: SMH/semis, Mag 7 etc.

Update 6/20: Post OPEX and into Monday 6/30 we are looking for the SPX to move to 5,900 and revolve around that strike. Given that, we will be looking to enter into put flies for next week around 5,900. We like flies here because we think the massive 5,905 JPM strike will be a shock absorber into 6/30 – unless there is some truly large escalation in Middle East tensions (lets pray that doesn’t happen).

Key SG levels for the SPX are:

- Resistance: 6,100, 6,120

- Pivot: 6,050 (bearish <, bullish >)

- Support: 6,000, 5,905 (6/30 Exp JPM Call)

Founder’s Note:

Futures are flat, and vols are in ever so slightly, with Powell again on deck at 10AM ET.

As we flagged last night, Captain Condor is in with at 11k Condor at 6,120/6,125 x 6,055/6,050. These are our target levels for today – and we note that 6,120 roughly lines up with SPY 610 Call Wall.

The SPX Call Wall remains at 6,100 – and so the current weight of positive gamma sits in this 20 point range (6,100-6,120).

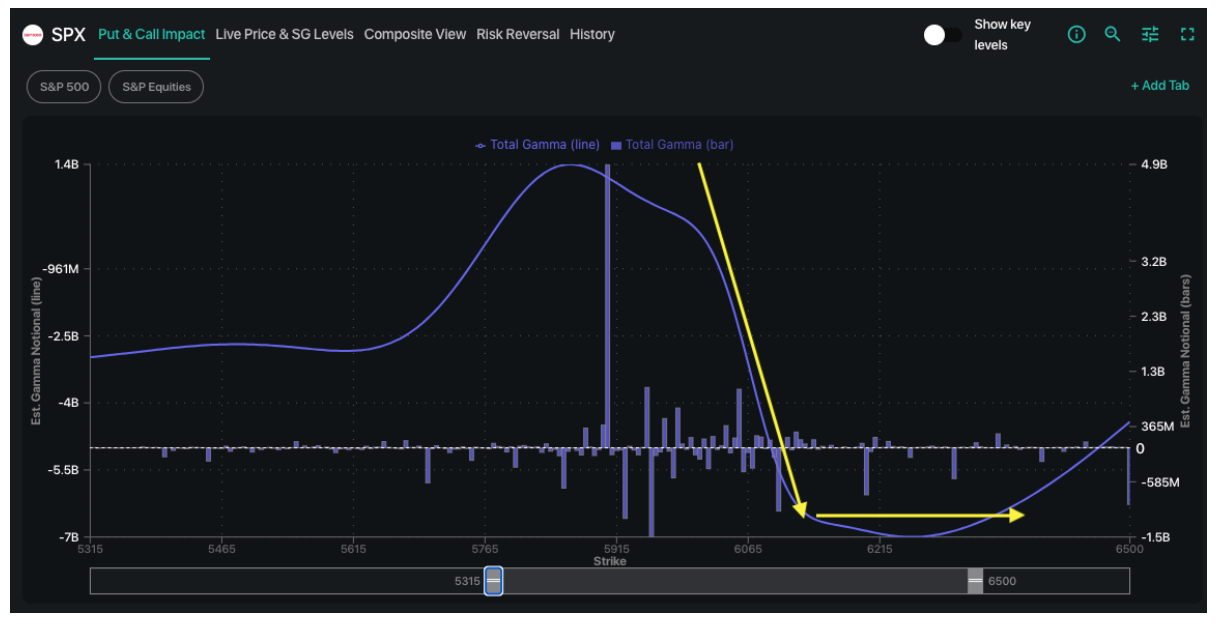

The other item from last night was that call skew seemed to come in rather sharply with the rally into 6,100. With that, we see that the SPX GEX has changed shape quite sharply, going from a gradual negative gamma slide >6,100 and into 6,200 (see y’day note), to a cliff that ends right at 6,100. This suggests that positive gamma >6,100 was added which corresponds to the drop in call skew. Essentially traders monetized the upside yesterday, and that should put a damper on the rate of change to the upside. We are looking at this as more of a volatility collapse signal and sticky SPX prices vs a massive topping signal.

How do we trade this?

SPX ATM vol is now <=13%, with 1-month realized at 11. That is tight. VIX seems like it can come in some now – but the SPX vol is pretty dead. Given that we see pinning flows in SPX, that vol may come in a bit more – but what we are looking at here is “stock picking”. This would come with a drop in equity correlation.

Below in Compass we would look at names ready to break out – like XLV or XLB, or names with cheap calls – for example SMH is showing relatively cheaper calls vs SPY. You could of course break into single stocks too, with many Mag 7 names showing relatively cheap call options.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6077.98 | $6025 | $606 | $21856 | $539 | $2132 | $214 |

| SG Gamma Index™: |

| 2.607 | 0.065 |

|

|

|

|

| SG Implied 1-Day Move: | 0.71% | 0.71% | 0.71% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6107.98 | $6055 | $604 | $21620 | $539 | $2100 | $212 |

| Absolute Gamma Strike: | $6052.98 | $6000 | $600 | $22200 | $540 | $2100 | $215 |

| Call Wall: | $6152.98 | $6100 | $610 | $21625 | $545 | $2200 | $220 |

| Put Wall: | $6107.98 | $6055 | $590 | $19500 | $470 | $2145 | $200 |

| Zero Gamma Level: | $6042.98 | $5990 | $605 | $21475 | $534 | $2143 | $215 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.444 | 1.077 | 2.007 | 1.113 | 1.196 | 0.817 |

| Gamma Notional (MM): | ‑$37.104M | $232.497M | $5.963M | $193.064M | ‑$13.333M | ‑$210.564M |

| 25 Delta Risk Reversal: | -0.049 | -0.031 | -0.048 | 0.00 | -0.035 | -0.016 |

| Call Volume: | 592.615K | 1.636M | 13.617K | 687.388K | 15.395K | 246.567K |

| Put Volume: | 995.633K | 2.32M | 15.702K | 1.108M | 23.66K | 715.812K |

| Call Open Interest: | 6.61M | 5.324M | 54.452K | 2.973M | 228.932K | 3.275M |

| Put Open Interest: | 11.604M | 11.294M | 69.092K | 4.588M | 375.807K | 7.125M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6100, 6050, 5000] |

| SPY Levels: [600, 605, 610, 607] |

| NDX Levels: [22200, 21625, 22100, 22000] |

| QQQ Levels: [540, 530, 545, 535] |

| SPX Combos: [(6278,86.04), (6254,84.46), (6230,97.60), (6206,83.34), (6182,96.43), (6158,93.15), (6140,71.27), (6134,99.36), (6110,98.43), (6103,77.90), (6091,81.85), (6085,78.39), (6079,99.47), (6073,91.75), (6067,87.32), (6061,95.29), (6055,99.97), (6049,89.30), (6043,91.38), (6037,86.46), (6031,99.66), (6025,93.55), (6013,72.43), (6007,90.92), (6001,83.34), (5995,78.62), (5989,95.14), (5983,72.65), (5911,73.49), (5887,92.18), (5862,84.21), (5856,75.70), (5832,87.85), (5808,77.76), (5784,73.88), (5736,88.94)] |

| SPY Combos: [607.35, 617.55, 604.95, 592.95] |

| NDX Combos: [22075, 21878, 21310, 22272] |

| QQQ Combos: [540.16, 525.8, 524.74, 544.94] |

0 comentarios