Macro Theme:

Key dates ahead:

- 6/27: PCE

- 6/30: Quarterly OPEX

June OPEX Playbook:

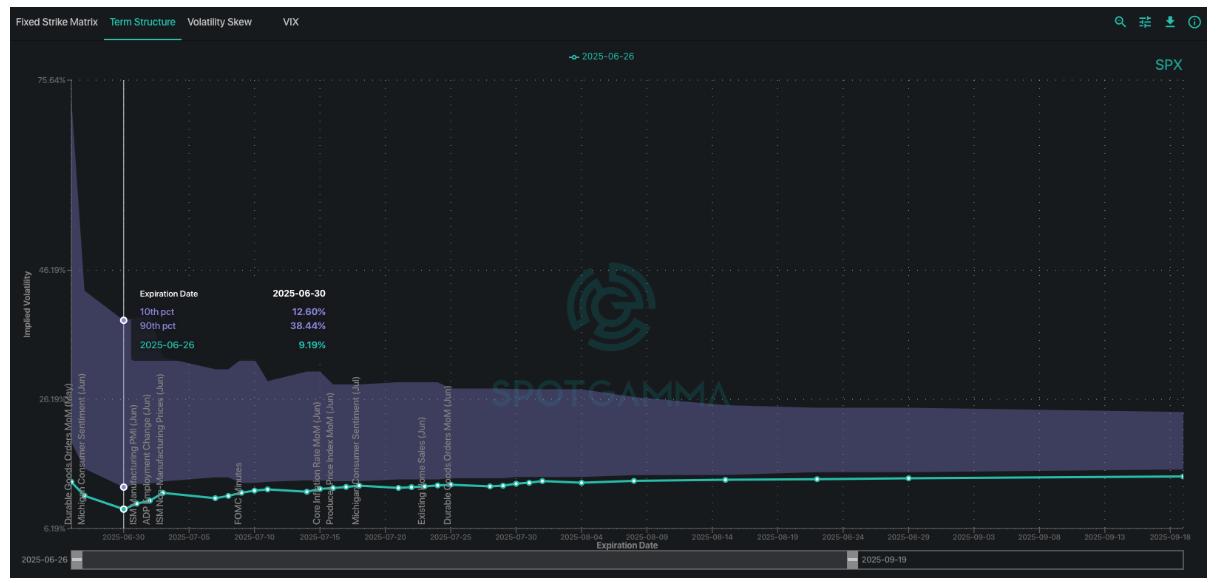

Update: 6/27: We think implied volatility will have a brief uptick on Monday as quarter end hits and the JPM collar trade & its related positions expire/roll off. With that we think a quick 1-2 session shake out is due, and that shake out would quickly recover ahead of the July 4th weekend. As a result, we are looking to be small long 6/30 or 7/1 S&P options (ex: straddle/strangle), buying them because the IV is just 9.1%. If equities should correct some on Monday we would look to buy the dip/sell IV pops into next weeks 3 day weekend.

Update 6/25: The apparent resolution of the Middle East conflict put a bid into stocks, which has rendered the JPM Call for 6/30 irrelevant. SPX vols have since collapsed, and we now look for equity correlation to decline. This means we think SPX stays fairly sticky in the 6,100-6,120 area, and we look to play longs in top single stocks which currently reflect cheaper calls vs SPY/QQQ: SMH/semis, Mag 7 etc.

Key SG levels for the SPX are:

- Resistance: 6,200

- Pivot: 6,100 (bearish <, bullish >)

- Support: 6,150, 6,100, 6000

Founder’s Note:

Futures +30bps ahead of PCE at 8:30AM ET.

Straddle check: $22/35 bps/14.2% IV ref(6,160). Bottom basement expectations despite PCE. However, should PCE be a miss, we’d expect the dip to be bought in a heavy way because there are big positive gamma strikes at 6,150 & 6,140. To the upside there are no material gamma strikes until 6,210. This dynamic will of course change because 0DTE traders will flood in after PCE & the market open – remember 0DTE volume is consistently 55-65% of SPX trading.

Monday’s ATM IV is now a 9.1% (!!!) – and as we covered in yesterday’s AM note (read here), we think this is due to the JPM collar & related positions squashing vol, and the rolling/expiration of those positions (along with Quarter end flow) could be a trigger for a short term jump in vol. We emphasize short term, because its very unlikely anyone wants to carry long protection over the July 4th weekend. More simply said: we are likely going to take a little swing at owning 6/30 or 7/1 straddles, placing the order into tonights close. Yes, there is some weekend carry cost, but that is de minimus given the low IV.

There is another dynamic here, and that is single stocks are starting to feel short term overbought. You can see this in compass as many names are now in the bottom right quadrant (reflecting expensive calls).

From a positioning standpoint, in yesterday’s Q&A we scanned at least a dozen stocks that all had a very similar “just above positive gamma thats about to expire” looks. This implies that we could lose some single stock cushioning/support. Again, this is not a sirens call for an all time high top as much as a 1-2 day shake out possibly today (PCE dependent) into Monday. Ultimately we think stocks will have the tailwind of IV suppression from after Monday through next weeks holiday.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6144.68 |

$6092 |

$611 |

$22237 |

$546 |

$2136 |

$215 |

|

SG Gamma Index™: |

|

2.796 |

0.096 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.68% |

0.68% |

0.68% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6092.68 |

$6040 |

$609 |

$21620 |

$544 |

$2155 |

$212 |

|

Absolute Gamma Strike: |

$6052.68 |

$6000 |

$600 |

$22500 |

$545 |

$2150 |

$215 |

|

Call Wall: |

$6252.68 |

$6200 |

$615 |

$21625 |

$550 |

$2185 |

$215 |

|

Put Wall: |

$5952.68 |

$5900 |

$590 |

$22250 |

$500 |

$2150 |

$200 |

|

Zero Gamma Level: |

$6063.68 |

$6011 |

$606 |

$21686 |

$541 |

$2147 |

$215 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.476 |

1.104 |

1.862 |

1.244 |

1.242 |

0.894 |

|

Gamma Notional (MM): |

$379.111M |

$676.449M |

$7.997M |

$412.468M |

‑$64.482M |

‑$22.874M |

|

25 Delta Risk Reversal: |

-0.041 |

-0.018 |

-0.042 |

-0.025 |

-0.025 |

-0.006 |

|

Call Volume: |

647.933K |

1.469M |

10.985K |

676.293K |

13.10K |

353.385K |

|

Put Volume: |

851.758K |

2.205M |

11.626K |

913.591K |

16.484K |

246.756K |

|

Call Open Interest: |

6.806M |

5.656M |

56.934K |

3.135M |

256.477K |

3.402M |

|

Put Open Interest: |

11.849M |

12.108M |

75.718K |

4.80M |

401.332K |

7.274M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6150, 6100, 6050] |

|

SPY Levels: [600, 610, 615, 611] |

|

NDX Levels: [22500, 21625, 22200, 22300] |

|

QQQ Levels: [545, 540, 550, 530] |

|

SPX Combos: [(6372,76.45), (6348,95.67), (6324,76.23), (6299,90.36), (6275,88.31), (6251,98.32), (6226,88.06), (6220,75.80), (6202,98.20), (6171,97.44), (6159,84.55), (6153,82.26), (6147,99.82), (6141,90.26), (6135,84.73), (6129,89.33), (6123,99.74), (6117,92.94), (6110,95.25), (6104,94.00), (6098,98.79), (6092,98.42), (6080,78.74), (6074,92.61), (6068,71.93), (6056,68.73), (6050,98.05), (6025,78.00), (5903,83.12), (5879,71.12), (5873,69.87), (5855,83.07), (5800,71.13)] |

|

SPY Combos: [607.73, 617.44, 612.58, 610.16] |

|

NDX Combos: [22393, 21415, 22193, 22282] |

|

QQQ Combos: [544.95, 549.82, 526.01, 547.65] |

0 comentarios