Futures have pulled back some to 4005. As we shift into a light positive gamma position, our implied range on the day now declines to 0.99% (from ~1.2% readings last week). SG levels remain largely unchanged, with 4000-4015(SPY400) serving as major, Call Wallresistance. Above that level we see further resistance bars at 4023 and 4031. For today, support shows at 3970 (Vol Trigger) – 3965 (SPY 395), followed by 3950.

The top of our trading range is 4015 (SPY 400 Call Wall) – anything above that we consider “overbought” until/unless the Call Wall rolls higher.

As we remarked on Thursday, the failure of the SPX to close > 4000 after CPI creates a major headwind for bulls. This is because of Fridays large OPEX, and the gamma tied to that 4000 strike. As positions decay around 4000, it may form a multi-day pin around 3950-4015. This is the charm effect.

Further, we think vanna was a major headwind post-CPI (options decaying after the CPI IVdrop), and now IV is < RV (see Fridays note), which has not been a bullish signal. We read that IV is now too cheap, and the timing for IV to catch a bid increases with Fridays expiration.

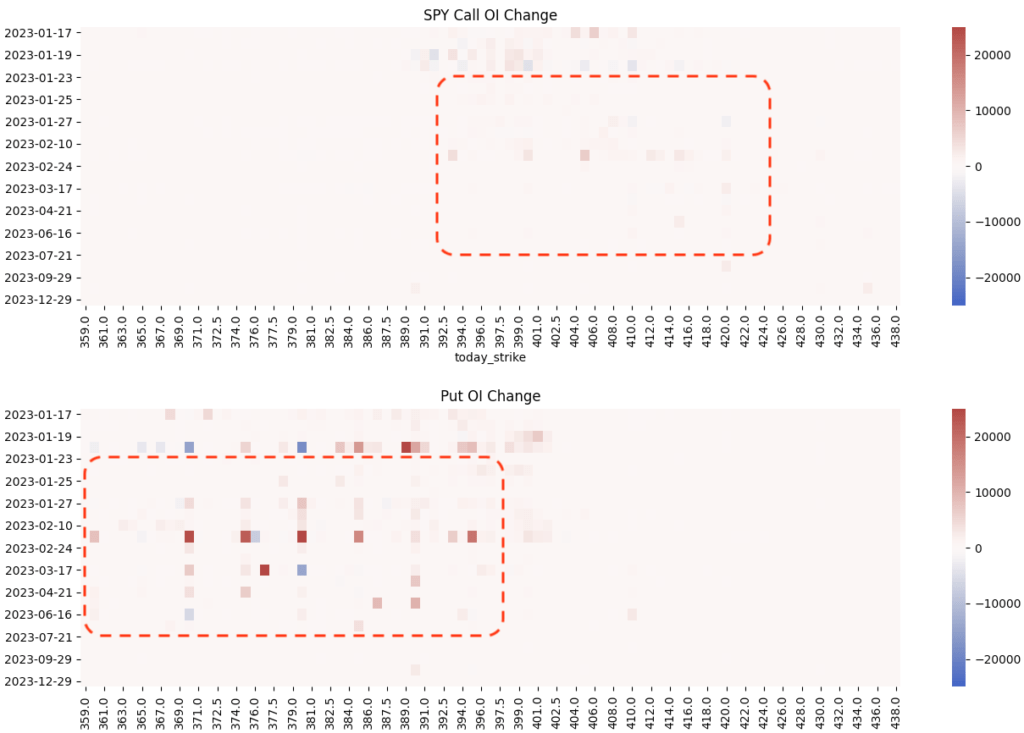

Below we’ve plotted the change in SPY calls (top) vs puts (bottom) from Thursday to Friday, and as you can see the addition of put positions far outweighs the addition of calls. Our data suggests that calls, particularly short term, were sold and that post-OPEX puts were bought.

The bottom line is that we look for trades that play mean reversion this week, off of 4000 area resistance and 3900 support. Jan OPEX wipes away a big chunk of gamma, and we think that volatility therefore expands (i.e. unpinning) into the end of January. The combination of low IVinto the OPEX “release” suggests long Feb expiration puts are now worth consideration.

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3998 | 3998 | 398 | 11541 | 280 |

| SG Implied 1-Day Move:: | 0.99%, | (±pts): 40.0 | VIX 1 Day Impl. Move:1.15% | ||

| SG Implied 5-Day Move: | 2.76% | 3998 (Monday Ref Price) | Range: 3888.0 | 4109.0 | ||

| SpotGamma Gamma Index™: | 0.71 | 0.71 | -0.10 | 0.06 | 0.00 |

| Volatility Trigger™: | 3970 | 3970 | 396 | 11190 | 278 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 11275 | 280 |

| Gamma Notional(MM): | 297.0 | 297.0 | -580.0 | 9.0 | -16.0 |

| Put Wall: | 3800 | 3800 | 380 | 11000 | 265 |

| Call Wall : | 4000 | 4000 | 400 | 11275 | 280 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3970 | 3970 | 400.0 | 10946.0 | 305 |

| CP Gam Tilt: | 1.19 | 1.15 | 0.84 | 1.71 | 0.99 |

| Delta Neutral Px: | 3965 | ||||

| Net Delta(MM): | $1,493,893 | $1,493,893 | $144,409 | $49,385 | $77,843 |

| 25D Risk Reversal | -0.04 | -0.05 | -0.04 | -0.06 | -0.05 |

| Call Volume | 426,597 | 426,597 | 1,587,926 | 6,906 | 592,312 |

| Put Volume | 929,800 | 929,800 | 2,547,929 | 8,241 | 937,069 |

| Call Open Interest | 5,747,600 | 5,747,600 | 6,336,681 | 65,842 | 4,647,317 |

| Put Open Interest | 10,552,175 | 10,552,175 | 12,832,540 | 62,514 | 6,699,409 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4050, 4000, 3950, 3900] |

| SPY: [400, 398, 395, 390] |

| QQQ: [285, 280, 275, 270] |

| NDX:[12000, 11600, 11500, 11275] |

| SPX Combo (strike, %ile): [(4175.0, 77.34), (4151.0, 86.98), (4099.0, 95.76), (4075.0, 92.44), (4063.0, 91.03), (4051.0, 95.21), (4035.0, 79.05), (4031.0, 90.3), (4023.0, 91.67), (4015.0, 88.79), (4011.0, 80.23), (4003.0, 78.3), (3999.0, 98.94), (3915.0, 79.77), (3899.0, 88.21), (3851.0, 90.58), (3811.0, 80.4)] |

| SPY Combo: [398.5, 408.46, 403.68, 406.07, 400.89] |

| NDX Combo: [11276.0, 11703.0, 11507.0, 11911.0, 11091.0] |