Macro Theme:

Key dates ahead:

- 8/14: PPI

- 8/15: OPEX

- 8/20: VIX EXP

- 8/23: J-HOLE

- 8/27: NVDA ER

Update 8/13: Our new risk pivot is 6,400. We are looking for a tag of 6,500 into Friday, which implies the bulk of SPX short term gains are now made (ref SPX 6,459). Per yesterdays update (8/12) we want to add a new small tranche of Sep VIX call spreads and SPX put spreads.

8/12: We want to remain long of stocks with the SPX is >6,350. We will also being looking to own end-of-August SPX puts and/or VIX calls into CPI on the basis that IV is simply cheap enough to warrant adding a fresh sliver of downside plays.

7/30: We recommend ~8/11-8/15 exp 6,500 calls as an upside play out of FOMC, GDP, NFP and Mag 7 earnings. This is because they are trading at a 9-10% IV, and we think a vol contraction + giant positioning at 6,500 could be a target with benign to good outcomes from these events/data.

7/28: SMH 1-month options scan as both very low IV, and neutral call vs put prices. As such we will be adding 1-month ~300 strike SMH calls into the upcoming earnings deluge (ref $287).

Key SG levels for the SPX are:

- Resistance: 6,475, 6,500

- Pivot: 6,400 (bearish <, bullish >)

- Support: 6,450, 6,300

Looking for more in-depth insights into how options flows are evolving? We’re excited to introduce FlowPatrol™ — a daily pre-market report that shows you what’s being bought vs. sold, how sector and single-stock positioning is shifting, and the key trades driving it all.

Stay informed of how options flow evolves each day: Opt in to receive FlowPatrol daily

Founder’s Note:

Futures are 20bps higher with no major data on the schedule for today.

TLDR: We think “grind mode” now re-engages, with positive drift into 6,500 on tap into Friday. Overall we want to remain long of equities while the SPX is >6,400, below <6,400 we flip back to risk off. A hot PPI tomorrow could dash those plans, and on that note we are buying a small tranche of Sep VIX calls and end-of-August SPX put spreads – simply because vol is now too cheap for us to not carry some protection.

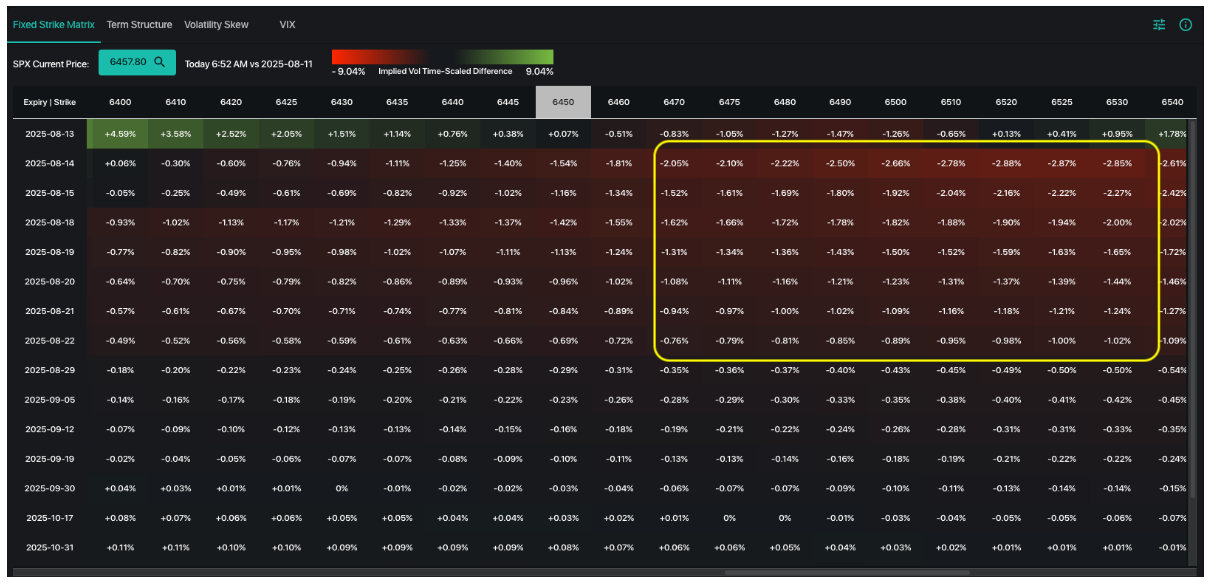

The big dynamic over the last 24 hours has been vol, which got crushed following the benign CPI. Vol down creates long equity demand, which combined with the 0DTE “search and destroy” algos we’ve been highlighting (see y’day) serve to push the market higher. Below is the current SPX fixed strike vol vs Monday night, and you can see that 1-2pt vol crush. The most interesting thing right now is the asymmetric upside crush for upside strikes in the >6,500 area.

This implies heavy upside selling of those calls, which further implies the SPX flips back into a grind mode into Friday’s OPEX, with 6,500 pinning resistance. The lower upside IV’s signal traders are selling calls, flooding dealers with positive gamma.

As far as prices ranges go, we have one big negative gamma strike via the dealers short ~10k of the 6,475 0DTE calls, and then we see layered positive gamma strikes >6,500. Do the downside there are net positive gamma strikes, and support, from 6,400-6,450. Below 6,400, which is particularly unlikely for today, likely triggers and extended period of risk off.

Given this grind dynamic, we will be more focused on single stock plays to outperform (as per the core SMH call position discussed in recent weeks).

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6467.62 | $6445 | $642 | $23839 | $580 | $2282 | $226 |

| SG Gamma Index™: |

| 4.002 | -0.013 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.45% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6506.8 | $648.82 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6427.9 | $640.96 |

|

|

|

|

| SG Volatility Trigger™: | $6417.62 | $6395 | $639 | $22920 | $579 | $2190 | $223 |

| Absolute Gamma Strike: | $6022.62 | $6000 | $640 | $24000 | $580 | $2250 | $230 |

| Call Wall: | $6522.62 | $6500 | $645 | $23700 | $580 | $2250 | $230 |

| Put Wall: | $6022.62 | $6000 | $620 | $21500 | $550 | $2180 | $215 |

| Zero Gamma Level: | $6334.62 | $6312 | $641 | $22728 | $574 | $2226 | $225 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.538 | 0.988 | 2.19 | 1.223 | 1.422 | 0.996 |

| Gamma Notional (MM): | $1.386B | $356.443M | $30.582M | $470.258M | $39.519M | $129.541M |

| 25 Delta Risk Reversal: | -0.04 | -0.018 | -0.042 | 0.00 | -0.026 | -0.008 |

| Call Volume: | 573.065K | 1.29M | 11.836K | 675.252K | 27.991K | 746.633K |

| Put Volume: | 1.006M | 2.34M | 11.862K | 992.807K | 37.515K | 1.006M |

| Call Open Interest: | 7.691M | 5.611M | 74.334K | 3.568M | 282.659K | 3.96M |

| Put Open Interest: | 13.385M | 14.457M | 81.802K | 5.601M | 446.115K | 8.958M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6450, 6400, 6500] |

| SPY Levels: [640, 630, 645, 642] |

| NDX Levels: [24000, 23700, 23800, 23000] |

| QQQ Levels: [580, 575, 560, 570] |

| SPX Combos: [(6749,93.46), (6697,96.63), (6678,74.80), (6652,95.66), (6626,74.19), (6620,70.81), (6600,99.15), (6575,92.59), (6568,79.09), (6549,98.22), (6542,81.32), (6530,82.31), (6523,97.27), (6517,89.38), (6510,90.21), (6504,95.38), (6497,99.98), (6491,93.30), (6484,86.52), (6478,99.94), (6472,98.96), (6465,94.38), (6459,97.75), (6452,99.95), (6446,91.39), (6439,87.82), (6433,89.15), (6426,96.36), (6420,92.98), (6407,80.83), (6401,96.13), (6388,84.24), (6317,83.77), (6298,74.06), (6278,78.43), (6265,75.23), (6252,78.25), (6220,83.47), (6201,86.08), (6188,75.72), (6149,80.57)] |

| SPY Combos: [648.64, 643.55, 638.46, 658.81] |

| NDX Combos: [23839, 23911, 24054, 24006] |

| QQQ Combos: [579.72, 561.39, 576.86, 575.14] |

0 comentarios