Macro Theme:

Key dates ahead:

- 7/15: CPI

- 7/16: Earnings Start

- 7/30: FOMC

July OPEX Playbook:

Update 7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

7/8: Watch the second half of July as a possible turning point/change in bullish trend: 7/15 CPI, 7/18 OPEX, 7/30 FOMC & 8/1 tariff deadline. If SPX breaks 6,200 at any time from now through that window we will flip to risk-off.

7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Key SG levels for the SPX are:

- Resistance: 6,260, 6,300

- Pivot: 6,200 (bearish <, bullish >)

- Support: 6,200, 6,100

Founder’s Note:

Futures are off 50bps with no data on the tape. Traders are blaming the 35% Canadian tariff proposal for the drawdown – but we think this is just “overbought tremors”.

Vols are mildly higher, but we’d expect those vols to get sold today in front of the weekend, with a big positive gamma bar at 6,250 there to add some support.

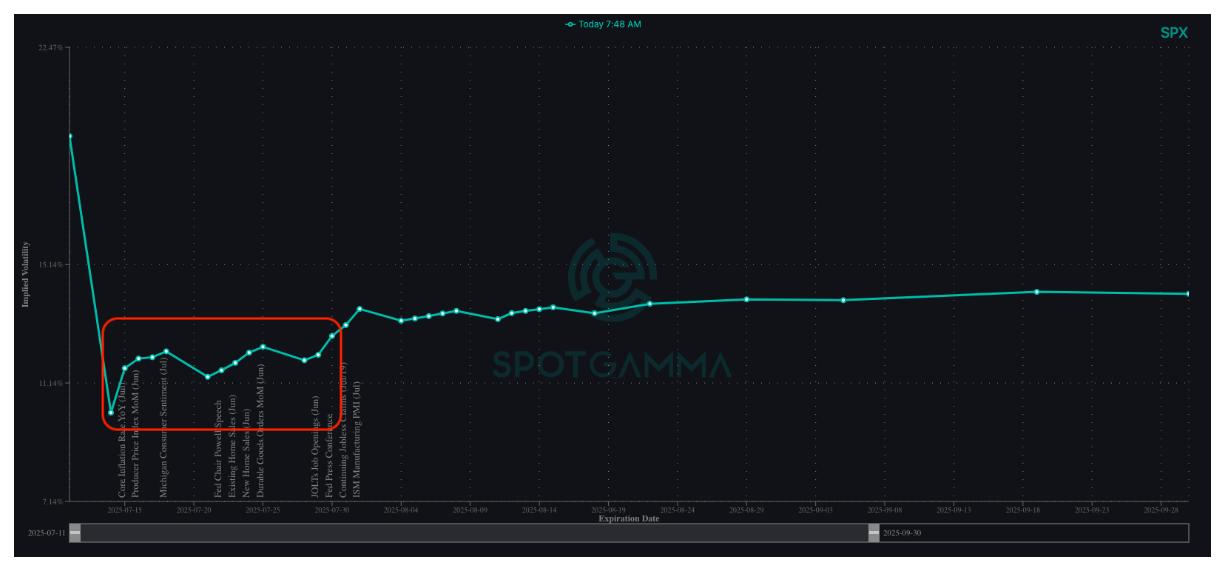

If you look at SPX term structure there is very low vol for the rest of July. despite CPI & FOMC, and a clear uptick tied to the 8/1 tariff deadline. We have been advocating for traders to sell call skew and/or buy puts into next week as we think that low IV expectation for the rest of July could be wrong. A kicker for that trade is you are getting into puts at objectively low IV’s which means low carry costs…particularly for longer dated puts that will hold 8/1 event vol premium. We like 2 or 3 month expiration SPX puts, and possibly 1-month risk reversals in high call skew stocks (ex: XLB, XLK).

Now we turn to the hottest trade in town: crypto.

Bitcoin nearly tagged 119k this am and is now up 7% since Wed night. The call vol in stuff like COIN, MSTR and IBIT is now hitting +90th percentile, which screams overbought. Adding to this is the fact that these IV readings are from last nights close – and so these IV’s are likely even richer this AM. ~2-3 month call 1x2s or broken wing call flies might be decent ways to play a mild correction in this space.

We’ll also just pass on anecdotally that we have been buying ~20-25 handle wide 1DTE ES/SPX strangles with a fair amount of success into this low IV environment. 4 our of the past 5 session these long strangles have paid – this is essentially the “Anti-Captain” trade. We will likely look at doing a wide 1DTE long condor into tonights close – selecting a condor as to try and carry some of the weekend decay with short deeper OTM contracts. Don’t take that as a recommendation (we are not qualified to offer investment advice), but more of a nod to IV’s already being a bit underpriced in this past relatively data-free week.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6308.2 | $6263 | $625 | $22864 | $555 | $2252 | $224 |

| SG Gamma Index™: |

| 3.183 | 0.069 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6290.2 | $6245 | $624 | $22650 | $554 | $2160 | $219 |

| Absolute Gamma Strike: | $6045.2 | $6000 | $620 | $23000 | $555 | $2200 | $220 |

| Call Wall: | $6345.2 | $6300 | $630 | $23000 | $560 | $2300 | $230 |

| Put Wall: | $5745.2 | $5700 | $610 | $22560 | $500 | $2150 | $200 |

| Zero Gamma Level: | $6225.2 | $6180 | $624 | $22635 | $550 | $2197 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.545 | 1.073 | 1.396 | 1.236 | 1.432 | 1.202 |

| Gamma Notional (MM): | $712.228M | $247.206M | $11.547M | $337.11M | $25.051M | $298.23M |

| 25 Delta Risk Reversal: | -0.035 | -0.019 | -0.037 | -0.019 | -0.024 | -0.004 |

| Call Volume: | 483.793K | 1.142M | 7.254K | 649.45K | 33.985K | 507.363K |

| Put Volume: | 676.783K | 1.789M | 10.07K | 698.999K | 46.788K | 607.153K |

| Call Open Interest: | 7.143M | 5.725M | 63.79K | 3.286M | 258.878K | 3.939M |

| Put Open Interest: | 12.194M | 13.081M | 82.73K | 5.156M | 411.552K | 7.991M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6250, 6200] |

| SPY Levels: [620, 625, 630, 600] |

| NDX Levels: [23000, 22700, 22500, 22750] |

| QQQ Levels: [555, 550, 560, 545] |

| SPX Combos: [(6558,80.87), (6533,90.76), (6508,82.99), (6489,87.80), (6482,99.71), (6457,85.34), (6432,96.24), (6407,93.62), (6382,99.07), (6370,70.74), (6363,79.70), (6357,95.29), (6351,81.03), (6345,90.95), (6332,99.34), (6326,91.81), (6320,75.85), (6313,93.96), (6307,98.92), (6301,96.76), (6295,97.69), (6288,86.45), (6282,99.84), (6276,96.54), (6263,78.69), (6257,96.94), (6251,70.27), (6232,92.32), (6226,81.90), (6182,80.61), (6107,76.39), (6032,69.74), (6006,76.19)] |

| SPY Combos: [627.8, 647.77, 625.31, 637.79] |

| NDX Combos: [23048, 22591, 22842, 23254] |

| QQQ Combos: [560.14, 559.59, 565.15, 570.16] |

0 comentarios