Macro Theme:

Key dates ahead:

- 1/13: CPI

- 1/14: Supreme Court Tariffs

- 1/16: OPEX

- 1/21: VIX Exp

- 1/29: FOMC

SG Summary:

Update 1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

1/2: SPX is below our Risk Pivot at 6,890, and we see SPX IV’s being anchored higher into the start of ’26. Given that we have a neutral to short-leaning stance as non-0DTE gamma is negative down into 6,600, and higher SPX IV’s could also work to pressure SPX lower. A close back >6,900 into the week of 1/5 would remove the short bias.

Key SG levels for the SPX are:

- Resistance: 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,950, 6,900, 6,850

Founder’s Note:

Futures are off fractionally ahead of 8:30AM ET CPI.

TLDR: We remain leaning long while SPX >6,900. <6,900 we flip quickly to a risk-off stance.

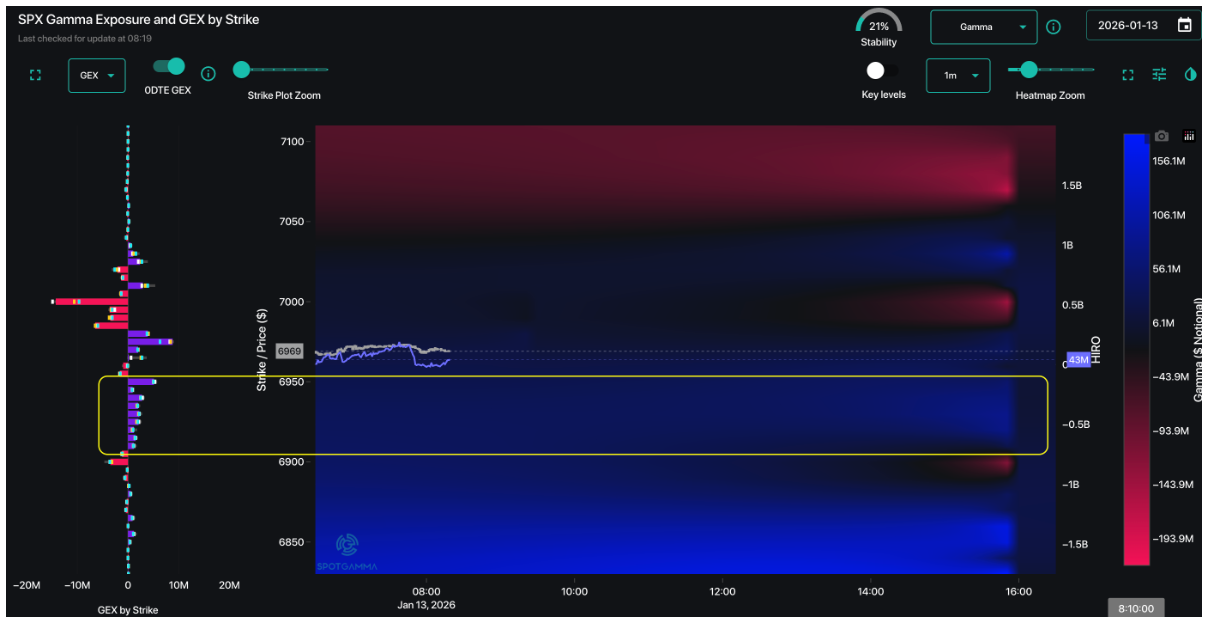

There is continuous positive gamma from 6,900 to 6,950 which suggests that dips will be bought today – much as they have for the last several days. 6,975 is initial resistance, but over that we see a gap in resistance to 7,000.

With SPX realized vol near 9%, we see ATM IVs around 9-11% out into early Feb. As you can see below, there is a small premium for this week due to various data points, with Mon – Wed of next week marking a real <10% lull. Then, IV picks up a bit into FOMC. ATM IV around 10% is quite low, which syncs with a market that has had low volatility and is at ATH. However, there is a bit of a relative bid for >1-month SPX ATM through downside IV, which is why we see the VIX at +15. This indicates traders are adding some protection even though these short dated IVs are quite low. Obviously single stock IV remains bid with high call demand and into upcoming earnings.

This is all fine until its not, and the market keeps absorbing headlines in stride. Criminal investigations into the Fed, Iran-related escalations/tariffs, etc are simply micro-dips to be bought. We certainly can’t argue with price action, and see little reason for the bullish impulse to change until critical risk thresholds are crossed.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$7015.1 |

$6977 |

$695 |

$25787 |

$627 |

$2635 |

$261 |

|

SG Gamma Index™: |

|

2.46 |

-0.055 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.57% |

0.57% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

$7020.84 |

$699.46 |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

$6941.26 |

$691.54 |

|

|

|

|

|

SG Volatility Trigger™: |

$6983.1 |

$6945 |

$694 |

$25240 |

$624 |

$2580 |

$259 |

|

Absolute Gamma Strike: |

$7038.1 |

$7000 |

$695 |

$25250 |

$630 |

$2700 |

$260 |

|

Call Wall: |

$7038.1 |

$7000 |

$700 |

$25250 |

$640 |

$2700 |

$265 |

|

Put Wall: |

$6938.1 |

$6900 |

$690 |

$24000 |

$610 |

$2450 |

$245 |

|

Zero Gamma Level: |

$6974.1 |

$6936 |

$693 |

$25147 |

$621 |

$2590 |

$259 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6000] |

|

SPY Levels: [695, 690, 700, 696] |

|

NDX Levels: [25250, 25800, 26000, 25900] |

|

QQQ Levels: [630, 620, 625, 627] |

|

SPX Combos: [(7298,93.95), (7277,78.50), (7249,92.10), (7228,80.67), (7208,71.73), (7201,98.06), (7194,70.15), (7173,80.40), (7152,98.13), (7124,90.71), (7117,75.56), (7103,99.16), (7089,74.11), (7082,92.54), (7075,97.35), (7068,93.62), (7061,92.64), (7054,89.11), (7047,99.79), (7040,91.23), (7033,97.90), (7026,99.20), (7019,97.73), (7012,97.56), (7005,94.66), (6998,99.95), (6991,85.21), (6984,96.46), (6977,97.11), (6963,73.05), (6949,90.77), (6942,83.04), (6935,68.82), (6928,92.57), (6921,81.54), (6914,74.08), (6907,79.37), (6901,94.02), (6894,70.44), (6887,74.37), (6873,91.96), (6866,74.04), (6859,81.41), (6852,89.87), (6838,77.21), (6824,87.76), (6803,94.08), (6775,84.67), (6768,77.82), (6747,88.21), (6733,69.74), (6726,80.01), (6698,94.32), (6677,75.02), (6649,78.24)] |

|

SPY Combos: [697.46, 702.32, 699.54, 696.07] |

|

NDX Combos: [25788, 25891, 25246, 26303] |

|

QQQ Combos: [629.79, 614.13, 627.29, 632.3] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.238 |

0.954 |

1.786 |

1.121 |

1.507 |

1.035 |

|

Gamma Notional (MM): |

$695.131M |

‑$2.281M |

$16.84M |

$208.795M |

$33.432M |

$103.926M |

|

25 Delta Risk Reversal: |

-0.041 |

0.00 |

-0.049 |

0.00 |

-0.024 |

-0.008 |

|

Call Volume: |

620.938K |

1.103M |

10.54K |

643.429K |

19.522K |

241.247K |

|

Put Volume: |

974.11K |

1.415M |

12.717K |

899.537K |

26.438K |

406.925K |

|

Call Open Interest: |

7.348M |

5.095M |

58.083K |

3.629M |

217.582K |

2.923M |

|

Put Open Interest: |

12.262M |

11.488M |

89.013K |

5.514M |

383.861K |

6.93M |

0 comentarios