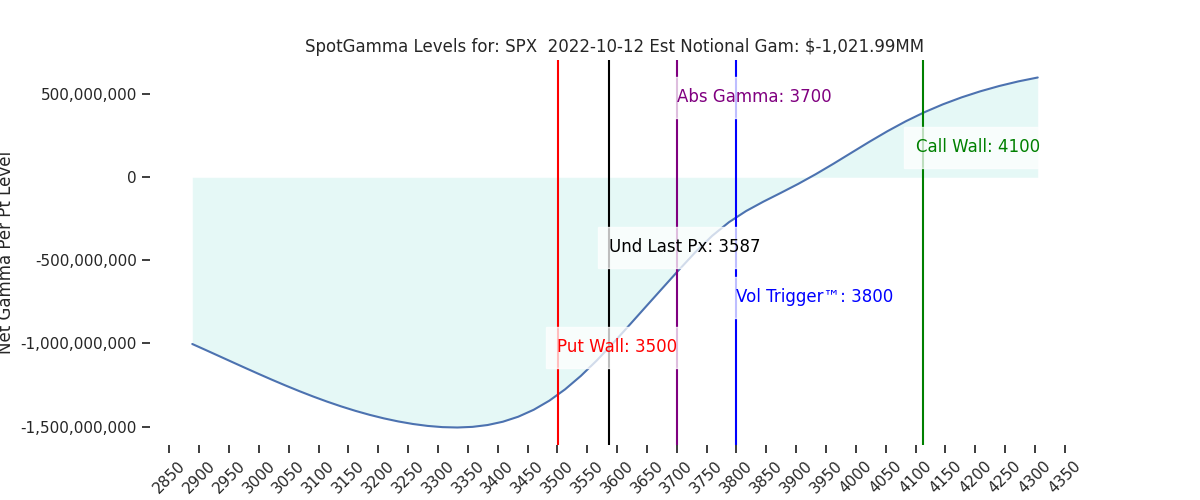

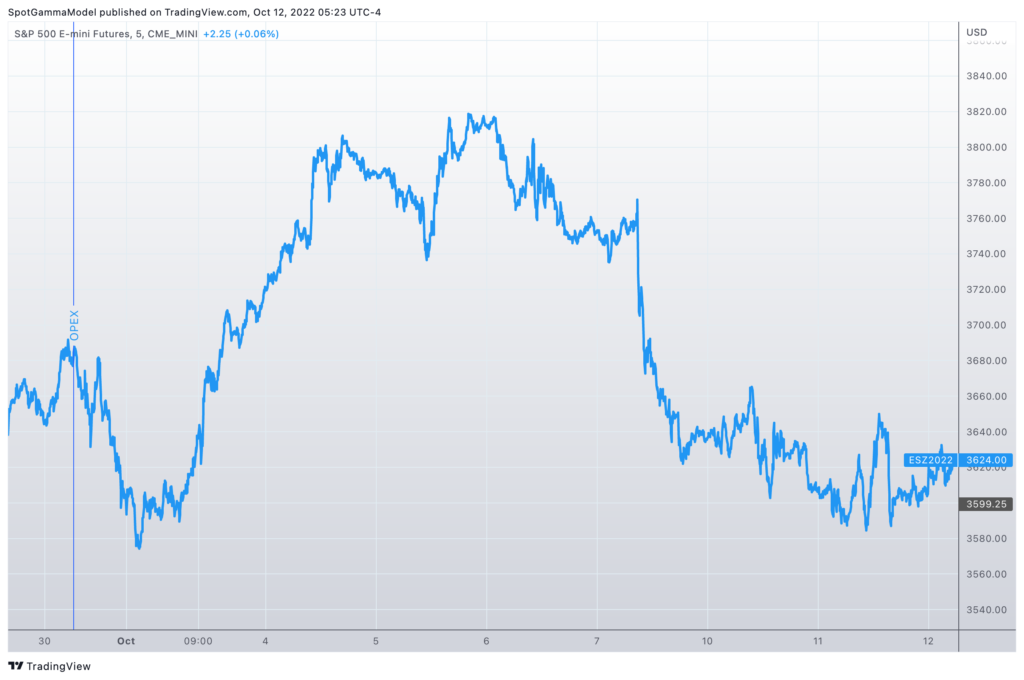

Futures have pressed higher to 3621. Resistance is at 3648, then 3700. Support shows at 3600 then 3562.

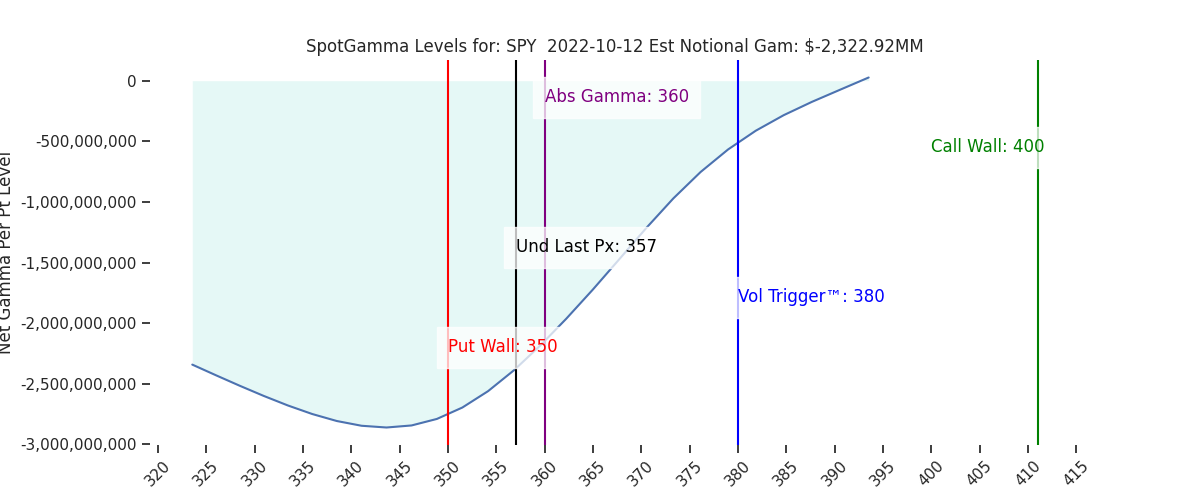

Yesterdays sharp drop in markets was driven by BOE comments, and that seemed to draw out put buyers. With that our SPX Put Wall shifted down to 3500, which matches the SPY 350 Put Wall. We therefore view markets as not “oversold” until/unless we break 3500.

Recall that headlines matter more in large negative gamma regimes, where algos spark and an initial reaction which is reinforced by options hedging flows. This was exemplified yesterday in the very large swings tied to those BOE comments. Ultimately, despite the wide swings, markets are holding fairly steady in front of tomorrows CPI.

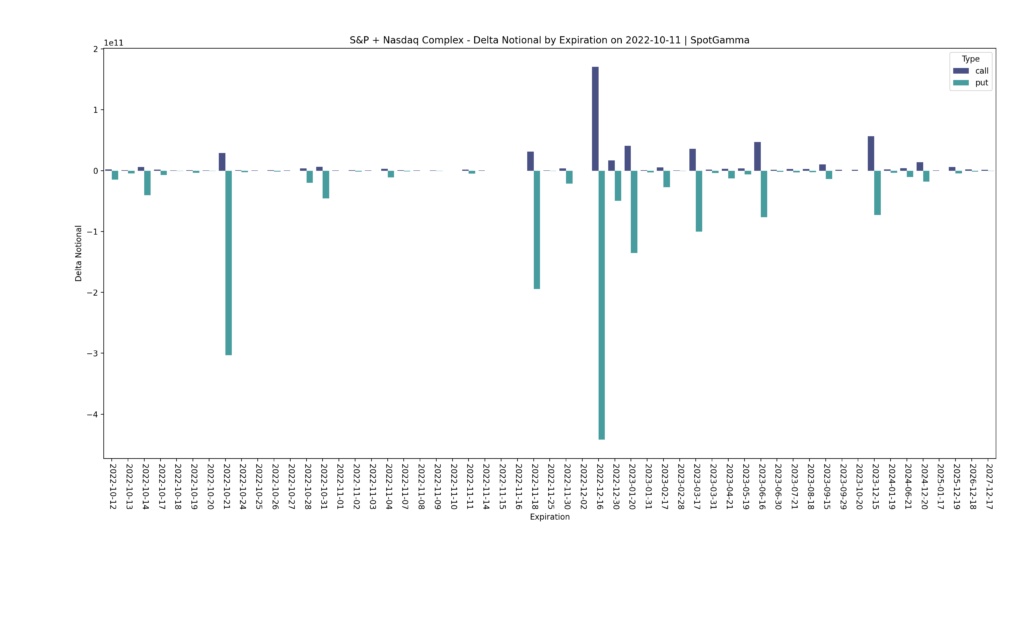

Even though tomorrows CPI is being marked with elevated IV, there is not a large expiration until 10/21, as shown below. Therefore we continue to believe that tomorrows CPI will spark either a massive spike in IV (i.e. VIX), or a large drop in IV. This will invoke vanna hedging flows, which will further drive the underlying index prices. As the October monthly OPEX deltas are fairly large, there is plenty of fuel to extend the CPI reaction to a large 5% rally, or push us down to the 3500 Put Wall. The key insight here is this CPI trigger will spark a multi-session directional trend into October OPEX.

After October OPEX we arrive to another window of catalysts including various global central bank meetings, an FOMC and US midterm elections. Therefore we view the CPI reaction as fairly limited in duration (i.e. into Oct OPEX).

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

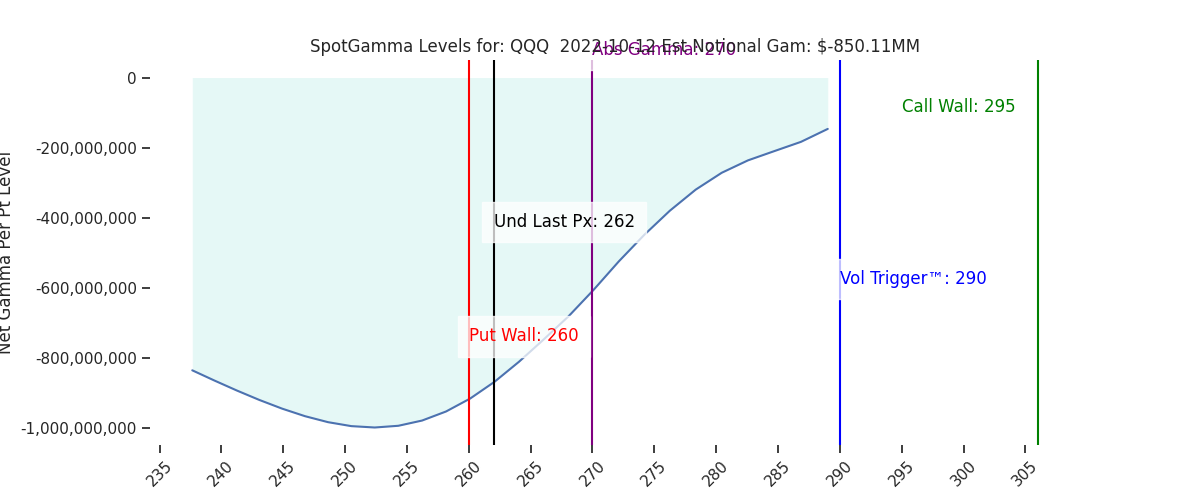

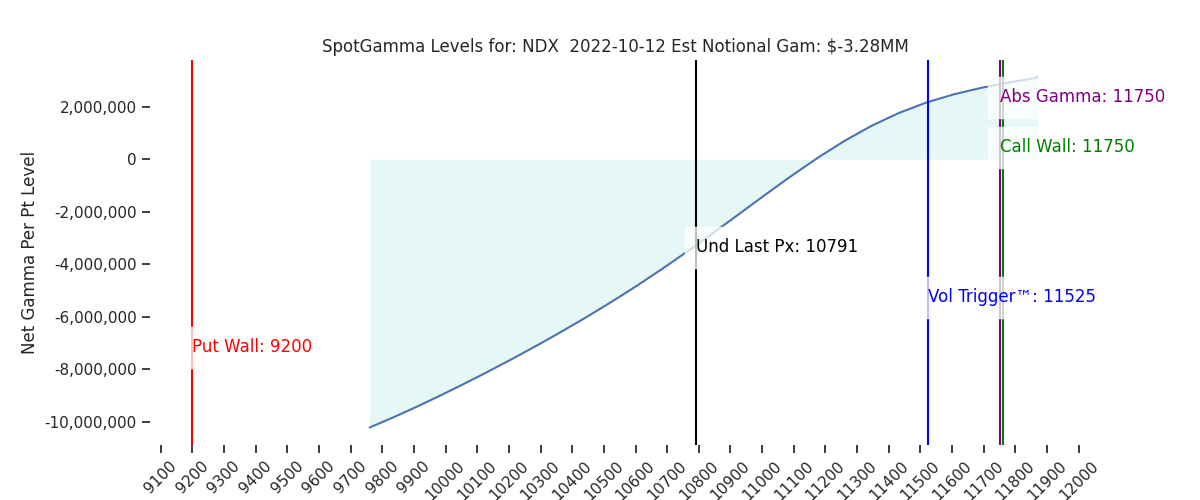

| Ref Price: | 3587 | 3588 | 357 | 10791 | 262 |

| SG Implied 1-Day Move:: | 1.26%, | (±pts): 45.0 | VIX 1 Day Impl. Move:2.12% | ||

| SG Implied 5-Day Move: | 3.08% | 3640 (Monday Ref Price) | Range: 3528.0 | 3753.0 | ||

| SpotGamma Gamma Index™: | -1.78 | -1.71 | -0.43 | -0.02 | -0.12 |

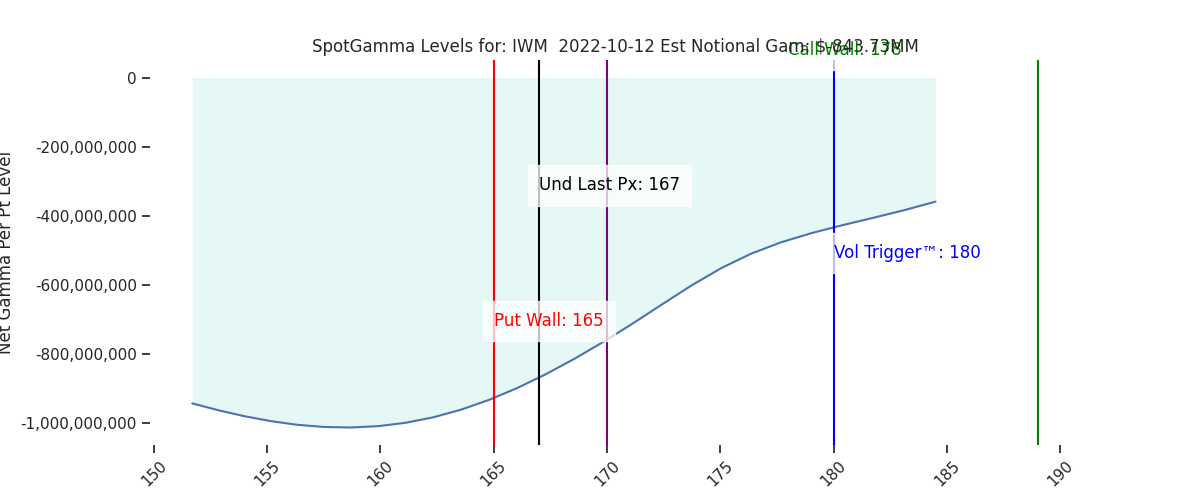

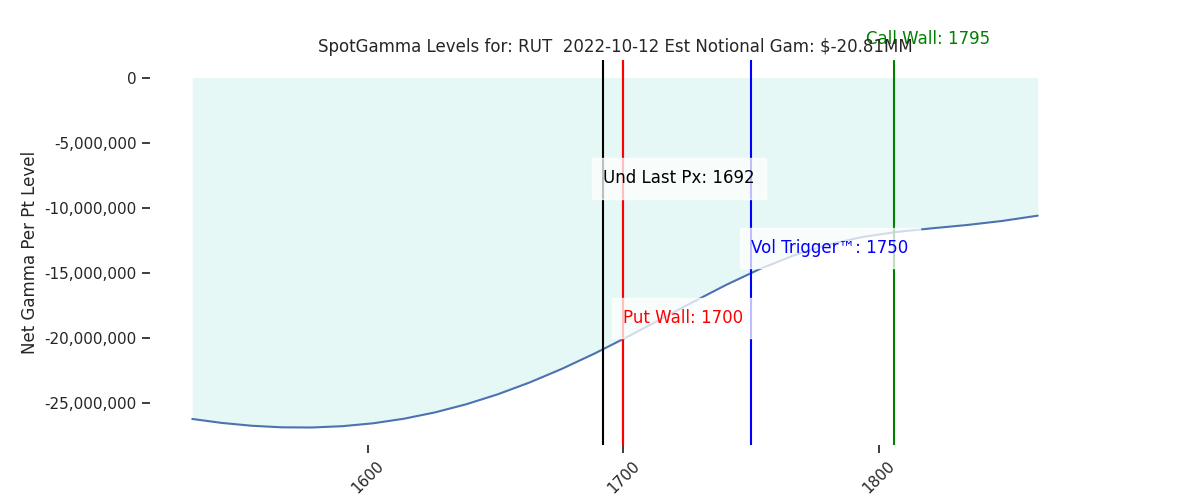

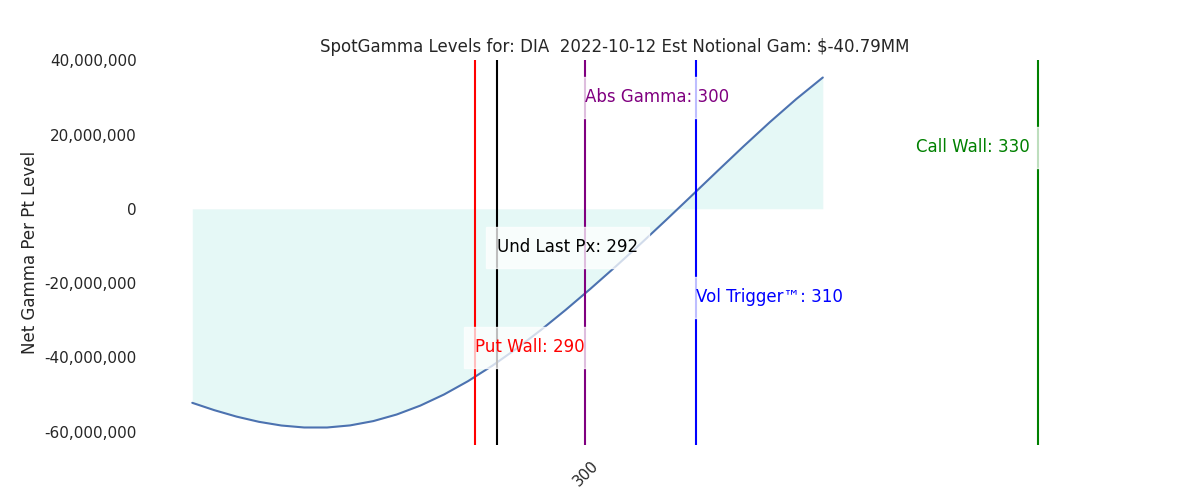

| Volatility Trigger™: | 3800 | 3800 | 380 | 11525 | 290 |

| SpotGamma Absolute Gamma Strike: | 3700 | 3700 | 360 | 11750 | 270 |

| Gamma Notional(MM): | -1022.0 | -1086.0 | -2323.0 | -3.0 | -850.0 |

| Put Wall: | 3500 | 3600 | 350 | 9200 | 260 |

| Call Wall : | 4100 | 3835 | 400 | 11750 | 295 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3914 | 3946 | 391.0 | 11104.0 | 300 |

| CP Gam Tilt: | 0.51 | 0.46 | 0.43 | 0.7 | 0.49 |

| Delta Neutral Px: | 3923 | ||||

| Net Delta(MM): | $1,815,895 | $1,743,270 | $228,079 | $48,508 | $103,978 |

| 25D Risk Reversal | -0.07 | -0.06 | -0.05 | -0.06 | -0.05 |

| Call Volume | 616,115 | 727,153 | 3,337,561 | 8,463 | 1,164,115 |

| Put Volume | 880,933 | 1,003,323 | 4,425,021 | 8,591 | 1,320,246 |

| Call Open Interest | 6,810,915 | 6,608,820 | 8,526,647 | 61,906 | 5,005,051 |

| Put Open Interest | 11,348,035 | 11,201,379 | 13,713,794 | 78,794 | 6,765,573 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4000, 3700, 3650, 3600] |

| SPY: [370, 360, 355, 350] |

| QQQ: [280, 270, 265, 260] |

| NDX:[12000, 11750, 11500, 11000] |

| SPX Combo (strike, %ile): [(3749.0, 72.91), (3698.0, 81.68), (3648.0, 88.48), (3623.0, 76.61), (3609.0, 84.36), (3598.0, 96.77), (3573.0, 81.36), (3562.0, 87.57), (3548.0, 94.19), (3523.0, 83.19), (3512.0, 89.31), (3498.0, 97.88), (3472.0, 74.0), (3447.0, 92.28), (3422.0, 75.11), (3411.0, 73.9)] |

| SPY Combo: [348.8, 358.81, 353.8, 343.79, 350.23] |

| NDX Combo: [10683.0, 10888.0, 10478.0, 10263.0, 11094.0] |