Macro Theme:

Key dates ahead:

- 7/16: PPI

- 7/16: VIX Exp, Earnings Start

- 7/17: Jobless Claims

- 7/30: FOMC

July OPEX Playbook:

Update 7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

7/8: Watch the second half of July as a possible turning point/change in bullish trend: 7/15 CPI, 7/18 OPEX, 7/30 FOMC & 8/1 tariff deadline. If SPX breaks 6,200 at any time from now through that window we will flip to risk-off.

7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Key SG levels for the SPX are:

- Resistance: 6,250, 6,300

- Pivot: 6,200 (bearish <, bullish >)

- Support: 6,200, 6,180, 6,100

Founder’s Note:

Futures are flat ahead of PPI at 8:30 and VIX Exp at 9:30AM ET.

TLDR: We remain of the view that equities are due for a correction, with short dated vol being underprices (<8/1 IV’s). Yesterday reinforced that view, and we could make the case that today’s VIX expiration was supportive of equities – which yesterday saw a massive -$8bn of negative delta in the S&P500.

Rates did move higher after yesterdays CPI, and so PPI may add more eyes on the rate space, particularly in light of Trump’s pressure on Powell to cut. If anything that adds intrigue (i.e. event vol) to the 7/30 FOMC.

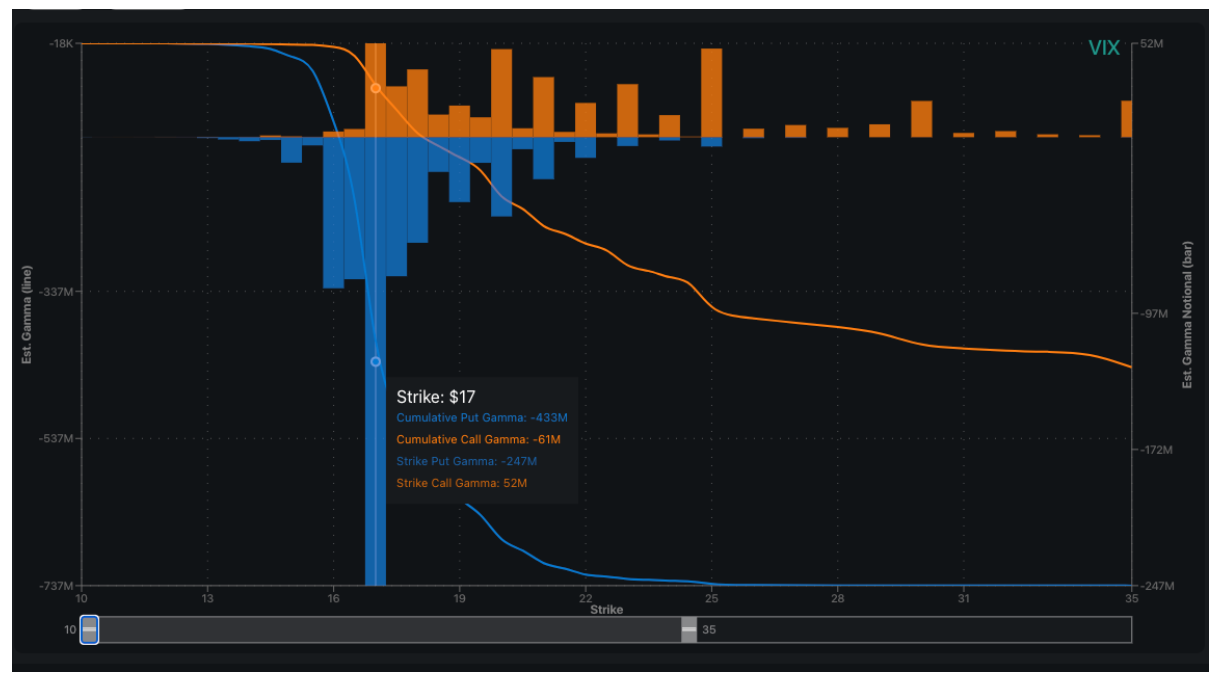

For VIX exp, 17 is still the dominant strike and possibly a VIX pin level into 9:30. We’ve seen many odd ES futures moves into VIX exp, and big jumpy cash moves out of VIX exp – so tread lightly around that time. The VIX is currently at 17.29, and so we will see if an un-tethering does indeed come with this AM expiration.

For levels – 6,250 is the obvious overhead resistance level with first support at 6,200. We also flag a pretty large 6,180 0DTE put, which could add downside support if PPI is a miss. At the moment this is the biggest strike on the board…and so we don’t rule out a test of that level.

Last night we talked about how NVDA had massive options volume of 4mm contracts, but only managed a puny $40mm in

HIRO

delta. Today we see the SGOI essentially unchanged from yesterday, suggesting the China-chip news didn’t unlock some massive NVDA value.

BABA, though, saw +$240mm

HIRO

on +400k contracts, and you can see plenty of negative gamma up to the 120’s. From the options landscape, this seems to be where traders are expressing bullishness on the NVDA Chinese chip news.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6308.91 | $6268 | $622 | $22855 | $556 | $2249 | $218 |

| SG Gamma Index™: |

| 1.513 | 0.010 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6285.91 | $6245 | $622 | $22840 | $556 | $2225 | $219 |

| Absolute Gamma Strike: | $6040.91 | $6000 | $620 | $23000 | $560 | $2200 | $220 |

| Call Wall: | $6340.91 | $6300 | $630 | $23100 | $560 | $2240 | $230 |

| Put Wall: | $6220.91 | $6180 | $610 | $22700 | $500 | $2160 | $210 |

| Zero Gamma Level: | $6225.91 | $6185 | $621 | $22626 | $555 | $2210 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.204 | 1.01 | 1.519 | 1.116 | 0.885 | 0.817 |

| Gamma Notional (MM): | $674.628M | ‑$163.16M | $8.613M | $101.911M | $20.457M | ‑$344.513M |

| 25 Delta Risk Reversal: | -0.045 | -0.024 | -0.042 | 0.00 | 0.00 | -0.017 |

| Call Volume: | 503.061K | 1.40M | 10.668K | 667.54K | 19.694K | 422.525K |

| Put Volume: | 938.217K | 1.826M | 9.233K | 827.473K | 29.407K | 891.575K |

| Call Open Interest: | 7.298M | 5.854M | 65.937K | 3.283M | 264.226K | 4.135M |

| Put Open Interest: | 12.522M | 13.166M | 81.119K | 5.307M | 431.77K | 8.378M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6250, 6200] |

| SPY Levels: [620, 625, 600, 630] |

| NDX Levels: [23000, 22800, 22900, 22500] |

| QQQ Levels: [560, 550, 555, 545] |

| SPX Combos: [(6576,89.66), (6551,82.80), (6532,87.79), (6526,99.50), (6500,83.95), (6475,94.65), (6450,91.84), (6425,98.36), (6406,72.08), (6400,95.10), (6388,77.93), (6375,97.85), (6369,85.70), (6356,85.09), (6350,99.10), (6344,76.65), (6338,95.82), (6331,75.25), (6325,99.76), (6319,94.50), (6312,88.22), (6306,90.74), (6300,98.68), (6281,74.34), (6269,88.61), (6262,80.29), (6250,86.44), (6243,71.20), (6231,70.91), (6225,84.74), (6218,81.92), (6212,83.21), (6206,90.53), (6200,91.40), (6181,70.52), (6175,72.63), (6168,73.16), (6149,87.45), (6124,79.03), (6074,82.47), (6043,78.25), (6024,76.08), (5974,74.37)] |

| SPY Combos: [627.93, 647.93, 632.93, 637.93] |

| NDX Combos: [22993, 23084, 23198, 23404] |

| QQQ Combos: [560.1, 565.11, 570.12, 555.1] |

0 comentarios