Macro Theme:

Key dates ahead:

- 8/20: VIX EXP

- 8/23: J-HOLE

- 8/27: NVDA ER

Update 8/18: Per recent updates, due to 11-12% SPX IV’s we want to now own a small amount of Sep put, and/or Sep VIX call spreads into JHOLE & NVDA (8/27), while maintaining a core long position as long as the SPX is >6,400. The core long position can be stock, or expressed via call options as call IV’s are also quite cheap particularly in tech like SMH, XLK. For that upside we will likely elect to go with short dated (early Sep) call spreads or flies that we will likely look to buy Friday to play positive outcomes of JHOLE and NVDA ER.

Key SG levels for the SPX are:

- Resistance: 6,500

- Pivot: 6,400 (bearish <, bullish >)

- Support: 6,450, 6,300

Looking for more in-depth insights into how options flows are evolving? We’re excited to introduce FlowPatrol™ — a daily pre-market report that shows you what’s being bought vs. sold, how sector and single-stock positioning is shifting, and the key trades driving it all.

Stay informed of how options flow evolves each day: Opt in to receive FlowPatrol daily

Founder’s Note:

Futures are flat after a very quiet session yesterday. Housing starts at 8:30AM is our only hope for a light catalyst.

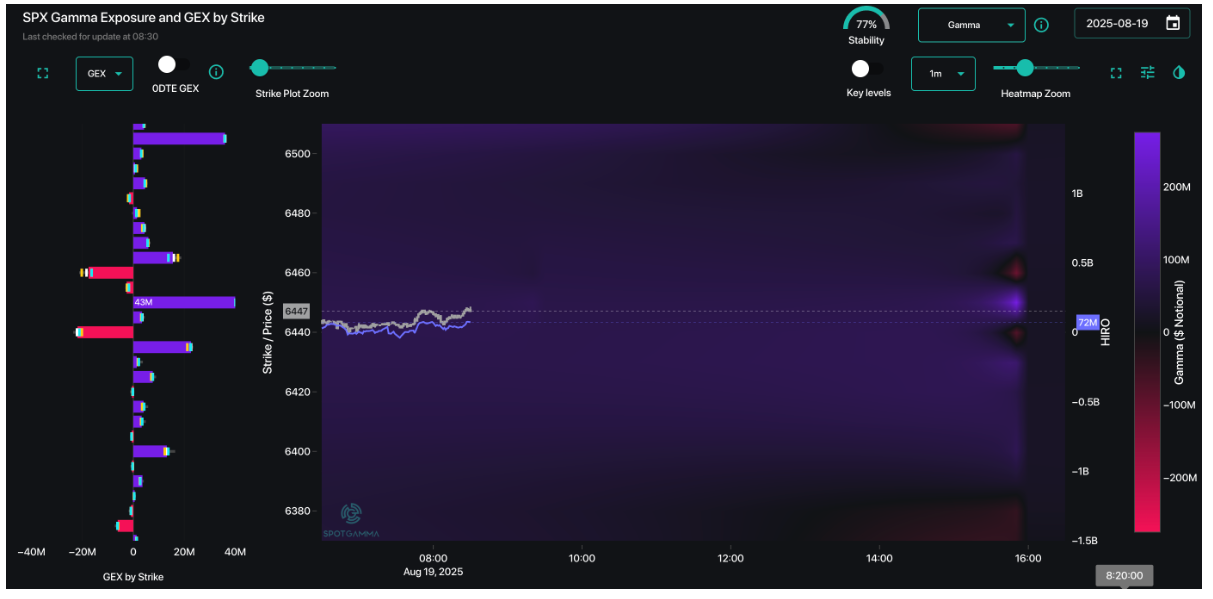

If you look at SPX positioning, we see nothing but “big blue” positive gamma from 6,400 – 6,500, which supports the idea of little movement via dealer-suppressing flows. The entire market is expecting this lack of movement, with the 0DTE straddle at just $18.75! Thats just 29 bps of implied movement on an IV of 11.8%. Thats “absolute low” kind of pricing. While this signals selling short dated SPX options has very little risk reward, you might be able to get away with shorting the VIX ETN’s (VXX, UVXY etc) over the next few sessions as the VIX curve is quite steep (see y’day note).

On the topic of VIX, expiration is tomorrow morning and that should release some volatility-suppressing flows. As you can see below, VIX puts (blue) dominate into VIX Exp, with almost zero positioning <15. Given this, we don’t see much of a reason via positioning to shove the VIX much lower. If there was, then that could be a catalyst for market upside today (as today is the last day for Aug VIX options to trade).

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6469.56 | $6449 | $643 | $23713 | $577 | $2294 | $227 |

| SG Gamma Index™: |

| 1.565 | -0.15 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.68% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6486.56 | $647.2 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6405.34 | $639.1 |

|

|

|

|

| SG Volatility Trigger™: | $6465.56 | $6445 | $642 | $23710 | $576 | $2280 | $227 |

| Absolute Gamma Strike: | $6020.56 | $6000 | $640 | $23800 | $580 | $2300 | $220 |

| Call Wall: | $6520.56 | $6500 | $650 | $23725 | $580 | $2335 | $230 |

| Put Wall: | $6455.56 | $6435 | $635 | $23760 | $565 | $2210 | $220 |

| Zero Gamma Level: | $6431.56 | $6411 | $642 | $23476 | $576 | $2271 | $229 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.203 | 0.861 | 1.401 | 0.936 | 1.037 | 0.782 |

| Gamma Notional (MM): | $509.745M | ‑$250.284M | $12.063M | ‑$4.958M | $5.632M | ‑$218.318M |

| 25 Delta Risk Reversal: | -0.042 | 0.00 | -0.043 | 0.00 | -0.027 | -0.021 |

| Call Volume: | 369.205K | 879.45K | 6.146K | 552.306K | 10.133K | 157.857K |

| Put Volume: | 606.508K | 1.127M | 8.287K | 736.27K | 21.421K | 282.848K |

| Call Open Interest: | 7.214M | 4.982M | 65.892K | 3.326M | 270.806K | 3.583M |

| Put Open Interest: | 12.499M | 12.038M | 76.074K | 5.171M | 431.616K | 7.642M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6500, 6450, 6400] |

| SPY Levels: [640, 645, 630, 643] |

| NDX Levels: [23800, 23700, 23725, 23600] |

| QQQ Levels: [580, 575, 560, 570] |

| SPX Combos: [(6752,94.00), (6701,97.14), (6675,77.26), (6649,96.25), (6623,75.84), (6617,75.49), (6597,99.27), (6578,95.02), (6565,78.33), (6559,78.70), (6552,98.45), (6539,86.47), (6533,89.44), (6527,94.89), (6520,68.57), (6514,90.99), (6507,98.73), (6501,99.76), (6494,88.51), (6488,96.83), (6481,89.74), (6475,97.64), (6468,94.64), (6462,98.38), (6456,87.97), (6449,89.83), (6443,93.06), (6436,91.60), (6430,71.69), (6423,85.01), (6417,94.53), (6404,71.41), (6398,86.81), (6391,78.75), (6385,74.43), (6378,84.78), (6365,87.15), (6352,85.82), (6333,77.87), (6314,78.35), (6301,85.56), (6275,69.18), (6269,75.08), (6249,83.46), (6217,83.99), (6198,85.97), (6152,78.54)] |

| SPY Combos: [648.61, 658.26, 653.11, 651.18] |

| NDX Combos: [23714, 23832, 23903, 23809] |

| QQQ Combos: [580.12, 577.23, 583, 565.11] |

0 comentarios