Macro Theme:

Key dates ahead:

- 9/5: NFP

Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

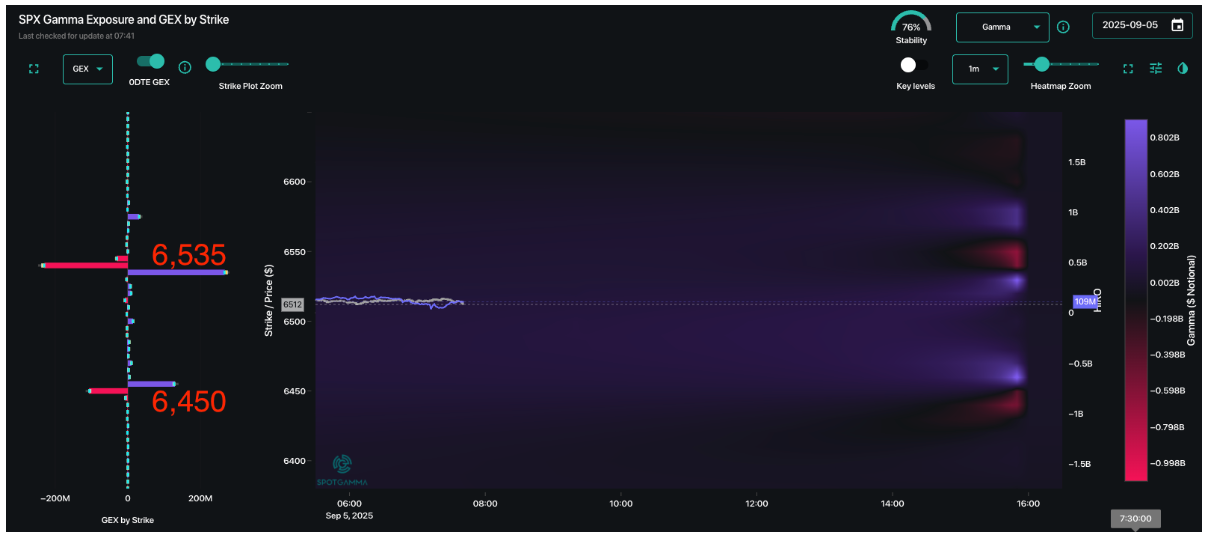

- Resistance: 6,535, 6,600

- Pivot: 6,450 (bearish <, bullish >)

- Support: 6,500, 6,450, 6,400, 6,300, 6,175

Founder’s Note:

Futures are +20bps higher ahead of NFP at 8:30AM ET.

The levels for today are clear: 6,535 to the upside and 6,450 to the downside. These levels are courtesy of Captain Condor and his 50k 0DTE condor, which has been a part of the daily “seek and destroy” algo that has been dominating markets this week (and many days over the past month (see video here & PM note here).

First, lets cover the downside. <6,500 likely leads to a test of 6,450 ,which is now our long term risk-off level. If you pull Captain Condor from the equation, we’d have virtually no positive gamma below, but his 50k lot of spreads at 6,450 would likely be a bouncing point for today.

SPX in EquityHub shows the gamma projection with todays positions (purple line highlighted by yellow arrow), and you can see it hits zero at 6,400. The dashed line is the gamma line ex todays expiration, and you see that gamma is much more negative <6,450. If we test 6,450 today then we would look to hold SPX put spreads for 9/19 OPEX, with eyes on the 6,300 level.

Turning to the upside, the interesting question here is: “What is a bad NFP?” Good data (i.e. jobs and wages are up)? Or people don’t have jobs, in which case we get a rate cut? In other words, what exactly is being hedged?

I would answer “nothing” because the 0DTE straddle is $36/55bps – that is really pretty paltry. That being said, the IV’s for next week are nearing lower vol bounds, with ATM IV’s between Monday and 9/19 just above 10%. 1-month SPX realized vol is ~9% – so the vol premium there is de minimus. The VIX is up at 15, and so the argument here is that if we skip past NFP unharmed then there is some vol premium to extract, which helps to boost stocks higher.

If NFP doesn’t matter than the upside level to watch is 6,600 for SPX into 9/17 (VIX exp/FOMC). As Captain Condor is at 6,535 today, that leaves about 1% of gains between here and that 6,600 over the next two weeks. The issue is there is almost no OI above 6,600, and so we currently can’t target much over that level. That being said, the above IV’s are “zombie territory” which likely means its a big grind for SPX, but other single stocks/IWM/memes will outperform over the next ~10 days. Shorting the vol ETP’s may also work over this next week, too, if the market is stable post-NFP.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6512.59 | $6502 | $649 | $23633 | $575 | $2379 | $236 |

| SG Gamma Index™: |

| 2.895 | -0.152 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.56% | 0.56% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.50% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6560.53 | $655.13 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6487.47 | $647.83 |

|

|

|

|

| SG Volatility Trigger™: | $6465.59 | $6455 | $645 | $23390 | $574 | $2340 | $234 |

| Absolute Gamma Strike: | $6510.59 | $6500 | $650 | $23725 | $560 | $2300 | $235 |

| Call Wall: | $6545.59 | $6535 | $650 | $23725 | $580 | $2375 | $240 |

| Put Wall: | $6465.59 | $6455 | $635 | $21500 | $560 | $2300 | $225 |

| Zero Gamma Level: | $6425.59 | $6415 | $647 | $23046 | $574 | $2338 | $234 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.313 | 0.879 | 1.892 | 0.890 | 1.438 | 0.964 |

| Gamma Notional (MM): | $1.14B | $58.758M | $28.703M | ‑$31.694M | $52.893M | $92.578M |

| 25 Delta Risk Reversal: | -0.05 | -0.047 | -0.06 | -0.05 | -0.032 | -0.028 |

| Call Volume: | 514.764K | 1.328M | 11.765K | 546.029K | 25.668K | 307.205K |

| Put Volume: | 992.112K | 1.972M | 10.644K | 913.029K | 39.588K | 513.407K |

| Call Open Interest: | 7.841M | 5.555M | 76.10K | 3.601M | 329.454K | 3.794M |

| Put Open Interest: | 13.694M | 13.361M | 84.166K | 6.242M | 496.942K | 8.482M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6500, 6450, 6000, 6400] |

| SPY Levels: [650, 645, 640, 630] |

| NDX Levels: [23725, 23900, 23910, 23400] |

| QQQ Levels: [560, 575, 570, 580] |

| SPX Combos: [(6801,96.37), (6749,94.93), (6697,98.45), (6678,83.75), (6658,80.00), (6652,98.24), (6639,75.10), (6632,79.46), (6626,89.83), (6613,89.13), (6600,99.79), (6593,86.31), (6580,80.42), (6574,98.69), (6567,91.54), (6561,94.60), (6554,91.45), (6548,99.74), (6541,99.96), (6535,99.96), (6528,99.65), (6522,94.72), (6515,83.01), (6509,98.05), (6502,99.95), (6496,70.93), (6489,86.89), (6483,90.42), (6476,91.62), (6470,74.05), (6457,99.89), (6450,99.86), (6444,83.37), (6437,76.26), (6431,81.97), (6418,82.73), (6411,87.22), (6398,94.44), (6379,71.39), (6372,81.17), (6359,89.43), (6353,87.65), (6333,73.25), (6314,83.06), (6301,90.20), (6275,68.75), (6262,73.83), (6248,90.77), (6209,77.28), (6203,89.87)] |

| SPY Combos: [648.89, 659.19, 639.88, 640.52] |

| NDX Combos: [23728, 23917, 23893, 23822] |

| QQQ Combos: [559.81, 577.48, 550.12, 544.99] |

0 comentarios