Macro Theme:

Key dates ahead:

- 7/15: CPI

- 7/16: Earnings Start

- 7/30: FOMC

July OPEX Playbook:

Update 7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

7/8: Watch the second half of July as a possible turning point/change in bullish trend: 7/15 CPI, 7/18 OPEX, 7/30 FOMC & 8/1 tariff deadline. If SPX breaks 6,200 at any time from now through that window we will flip to risk-off.

7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Key SG levels for the SPX are:

- Resistance: 6,260, 6,300

- Pivot: 6,200 (bearish <, bullish >)

- Support: 6,200, 6,100

Founder’s Note:

Futures are off 25bps, dismissing an increase in tariff rhetoric from Trump and chatter that Powell could step down.

BTC continues its move higher, to all time highs at 121.

We view 6,250 as prime resistance for today, with 6,200 support.

Vols are essentially flat from last Monday, with CPI tomorrow, VIX exp on Wed, and OPEX on Friday. We’ve stated several times that we think this upcoming period (today through 8/1) could bring an equity correction due to the very low volatility expectations, rich call skews, and potential catalysts. On that basis we recommended selling call spreads and/or buying longer dated downside protection.

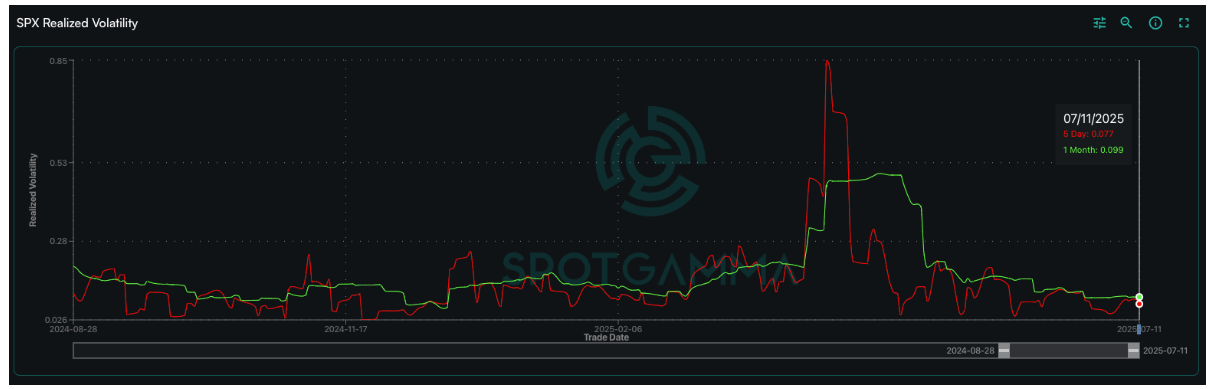

The fact is that SPX vol has been very stable for the last several weeks, as you can see below via 1-month SPX realized vol (green, 5-day = red).

The positive gamma positioning which has helped to stabilize this market is projected to be fairly stable in through this July OPEX. This is seen through the current SPX GEX (purple) being fairly unchanged when we remove July OPEX (yellow). This suggests that sticky upside into the 6,250-6,300 should remain in place. However, if we move down through 6,200 the positioning is sharply reduced – and such a move would also be accompanied with a spike in IV. That throws negative vanna onto a much lighter local gamma environment.

Obviously a lot can change from now to Friday – but the bottom line is this: If 6,200 is lost then that is the “bat signal” for a sharper correction of several percent. Further, we really don’t see any major support level below but we would instead watch 7/30 FOMC & 8/1 tariff TACO day as a time-based support/turning point.

Lastly – on Bitcoin.

Many are plotting BTC vols since 2020 or some crazy earlier period. We’d suggest that bitcoin has largely shifted into a more mature asset class and so the +100% IV’s of 2020 might be a thing of the past. Thats not a hill we want to die on as you really can’t discount how weird things can get in this environment.

That said we can see that IBIT (which launched in ~Nov) had IV’s in the 60s (which mirrors BTC vols in that time period), and so that is a reasonable “target high” IV for rich bitcoin vols. The chart below is from Friday’s close, and so this AM we are likely to see IBIT vols up quite a bit. We already see call skews in the >95th %’ile and so if we add in an IV rank >90 then that is a classic “stock up, vol up” overbought condition. Reference IBIT: $69.25.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6301.55 | $6259 | $623 | $22780 | $554 | $2234 | $221 |

| SG Gamma Index™: |

| 2.148 | -0.063 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6287.55 | $6245 | $624 | $22690 | $554 | $2195 | $219 |

| Absolute Gamma Strike: | $6042.55 | $6000 | $620 | $22500 | $550 | $2200 | $220 |

| Call Wall: | $6342.55 | $6300 | $630 | $23000 | $560 | $2300 | $230 |

| Put Wall: | $5742.55 | $5700 | $610 | $22490 | $500 | $2160 | $210 |

| Zero Gamma Level: | $6218.55 | $6176 | $622 | $22552 | $553 | $2212 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.335 | 0.935 | 1.161 | 1.044 | 1.047 | 0.887 |

| Gamma Notional (MM): | $672.276M | ‑$94.531M | $4.489M | $118.423M | $4.887M | ‑$93.345M |

| 25 Delta Risk Reversal: | -0.039 | -0.022 | -0.04 | -0.023 | 0.00 | -0.016 |

| Call Volume: | 454.679K | 995.554K | 6.49K | 510.723K | 12.966K | 245.876K |

| Put Volume: | 742.041K | 1.507M | 10.097K | 755.317K | 39.083K | 710.056K |

| Call Open Interest: | 7.156M | 5.66M | 62.527K | 3.206M | 254.352K | 3.947M |

| Put Open Interest: | 12.096M | 12.791M | 80.871K | 5.088M | 415.253K | 8.154M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6250, 6200] |

| SPY Levels: [620, 600, 630, 625] |

| NDX Levels: [22500, 22700, 23000, 22490] |

| QQQ Levels: [550, 555, 560, 545] |

| SPX Combos: [(6554,89.96), (6529,69.44), (6504,99.79), (6479,82.00), (6454,94.94), (6429,88.19), (6423,76.95), (6404,98.68), (6379,94.21), (6372,87.28), (6360,83.67), (6354,98.60), (6341,80.18), (6329,97.46), (6322,95.92), (6316,81.14), (6310,92.22), (6304,99.83), (6297,69.44), (6291,93.52), (6285,77.45), (6279,96.05), (6272,88.57), (6253,94.40), (6235,85.46), (6191,68.76), (6178,70.95), (6172,71.51), (6153,72.78), (6122,79.26), (6103,74.25), (6053,74.80), (6022,72.33), (6003,72.04), (5953,72.15)] |

| SPY Combos: [627.7, 647.72, 632.7, 637.71] |

| NDX Combos: [22507, 23008, 23213, 23418] |

| QQQ Combos: [559.89, 548.78, 554.89, 564.89] |

0 comentarios