Macro Theme:

Key dates ahead:

- 7/9: FOMC Mins

- 7/10: Jobless Claims

- 7/15: CPI

- 7/16: Earnings Start

- 7/30: FOMC

June OPEX Playbook:

Update 7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Update 6/30 (Looking past todays roll): Due to the large negative SPX gamma above, we will be looking to play long equity calls into the holiday weekend, likely in SMH due to cheap relative vol in names like NVDA & AVGO. Reference SPX 6,200.

Key SG levels for the SPX are:

- Resistance: 6,300

- Pivot: 6,250 (bearish <, bullish >)

- Support: 6,250, 6,200

Founder’s Note:

Futures are down 20bps, but vols are frankly not caring into the unofficial first week of summer trading.

This week is also data light with just Fed Mins on the 9th and Jobless Claims on the 10th.

CPI, OPEX earnings all fire up next week, and Trump has punted (or TACO’d?) tariff deadlines to 8/1.

Accordingly we see the 0DTE straddle at $26/41bps/IV16% (ref 6,260) – which is pretty light.

TLDR: We suspect the bit of vol premium available this AM will be sold, and that could push stocks back toward 6,300.

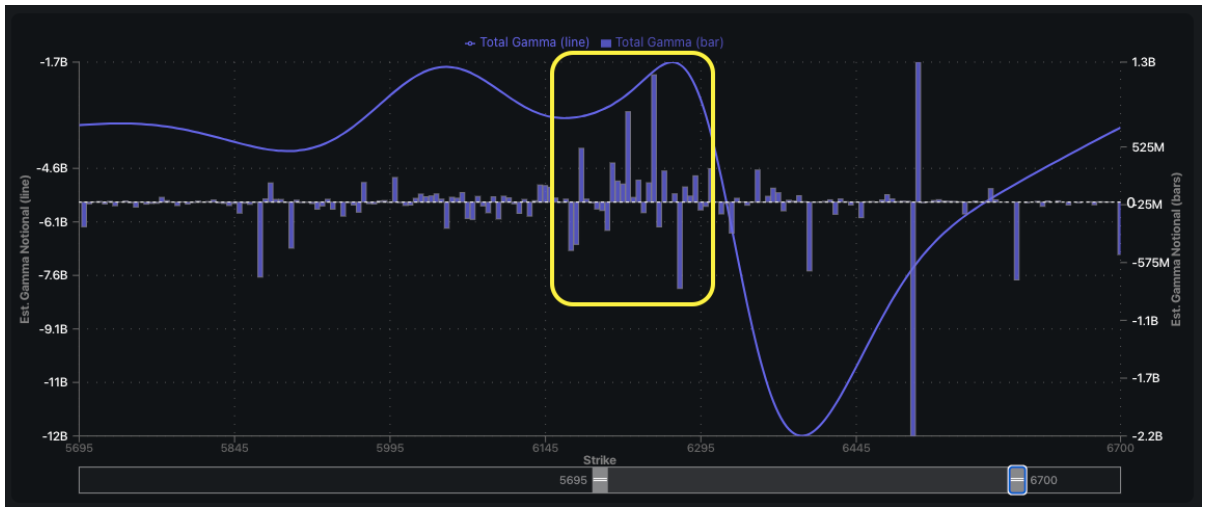

We quite frankly don’t see a major reason for change this week, either, given the major risks and change are all next week, and there is a decent pocket of local positive gamma (yellow box) which has been consistently reinforced by 0DTE flows. Don’t forget: those 0DTE SPX flows are +60% of SPX volume these days.

We have to also remember that vol was smashed into Thursday’s close, with today’s IV going out in the 7%’s. Therefore today getting a bit of vol reflation off of the weekend effect makes sense – but we think that vol is just going to be re-smashed because this week isn’t offering much to move the risk needle. The VIX may hold up a bit because the 30-day window to which VIX is tied holds events like FOMC & the new tariff deadline, but short dated vol (aka this weeks exp IV) likely drops back to the 10% area (from ~14).

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6245.87 | $6198 | $620 | $22478 | $550 | $2197 | $221 |

| SG Gamma Index™: |

| 2.585 | -0.026 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.68% | 0.68% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| In PM note | In PM note |

|

|

|

|

| SG Implied 1-Day Move Low: |

| In PM note | In PM note |

|

|

|

|

| SG Volatility Trigger™: | $6217.87 | $6170 | $617 | $21610 | $549 | $2100 | $217 |

| Absolute Gamma Strike: | $6047.87 | $6000 | $620 | $22500 | $545 | $2200 | $220 |

| Call Wall: | $6347.87 | $6300 | $625 | $21625 | $560 | $2240 | $220 |

| Put Wall: | $5547.87 | $5500 | $600 | $19500 | $500 | $2090 | $200 |

| Zero Gamma Level: | $6162.87 | $6115 | $619 | $22086 | $545 | $2159 | $219 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.462 | 0.972 | 1.761 | 1.083 | 1.436 | 1.04 |

| Gamma Notional (MM): | $607.772M | $232.381M | $8.278M | $231.594M | $15.618M | $200.635M |

| 25 Delta Risk Reversal: | -0.043 | -0.021 | -0.044 | -0.025 | -0.026 | -0.008 |

| Call Volume: | 454.456K | 1.077M | 8.941K | 502.105K | 17.665K | 446.396K |

| Put Volume: | 676.425K | 1.705M | 9.07K | 686.509K | 26.627K | 545.48K |

| Call Open Interest: | 6.919M | 5.448M | 60.052K | 3.147M | 247.595K | 3.764M |

| Put Open Interest: | 11.575M | 12.043M | 75.236K | 4.921M | 384.274K | 7.384M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6200, 6250, 6300] |

| SPY Levels: [620, 600, 615, 610] |

| NDX Levels: [22500, 21625, 22600, 23000] |

| QQQ Levels: [545, 550, 540, 555] |

| SPX Combos: [(6496,76.27), (6477,86.24), (6471,99.29), (6446,77.00), (6421,92.77), (6396,85.26), (6372,97.52), (6347,81.68), (6341,73.63), (6322,96.01), (6297,89.95), (6291,86.30), (6279,81.91), (6272,99.72), (6260,79.54), (6254,80.85), (6248,99.19), (6241,94.00), (6235,84.02), (6229,91.02), (6223,99.36), (6217,80.12), (6210,87.09), (6204,78.11), (6198,97.53), (6192,81.26), (6173,97.88), (6148,85.83), (6043,74.54), (5993,72.91), (5894,75.19)] |

| SPY Combos: [620.12, 622.59, 628.15, 617.65] |

| NDX Combos: [22860, 22658, 21467, 22456] |

| QQQ Combos: [550.27, 540.97, 541.52, 526.2] |

0 comentarios