Macro Theme:

Key dates ahead:

- 7/3: NFP

- 7/4: July 4th (market closed)

- 7/16: Earnings Start

- 7/30: FOMC

June OPEX Playbook:

Update 6/30 (Looking past todays roll): Due to the large negative SPX gamma above, we will be looking to play long equity calls into the holiday weekend, likely in SMH due to cheap relative vol in names like NVDA & AVGO. Reference SPX 6,200.

Update: 6/27: We think implied volatility will have a brief uptick on Monday as quarter end hits and the JPM collar trade & its related positions expire/roll off. With that we think a quick 1-2 session shake out is due, and that shake out would quickly recover ahead of the July 4th weekend. As a result, we are looking to be small long 6/30 or 7/1 S&P options (ex: straddle/strangle), buying them because the IV is just 9.1%. If equities should correct some on Monday we would look to buy the dip/sell IV pops into next weeks 3 day weekend.

Key SG levels for the SPX are:

- Resistance: 6,225, 6,250, 6,300

- Pivot: 6,170 (bearish <, bullish >)

- Support: 6,200, 6,170, 6,100

Founder’s Note:

Futures are flat ahead of NFP at 8:30AM ET.

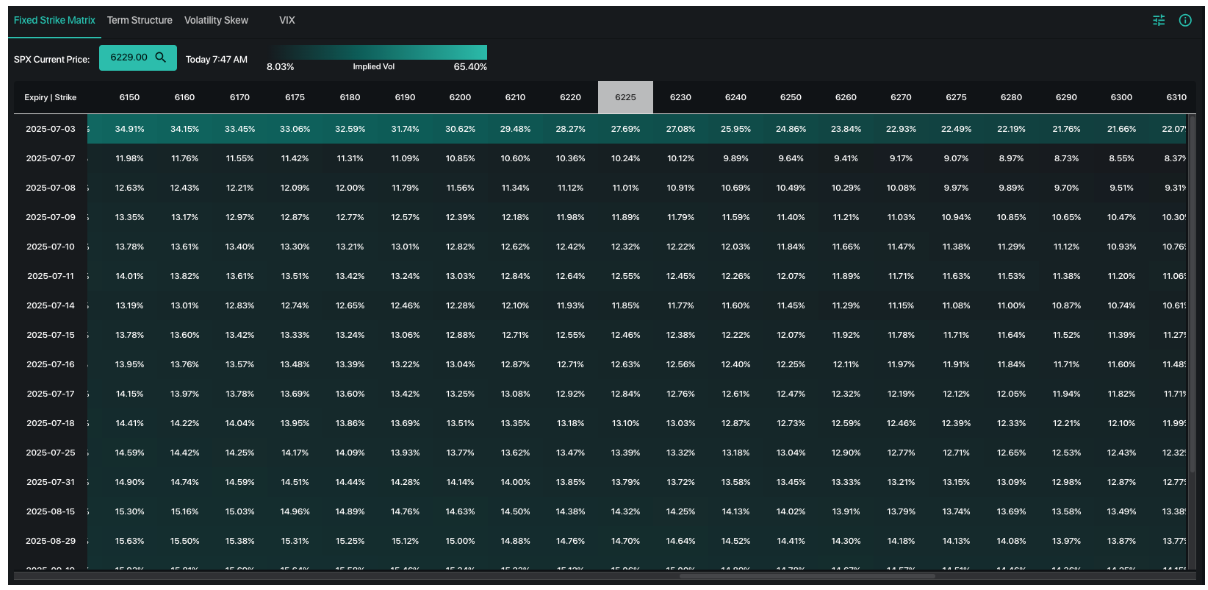

SPX is well supported at 6,225 and 6,200. Resistance is at 6,250.

The 0DTE straddle is $33.3/ /IV 25%, which is not a whole lot, but considering we are in front of the summer holiday then we’d reframe this as mildly important. The macro pundits are clinging to the notion that a “just right bad” report can imply earlier rate cuts. We don’t know about that, but we are willing to wager that anything outside of a giant tail print leads to positive SPX drift and vols leaking lower.

Those vols have a bit of downside left as ATM IV’s are 11-15% over the next 30 days, as we said yesterday the VIX at 16.7 is more “fairly valued” at ~12 considering that 1-month SPX realized is ~9%

When we look forward to OPEX as a place for the market to turn south and consolidate some of these gains – and for vol to reflate a bit. You can see before 7/18 there is nothing of meaningful size expiring. That leaves 0DTE volume to dominate – and it is at +60% of daily volume over the last few weeks. That same week is when earnings start to pick up and then the FOMC chatter around rates will increase, too (FOMC Jul 30).

For now we continue to want to press single stock positions for directional views, while playing “mean reversion with positive drift” intraday on SPX. Just like the last few days: find the +99th %ile positive gamma strike and look for the SPX to tag it.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6247.18 | $6198 | $620 | $22478 | $550 | $2197 | $221 |

| SG Gamma Index™: |

| 2.585 | -0.026 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.68% | 0.68% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6219.18 | $6170 | $617 | $21610 | $549 | $2100 | $217 |

| Absolute Gamma Strike: | $6049.18 | $6000 | $620 | $22500 | $545 | $2200 | $220 |

| Call Wall: | $6349.18 | $6300 | $625 | $21625 | $560 | $2240 | $220 |

| Put Wall: | $5549.18 | $5500 | $600 | $19500 | $500 | $2090 | $200 |

| Zero Gamma Level: | $6164.18 | $6115 | $619 | $22086 | $545 | $2159 | $219 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.462 | 0.972 | 1.761 | 1.083 | 1.436 | 1.04 |

| Gamma Notional (MM): | $607.772M | $232.381M | $8.278M | $231.594M | $15.618M | $200.635M |

| 25 Delta Risk Reversal: | -0.043 | -0.021 | -0.044 | -0.025 | -0.026 | -0.008 |

| Call Volume: | 454.456K | 1.077M | 8.941K | 502.105K | 17.665K | 446.396K |

| Put Volume: | 676.425K | 1.705M | 9.07K | 686.509K | 26.627K | 545.48K |

| Call Open Interest: | 6.919M | 5.448M | 60.052K | 3.147M | 247.595K | 3.764M |

| Put Open Interest: | 11.575M | 12.043M | 75.236K | 4.921M | 384.274K | 7.384M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6200, 6250, 6300] |

| SPY Levels: [620, 600, 615, 610] |

| NDX Levels: [22500, 21625, 22600, 23000] |

| QQQ Levels: [545, 550, 540, 555] |

| SPX Combos: [(6496,76.27), (6477,86.24), (6471,99.29), (6446,77.00), (6421,92.77), (6396,85.26), (6372,97.52), (6347,81.68), (6341,73.63), (6322,96.01), (6297,89.95), (6291,86.30), (6279,81.91), (6272,99.72), (6260,79.54), (6254,80.85), (6248,99.19), (6241,94.00), (6235,84.02), (6229,91.02), (6223,99.36), (6217,80.12), (6210,87.09), (6204,78.11), (6198,97.53), (6192,81.26), (6173,97.88), (6148,85.83), (6043,74.54), (5993,72.91), (5894,75.19)] |

| SPY Combos: [620.12, 622.59, 628.15, 617.65] |

| NDX Combos: [22860, 22658, 21467, 22456] |

| QQQ Combos: [550.27, 540.97, 541.52, 526.2] |

0 comentarios