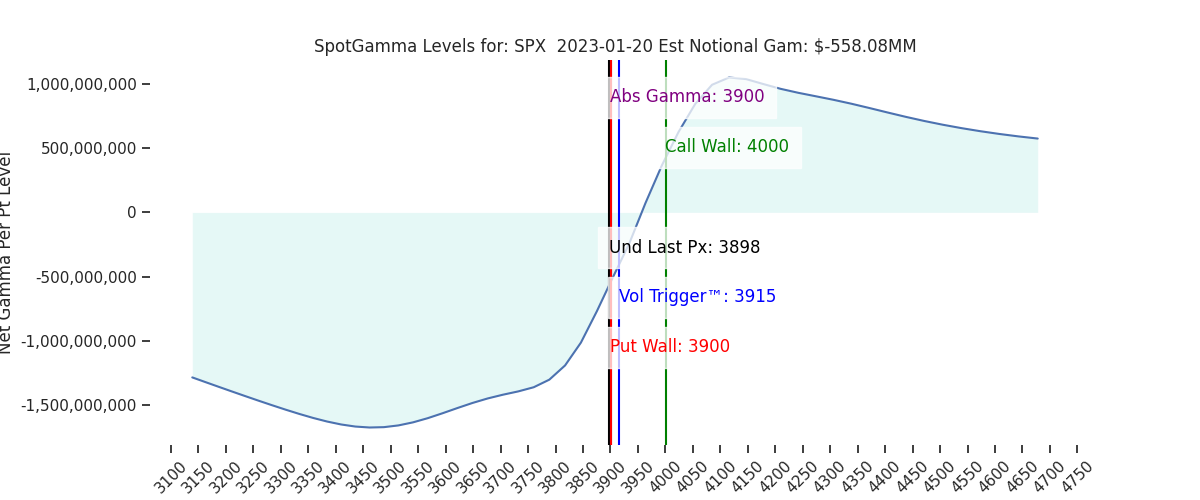

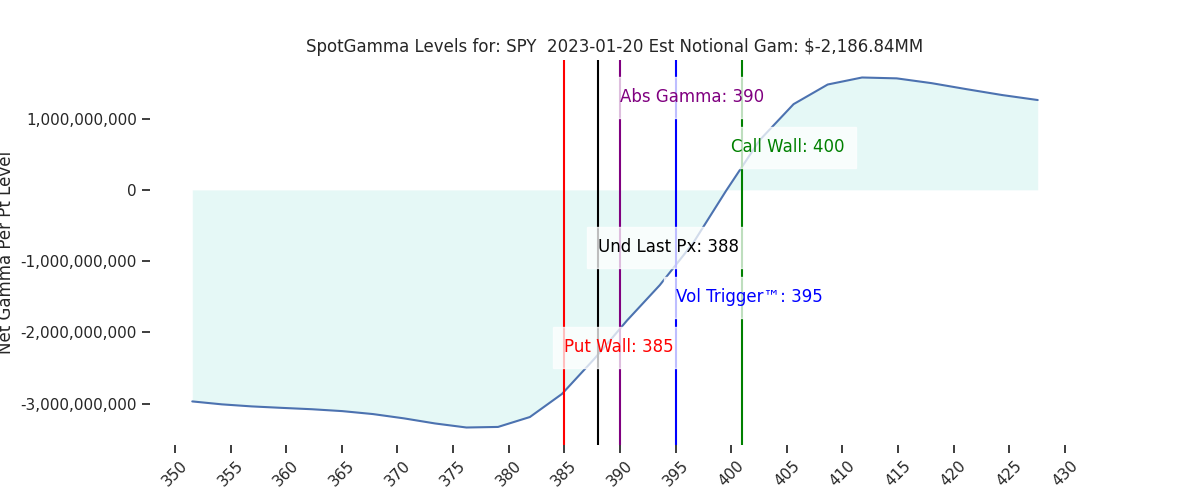

Futures are flat to 3920 ahead of todays expirations. Key SG Levels have nearly all shifted lower (Call Wall, Vol Trigger, Abs Gamma), centering around the 3915(390SPY) – 3900SPX area. This is the initial support area, with another band of support near 3870. Resistance above lies at 3950.

TLDR: Out of OPEX we see 4000 remaining as resistance, which combines with IV being at the lower end of its range. Downside support areas are less clear due to lack of positions. We give edge to a slide lower next week, but we do not anticipate a significant selloff.

Volume of note yesterday was at the 3900 SPX strike, which had put volume of 200k (!), and 120k on the call side. Thats large. Added to this was very heavy volume in SPY 388-390 Puts, and large 890k calls at the 390 strike. We generally read large volume areas as key support/resistance points – and this certainly fits the bill. 0DTE was only 37% of total volume, and so we think a fair amount of this was pre-OPEX rolling.

While 3900 ultimately proved to be support yesterday, the levels all shifting lower is bearish, as it implies options traders are accepting these lower price levels. Obviously this decline is just ahead of OPEX (and so major strike positions will reset), but we do feel its notable that the S&P was unable to snap sharply higher towards 3950-4000.

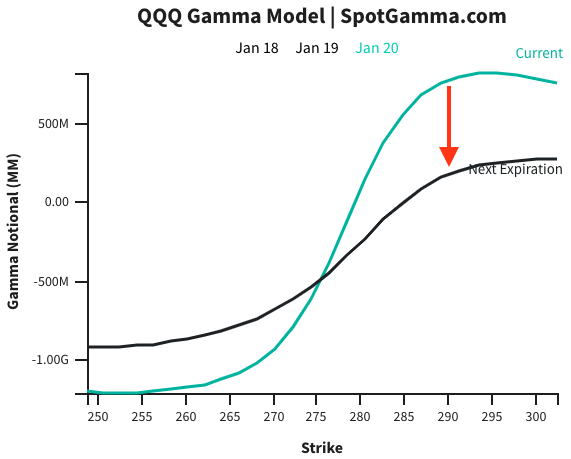

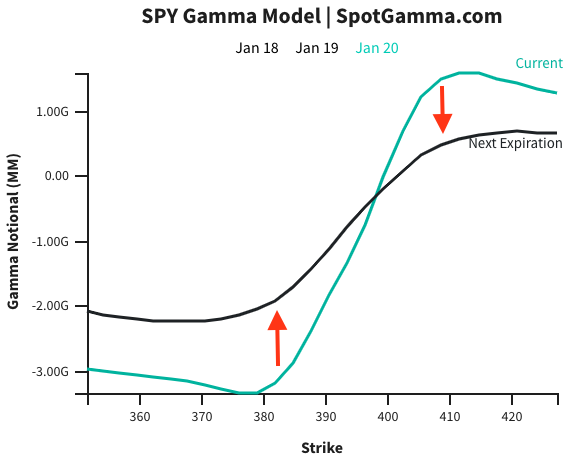

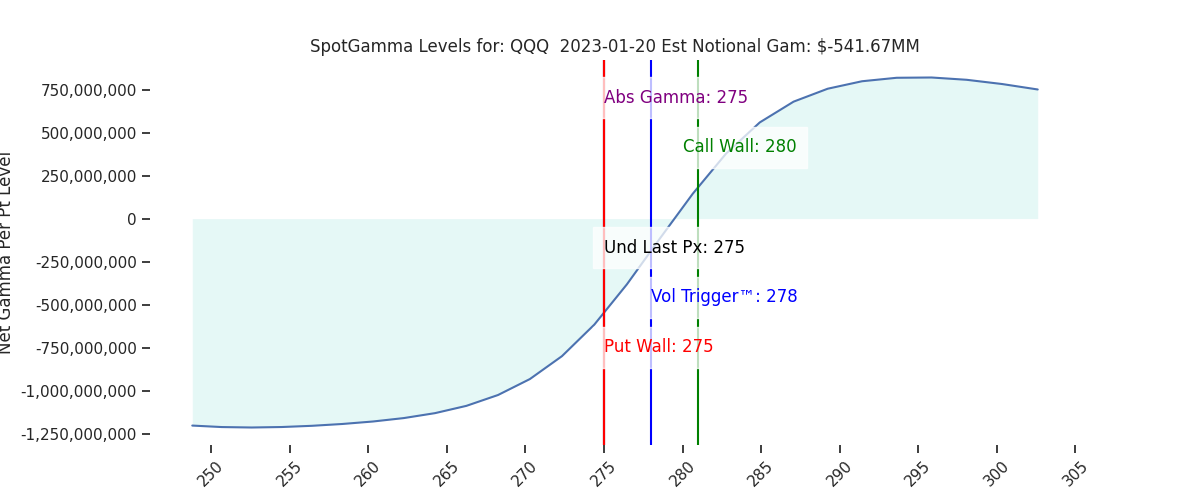

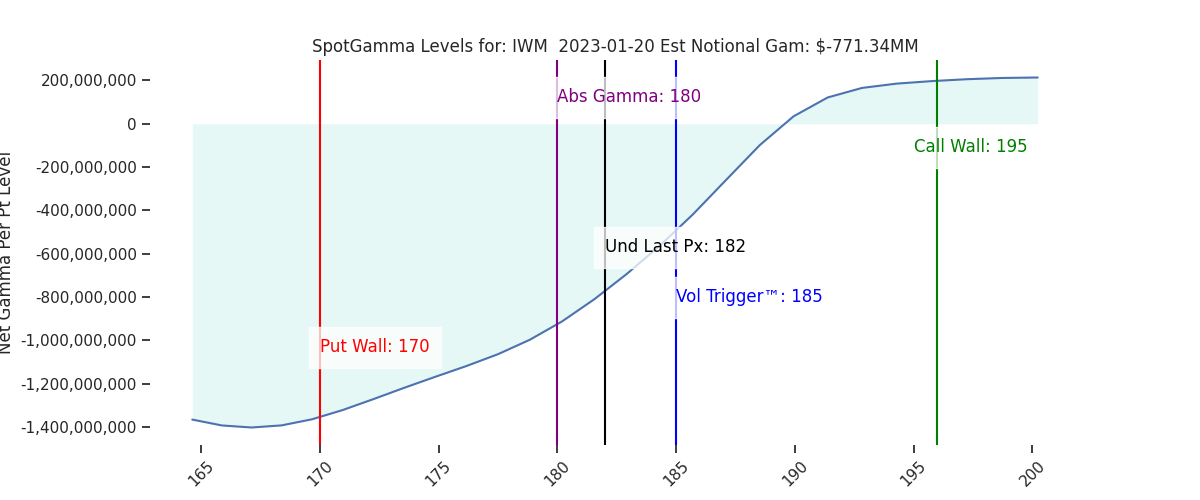

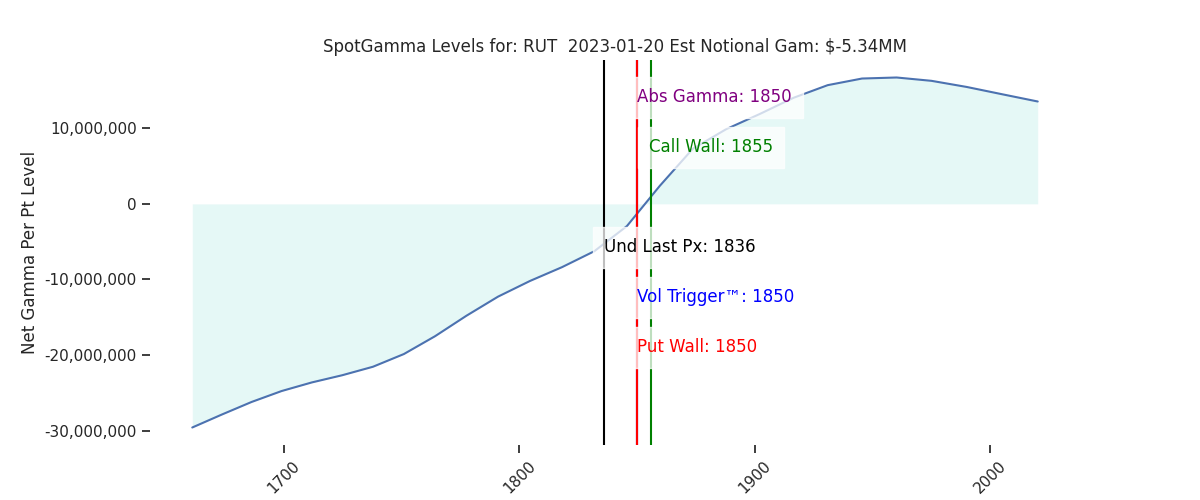

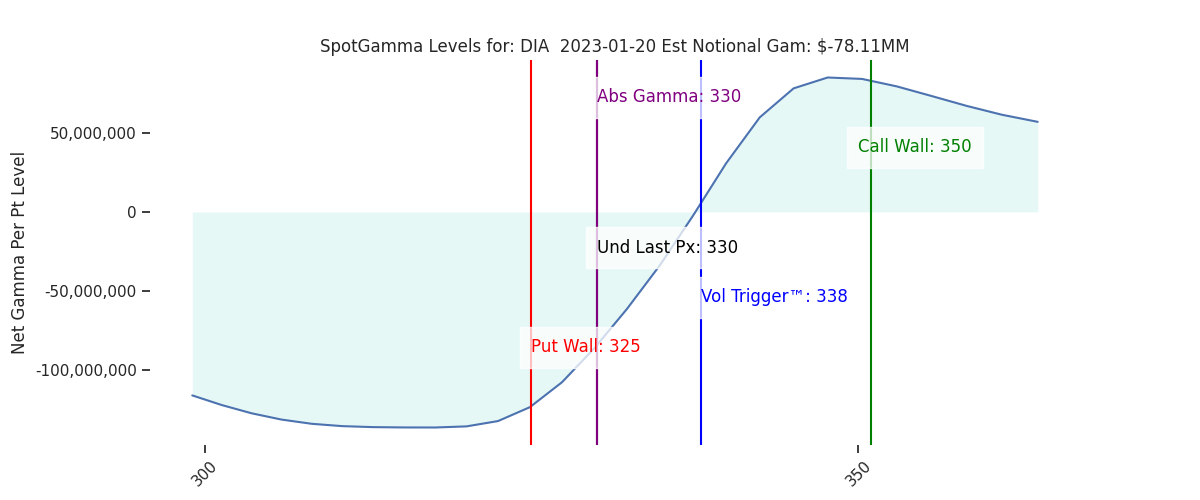

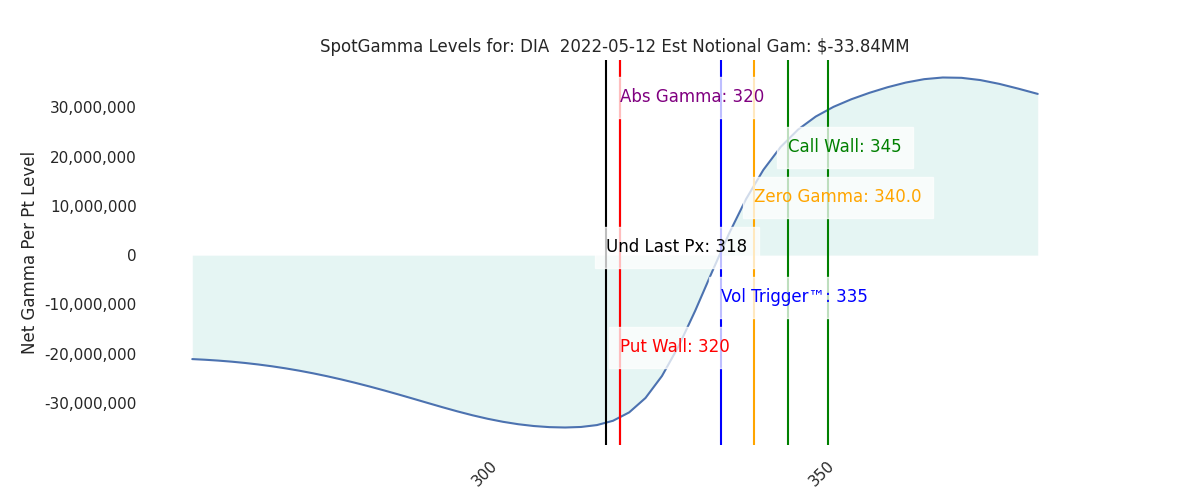

On the topic of position adjustments, we are today set to lose ~20-25% of total gamma across SPY/SPX/QQQ which should, again, lead to levels shifting for next week. You can see this gamma reduction in QQQ & SPY in the plot below.

Coming out of OPEX, things remain murky. It seems clear that 4000 will remain an import overhead resistance area due to current positioning. To the downside there are less areas of prominence. Yesterday we talked about the modest increase in IV being more about resolving oversold levels of IV vs being an indication of panic, and yesterday’s price action seemed to support that theme.

In other words traders were maybe too bullish earlier this week, and they have moderated some. This moderation appears to be more than a short term adjustment, as we are picking up some signs of traders adding downside protection. This is most prominent in the skew indicies highlighted below, which are all picking up from recent lows. We don’t think its (yet) enough to be a major downside driver here, but it’s a signal that the bullish fuel provided by put selling may be reduced into 2/1 FOMC.

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3898 | 3917 | 388 | 11295 | 275 |

| SG Implied 1-Day Move:: | 1.0%, | (±pts): 39.0 | VIX 1 Day Impl. Move:1.3% | ||

| SG Implied 5-Day Move: | 2.76% | 3998 (Monday Ref Price) | Range: 3888.0 | 4109.0 | ||

| SpotGamma Gamma Index™: | -0.79 | -0.57 | -0.44 | 0.03 | -0.08 |

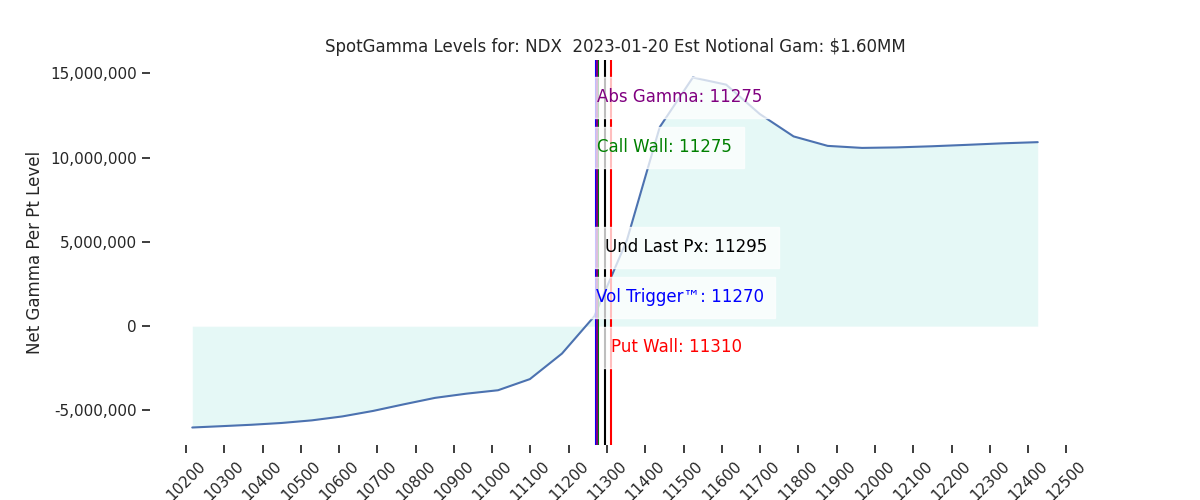

| Volatility Trigger™: | 3915 | 3970 | 395 | 11270 | 278 |

| SpotGamma Absolute Gamma Strike: | 3900 | 4000 | 390 | 11275 | 275 |

| Gamma Notional(MM): | -558.0 | -550.0 | -2187.0 | 2.0 | -542.0 |

| Put Wall: | 3900 | 3900 | 385 | 11310 | 275 |

| Call Wall : | 4000 | 4100 | 400 | 11275 | 280 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3954 | 3974 | 400.0 | 11202.0 | 299 |

| CP Gam Tilt: | 0.83 | 0.78 | 0.57 | 1.09 | 0.74 |

| Delta Neutral Px: | 3924 | ||||

| Net Delta(MM): | $1,516,049 | $1,556,125 | $170,517 | $40,197 | $80,795 |

| 25D Risk Reversal | -0.04 | -0.04 | -0.04 | -0.03 | -0.03 |

| Call Volume | 723,284 | 683,796 | 2,271,226 | 16,483 | 784,661 |

| Put Volume | 1,034,263 | 1,075,400 | 3,261,770 | 10,559 | 1,041,418 |

| Call Open Interest | 6,261,382 | 6,085,096 | 7,231,284 | 69,360 | 5,117,917 |

| Put Open Interest | 11,045,729 | 10,991,470 | 13,601,618 | 59,430 | 6,920,532 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4000, 3950, 3900, 3850] |

| SPY: [390, 388, 385, 380] |

| QQQ: [280, 275, 270, 265] |

| NDX:[11500, 11400, 11300, 11275] |

| SPX Combo (strike, %ile): [(4074.0, 77.73), (4066.0, 84.16), (4050.0, 87.96), (4031.0, 80.48), (4000.0, 95.45), (3976.0, 78.51), (3949.0, 91.04), (3914.0, 76.36), (3910.0, 88.28), (3898.0, 99.58), (3890.0, 90.68), (3883.0, 78.66), (3879.0, 90.56), (3875.0, 91.6), (3871.0, 89.58), (3859.0, 90.63), (3851.0, 79.72), (3809.0, 89.44), (3801.0, 94.77), (3750.0, 91.99)] |

| SPY Combo: [388.64, 398.74, 378.92, 373.87, 386.31] |

| NDX Combo: [11273.0, 11284.0, 11081.0, 11499.0, 10878.0] |

0 comentarios