Macro Theme:

Key dates ahead:

- 9/17: VIX Exp, FOMC

- 9/19: OPEX

Update: 9/11: Our key pivot is now 6,500. While SPX is >6,500, we favor of test of 6,600 into 9/17. <6,500, pre or post 9/17, we will flip to risk off.

9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

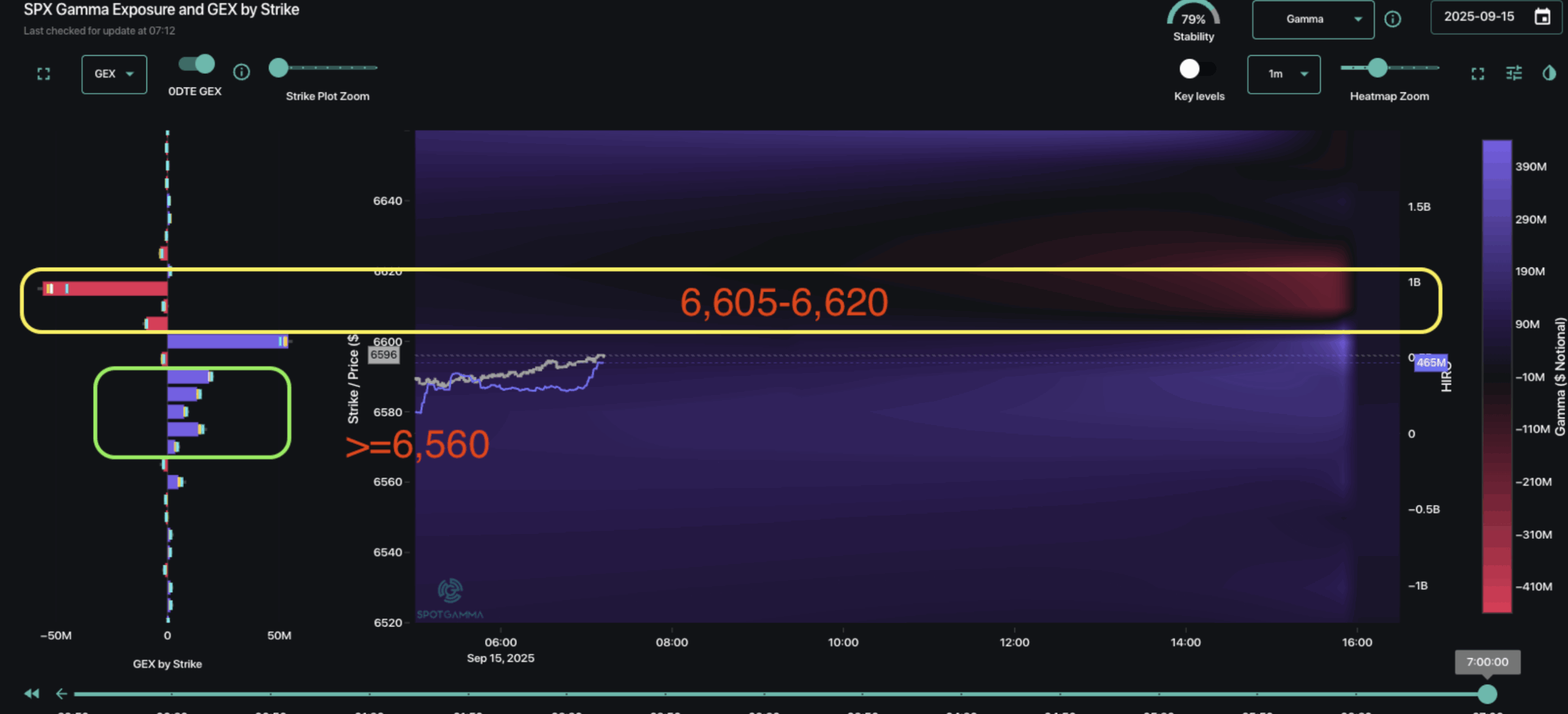

- Resistance: 6,600, 6,625

- Pivot: 6,500 (bearish <, bullish >)

- Support: 6,660, 6,500, 6,400

Founder’s Note:

Futures are 10bps higher with no major data on tap for today.

TLDR: One last day of 0DTE gamesmanship (ex: see Seek & Destroy from Friday), then we think risk starts to percolate tomorrow as its the last day Sep VIX options can trade. Then we have 9:30 AM ET VIX Exp Wed AM, followed by FOMC on Wed PM. While we remain risk on while SPX >6,500, we will be looking to add some small put plays today & tomorrow (given the cheap IV), looking to benefit from a potential SPX move into 6,4xx’s into end-of-Sep. Countering our bearish lean is Elon, whose $1bn TSLA stock purchase has the stock +7% premarket.

Major resistance is at 6,600 – a level which we think provides major resistance/pinning into Wednesday. Support is layered below via 0DTE positive gamma into 6,560. The most interesting dynamic (or maybe uninteresting) for today was that IV for today went out with a 5% figure on Friday night. That is absolute bottom-basement IV’s, and while there is a weekend effect which distorts those IV’s a bit, its still the lowest level we’ve seen in…well… as long as we can remember. The risk in these situations is that any material move triggers a vol cover, which leads to jumpy prices.

Being honest (as we’ve just labeled 6,600 as “the resistance”), this appears to be as much of a risk to the upside into that negative gamma pocket (yellow box) as it does to the downside.

On the topic of sneaking moves in this tight IV environment, we note TSLA is up 7% premarket after being up a similar amount on Friday. This after it was announced Elon bought +2mm shares/$1bn.

This seems like it has room to 450, based on current SGOI GEX, with short term support near 400.

Elons buy, we suppose, could change up the tech dynamic and re-ignite a broader bullish sentiment that has been surprisingly lacking in the call buying space. Our sentiment here comes from the put-skewed position of sector ETF’s on the Compass map. Bulls would point out that if Elon/FOMC/whatever sparks a bullish re-positioning, then stocks could shift quite a bit higher.

If that is your view, then you can look at buying rather cheap upside calls, as stuff like Nov 25 delta calls trade for a 10%-11% IV. Pretty cheap.

|

|

/ESU25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6643.14 |

$6584 |

$657 |

$24092 |

$586 |

$2397 |

$238 |

|

SG Gamma Index™: |

|

3.057 |

-0.102 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.58% |

0.58% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.59% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6554.14 |

$6495 |

$657 |

$23720 |

$584 |

$2385 |

$234 |

|

Absolute Gamma Strike: |

$6559.14 |

$6500 |

$640 |

$23725 |

$575 |

$2300 |

$235 |

|

Call Wall: |

$6659.14 |

$6600 |

$660 |

$23725 |

$590 |

$2420 |

$240 |

|

Put Wall: |

$6359.14 |

$6300 |

$640 |

$22500 |

$575 |

$2330 |

$225 |

|

Zero Gamma Level: |

$6556.14 |

$6497 |

$656 |

$23318 |

$585 |

$2391 |

$238 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.359 |

0.919 |

1.882 |

0.996 |

0.966 |

0.971 |

|

Gamma Notional (MM): |

$963.812M |

‑$23.865M |

$23.298M |

$122.216M |

‑$7.861M |

$11.096M |

|

25 Delta Risk Reversal: |

-0.038 |

-0.037 |

-0.044 |

-0.035 |

-0.021 |

-0.022 |

|

Call Volume: |

582.274K |

985.274K |

8.86K |

592.389K |

13.38K |

278.967K |

|

Put Volume: |

1.011M |

1.794M |

7.80K |

1.166M |

41.887K |

602.115K |

|

Call Open Interest: |

8.015M |

5.674M |

71.654K |

3.689M |

320.49K |

3.97M |

|

Put Open Interest: |

14.12M |

14.47M |

89.347K |

6.365M |

516.377K |

9.157M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6500, 6600, 6000, 6550] |

|

SPY Levels: [640, 650, 660, 655] |

|

NDX Levels: [23725, 24000, 24100, 23800] |

|

QQQ Levels: [575, 585, 580, 590] |

|

SPX Combos: [(6900,94.20), (6874,69.90), (6848,92.43), (6828,80.03), (6802,97.98), (6775,74.11), (6749,97.59), (6723,87.33), (6709,84.82), (6703,99.58), (6683,83.62), (6676,93.40), (6670,84.74), (6663,94.98), (6657,76.38), (6650,99.79), (6644,97.71), (6637,81.36), (6630,94.11), (6624,98.33), (6617,99.63), (6611,98.51), (6604,89.12), (6597,99.95), (6591,95.26), (6584,69.00), (6578,97.29), (6565,79.24), (6558,85.86), (6551,74.87), (6518,80.08), (6505,94.95), (6499,76.83), (6472,75.85), (6453,76.46), (6439,73.63), (6413,90.35), (6400,83.67), (6393,69.51), (6380,70.09), (6347,84.48), (6308,75.31), (6301,89.95), (6262,69.26)] |

|

SPY Combos: [658.91, 663.51, 661.54, 668.77] |

|

NDX Combos: [23731, 24237, 23610, 24116] |

|

QQQ Combos: [577.66, 589.92, 585.25, 584.08] |