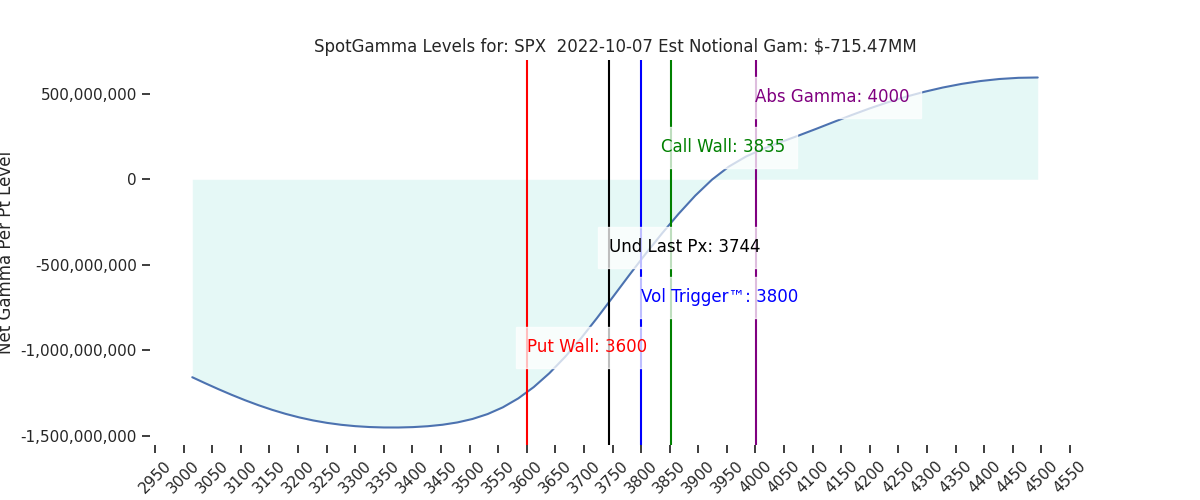

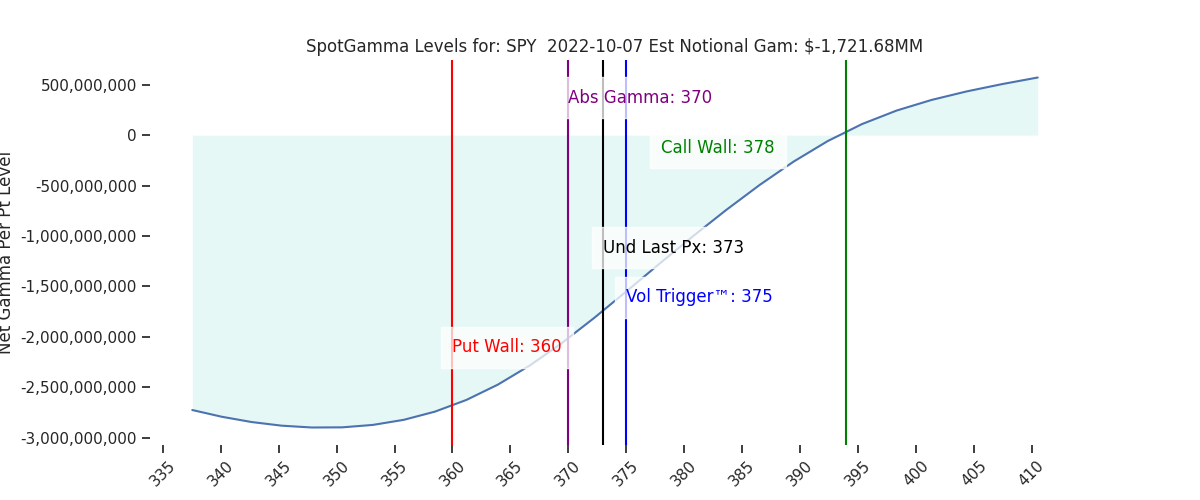

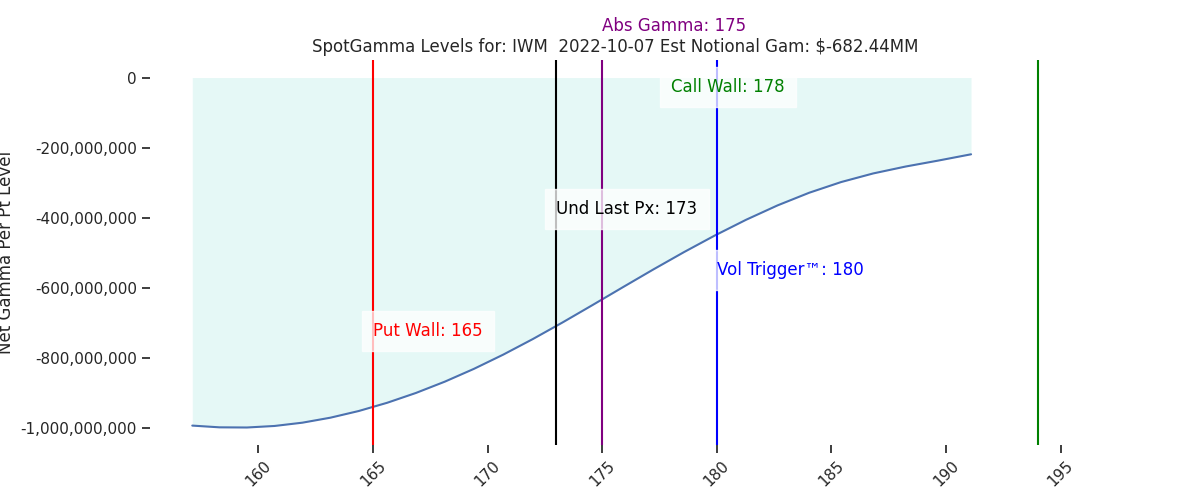

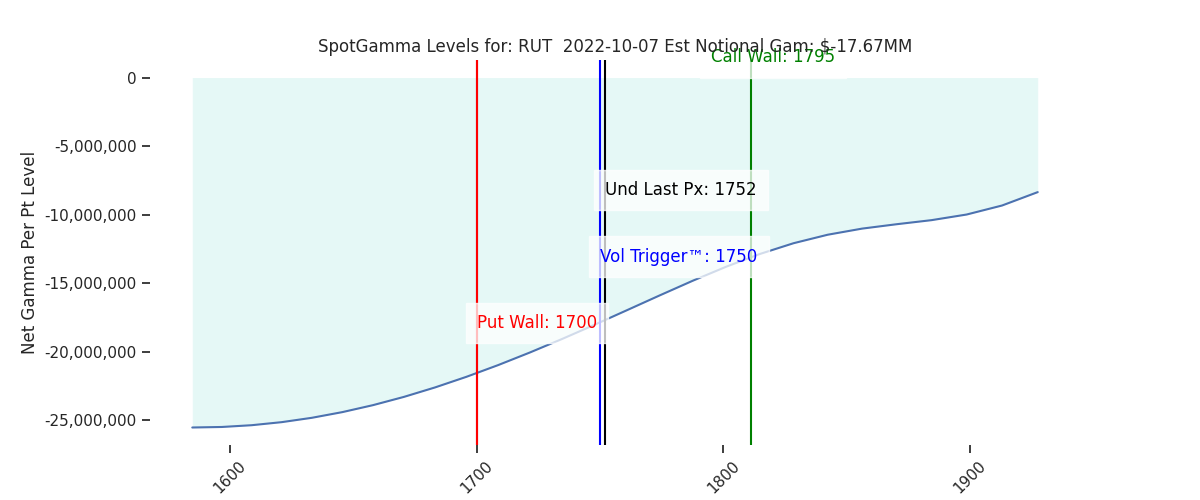

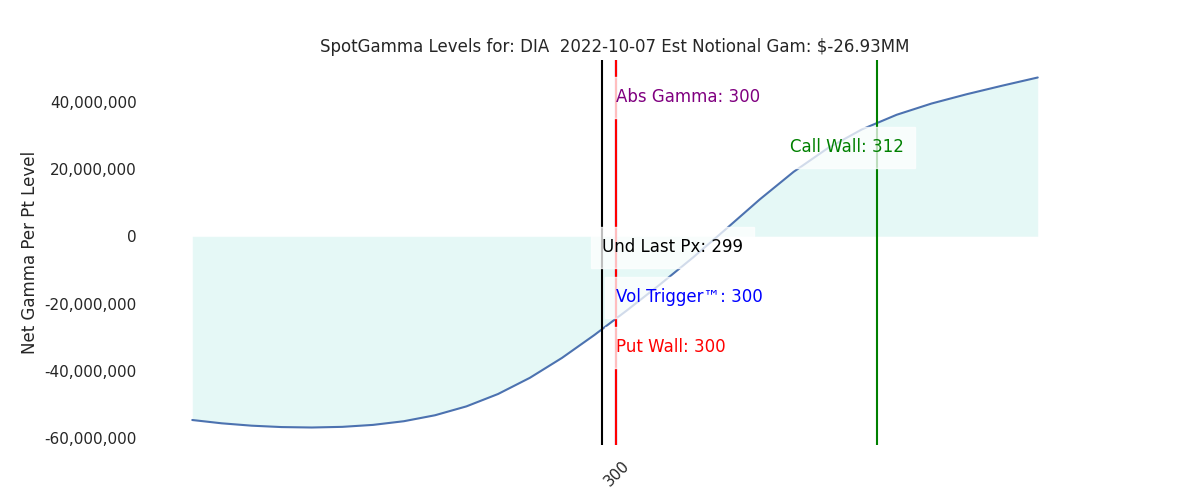

Futures are flat to last nights close, near 3760. Resistance remains at the band from 3800 (Vol Trigger) to 3820(SPY Call Wall) & 3835 (Call Wall). We have a pivot line at 3749, then support at 3720 (370 SPY) and 3700.

Traders are waiting for this mornings Non Farms report, however we are unsure that there is a print so loved by markets that they today break up through the 3800-3835 resistance band. Resistance is not only from the size of strikes positioned at that level, but is also the peak of today’s range from a volatility sense (the SG Implied 1 Day move is 47 handles).

The downside still retains higher risk, as our models are positioned here for “peak volatility” as shown in the scatter plot below. In the plot you can see that with a higher gamma index (right side), volatility contracts sharply. However, today’s reading (red line) is at the level wherein we see the most volatility. This is due to the fact that the max put position (ex: Tilt models) that was in place last week has been relieved due to both 9/30 expiration and this weeks +4% rally.

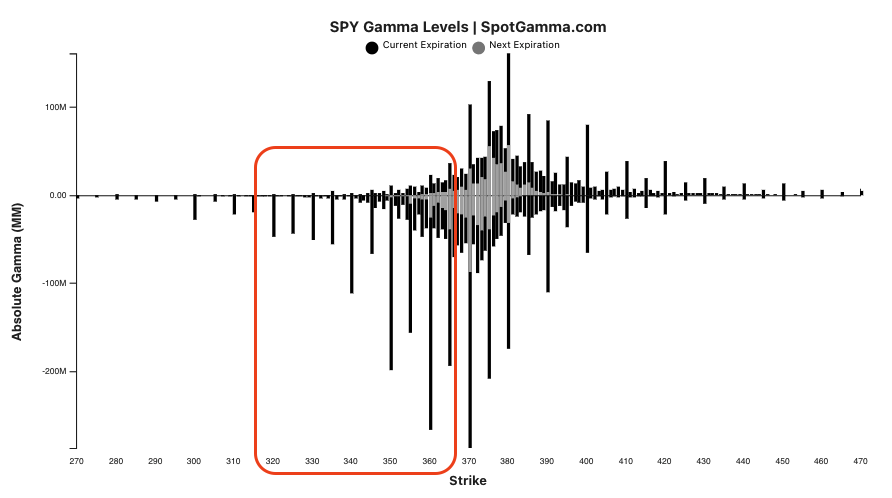

Volatility certainly “works both ways”, however below the 370 SPY/3700 SPX the strikes really only contain put options. As the market moves lower the negative gamma feedback loop spools up (dealers short to hedge, which pushes the market lower, requiring dealers to short more). This implies that a break of 3700 invokes a test of the 3600 Put Wall. This mechanism is not in place to the upside as over the 3800 gamma is neutral.

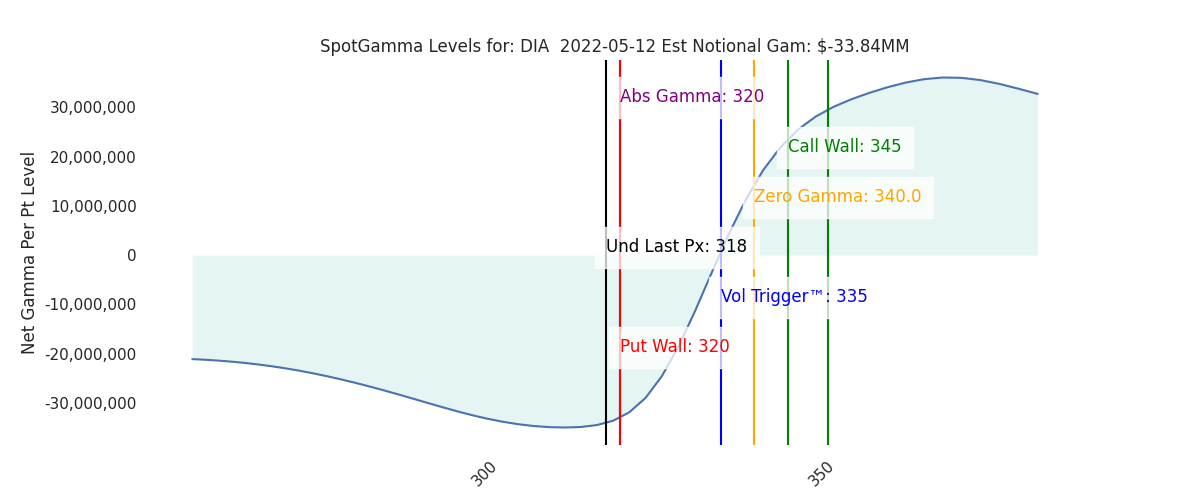

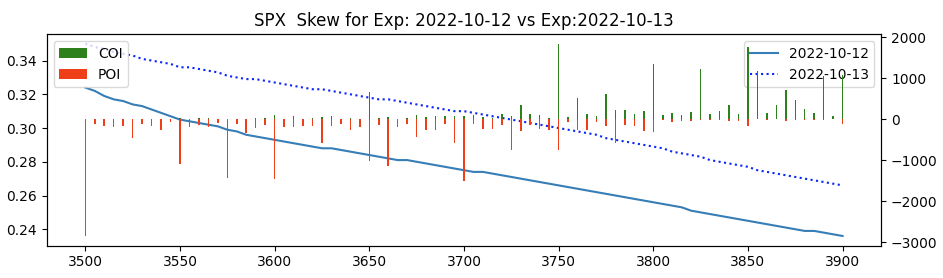

Ultimately, we think today’s jobs report won’t trigger much in the long term. The big print is next weeks CPI, and that is reflected in skew. Below you can see how much higher Wed 10/13 skew is (dashed blue) vs Tuesday 10/12 (compare this spread vs the Mon/Tues spread).

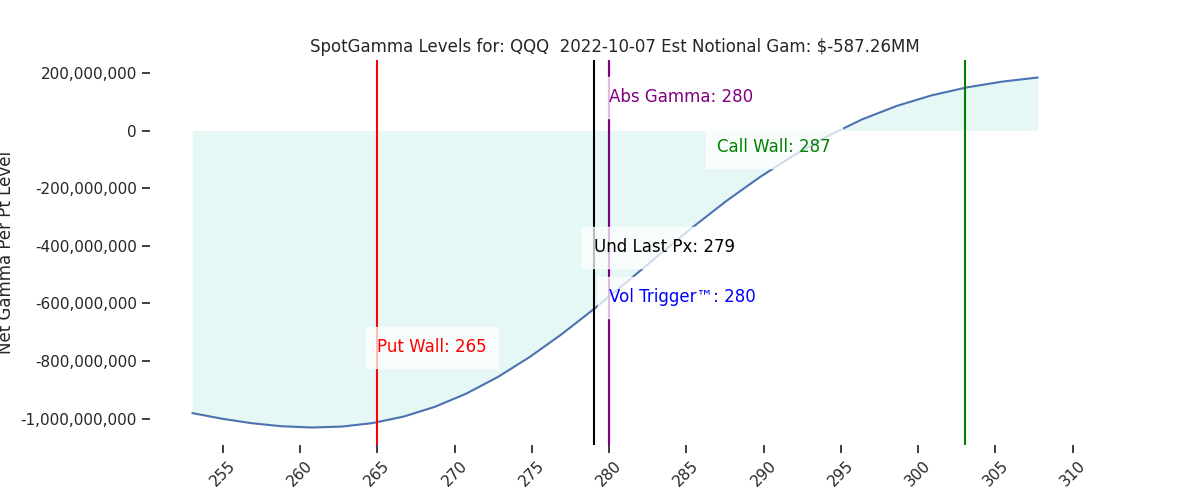

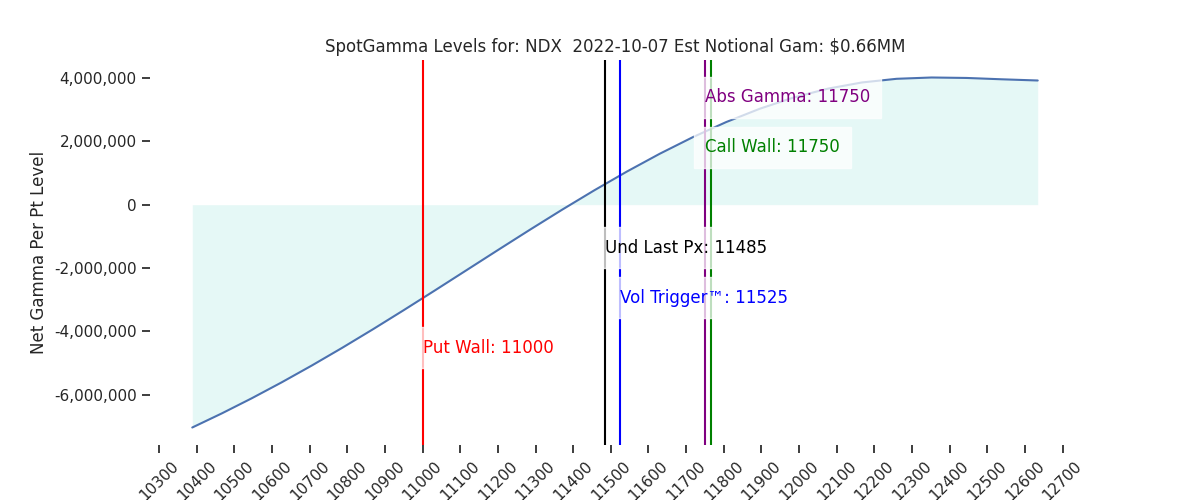

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3744 | 3744 | 373 | 11485 | 279 |

| SG Implied 1-Day Move:: | 1.26%, | (±pts): 47.0 | VIX 1 Day Impl. Move:1.92% | ||

| SG Implied 5-Day Move: | 3.08% | 3589 (Monday Ref Price) | Range: 3479.0 | 3700.0 | ||

| SpotGamma Gamma Index™: | -1.16 | -0.77 | -0.31 | 0.01 | -0.08 |

| Volatility Trigger™: | 3800 | 3800 | 375 | 11525 | 280 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 370 | 11750 | 280 |

| Gamma Notional(MM): | -715.0 | -726.0 | -1722.0 | 1.0 | -587.0 |

| Put Wall: | 3600 | 3600 | 360 | 11000 | 265 |

| Call Wall : | 3835 | 3835 | 378 | 11750 | 287 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3940 | 3911 | 392.0 | 11386.0 | 310 |

| CP Gam Tilt: | 0.67 | 0.62 | 0.55 | 1.06 | 0.66 |

| Delta Neutral Px: | 3944 | ||||

| Net Delta(MM): | $1,678,835 | $1,615,230 | $211,172 | $47,530 | $104,092 |

| 25D Risk Reversal | -0.07 | -0.06 | -0.06 | -0.07 | -0.07 |

| Call Volume | 483,165 | 685,468 | 2,909,137 | 6,443 | 1,010,032 |

| Put Volume | 737,312 | 717,035 | 3,630,863 | 6,181 | 1,110,642 |

| Call Open Interest | 6,328,454 | 6,225,929 | 8,176,484 | 59,784 | 4,898,581 |

| Put Open Interest | 11,113,377 | 10,915,252 | 13,753,780 | 76,200 | 6,947,491 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4000, 3900, 3800, 3700] |

| SPY: [380, 375, 370, 360] |

| QQQ: [290, 285, 280, 270] |

| NDX:[12500, 12000, 11750, 11500] |

| SPX Combo (strike, %ile): [(3834.0, 79.26), (3748.0, 85.35), (3711.0, 77.52), (3700.0, 92.08), (3673.0, 75.18), (3651.0, 93.7)] |

| SPY Combo: [363.87, 368.72, 373.57, 382.16, 369.84] |

| NDX Combo: [11750.0, 11290.0, 11497.0] |