Macro Theme:

Key dates ahead:

- 1/16: OPEX

- 1/21: VIX Exp

- 1/22: GDP, PCE

- 1/28: FOMC

SG Summary:

Update 1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

Key SG levels for the SPX are:

- Resistance: 6,950, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,925, 6,900, 6,850

Founder’s Note:

Futures are 20bps higher with no major data on deck for today.

The SPX is indicated to open at 6,950 – which is right in the center of the ~14-day prevailing range.

Our Risk Pivot remains at 6,890, and we want to remain long while SPX is above that level, eyeing the 7k area as resistance into FOMC.

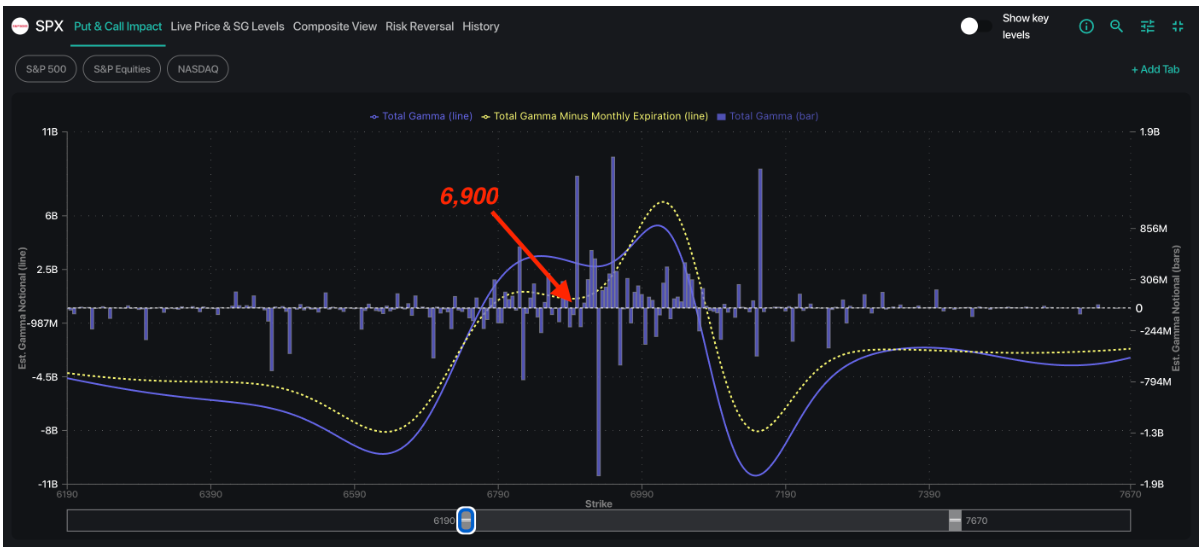

Today is Jan OPEX, with VIX Exp on Wed. With SPX at ATH, and realized vol ~8%, the OPEX edge would be in looking for SPX vol in increase, with some light mean reversion in SPX prices. However, for the SPX this expiration seems to not matter much, as SPX GEX shifts quite lightly (yellow = GEX after expiration vs purple = current GEX). Simply stated this OPEX does not seem to loosen up SPX GEX today all that much, nor shift it to a negative downside stance. Additionally, we are heading into a 3-day weekend with MLK on Monday. This incentivizes traders to sell short dated options, in order to collect extra perceived decay. Given that, if any equity weakness was to arrive, we’d anticipate it as a “next week thing” vs today.

As we’ve covered, upside here is tough as traders have sold calls into previous 7k attempts, and vol is likely to be sticky, which removes vanna as an upside surprise. It’s likely stocks need the catalysts of FOMC & earnings to push higher.

Single stocks are likely to lose a lot of ITM deltas from calls that have built up in value over the last year. We think OPEX could therefore bring some net selling in single stocks – but we hesitate to expect much until/unless the SPX Risk Pivot is broken (<6,890). If that level is broken, we do not think material vol selling will occur with FOMC on Wed 1/28. Further, on the single stock side, eyes are set to earnings which pick up in earnest next Wednesday (1/28).

Single stock vol is also going to be sticky for the next week due to earnings. You can see this in Compass, which measures 1-month DTE. Many top names having IV ranks that are in the 30-50% area, and they are also crowded in that bullishly positioned lower right quadrant. A move lower in stocks can shift these names towards puts (left on Compass), but vols are not likely to sink until post-ER. So, again, we base case read this as throttling upside, and if downside were to appear it could be ramped up a bit given this vol position. In summary, continue to favor long until SPX <6,890 – as that risk off level likely means single stocks are going to correct, too (i.e. correlation spike).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6981.75 |

$6944 |

$692 |

$25547 |

$621 |

$2674 |

$265 |

|

SG Gamma Index™: |

|

0.003 |

-0.317 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.56% |

0.56% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6982.75 |

$6945 |

$691 |

$25590 |

$622 |

$2570 |

$263 |

|

Absolute Gamma Strike: |

$7037.75 |

$7000 |

$690 |

$25600 |

$620 |

$2700 |

$265 |

|

Call Wall: |

$7037.75 |

$7000 |

$700 |

$25600 |

$627 |

$2670 |

$270 |

|

Put Wall: |

$6837.75 |

$6800 |

$680 |

$24000 |

$620 |

$2510 |

$250 |

|

Zero Gamma Level: |

$6941.75 |

$6904 |

$690 |

$25291 |

$620 |

$2608 |

$263 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6950, 6900, 6850] |

|

SPY Levels: [690, 695, 680, 685] |

|

NDX Levels: [25600, 25500, 25800, 25250] |

|

QQQ Levels: [620, 625, 610, 615] |

|

SPX Combos: [(7278,68.20), (7250,89.88), (7222,78.58), (7201,97.46), (7194,67.83), (7174,81.18), (7153,97.88), (7125,86.02), (7097,98.67), (7083,80.06), (7076,90.57), (7069,69.45), (7063,86.41), (7056,74.55), (7049,97.71), (7042,84.41), (7035,75.61), (7028,96.03), (7021,92.02), (7014,85.15), (7007,93.62), (7000,99.37), (6993,95.94), (6986,92.05), (6979,93.52), (6972,97.37), (6965,91.23), (6958,80.66), (6951,95.04), (6944,69.74), (6938,81.35), (6931,74.39), (6924,96.78), (6917,95.29), (6910,80.50), (6903,97.34), (6896,79.37), (6889,84.45), (6882,92.43), (6875,92.51), (6868,88.89), (6861,89.50), (6854,83.45), (6847,96.43), (6840,89.21), (6833,81.93), (6826,76.88), (6819,90.74), (6813,86.41), (6799,97.35), (6792,84.76), (6785,71.22), (6778,86.55), (6771,82.08), (6757,76.69), (6750,88.72), (6743,72.66), (6722,90.59), (6701,95.25), (6674,79.46), (6653,85.31), (6625,74.46)] |

|

SPY Combos: [698.03, 678.01, 707.7, 717.37] |

|

NDX Combos: [25470, 25777, 25266, 25803] |

|

QQQ Combos: [614.64, 610.31, 615.26, 627.04] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.00 |

0.771 |

1.146 |

0.895 |

1.637 |

1.066 |

|

Gamma Notional (MM): |

$61.445M |

‑$608.14M |

$4.86M |

‑$133.729M |

$42.306M |

$94.132M |

|

25 Delta Risk Reversal: |

-0.05 |

-0.032 |

-0.06 |

-0.043 |

-0.032 |

-0.019 |

|

Call Volume: |

834.068K |

1.412M |

19.259K |

978.308K |

34.521K |

407.407K |

|

Put Volume: |

1.135M |

1.90M |

17.718K |

1.245M |

52.485K |

845.863K |

|

Call Open Interest: |

7.776M |

5.32M |

60.508K |

3.808M |

231.765K |

3.012M |

|

Put Open Interest: |

12.983M |

12.22M |

101.284K |

5.787M |

414.889K |

7.42M |

0 comentarios