Macro Theme:

Key dates ahead:

- 7/9: FOMC Mins

- 7/10: Jobless Claims

- 7/15: CPI

- 7/16: Earnings Start

- 7/30: FOMC

July OPEX Playbook:

Update 7/8: Watch the second half of July as a possible turning point/change in bullish trend: 7/15 CPI, 7/18 OPEX, 7/30 FOMC & 8/1 tariff deadline. If SPX breaks 6,200 at any time from now through that window we will flip to risk-off.

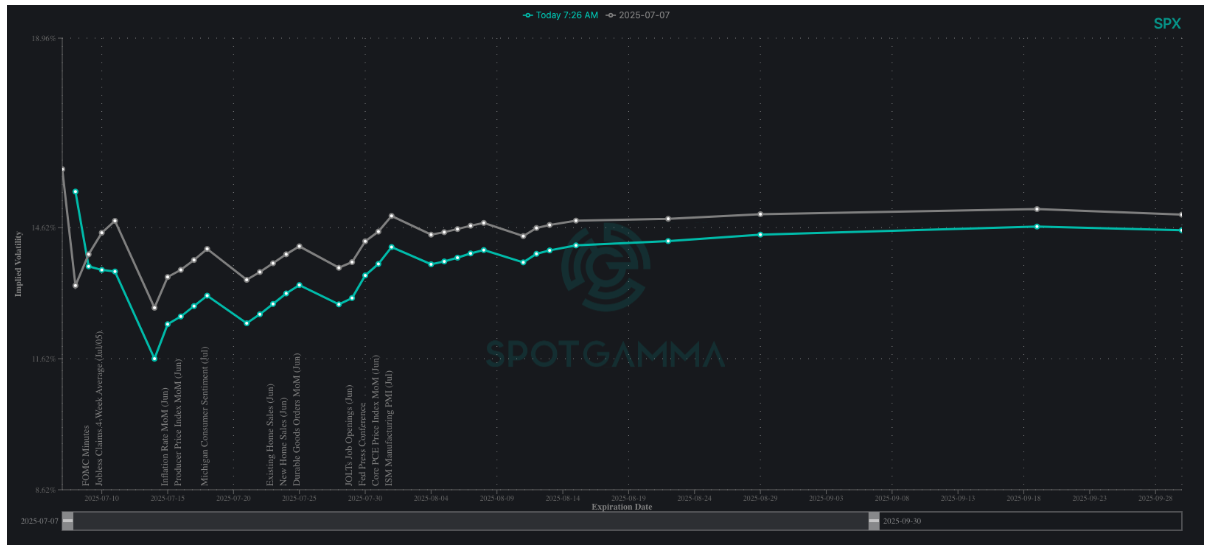

Update 7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Update 6/30 (Looking past todays roll): Due to the large negative SPX gamma above, we will be looking to play long equity calls into the holiday weekend, likely in SMH due to cheap relative vol in names like NVDA & AVGO. Reference SPX 6,200.

Key SG levels for the SPX are:

- Resistance: 6,260, 6,300

- Pivot: 6,200 (bearish <, bullish >)

- Support: 6,200, 6,1000

Founder’s Note:

Futures are 20bps higher with no major data on the tape today.

We start with vols, as after yesterday’s selling we see SPX fixed strike vol down ~1%, with SPX term structure sinking for this AM vs last nights close. This suggests that yesterday’s selling was more of a profit taking consolidation vs start of something bigger. On this point, we will remain in “buy the dip” mode until/unless 6,200 is broken.

Onto key levels for today, where the standout strikes are related to the 13k contract Captain Condor, which is at 6,260 x 6,190. This position gives us a clean overhead target (6,260) and reinforces 6,200 area support.

Next week is still the week we think can be a turning point given the slew of data, OPEX, end-of-month FOMC and then the 8/1 tariff deadline – which is peak IV as shown below. This doesn’t have to be point at which the market drops sharply, but the conditions will be ripe. The argument we made yesterday & echo today is that these are all “second half of July” problems, and so 0DTE traders can come out and (attempt to) harvest vol.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6324.7 | $6279 | $620 | $22866 | $552 | $2249 | $219 |

| SG Gamma Index™: |

| 2.721 | -0.098 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.69% | 0.71% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| In PM note | In PM note |

|

|

|

|

| SG Implied 1-Day Move Low: |

| In PM note | In PM note |

|

|

|

|

| SG Volatility Trigger™: | $6190.7 | $6145 | $619 | $21620 | $549 | $2195 | $219 |

| Absolute Gamma Strike: | $6045.7 | $6000 | $620 | $22500 | $550 | $2200 | $220 |

| Call Wall: | $6345.7 | $6300 | $625 | $21625 | $560 | $2240 | $230 |

| Put Wall: | $5545.7 | $5500 | $600 | $19500 | $500 | $2150 | $200 |

| Zero Gamma Level: | $6148.7 | $6103 | $619 | $22132 | $546 | $2193 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.518 | 0.898 | 1.486 | 1.064 | 1.10 | 0.828 |

| Gamma Notional (MM): | $939.43M | $86.57M | $16.398M | $221.844M | $29.818M | ‑$127.76M |

| 25 Delta Risk Reversal: | -0.04 | 0.00 | -0.045 | -0.026 | -0.034 | -0.015 |

| Call Volume: | 498.125K | 1.425M | 7.588K | 637.017K | 16.29K | 317.911K |

| Put Volume: | 809.97K | 2.088M | 10.134K | 836.799K | 31.785K | 883.311K |

| Call Open Interest: | 6.891M | 5.579M | 60.962K | 3.149M | 245.546K | 3.702M |

| Put Open Interest: | 11.586M | 12.11M | 77.212K | 4.903M | 392.228K | 7.543M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6200, 6500] |

| SPY Levels: [620, 600, 615, 625] |

| NDX Levels: [22500, 22600, 23000, 21625] |

| QQQ Levels: [550, 545, 540, 555] |

| SPX Combos: [(6574,79.58), (6549,89.12), (6524,80.03), (6505,87.33), (6499,99.57), (6474,83.50), (6449,95.27), (6424,91.55), (6399,98.50), (6374,94.13), (6367,82.34), (6361,79.45), (6348,97.83), (6342,93.22), (6330,82.00), (6323,97.68), (6317,96.08), (6311,86.73), (6304,72.17), (6298,99.75), (6292,81.16), (6286,86.05), (6279,77.15), (6273,98.92), (6248,95.72), (6235,72.01), (6198,88.10), (6173,70.08), (6072,75.46), (6022,75.46)] |

| SPY Combos: [627.22, 647.23, 624.71, 637.22] |

| NDX Combos: [23187, 22981, 23393, 23073] |

| QQQ Combos: [560.11, 565.12, 570.13, 556.78] |

0 comentarios