Macro Theme:

Key dates ahead:

- 7/24: Jobless Claims, Trump visit Fed

- 7/30: FOMC

- 8/1: Tariff Deadline

Update: 7/23: Trade deals and extensions have re-pumped the bulls, and so we look to maintain longs as long as the SPX remains above the risk pivot. Further, it appears that another blow-off top phase is underway, leading to us looking to express longs in top sectors/single stocks into “stock up, vol up” scenarios.

7/10: Call skews are getting quite elevated and so we are looking to ~1-month sell call skew in select names – most notably SPY. Check Compass for other names. We will also be looking to add ~2-month puts to play a market correction into the data-heavy window coming up 7/15-8/1.

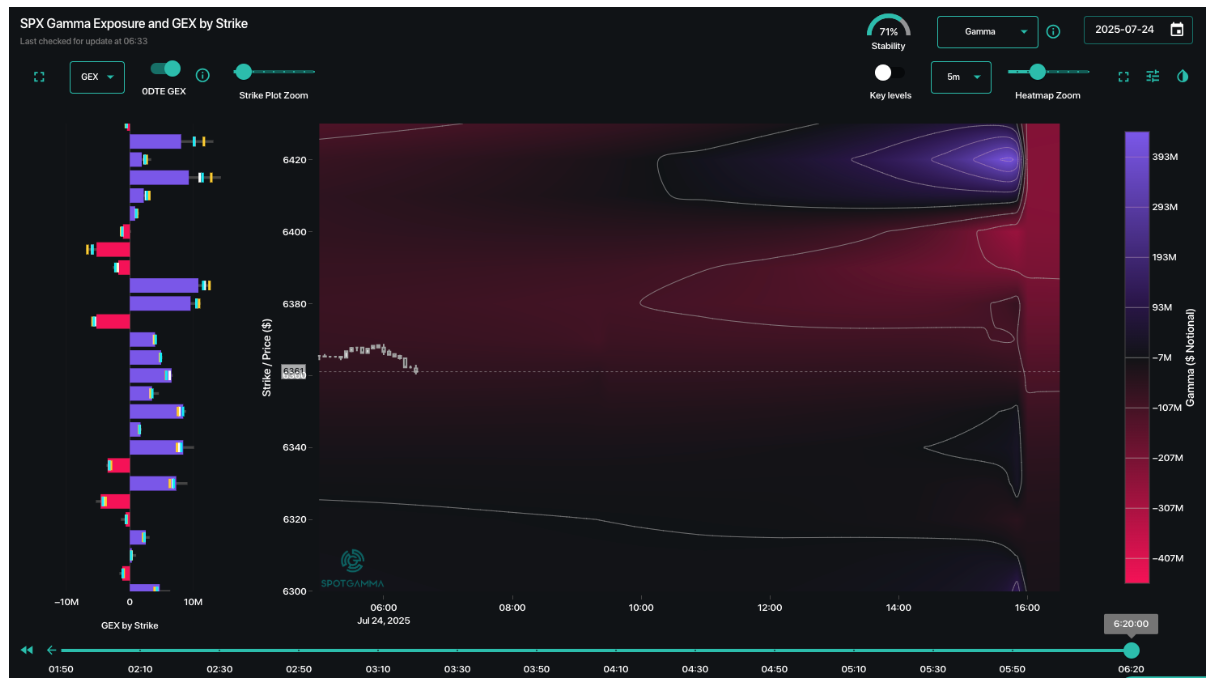

Key SG levels for the SPX are:

- Resistance: 6,400

- Pivot: 6,300 (bearish <, bullish >)

- Support: 6,300, 6,200

Founder’s Note:

Futures are flat, with TSLA -5% after earnings, and GOOGL +3%.

Major support @ 6,300. We are bearish below there, and remain bullish above.

Major resistance @ 6,400. As volatility contracts it should add a light tail wind to equity prices.

We start today with an expectation of low volatility, as there again appears to be a seller of a strip of 0DTE SPX options, which creates small positive gamma across the entire 6,300-6,400 range. On their own these strikes are not large, but together they are providing market stability. Further, we would expect 0DTE sellers to step up into any market movement, which would add support/resistance to keep the SPX contained.

In regards to vols, its clear the EU positive trade rumors were a big boost for equities and allowed longer dated vols to sink. In fact, the ~12PM headlines of talk advancements led to $10 billion in S&P500

HIRO

values – one of the most positive readings we’ve ever seen, and we now see the VIX at 15.3 which is the lowest reading since early Feb.

There is very little on the docket this week which may upset the low vol dynamic, although we do note that Trump is going to visit the Federal Reserve at 4PM, today. Short dated vols, as denoted by 1-day VIX, below, are now at lower bounds. Next week there is the FOMC, which should increase short dated vols, but that comes against the rumors of tariff deals which have proven to be a big vol dampener.

Polymarket still holds “Powell Out in ’25” at just 19%, and who knows what comes of this Trump/Fed visit. Regardless, with vols in the gutter we think there is little reason to be short volatility here as the risk/reward is pretty poor. On this note, while equities certainly did not turn south on OPEX we still think it can make sense to hold some >=1-month SPX puts/VIX calls into these vol lows.

Lastly, key levels for TSLA: $310 is a big positive gamma strike, and we think the stock holds that level into tomorrows expiration. Further, the gamma appears to get more positive after this Friday, which implies support.

For GOOGL, 195 is a huge positive gamma level, and key support. The stock shows negative gamma above, suggesting a move to 205-210 is reasonable.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6345.07 | $6309 | $634 | $23063 | $563 | $2248 | $226 |

| SG Gamma Index™: |

| 3.071 | -0.007 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6351.07 | $6315 | $629 | $22940 | $562 | $2245 | $224 |

| Absolute Gamma Strike: | $6036.07 | $6000 | $630 | $23050 | $560 | $2200 | $230 |

| Call Wall: | $6436.07 | $6400 | $640 | $23050 | $570 | $2300 | $230 |

| Put Wall: | $6136.07 | $6100 | $620 | $22800 | $550 | $2000 | $210 |

| Zero Gamma Level: | $6309.07 | $6273 | $628 | $22661 | $558 | $2260 | $226 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.492 | 0.993 | 2.351 | 0.991 | 1.167 | 0.947 |

| Gamma Notional (MM): | $340.336M | $511.558M | $24.78M | $226.632M | ‑$13.30M | $71.647M |

| 25 Delta Risk Reversal: | -0.039 | -0.021 | -0.044 | -0.024 | -0.034 | -0.015 |

| Call Volume: | 502.63K | 1.105M | 18.602K | 637.819K | 15.324K | 266.521K |

| Put Volume: | 710.878K | 1.971M | 10.711K | 755.92K | 35.502K | 670.488K |

| Call Open Interest: | 7.103M | 5.282M | 75.648K | 3.237M | 252.358K | 3.77M |

| Put Open Interest: | 11.934M | 12.869M | 74.007K | 5.177M | 420.488K | 7.679M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6400, 6350] |

| SPY Levels: [630, 620, 625, 600] |

| NDX Levels: [23050, 23100, 23350, 23000] |

| QQQ Levels: [560, 565, 550, 570] |

| SPX Combos: [(6594,90.49), (6549,97.89), (6524,84.10), (6499,94.60), (6474,84.13), (6467,75.77), (6455,91.90), (6448,99.86), (6423,90.80), (6417,81.85), (6398,97.90), (6385,85.99), (6379,81.35), (6373,96.58), (6366,98.23), (6360,91.59), (6354,88.05), (6347,99.96), (6341,97.10), (6335,92.79), (6329,96.29), (6322,97.43), (6316,98.17), (6310,95.59), (6303,84.02), (6297,98.20), (6291,82.77), (6215,84.05), (6177,72.39), (6171,86.80), (6120,69.56), (6101,73.08), (6070,75.90), (6051,84.78), (6000,74.70)] |

| SPY Combos: [637.66, 647.73, 633.26, 630.75] |

| NDX Combos: [23294, 23248, 23271, 22994] |

| QQQ Combos: [560.69, 570.23, 565.18, 564.62] |

0 comentarios