Macro Theme:

Key dates ahead:

- 9/10: PPI

- 9/11: CPI

- 9/17: VIX Exp, FOMC

- 9/19: OPEX

Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

- Resistance: 6,505, 6,525, 6,550, 6,600

- Pivot: 6,450 (bearish <, bullish >)

- Support: 6,450, 6,400, 6,300, 6,175

Founder’s Note:

Futures are +10bps with PPI on deck at 8:30 AM ET.

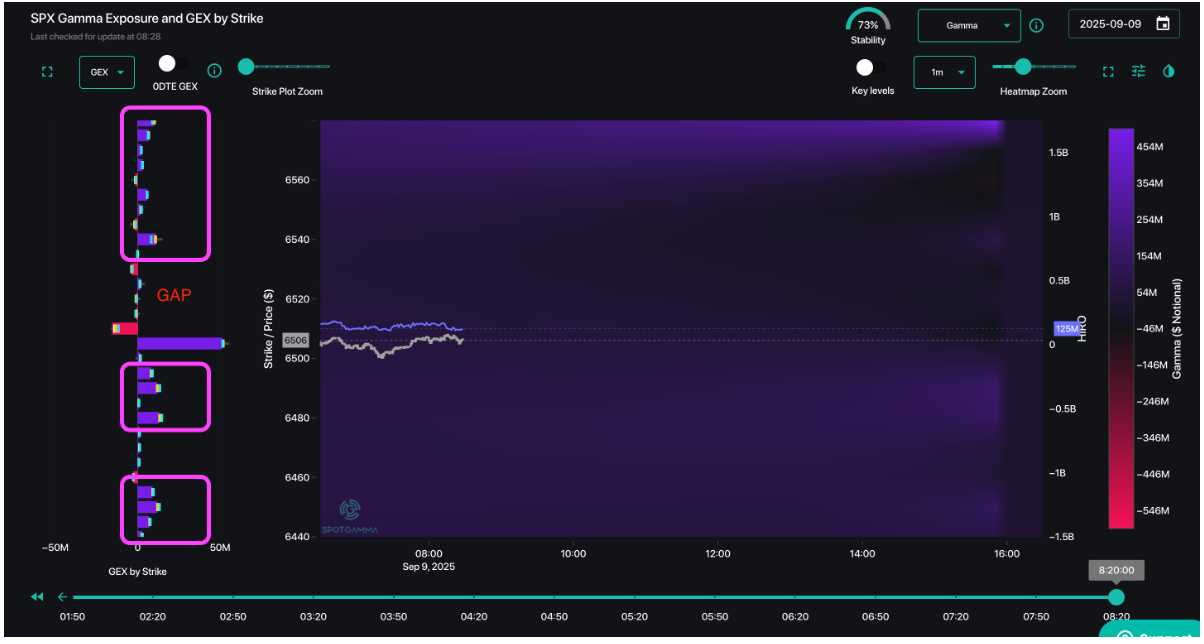

Levels for today are very much the same as yesterday: 6,505 is the key upside level, and we need to close above that to gain a level of stability that unlocks upside. We also note a gap from 6,505 up to 6,540 which could be quickly filled with benign macro data.. To the downside there is a layer of 0DTE support from 6,495-6,485. 6,450 remains our risk-off level, with some positive gamma layered below that strike.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6503.16 | $6495 | $648 | $23762 | $578 | $2394 | $238 |

| SG Gamma Index™: |

| 1.994 | -0.094 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.57% | 0.57% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.76% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6478.16 | $6470 | $645 | $23720 | $579 | $2370 | $234 |

| Absolute Gamma Strike: | $6508.16 | $6500 | $650 | $23725 | $580 | $2300 | $235 |

| Call Wall: | $6608.16 | $6600 | $650 | $23725 | $585 | $2500 | $240 |

| Put Wall: | $6308.16 | $6300 | $635 | $22500 | $560 | $2250 | $220 |

| Zero Gamma Level: | $6417.16 | $6409 | $647 | $23347 | $577 | $2371 | $236 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.22 | 0.925 | 1.632 | 0.956 | 1.034 | 1.085 |

| Gamma Notional (MM): | $704.77M | $184.957M | $18.401M | $35.059M | $7.341M | $246.725M |

| 25 Delta Risk Reversal: | -0.05 | -0.043 | -0.058 | -0.046 | 0.00 | -0.026 |

| Call Volume: | 539.557K | 1.073M | 8.838K | 543.464K | 11.654K | 274.99K |

| Put Volume: | 824.703K | 1.394M | 11.161K | 893.89K | 30.193K | 270.307K |

| Call Open Interest: | 7.78M | 5.628M | 70.141K | 3.573M | 305.828K | 3.827M |

| Put Open Interest: | 13.596M | 13.244M | 85.301K | 6.157M | 503.106K | 8.536M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6500, 6000, 6450, 6400] |

| SPY Levels: [650, 645, 640, 630] |

| NDX Levels: [23725, 23800, 23900, 24000] |

| QQQ Levels: [580, 560, 575, 570] |

| SPX Combos: [(6800,96.23), (6748,94.73), (6703,98.32), (6677,82.40), (6658,79.21), (6651,98.01), (6638,77.73), (6632,74.98), (6625,90.96), (6619,70.98), (6612,81.85), (6606,85.27), (6599,99.83), (6593,92.07), (6586,75.11), (6580,87.83), (6573,98.32), (6567,78.92), (6560,92.76), (6554,80.47), (6547,99.59), (6541,95.29), (6534,90.92), (6528,99.58), (6521,91.51), (6515,91.31), (6508,99.80), (6502,99.23), (6476,72.86), (6469,74.49), (6463,76.43), (6450,92.13), (6443,90.54), (6437,77.22), (6430,73.30), (6424,82.18), (6417,87.68), (6411,81.41), (6404,74.95), (6398,93.93), (6378,90.24), (6359,88.46), (6352,88.67), (6307,83.58), (6300,90.97), (6274,71.68), (6255,73.56), (6248,90.48), (6209,74.46), (6203,90.29), (6177,71.05)] |

| SPY Combos: [658.89, 649.83, 649.18, 654.36] |

| NDX Combos: [23715, 24024, 23929, 23905] |

| QQQ Combos: [577.79, 580.09, 559.93, 585.28] |

0 comentarios