Macro Theme:

Key dates ahead:

- 8/12: CPI

- 8/15: OPEX

- 8/20: VIX EXP

- 8/23: J-HOLE

- 8/27: NVDA ER

UPDATE 8/12: We want to remain long of stocks with the SPX is >6,350. We will also being looking to own end-of-August SPX puts and/or VIX calls into CPI on the basis that IV is simply cheap enough to warrant adding a fresh sliver of downside plays.

7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol contraction + giant positioning at 6,500 could be a target with benign to good outcomes from these events/data.

7/28: SMH 1-month options scan as both very low IV, and neutral call vs put prices. As such we will be adding 1-month ~300 strike SMH calls into the upcoming earnings deluge (ref $287).

Key SG levels for the SPX are:

- Resistance: 6,400, 6,425 (SPY 640), 6,500

- Pivot: 6,350 (bearish <, bullish >)

- Support: 6,300 6,250, 6,200

Looking for more in-depth insights into how options flows are evolving? We’re excited to introduce FlowPatrol™ — a daily pre-market report that shows you what’s being bought vs. sold, how sector and single-stock positioning is shifting, and the key trades driving it all.

Stay informed of how options flow evolves each day: Opt in to receive FlowPatrol daily

Founder’s Note:

Futures are flat ahead of CPI at 8:30AM ET.

TLDR: We default to wanting to remain long equities while SPX is >6,350. We will also look to add end-of-August put spreads into CPI print and holding them through the next 2 weeks on the basis the IV is cheap enough to validate a fresh sliver of hedges.

The general idea here is that if the CPI in benign, it clears the way for a final vol contraction into August OPEX which could spark a decent move up into the 6,450 area. Any hot CPI can obviously do some downside damage, and that damage could be worse than people expect as there are very light downside hedges in place.

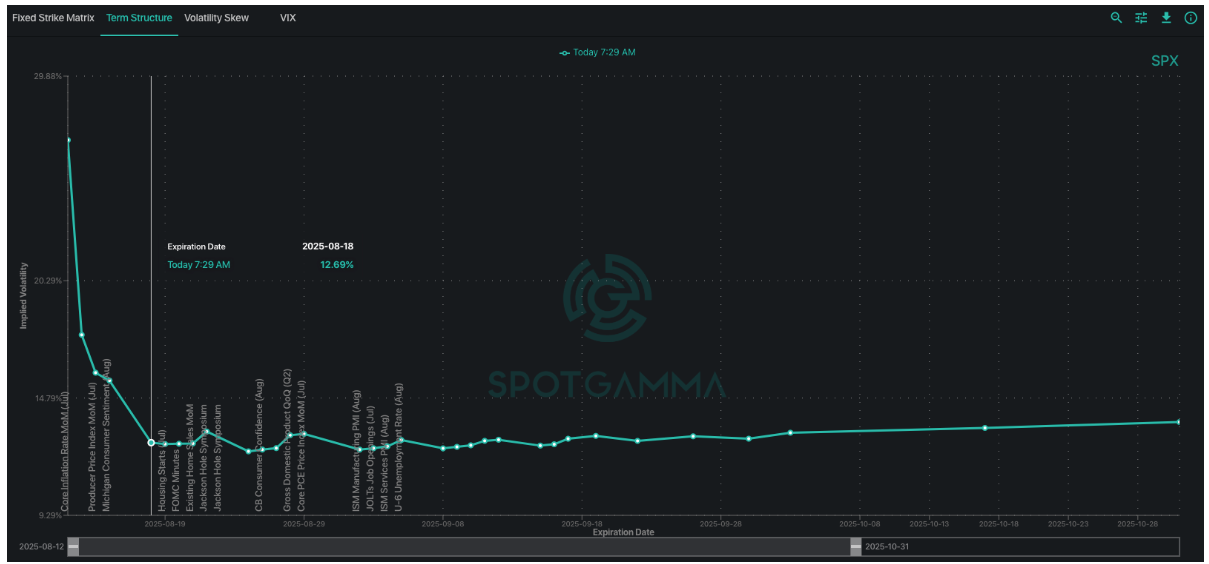

The ATM 0DTE straddle for today is $43/69bps/26% IV – that is quite a calm price, suggesting that traders really don’t expect much. Odds are that they are correct, but the “prize” you win for being correct is at most a ~1 point vol contraction. Why 1 vol point? Because ~1-month ATM SPX IV’s are 12.6%, which is dang near as low as ATM IV’s go particularly given Jackson Hole and NVDA fit into the 1-month window. Again, should CPI be in line then we’d expect SPX to close >6,400 for today, and if that happens then 6,450-6,500 should be in play for weeks end.

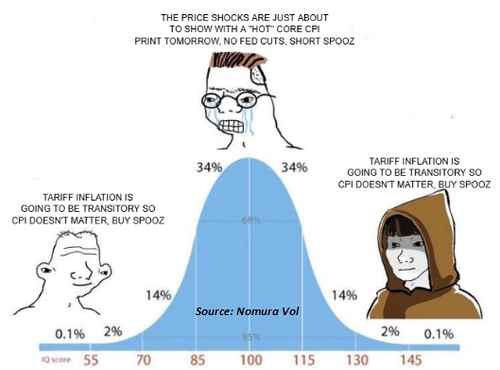

We worry a bit about that “automatic upside” happening as it may be a consensus trade, but if the market can more fully grasp a rate cut then it could imply Fed support – which means any future little vol spike will be sold/equity dips bought until downside is “forced” upon traders via a change in narrative. This chart from a recent Nomura piece suggests that “automatic upside” with a quiet CPI isn’t such a consensus idea…

All the above said, given this low IV, we like getting back into our “sliver” of end-of-August put spreads or Sep VIX calls into CPI and holding through OPEX. The risk of another July 31st type spasm is real, and the cost of carry is very low.

The other thing that catches our eye here is Ethereum, with ETHA hitting very high IV levels as you can see in Compass. We are looking to own some put flies and or >1-month short call flies/spreads (nothing naked short) to play a vol contraction and a cooling in ETH prices.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6395.86 | $6373 | $635 | $23526 | $572 | $2216 | $220 |

| SG Gamma Index™: |

| 1.701 | -0.226 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.62% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.45% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6440.64 | $642.18 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6361.26 | $634.26 |

|

|

|

|

| SG Volatility Trigger™: | $6367.86 | $6345 | $635 | $22940 | $572 | $2195 | $220 |

| Absolute Gamma Strike: | $6022.86 | $6000 | $630 | $23050 | $560 | $2200 | $220 |

| Call Wall: | $6522.86 | $6500 | $640 | $23050 | $580 | $2250 | $230 |

| Put Wall: | $6222.86 | $6200 | $625 | $23300 | $565 | $2180 | $215 |

| Zero Gamma Level: | $6311.86 | $6289 | $634 | $22770 | $567 | $2228 | $225 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.213 | 0.808 | 1.601 | 1.075 | 0.886 | 0.572 |

| Gamma Notional (MM): | $500.982M | ‑$522.075M | $16.335M | $183.799M | ‑$13.611M | ‑$886.94M |

| 25 Delta Risk Reversal: | -0.043 | 0.00 | -0.049 | 0.00 | -0.04 | -0.022 |

| Call Volume: | 487.173K | 1.024M | 9.902K | 529.004K | 16.777K | 282.727K |

| Put Volume: | 758.708K | 1.455M | 10.737K | 760.34K | 23.167K | 452.587K |

| Call Open Interest: | 7.623M | 5.591M | 71.608K | 3.533M | 276.462K | 3.977M |

| Put Open Interest: | 13.131M | 13.871M | 81.382K | 5.488M | 446.099K | 8.73M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6400, 6300, 6350] |

| SPY Levels: [630, 620, 640, 625] |

| NDX Levels: [23050, 23400, 23000, 23700] |

| QQQ Levels: [560, 570, 580, 575] |

| SPX Combos: [(6648,93.38), (6622,73.80), (6603,98.33), (6577,89.53), (6552,96.08), (6526,91.38), (6514,81.31), (6507,95.72), (6501,99.72), (6488,80.13), (6482,87.54), (6475,96.70), (6469,87.74), (6463,95.87), (6456,85.46), (6450,99.30), (6444,82.91), (6437,95.04), (6431,85.95), (6424,96.33), (6418,96.13), (6412,95.09), (6405,86.92), (6399,98.66), (6393,75.82), (6380,69.63), (6342,79.54), (6335,79.93), (6329,74.46), (6322,89.62), (6316,89.94), (6297,83.24), (6284,70.70), (6278,85.44), (6271,75.36), (6265,86.44), (6252,89.31), (6227,78.95), (6220,75.50), (6214,85.92), (6201,91.24), (6189,71.00), (6182,72.66), (6176,71.17), (6163,77.97), (6150,84.71), (6112,77.94), (6099,86.70)] |

| SPY Combos: [638.39, 647.95, 642.85, 645.4] |

| NDX Combos: [23809, 23056, 23691, 23621] |

| QQQ Combos: [579.72, 560.76, 574.55, 575.12] |

0 comentarios