Macro Theme:

Key dates ahead:

- 9/17: VIX Exp, FOMC

- 9/19: OPEX

Update: 9/11: Our key pivot is now 6,500. While SPX is >6,500, we favor of test of 6,600 into 9/17. <6,500, pre or post 9/17, we will flip to risk off.

9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

- Resistance: 6,600

- Pivot: 6,500 (bearish <, bullish >)

- Support: 6,650, 6,500, 6,400

Founder’s Note:

Futures are flat with Michigan at 10AM ET.

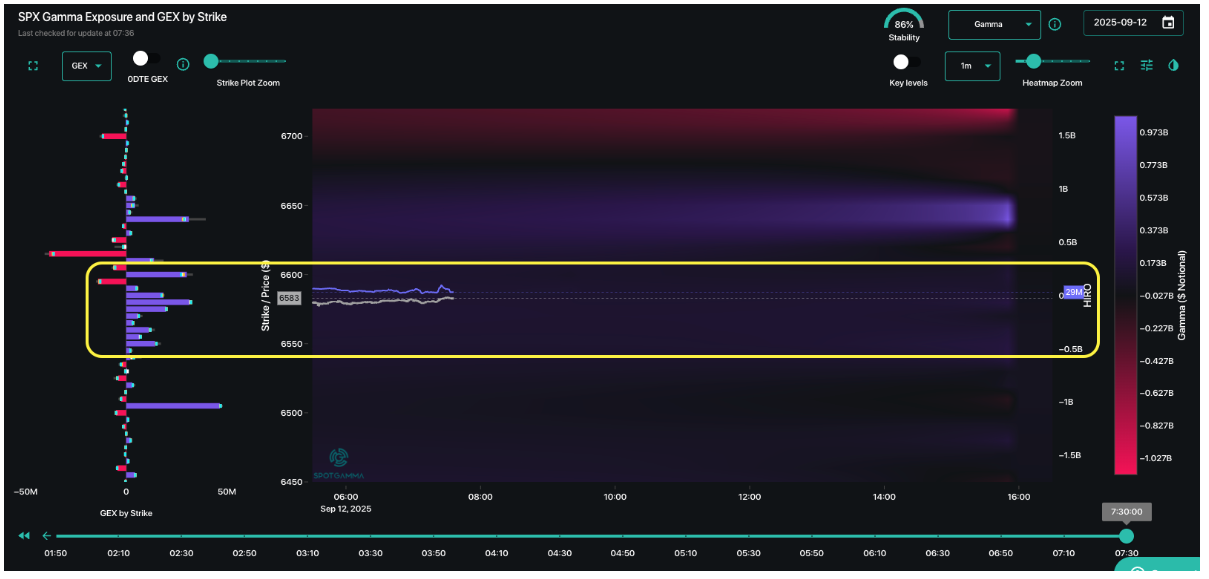

6,600 is the major upside level, with layered support into the major support line of 6,550.

We’re expecting quite little from SPX today, as it is blanketed with positive gamma. On this point todays straddle is an absolute bottom-basement expectation: $19.2/29bps (ref 6,585 IV 11.8%). We’d not want to be short of such pathetic expectations – but that doesn’t mean we want to buy 0DTE options either given the positive gamma dynamic.

We’d wager most traders are bored by this zombie-like dynamic (slow grind up), and so they step out on the risk spectrum into memes like OPEN, WDC – whatever is providing a pump. This was much of what we talked about in our Zombie piece from ~1-month ago: namely SPX RV goes near 6%, pre-FOMC IV’s go <8% – but we also thought correlation would really collapse.

So far those first two are on point, but correlation via CBOE COR1M has been somewhat sticky. Yes, its no where near “risk off” highs, but it also well above lows which we tagged the last time equity vol was in the gutter. I think this is an important dynamic to recognize because as FOMC marked rates are likely to drop next week, it presents alternative asset classes to play in (bonds, crypto, etc).

Almost all major sectors are clustered in a similar risk stance: traders favor puts over calls, but IV is still relatively low. Bonds (LQD, TLT, HYG, etc) all have a distinct neutral-to-call bias, as do some similar rate-sensitive plays like XLF, XHB and IWM. This is not really the look of a broad-based bullish equity outlook, which is what we’d need to see COR1M make new lows. Something could of course trigger equity call buyers to change their tune, but if ATH’s, ORCL +40%, IV at 6% can’t get them started – what will? We find all this rather concerning as we march toward 9/17 VIX exp + FOMC, which should reduce the forces that is driving vol lower.

|

|

/ESU25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6593.96 |

$6587 |

$657 |

$23992 |

$584 |

$2421 |

$240 |

|

SG Gamma Index™: |

|

4.438 |

-0.039 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.58% |

0.58% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.76% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6501.96 |

$6495 |

$657 |

$23720 |

$583 |

$2370 |

$234 |

|

Absolute Gamma Strike: |

$6506.96 |

$6500 |

$650 |

$23725 |

$580 |

$2300 |

$235 |

|

Call Wall: |

$6606.96 |

$6600 |

$660 |

$23725 |

$590 |

$2500 |

$240 |

|

Put Wall: |

$6306.96 |

$6300 |

$656 |

$22500 |

$560 |

$2330 |

$225 |

|

Zero Gamma Level: |

$6457.96 |

$6451 |

$656 |

$23397 |

$583 |

$2379 |

$238 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.564 |

0.971 |

1.807 |

1.054 |

1.261 |

1.114 |

|

Gamma Notional (MM): |

$1.328B |

$5.035M |

$21.502M |

$141.68M |

$28.895M |

$285.499M |

|

25 Delta Risk Reversal: |

-0.04 |

-0.035 |

-0.047 |

-0.036 |

-0.021 |

-0.018 |

|

Call Volume: |

766.055K |

1.307M |

8.472K |

558.379K |

18.431K |

580.333K |

|

Put Volume: |

1.038M |

2.81M |

10.46K |

916.602K |

30.427K |

724.725K |

|

Call Open Interest: |

7.989M |

5.859M |

71.766K |

3.658M |

321.65K |

4.006M |

|

Put Open Interest: |

14.232M |

14.786M |

92.166K |

6.416M |

510.318K |

9.159M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6500, 6600, 6000, 6550] |

|

SPY Levels: [650, 657, 660, 655] |

|

NDX Levels: [23725, 24000, 23800, 23850] |

|

QQQ Levels: [580, 585, 590, 560] |

|

SPX Combos: [(6897,94.50), (6877,72.07), (6851,91.96), (6825,78.91), (6798,97.78), (6772,80.31), (6752,98.13), (6726,84.12), (6713,87.23), (6699,99.66), (6693,70.55), (6680,69.21), (6673,95.80), (6660,93.47), (6653,84.25), (6647,99.90), (6640,99.07), (6634,90.93), (6627,99.75), (6620,98.54), (6614,99.64), (6607,99.47), (6601,99.98), (6594,91.45), (6587,98.53), (6581,88.87), (6574,92.79), (6568,78.56), (6548,94.91), (6541,69.17), (6528,86.55), (6502,98.66), (6449,78.21), (6443,77.19), (6423,76.87), (6410,87.70), (6403,80.99), (6383,73.66), (6363,70.97), (6350,79.93), (6311,70.63), (6298,89.77), (6278,74.32)] |

|

SPY Combos: [658.73, 656.78, 654.17, 663.95] |

|

NDX Combos: [23729, 24232, 24041, 23993] |

|

QQQ Combos: [570.83, 577.8, 584.76, 589.99] |