Macro Theme:

Key dates ahead:

- 10/9 FOMC Mins

- 10/10 CPI

- 10/18 OPEX

Key SG levels for the SPX are:

- Support: 5,720, 5,700, 5,600

- Resistance: 5,750, 5,775, 5,800

- As of 10/7/24:

- Long with close >5,720

- Risk-off on a break <5,700

QQQ:

- Support: 485

- Resistance: 490

IWM:

- Support: 210

- Resistance: 218, 220

- As of 10/7/24:

- Bullish with close >220

Founder’s Note:

Futures are flat, after a strong session yesterday. FOMC mins are on the docket for today, at 2pm ET.

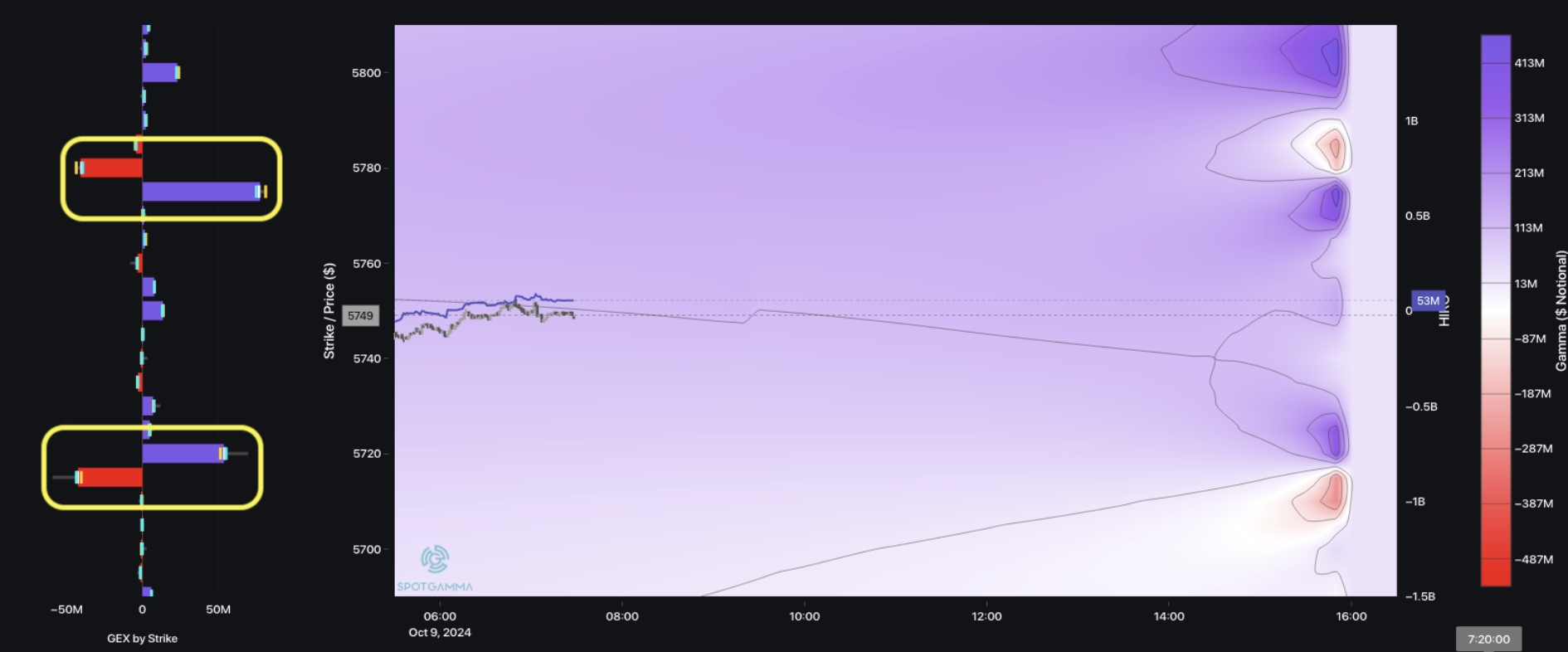

This morning we see the 0DTE iron condor seller is back, as highlighted below. This is a trader selling a large ~12k of the 5,775/5,780 call spread vs 5,720/5,715 put spread.

Overall this is a positive gamma position, which should be supportive of equity prices. Those aforementioned condor positions should form some guard rails for SPX prices today, with larger resistance above at 5,800, and major support at 5,700.

CPI data comes in tomorrow AM, and that event appears to be drawing a 1% event-vol premium. That suggests that the CPI is back in focus as a key market driver.

Helping bulls, is the volatility complex. Over the last few days we have seen at & near-the-money IV’s contract a bit (allegedly due to lack of escalation in the Middle East). Shown below is 11/8 SPX Skew for this morning (teal) vs Monday’s close (gray). While an ATM vol decline is clear, we also note that tail IV’s are flat to higher (i.e. strikes <=5000). We continue to think that IV’s aren’t likely to drop much further given not only geopolitics, but elections & rates. Tomorrow’s CPI could materially shift vols, and equity prices.

Lastly, we flag that NVDA continues to impress, as its now up 10% over the last 5 days. This is directly responsible for ~70bps of S&P500/QQQ performance, and indirectly a lot more (via other chip shares & ETF’s). Should this outperformance continue, its going to force equities higher – regardless of any macro concerns ahead. We continue to be impressed by the low call skew from NVDA which reflects a lack of long call demand.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5800.92 | $5751 | $573 | $20107 | $489 | $2194 | $217 |

| SG Gamma Index™: |

| 1.494 | -0.259 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5779.92 | $5730 | $573 | $19720 | $489 | $2200 | $218 |

| Absolute Gamma Strike: | $5849.92 | $5800 | $550 | $19725 | $490 | $2200 | $220 |

| Call Wall: | $5849.92 | $5800 | $575 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5769.92 | $5720 | $560 | $18500 | $460 | $2000 | $210 |

| Zero Gamma Level: | $5766.92 | $5717 | $576 | $19609 | $488 | $2206 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.227 | 0.759 | 1.785 | 0.933 | 0.810 | 0.705 |

| Gamma Notional (MM): | $470.821M | ‑$761.097M | $15.048M | ‑$35.939M | ‑$25.319M | ‑$490.90M |

| 25 Delta Risk Reversal: | -0.068 | -0.051 | -0.066 | -0.044 | 0.00 | -0.022 |

| Call Volume: | 422.492K | 1.112M | 7.947K | 638.073K | 10.212K | 221.266K |

| Put Volume: | 869.309K | 1.922M | 8.707K | 871.248K | 11.761K | 268.65K |

| Call Open Interest: | 6.72M | 5.193M | 58.436K | 3.065M | 293.714K | 4.101M |

| Put Open Interest: | 13.618M | 14.74M | 80.29K | 6.008M | 507.978K | 7.982M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5750, 5700, 5000] |

| SPY Levels: [550, 570, 572, 575] |

| NDX Levels: [19725, 20000, 20500, 20200] |

| QQQ Levels: [490, 485, 480, 475] |

| SPX Combos: [(5998,98.37), (5952,92.42), (5941,71.48), (5924,76.81), (5918,69.63), (5901,98.85), (5878,95.01), (5872,84.50), (5860,79.32), (5849,99.33), (5843,76.47), (5837,95.01), (5832,87.87), (5826,95.54), (5820,94.52), (5814,81.70), (5809,90.73), (5803,92.37), (5797,99.78), (5791,94.95), (5786,89.87), (5780,99.31), (5774,99.63), (5768,94.45), (5763,96.59), (5757,78.26), (5751,89.98), (5722,96.69), (5717,94.12), (5688,84.19), (5671,85.48), (5648,86.42), (5625,81.74), (5619,88.65), (5607,71.50), (5602,91.64), (5550,79.46), (5521,80.45), (5498,93.28), (5475,71.42)] |

| SPY Combos: [578.02, 583.13, 588.24, 558.15] |

| NDX Combos: [19726, 20550, 20349, 20128] |

| QQQ Combos: [480.17, 459.92, 470.05, 489.81] |

0 comentarios