Founders Note for: 2022-07-01 06:49 EDT

Macro Theme:

- Rallies should be categorized as “short covering” and subject to failure

- Volatility should remain elevated until/unless the market closes >4000, the strike at which we see major resistance.

- 6/30 exp removes large put positions and may expose the market to further downside into July

- July 15th & 20th are important dates to market due to large equity & VIX expirations into a July 27th FOMC

- Note 3400 as significant long term support (Feb ’20 highs) + JPM collar positions

Daily Note:

Futures are at 3777 up from overnight lows of 3744. We see resistance at 3800, then 3900. Support shows at 3750 and 3710 (SPY370). Today is another day which likely exhibits high volatility due to waning holiday liquidity (Monday US equity markets are closed).

There were not many changes in terms of levels overnight, with the 3700 Put Wall remaining in place. While we look for overall weakness into July, this 3700 level is our large support level in the short term. If that level rolls lower then we look for continued downside.

On a larger time frame we’ve noted 4000 as major resistance, and that was bolstered by the addition of the JPM Fun Sep 30th 4005 calls. This 4005 level is now our Call Wall, too. We’ve been talking about how levels have been “transient” due to small positions that are frequently shifted. While this JPM positions are obviously longer dated calls (and thus a bit less gamma) its addition on the 4000 area creates a pretty sizeable wall. As with the Put Wall, should the Call Wall roll up then we generally look for higher market levels.

Lastly, we wanted to note on a lot of the talk around skew (we’ve discussed recently). The views are that essentially puts have been sold, along with a bid to calls as traders have been concerned about missing a right tail move. We think a lot of that skew flattening was due to June 17th OPEX + FOMC, and playing (or hedging for) the rally window into month end.

At this point we see little resistance up into 4000, but the large fuel from put expiration (and/or outright selling) has now been removed. That likely means we’ll need some type of fundamental rally spark, like lower inflation prints, earnings, etc.

Further, if skew is flat as traders have been selling puts/buying calls, then any type of reversal or drawdown to equities which leads to a steepening of skew could add fuel to a downside fire as traders are forced back into buying puts (traders buying puts infers dealers need to short).

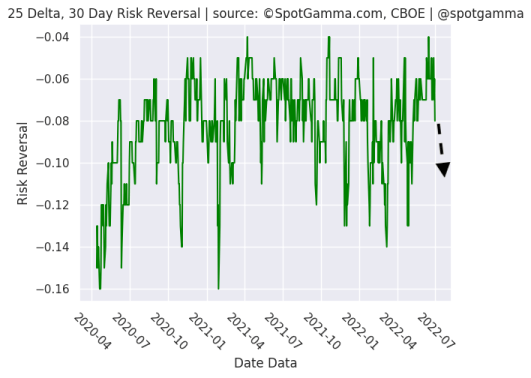

Below is our Risk Reversal metric, which is a measure of skew. We’ve been noting that, despite a “put heavy” market, its a held a bullish stance with readings near -0.05. This has more or less coincided with a 5% rally from recent S&P500 lows. If put demand picks up (indicated by readings near -0.1) then options demand shifts from equity tailwind, to headwind. This metric is starting to register that put demand, which syncs with our view that markets have some troubles into July.

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3789 | 3781 | 377 | 11503 | 280 |

| SpotGamma Imp. 1 Day Move: Est 1 StdDev Open to Close Range |

1.19%, | (±pts): 45.0 | VIX 1 Day Impl. Move:1.81% | ||

| SpotGamma Imp. 5 Day Move: | 2.84% | 3912 (Monday Ref Px) | Range: 3801.0 | 4023.0 | ||

| SpotGamma Gamma Index™: | -1.19 | -1.08 | -0.24 | 0.01 | -0.09 |

| Volatility Trigger™: | 4000 | 3910 | 376 | 11070 | 280 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 380 | 11150 | 280 |

| Gamma Notional(MM): | -675.0 | -766.13 | -1240.0 | 1.0 | -522.0 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3977 | 3969 | 0 | 0 | 0 |

| Put Wall Support: | 3700 | 3700 | 370 | 10500 | 280 |

| Call Wall Strike: | 4005 | 4300 | 382 | 11150 | 282 |

| CP Gam Tilt: | 0.62 | 0.57 | 0.55 | 1.11 | 0.66 |

| Delta Neutral Px: | 4051 | ||||

| Net Delta(MM): | $1,485,848 | $1,491,977 | $156,200 | $52,833 | $96,359 |

| 25D Risk Reversal | -0.08 | -0.06 | -0.07 | -0.09 | -0.09 |

| Call Volume | 551,283 | 494,986 | 2,174,543 | 10,696 | 925,886 |

| Put Volume | 828,941 | 730,928 | 2,971,315 | 8,488 | 1,352,304 |

| Call Open Interest | 5,440,998 | 5,769,499 | 6,564,766 | 60,632 | 4,374,247 |

| Put Open Interest | 9,433,872 |