Rallies should be categorized as short covering and subject to failure.

S&P 500 Levels:

- $4,000.00 is significant overhead resistance.

- $3,900.00 is a pivot above which volatility should decrease.

- $3,800.00 is major support below which there may be an accelerated sell-off.

What To Watch:

- Volatility may increase following the July 15 (equity) and July 20 (VIX) options expirations.

- The potential for volatility to remain heightened into the July 27th FOMC rate decision.

Daily Note:

Futures are weaker this morning, down to 3750. Volatility will likely remain high today with support at 3750 (SPY 375) then 3700. Resistance shows at 3800.

Yesterdays AM bounce was strong off of the morning low of 3750, and futures are currently retesting that level. 3750 is a moderate gamma level, and an area which has functioned as support several times the last month.

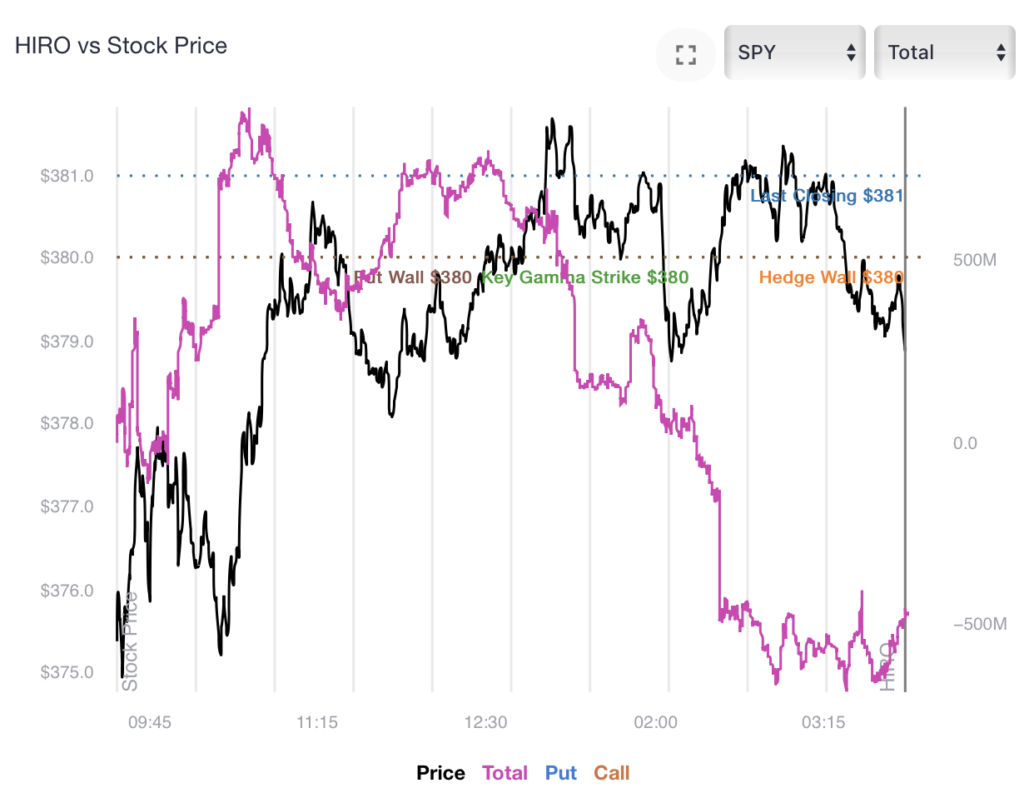

W’ed note that HIRO captured strong positive deltas off of that morning low, but as the market revisited 3800 those deltas turned negative as shown below (purple line). This real time flow, plus our view on general dealer positioning (negative gamma due to put holdings) suggests short covering of that rally.

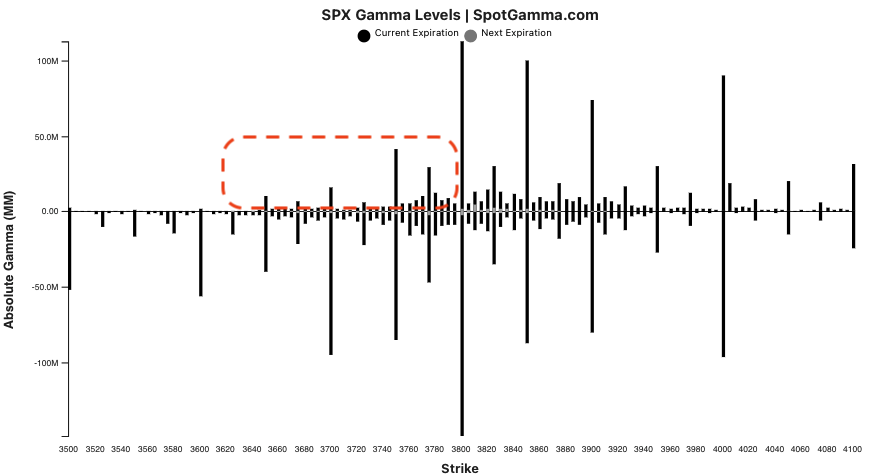

Yesterdays trading seemed to have built up the positioning at 3800, which makes it more of a short term resistance/pinning area (into Fridays OPEX). You can see that whats most critical about this level is that <3800 call open interest fades sharply (red box). This means that its purely put gamma <3800 which is associated with higher levels of volatility. Again, this is playing into this time frame wherein we see catalysts for higher volatility (detailed here).

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3801 | 3802 | 378 | 11728 | 285 |

| SpotGamma Imp. 1 Day Move: Est 1 StdDev Open to Close Range |

1.22%, | (±pts): 46.0 | VIX 1 Day Impl. Move:1.68% | ||

| SpotGamma Imp. 5 Day Move: | 2.98% | 3899 (Monday Ref Px) | Range: 3783.0 | 4015.0 | ||

| SpotGamma Gamma Index™: | -1.09 | -1.05 | -0.31 | -0.01 | -0.07 |

| Volatility Trigger™: | 3825 | 3860 | 385 | 12000 | 290 |

| SpotGamma Absolute Gamma Strike: | 3800 | 3800 | 380 | 12500 | 280 |

| Gamma Notional(MM): | -692.0 | -673.92 | -1589.0 | -1.0 | -456.0 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3957 | 3989 | 0 | 0 | 0 |

| Put Wall Support: | 3700 | 3700 | 370 | 11000 | 280 |

| Call Wall Strike: | 4005 | 4005 | 390 | 11150 | 295 |

| CP Gam Tilt: | 0.69 | 0.63 | 0.51 | 0.91 | 0.72 |

| Delta Neutral Px: | 4033 | ||||

| Net Delta(MM): | $1,554,713 | $1,564,042 | $163,083 | $60,118 | $99,735 |

| 25D Risk Reversal | -0.08 | -0.08 | -0.06 | -0.07 | -0.07 |

| Call Volume | 486,870 | 371,321 | 1,699,541 | 6,476 | 744,862 |

| Put Volume | 871,946 | 643,453 | 2,902,061 | 5,985 | 1,002,464 |

| Call Open Interest | 5,799,676 | 5,783,554 | 7,082,086 | 68,280 | 4,578,641 |

| Put Open Interest | 10,048,084 | 9,921,939 | 11,177,310 | 64,739 | 6,516,805 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4000, 3900, 3850, 3800] |

| SPY: [385, 380, 375, 370] |

| QQQ: [300, 290, 285, 280] |

| NDX:[12500, 12000, 11800, 11150] |

| SPX Combo (strike, %ile): [3698.0, 3748.0, 3801.0, 3714.0, 3763.0] |

| SPY Combo: [368.6, 373.53, 378.83, 370.12, 375.04] |

| NDX Combo: [11494.0] |