Macro Theme:

Key dates ahead:

- 8/20: VIX EXP

- 8/23: J-HOLE

- 8/27: NVDA ER

Update 8/18: Per recent updates, due to 11-12% SPX IV’s we want to now own a small amount of Sep put, and/or Sep VIX call spreads into JHOLE & NVDA (8/27), while maintaining a core long position as long as the SPX is >6,400. The core long position can be stock, or expressed via call options as call IV’s are also quite cheap particularly in tech like SMH, XLK. For that upside we will likely elect to go with short dated (early Sep) call spreads or flies that we will likely look to buy Friday to play positive outcomes of JHOLE and NVDA ER.

Key SG levels for the SPX are:

- Resistance: 6,500

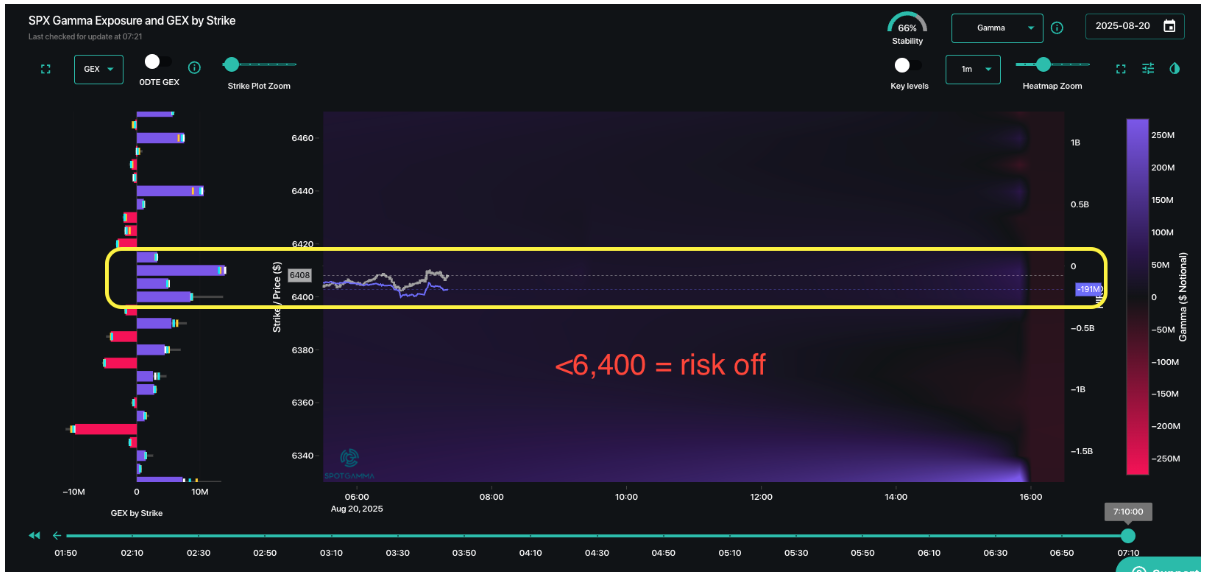

- Pivot: 6,400 (bearish <, bullish >)

- Support: 6,450, 6,300

Looking for more in-depth insights into how options flows are evolving? We’re excited to introduce FlowPatrol™ — a daily pre-market report that shows you what’s being bought vs. sold, how sector and single-stock positioning is shifting, and the key trades driving it all.

Founder’s Note:

Futures are off 10bps with FOMC mins at 2pm ET.

TLDR: So far the pullback is a mild correction/hedging event into twin catalysts: JHOLE & NVDA. <6,400 is the signal that things are likely to get much uglier.

VIX expiration is at 9:30AM ET – watch for unusual equity futures movement into that time.

The SPX play, from our view, seems pretty clear and in line with that of our recent notes: remain risk on with SPX >6,400, and shift to risk off <6,400. This view was reinforced after some traders added long puts into the 6,300’s, as seen via the negative gamma strikes (red) – most notably at 6,350.

As discussed yesterday, there was real negative deltas in Nasdaq and single stocks, driven by tech names. QQQ gamma is really quite negative now, as show below, with negative gamma across all strikes. This implies tech is to remain volatile across QQQ 550-580.

Turning to volatility, SPX vols are reinforcing the 2 time windows that matter (in this case we show the change in fixed strike SPX vol from Monday night, pre-selloff):

1) Short dated vols are up after yesterdays drop and into JHOLE (red box). We also note that the CME had a rate cut at ~95% a week ago, and now its 85%. 85% still seems like consensus, but if that expectation wobbles then equity vols likely spike. The opposite side of that is likely a quick move back to 6,450-6,500 for event 2…

2) 8/27 NVDA ER (yellow box). Traders have started to increase their downside hedges into NVDA earnings, with the AI narrative under attack. The top 8 names in the S&P500 are 35% of the index, and they all have something to lose if that AI story loses its luster (NVDA, AAPL, GOOGL, MSFT, META, TSLA, AMZN, AVGO)

While there are short dated hedges coming in, the >=2week out IV’s are essentially unchanged since Monday night (blue box). Ultimately what this suggests is that traders have some short term caution, but are not all that panicked.

On this point, yesterday was quite ugly for tech and crowded momentum names, but many sectors were in fact green on the day. That infers yesterday was a low correlation selloff, and some rotation is happening, which implies less risk than a high correlation equity dump. This can all change quite quickly, which is why we like to maintain that small set of SPX put spreads and/or Sep VIX calls outlined in recent days. The vol data above suggests that ~1-month protection is still pretty cheap.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6430.65 | $6411 | $639 | $23384 | $569 | $2276 | $226 |

| SG Gamma Index™: |

| -0.005 | -0.361 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.68% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6449.65 | $6430 | $640 | $23600 | $570 | $2280 | $227 |

| Absolute Gamma Strike: | $6019.65 | $6000 | $640 | $23725 | $560 | $2300 | $220 |

| Call Wall: | $6519.65 | $6500 | $650 | $23725 | $580 | $2290 | $230 |

| Put Wall: | $6319.65 | $6300 | $635 | $23300 | $565 | $2210 | $220 |

| Zero Gamma Level: | $6393.65 | $6374 | $638 | $23501 | $572 | $2271 | $229 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.999 | 0.708 | 0.835 | 0.735 | 0.911 | 0.677 |

| Gamma Notional (MM): | $80.409M | ‑$779.451M | ‑$7.188M | ‑$474.537M | ‑$8.359M | ‑$449.347M |

| 25 Delta Risk Reversal: | -0.047 | 0.00 | -0.053 | -0.035 | -0.032 | -0.028 |

| Call Volume: | 478.927K | 1.197M | 10.077K | 1.015M | 10.209K | 223.177K |

| Put Volume: | 933.912K | 1.703M | 14.069K | 1.299M | 23.492K | 545.444K |

| Call Open Interest: | 7.28M | 5.066M | 67.07K | 3.484M | 272.894K | 3.618M |

| Put Open Interest: | 12.771M | 12.154M | 81.443K | 5.389M | 439.928K | 7.806M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6400, 6500, 6450] |

| SPY Levels: [640, 630, 635, 620] |

| NDX Levels: [23725, 23700, 23400, 23000] |

| QQQ Levels: [560, 570, 575, 565] |

| SPX Combos: [(6700,96.37), (6674,71.38), (6649,94.58), (6623,78.34), (6597,98.82), (6578,92.29), (6565,69.84), (6552,97.08), (6540,79.78), (6533,79.94), (6527,90.39), (6514,84.70), (6508,97.14), (6501,99.58), (6495,72.01), (6488,79.47), (6482,89.68), (6475,94.40), (6469,75.53), (6463,93.22), (6456,85.08), (6450,93.21), (6437,76.18), (6418,72.06), (6411,77.45), (6405,83.16), (6399,93.46), (6392,95.78), (6386,85.22), (6379,84.49), (6373,96.57), (6360,94.42), (6354,77.65), (6347,94.73), (6341,80.13), (6328,89.21), (6322,78.81), (6315,87.68), (6302,95.15), (6296,70.82), (6290,69.10), (6283,73.26), (6277,80.55), (6264,79.93), (6257,72.00), (6251,88.40), (6213,82.77), (6200,90.13), (6187,75.52), (6161,71.86), (6149,81.38), (6123,68.30), (6110,73.88), (6097,88.75)] |

| SPY Combos: [648.45, 658.1, 649.09, 653.59] |

| NDX Combos: [23736, 23198, 23011, 23291] |

| QQQ Combos: [577.11, 580, 581.73, 579.42] |

0 comentarios