Macro Theme:

Key dates ahead:

- 7/17: Jobless Claims

- 7/30: FOMC

July OPEX Playbook:

Update 7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

7/8: Watch the second half of July as a possible turning point/change in bullish trend: 7/15 CPI, 7/18 OPEX, 7/30 FOMC & 8/1 tariff deadline. If SPX breaks 6,200 at any time from now through that window we will flip to risk-off.

7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Key SG levels for the SPX are:

- Resistance: 6,300

- Pivot: 6,200 (bearish <, bullish >)

- Support: 6,250, 6,200, 6,180, 6,100

Founder’s Note:

Macro Theme:

Key dates ahead:

- 7/16: PPI

- 7/16: VIX Exp, Earnings Start

- 7/17: Jobless Claims

- 7/30: FOMC

July OPEX Playbook:

Update 7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

7/8: Watch the second half of July as a possible turning point/change in bullish trend: 7/15 CPI, 7/18 OPEX, 7/30 FOMC & 8/1 tariff deadline. If SPX breaks 6,200 at any time from now through that window we will flip to risk-off.

7/7: We think the SPX holds the 6,250-6,300 area this week, and short dated IV’s like contract sharply (ref 15% ATM IV). Next week could be a big turning point with CPI/OPEX & earnings kicking off.

Key SG levels for the SPX are:

- Resistance: 6,250, 6,300

- Pivot: 6,200 (bearish <, bullish >)

- Support: 6,200, 6,180, 6,100

Founder’s Note:

Futures are flat ahead of Retail Sales and Jobless Claims at 8:30AM ET.

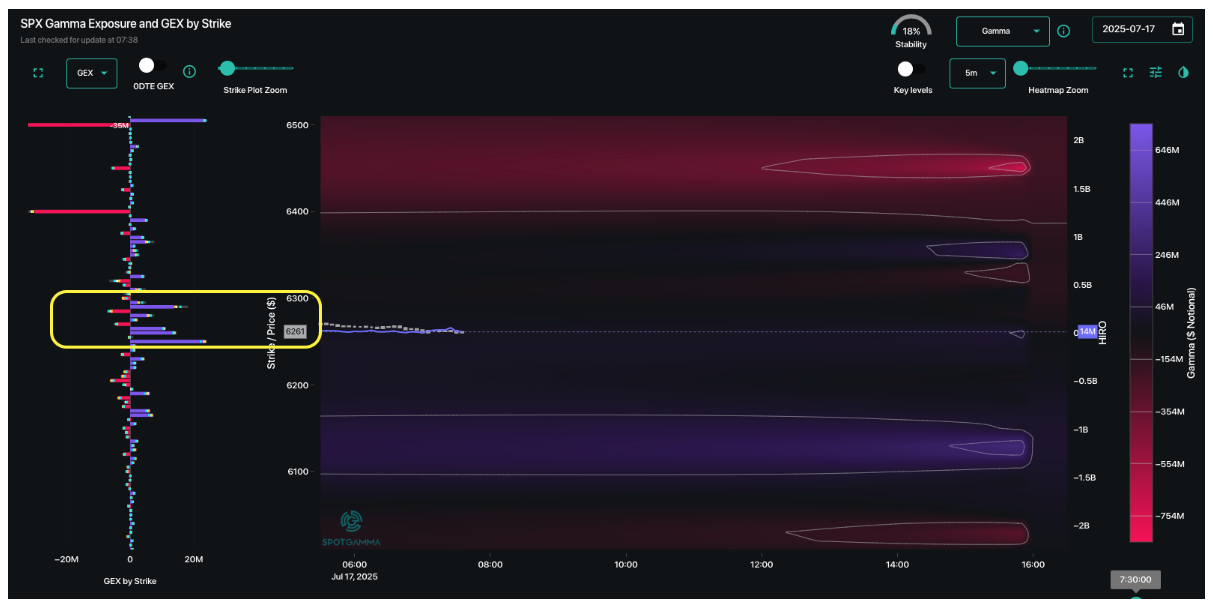

TLDR: Very little to update here as realized vol remains low into this expiration. While we anticipate weakness at some point now through Aug 1, we need to see a shot across the risk-bow before taking more action (<=6,200). So, for now, its sitting tight with a few downside long puts/VIX calls in place.

Due to the positive gamma at 6,250-6,300, bulls hold the reigns. A move <6,250 implies a test of 6,200. Ultimately the trend higher can be salvaged if SPX bounces there, but should 6,200 give way we think that signals a longer term correction, with eyes on 6,000.

Yesterday’s mini-flash crash on the Powell headlines brought forward a key point we’ve been harping on: the market is underpricing anything less than perfection over the next 1-2 weeks. You see this in the much lower SPX ATM IV in red. We’ve beat this point to death, but it remains the core dynamic on the table. For this reason we continue to like owning August VIX call spreads.

Aside from this dynamic, there is very little out there of note. Call skews remain rich even though we see a lot of positive gamma in top single stocks. For example, META has a giant positive gamma strike at $700, which could be stalling price action. This positive gamma reduces with Friday’s expiration – which as a base case should allow for volatility to increase next week.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6283.53 | $6243 | $624 | $22884 | $557 | $2205 | $221 |

| SG Gamma Index™: |

| 2.062 | 0.014 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6285.53 | $6245 | $622 | $22820 | $557 | $2235 | $219 |

| Absolute Gamma Strike: | $6040.53 | $6000 | $620 | $23000 | $555 | $2200 | $220 |

| Call Wall: | $6540.53 | $6500 | $630 | $22900 | $560 | $2250 | $230 |

| Put Wall: | $6090.53 | $6050 | $610 | $22700 | $500 | $2160 | $210 |

| Zero Gamma Level: | $6247.53 | $6207 | $623 | $22655 | $552 | $2216 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.283 | 1.013 | 1.489 | 1.128 | 1.007 | 0.903 |

| Gamma Notional (MM): | $327.527M | $157.289M | $11.239M | $222.974M | ‑$26.487M | ‑$99.64M |

| 25 Delta Risk Reversal: | -0.045 | -0.025 | -0.048 | -0.024 | -0.037 | -0.018 |

| Call Volume: | 570.414K | 1.426M | 9.275K | 688.503K | 23.359K | 366.693K |

| Put Volume: | 863.985K | 2.169M | 11.393K | 978.966K | 27.57K | 807.105K |

| Call Open Interest: | 7.379M | 5.861M | 67.187K | 3.33M | 270.176K | 4.124M |

| Put Open Interest: | 12.663M | 13.351M | 82.852K | 5.382M | 439.784K | 8.563M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6250, 6200] |

| SPY Levels: [620, 630, 625, 600] |

| NDX Levels: [23000, 22900, 22800, 22500] |

| QQQ Levels: [555, 560, 550, 545] |

| SPX Combos: [(6531,89.93), (6506,70.55), (6487,88.34), (6481,99.56), (6456,76.88), (6431,94.55), (6406,85.04), (6400,76.26), (6381,99.28), (6362,73.88), (6356,88.07), (6350,84.69), (6344,79.44), (6337,84.94), (6331,97.99), (6319,84.27), (6312,90.33), (6306,95.70), (6300,97.87), (6294,90.77), (6287,97.21), (6281,99.54), (6275,86.47), (6269,93.12), (6262,97.19), (6256,95.39), (6250,92.87), (6231,92.83), (6200,87.52), (6194,81.19), (6169,87.77), (6163,70.50), (6150,82.89), (6144,84.47), (6131,69.65), (6119,75.52), (6106,74.87), (6100,81.36), (6081,81.08), (6031,83.68), (6000,74.61), (5982,82.23)] |

| SPY Combos: [627.71, 647.62, 630.2, 625.22] |

| NDX Combos: [22999, 23205, 22885, 23411] |

| QQQ Combos: [560.05, 562.28, 565.06, 570.07] |

0 comentarios