Macro Theme:

Key dates ahead:

- 8/27: NVDA ER

- 8/28: Jobless Claims

- 8/29: PCE

Update 8/25: Post JHOLE: At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in. Further, that downside action would clash with volatility expectations that are de minimus – so VIX/vol would jump. We read this as downside is wide open into 6,150. The current best case scenario is a move to 6,525 to the upside, which also syncs with QQQ needing ~2% upside to match the ATH set into Aug OPEX.

8/22: JHOLE plays: 6,300 x 6,250, 6,200 put flies, or 6,200 x 6,100 x 6,000 Monday put flies as a way to express lotto downside. Upside we like Mon/Tue 6,450 x 6,500 call spreads or flies. We elect for spreads or flies here because the 1-3 DTE IV’s are quite elevated. Longer dated >=1-month IV’s remain fairly valued, which warrants put spreads (in the event you didn’t add a sliver of puts with the 8/18 update).

8/18: Per recent updates, due to 11-12% SPX IV’s we want to now own a small amount of Sep puts, and/or Sep VIX call spreads into JHOLE & NVDA (8/27), while maintaining a core long position as long as the SPX is >6,400. The core long position can be stock, or expressed via call options as call IV’s are also quite cheap particularly in tech like SMH, XLK. For that upside we will likely elect to go with short dated (early Sep) call spreads or flies that we will likely look to buy Friday to play positive outcomes of JHOLE and NVDA ER.

Key SG levels for the SPX are:

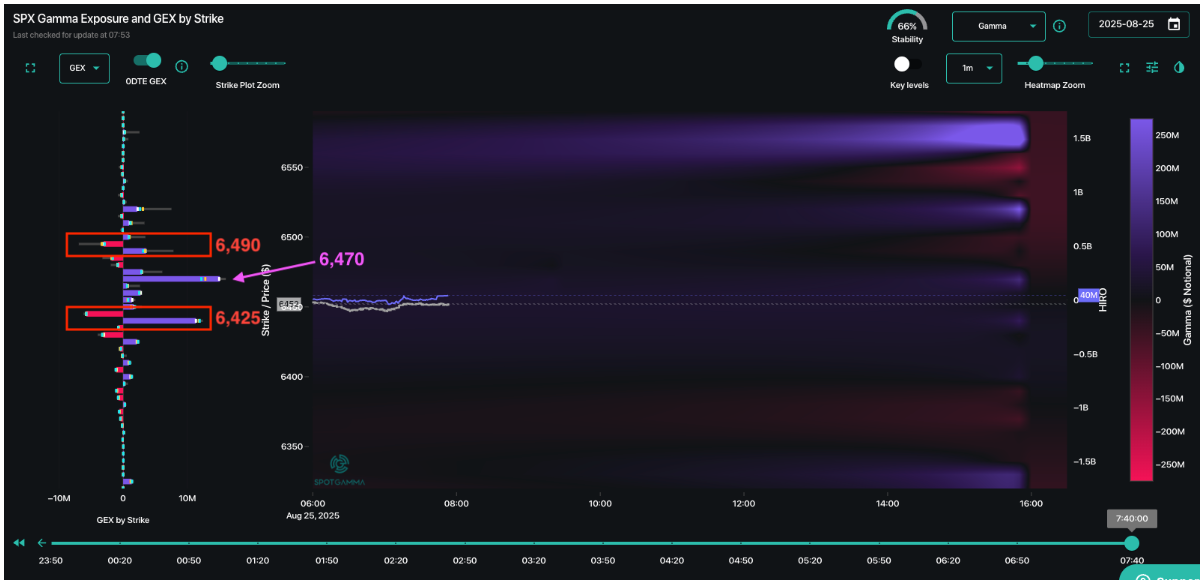

- Resistance: 6,470, 6,490, 6,500

- Pivot: 6,400 (bearish <, bullish >)

- Support: 6,300, 6,150

Looking for more in-depth insights into how options flows are evolving? We’re excited to introduce FlowPatrol™ — a daily pre-market report that shows you what’s being bought vs. sold, how sector and single-stock positioning is shifting, and the key trades driving it all.

Stay informed of how options flow evolves each day: Opt in to receive FlowPatrol daily

Founder’s Note:

Futures are off 20 bps after the Friday fireworks.

TLDR: The follow through on a rally is a bit shaky at the moment, as vols do their normal “Monday re-inflation”. Our into Friday was that there should be some digestion of price from 6,450-6,500 into Wed NVDA earnings. Accordingly, we will continue to lean bullish while SPX >6,400. Should SPX break <6,400 then we would shift to risk-off, & look for a fast test of 6,300. We note crypto is flagging some concerns, with BTC now down below the Powell speech.

There are some major 0DTE levels on the board: support at 6,425 & 6,490 resistance due to a 0DTE condor, and then the 6,470 has large 0DTE positive gamma. This should keep the SPX in a fairly tight range for today.

That tight range is the market consensus, as today’s 0DTE straddle is priced at $21.5, or 33 bps (ref 6445 IV 13.5%) which is as low as it gets. Interestingly ES futures have already moved $20 overnight (implying 0DTE straddle is cheap)…but $20 from implied opening prices of 6,445 puts us right on the huge 0DTE condor strike of 6,425 & big 0DTE strike of 6,470.

Fixed strike vols are still lower vs pre-Powell, suggesting that the market is comfortable with what Powell said. The exception to lower vols remains the 2 days post-NVDA earnings. Keep in mind – we are looking at SPX vols, and for them to be so elevated due to a single earnings report is saying something. Granted that company is 7.5% (!) of the SPX, and 14% (!!!) of the NDX – so it is a major market event.

All of the above laid out, the deal here is pretty simple.

At any point moving forward should SPX break under 6,400 this market could get pretty nasty, as that is where negative gamma comes in. Further, that downside action would clash with volatility expectations that are de minimus – so VIX/vol would jump. We read this as downside is wide open into 6,150.

The current best case scenario is a move to 6,525 to the upside, which also syncs with QQQ needing ~2% upside to match the ATH set into Aug OPEX.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6481.91 | $6466 | $645 | $23498 | $571 | $2361 | $234 |

| SG Gamma Index™: |

| 2.226 | -0.152 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.61% | 0.61% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.51% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6460.91 | $6445 | $645 | $23490 | $572 | $2260 | $229 |

| Absolute Gamma Strike: | $6015.91 | $6000 | $640 | $23725 | $570 | $2300 | $235 |

| Call Wall: | $6515.91 | $6500 | $650 | $23725 | $580 | $2400 | $235 |

| Put Wall: | $6315.91 | $6300 | $635 | $23150 | $560 | $2210 | $220 |

| Zero Gamma Level: | $6396.91 | $6381 | $644 | $23438 | $571 | $2303 | $232 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.293 | 0.861 | 1.036 | 0.909 | 1.361 | 1.105 |

| Gamma Notional (MM): | $835.732M | ‑$41.459M | $3.119M | ‑$549.274K | $31.018M | $258.109M |

| 25 Delta Risk Reversal: | -0.04 | 0.00 | -0.046 | 0.00 | -0.021 | -0.019 |

| Call Volume: | 622.84K | 1.412M | 8.327K | 823.439K | 56.984K | 760.60K |

| Put Volume: | 1.013M | 2.855M | 13.835K | 1.09M | 72.51K | 1.436M |

| Call Open Interest: | 7.427M | 5.234M | 66.728K | 3.489M | 284.511K | 3.791M |

| Put Open Interest: | 12.846M | 12.634M | 81.019K | 5.507M | 439.622K | 8.085M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6500, 6400, 6450] |

| SPY Levels: [640, 630, 645, 650] |

| NDX Levels: [23725, 23700, 23600, 23150] |

| QQQ Levels: [570, 560, 580, 575] |

| SPX Combos: [(6751,94.30), (6700,97.37), (6674,76.09), (6648,97.32), (6629,87.30), (6616,70.20), (6603,99.56), (6583,72.15), (6577,95.60), (6564,83.50), (6557,90.95), (6551,98.60), (6538,96.71), (6532,89.18), (6525,96.93), (6519,87.46), (6512,98.70), (6506,97.73), (6499,99.92), (6493,97.04), (6486,91.89), (6480,88.88), (6473,98.69), (6460,76.59), (6441,86.13), (6435,79.06), (6428,76.55), (6422,73.03), (6415,80.88), (6402,82.58), (6383,81.51), (6363,88.47), (6351,81.94), (6331,68.79), (6312,81.29), (6299,89.52), (6273,76.54), (6266,71.10), (6254,88.96), (6215,77.45), (6202,84.16), (6163,69.59), (6150,77.86)] |

| SPY Combos: [648.26, 658.43, 628.56, 629.83] |

| NDX Combos: [23146, 23733, 23827, 23616] |

| QQQ Combos: [577.36, 559.9, 549.76, 580.18] |

0 comentarios