Futures are at 3900, down nearly 1% from the cash close. Volatility estimates remain in line with the last several sessions. We look for resistance at 4000, with support at 3900 then 3865.

We’re now well below 4000, and into that “purely put” territory (see y’days note). All eyes now shift to the 3800 level, as this is where gamma actually starts to increase, which would in theory lead to reduced volatility estimates. This is because so much of the existing options position(s) are deep in the money (on the put side) pushing a delta of 1.

We continue to see puts rolled out, but they are in relatively small size. This syncs more or less with the lack of capitulation and no real spike in VIX. The VIX, near 35, has still not touched the ~38 intraday high from 2/24 despite the SPX -5% lower.

1 month realized vol in the SPX is currently at 32, which that is second to only the March ’20 crash. Through this lens a 34/35 VIX is fairly reasonable, and doesn’t carry much premium.

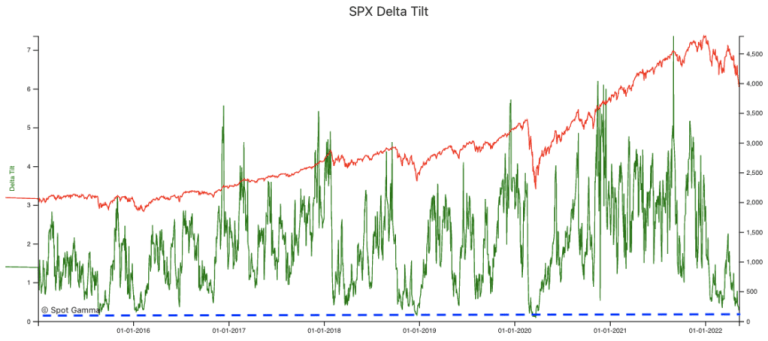

With this last move lower our Delta Tilt reading now matches that of previous major lows – suggesting again that we are at “peak puts”, and (barring a massive rally) there is little to change this signal before 5/20 wherein we’ll lose about 25% of total S&P500 gamma.

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3935 | 3935 | 392 | 11967 | 291 |

| SpotGamma Imp. 1 Day Move: Est 1 StdDev Open to Close Range |

1.19%, | (±pts): 47.0 | VIX 1 Day Impl. Move:2.07% | ||

| SpotGamma Imp. 5 Day Move: | 2.99% | 4123 (Monday Ref Px) | Range: 4000.0 | 4247.0 | ||

| SpotGamma Gamma Index™: | -2.11 | -2.11 | -0.37 | -0.02 | -0.11 |

| Volatility Trigger™: | 4300 | 4300 | 415 | 13200 | 310 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 12000 | 300 |

| Gamma Notional(MM): | -1061.0 | -1061.3 | -1756.0 | -3.0 | -677.0 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4288 | 4383 | 0 | 0 | 0 |

| Put Wall Support: | 3700 | 3700 | 380 | 12000 | 300 |

| Call Wall Strike: | 4700 | 4700 | 450 | 14000 | 330 |

| CP Gam Tilt: | 0.43 | 0.43 | 0.37 | 0.62 | 0.48 |

| Delta Neutral Px: | 4271 | ||||

| Net Delta(MM): | $1,667,696 | $1,667,696 | $182,390 | $38,131 | $98,287 |

| 25D Risk Reversal | -0.07 | -0.07 | -0.05 | -0.08 | -0.07 |

| Call Volume | 436,320 | 436,320 | 1,839,259 | 12,004 | 1,224,876 |

| Put Volume | 837,208 | 837,208 | 2,506,147 | 10,141 | 1,137,185 |

| Call Open Interest | 5,637,637 | 5,637,637 | 7,090,500 | 61,169 | 4,971,762 |

| Put Open Interest | 9,698,511 | 9,698,511 | 10,008,467 | 46,879 | 5,671,823 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4200, 4000, 3900, 3700] |

| SPY: [400, 395, 390, 380] |

| QQQ: [310, 300, 290, 280] |

| NDX:[14000, 12500, 12400, 12000] |

| SPX Combo (strike, %ile): [3900.0, 3998.0, 3951.0, 3849.0, 3876.0] |

| SPY Combo: [389.22, 399.03, 394.32, 384.11, 386.86] |

| NDX Combo: [12303.0, 11896.0, 11692.0, 12099.0] |