Macro Theme:

Key dates ahead:

- 9/10: PPI

- 9/11: CPI

- 9/17: VIX Exp, FOMC

- 9/19: OPEX

Update 9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

- Resistance: 6,550, 6,600

- Pivot: 6,450 (bearish <, bullish >)

- Support: 6,505, 6,450, 6,400, 6,300, 6,175

Founder’s Note:

Futures are 30bps higher after ORCL (+30% !!!) crushed earnings.

TLDR: We stay long with SPX>6,500 into 9/17. Look to add downside insurance via >= 1-month SPX put spreads/put flies.

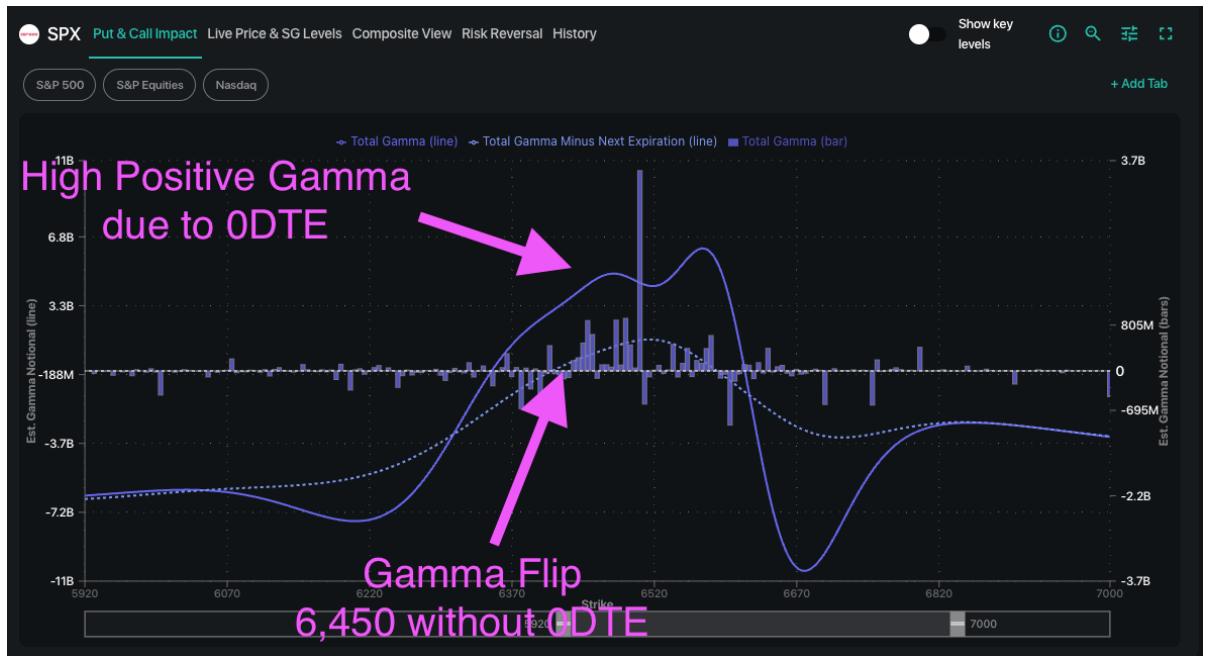

Initial resistance for today is at 6,545 due to a large 0DTE position, with support layered down into 6,500. Below 6,500 we will look to be directionally neutral (vs long >6,500), and below 6,450 we flip to long term risk-off. A lot of what currently stabilizes the SPX is 0DTE driven, but that 0DTE rolls in on a daily basis and we would think that trend continues until next week. We lean on <6,450 as risk off because that is where gamma ex-0DTE flips negative.

The ORCL pop has pushed the SPX solidly above our key 6,505 level. Baring a big PPI miss at 8:30 AM ET, we should see vols contract a bit further, which adds additional equity support. Todays 0DTE straddle is a mere $22/33bps (ref 6,535), which is higher than yesterday’s 30bps straddle – but hardly carrying a premium. This suggests that PPI really doesn’t matter much & it’ll take a multi std dev miss to move the market. CPI, tomorrow, is pricing in a bit more weight.

As we talked about yesterday, no one is in calls at this juncture. The ORCL move may be a signal of that lack of upside weighting, as the giant 30% move clearly reflects earnings that were underpriced. This presents a right tail risk, vs the idea that a few more days of “Zombie” can lead to a grind higher in SPX as IV contracts. What is ultimately happening here is there is mild risk priced into tomorrow’s CPI, and if that is in line then short dated traders come in and squeeze and vol risk premium that exists, as any expiration before Sep 17th FOMC is seen as “risk free”.

This is our base case scenario, and with 6,550 is now obviously in play, as is the growing 6,600 strike – which is our best case upside scenario into 9/17.

Just as the right tail (or any upside) may be underpriced, so is the left tail. Its true traders are favoring puts vs calls at this juncture, but IV’s are pricing in a real lack of downside volatility expectations. Thats not necessarily right or wrong, but with FOMC coming up + Sep OPEX + any unknowns it seems rather prudent to carry some +1 month protection. Sometimes you just buy options because they are cheap.

In regards to ORCL, we think the stock is quite maxed out as there are virtually no call positions (orange bars) >325 (stock is 318 premarket), which implies options hedging flows wane above that level. Being short of call spreads or call flies may make some sense here given this dynamic.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6518.85 | $6512 | $650 | $23839 | $580 | $2381 | $236 |

| SG Gamma Index™: |

| 2.37 | -0.172 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.76% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6501.85 | $6495 | $647 | $23720 | $579 | $2370 | $234 |

| Absolute Gamma Strike: | $6506.85 | $6500 | $650 | $23725 | $580 | $2300 | $235 |

| Call Wall: | $6606.85 | $6600 | $650 | $23725 | $585 | $2500 | $240 |

| Put Wall: | $6306.85 | $6300 | $640 | $22500 | $560 | $2250 | $225 |

| Zero Gamma Level: | $6432.85 | $6426 | $649 | $23424 | $579 | $2376 | $236 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.262 | 0.871 | 1.73 | 0.995 | 0.906 | 0.906 |

| Gamma Notional (MM): | $826.754M | ‑$117.784M | $22.849M | $192.762M | ‑$6.981M | ‑$3.765M |

| 25 Delta Risk Reversal: | -0.048 | -0.044 | -0.055 | -0.046 | -0.031 | -0.026 |

| Call Volume: | 502.721K | 888.944K | 6.23K | 500.292K | 17.22K | 254.053K |

| Put Volume: | 918.723K | 1.667M | 10.359K | 799.701K | 22.756K | 702.994K |

| Call Open Interest: | 7.81M | 5.629M | 70.118K | 3.585M | 312.113K | 3.877M |

| Put Open Interest: | 13.86M | 13.609M | 88.814K | 6.22M | 503.849K | 8.775M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6500, 6000, 6450, 6400] |

| SPY Levels: [650, 640, 645, 630] |

| NDX Levels: [23725, 23900, 23800, 24000] |

| QQQ Levels: [580, 560, 575, 570] |

| SPX Combos: [(6825,72.55), (6799,96.52), (6747,95.36), (6708,68.59), (6701,98.53), (6675,82.56), (6662,81.28), (6649,98.47), (6643,80.08), (6630,81.62), (6623,92.16), (6617,87.77), (6610,90.84), (6604,68.34), (6597,99.93), (6591,91.39), (6584,73.16), (6578,99.33), (6571,90.43), (6565,82.25), (6558,98.47), (6552,99.68), (6545,78.29), (6539,96.31), (6532,99.13), (6526,98.48), (6519,89.93), (6513,91.23), (6506,98.75), (6500,95.74), (6493,72.31), (6467,89.16), (6461,73.84), (6447,95.08), (6441,81.14), (6428,87.64), (6421,79.86), (6408,92.88), (6402,90.69), (6389,74.02), (6382,83.91), (6356,85.43), (6350,87.48), (6311,81.37), (6298,92.42), (6278,82.12), (6259,74.34), (6252,91.41), (6207,71.69), (6200,90.00)] |

| SPY Combos: [659.21, 650.13, 654.02, 652.07] |

| NDX Combos: [23721, 23911, 24031, 24221] |

| QQQ Combos: [577.71, 585.24, 582.92, 582.34] |

0 comentarios