Macro Theme:

Key dates ahead:

- 8/12: CPI

- 8/15: OPEX

- 8/20: VIX EXP

- 8/23: J-HOLE

- 8/27: NVDA ER

7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol contraction + giant positioning at 6,500 could be a target with benign to good outcomes from these events/data.

7/28: SMH 1-month options scan as both very low IV, and neutral call vs put prices. As such we will be adding 1-month ~300 strike SMH calls into the upcoming earnings deluge (ref $287).

Update 8/1: Puts & VIX calls are paying, and we look to close and/or roll that sliver of puts today as SPX popped into risk-off levels <6,300. We see an ultimate possible low at 6,000-6,100, with a view that what is happening here is more of a mild correction vs start of something more nefarious. If large non-0DTE puts are bought today, then we would likely change that view.

Key SG levels for the SPX are:

- Resistance: 6,400, 6,425 (SPY 640), 6,500

- Pivot: 6,300 (bearish <, bullish >)

- Support: 6,250, 6,200

Founder’s Note:

Futures are +30 bps with no major data on tap.

TLDR: We’re sticking to plan: 6,400 remains the prime overhead target. We think vol can continue to contract through to Tuesday, and should CPI be benign then that can add some further equity boost into next Friday’s OPEX. As calls are generally cheap we like owning upside call spreads in tech – this gives us fixed risk to the downside, too. Risk-off remains in play on a break <6,300.

First support is back at 6,350 today, with light positive gamma strikes from 6,370 down to 6,300. 6,350 was initial support yesterday due to a big 0DTE position, but that position was pulled – paving a way for the test of the 99th %ile 6,310 strike (see last nights note). While yesterday had a big range, it was so much in control of 0DTE options as we again saw massive

HIRO

deltas shove the SPX to the 99th %’ile 0DTE strike…then once that strike is hit those deltas shut off.

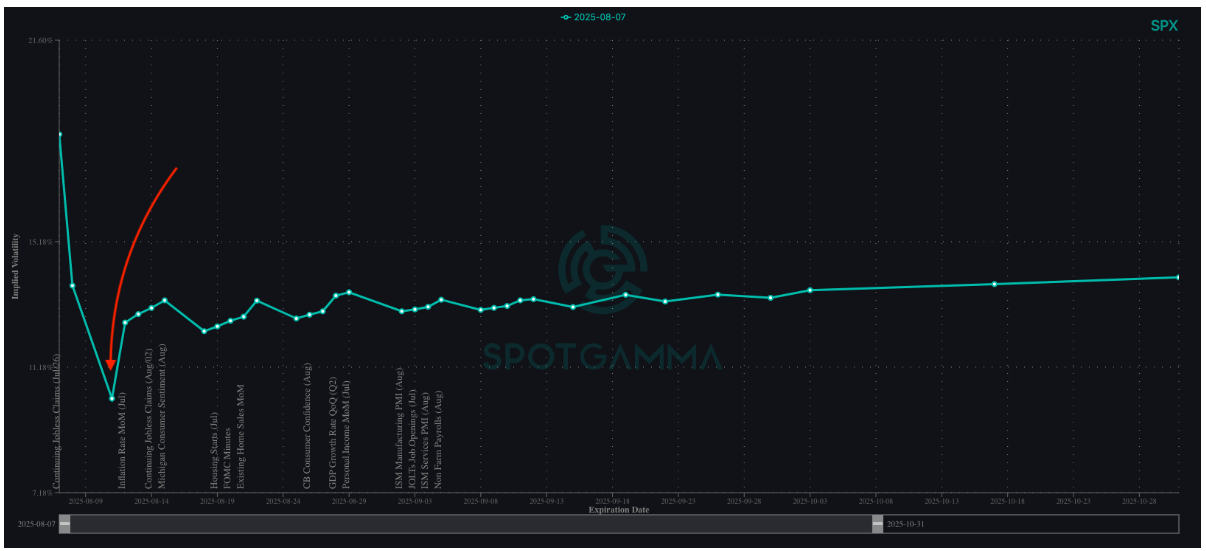

Start of day vol yesterday implied a low volatility session, but the intraday range was 1.25%. However, on a close to close basis, the SPX was unchanged. This means that most volatility metrics reflect zero volatility, which allows forward IV to contract. On this point, we see Monday is at a 10% IV, and while that is the product of the weekend effect, the 10% IV mark still shows us that expectations for vol today into tomorrow is essentially in the gutter. Finishing this point: todays 0DTE straddle is $25/39bps/16% IV. This lends to the idea that vanna remains a tailwind for equities into Tuesdays CPI print. Traders don’t really care about Tuesdays CPI print – its just that there is no data today or Monday for traders to 0DTE hedge.

Stepping away from equities, we see gold and silver are now showing pretty elevated call prices relative to puts (orange box). The implied vol is not particularly high, which to us signals that upside is still possible (we want to see higher IV as an interim topping signal). As the call skew itself may be a bit rich (orange box to the right of this chart) we’d look to own call spreads.

The other interesting thing is crypto, with Trump announcing crypto can go into 401k’s. That gave a brief pop to the space, with many stocks like CRCL, COIN having been sharply down over the previous few sessions. We think those names still scan as relatively ways to play more upside in crypto – as does the IBIT ETF. Note, though, the much higher IV rank for ETHA (Ethereum ETF) over BTC. ETH has been outperforming BTC as of late – but that high IV rank with ETH nearing key 4k resistance suggests “overheated”.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6364.78 | $6340 | $632 | $23389 | $569 | $2214 | $219 |

| SG Gamma Index™: |

| 0.906 | -0.282 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6398.34 | $637.91 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6320.76 | $630.17 |

|

|

|

|

| SG Volatility Trigger™: | $6364.78 | $6340 | $630 | $23040 | $565 | $2205 | $220 |

| Absolute Gamma Strike: | $6024.78 | $6000 | $630 | $23050 | $560 | $2200 | $220 |

| Call Wall: | $6424.78 | $6400 | $640 | $23050 | $580 | $2250 | $230 |

| Put Wall: | $6224.78 | $6200 | $625 | $22900 | $560 | $2180 | $210 |

| Zero Gamma Level: | $6327.78 | $6303 | $631 | $22981 | $564 | $2226 | $226 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.108 | 0.777 | 1.545 | 0.969 | 0.806 | 0.493 |

| Gamma Notional (MM): | $462.742M | ‑$347.96M | $21.523M | $201.597M | ‑$20.188M | ‑$1.138B |

| 25 Delta Risk Reversal: | -0.051 | -0.032 | -0.054 | -0.036 | -0.045 | -0.028 |

| Call Volume: | 588.354K | 1.544M | 11.394K | 819.767K | 13.812K | 295.501K |

| Put Volume: | 774.65K | 1.886M | 12.854K | 1.08M | 23.209K | 428.85K |

| Call Open Interest: | 7.627M | 5.762M | 72.386K | 3.553M | 274.651K | 3.924M |

| Put Open Interest: | 13.161M | 13.724M | 82.435K | 5.56M | 441.59K | 8.835M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6300, 6400, 6350] |

| SPY Levels: [630, 620, 625, 640] |

| NDX Levels: [23050, 23000, 23400, 23200] |

| QQQ Levels: [560, 570, 565, 550] |

| SPX Combos: [(6651,91.74), (6600,97.80), (6575,84.72), (6549,94.44), (6524,86.41), (6518,78.17), (6505,91.52), (6498,99.45), (6479,74.60), (6473,96.03), (6467,77.09), (6460,73.06), (6448,98.06), (6441,69.54), (6429,77.00), (6422,95.62), (6416,89.76), (6410,85.32), (6403,80.56), (6397,99.69), (6391,79.55), (6384,77.70), (6378,97.07), (6372,88.89), (6365,84.81), (6359,82.95), (6353,97.18), (6315,81.45), (6302,88.63), (6289,78.28), (6283,83.63), (6277,82.87), (6270,93.73), (6258,84.62), (6251,88.06), (6239,87.31), (6232,83.56), (6226,74.45), (6220,92.69), (6201,93.14), (6188,87.19), (6175,73.51), (6169,79.88), (6162,71.18), (6150,91.33), (6137,71.68), (6118,87.47), (6099,91.53), (6067,71.77), (6048,75.30)] |

| SPY Combos: [638.48, 647.97, 643.54, 658.09] |

| NDX Combos: [23039, 23015, 23834, 23506] |

| QQQ Combos: [561.08, 571.86, 559.94, 570.16] |

0 comentarios