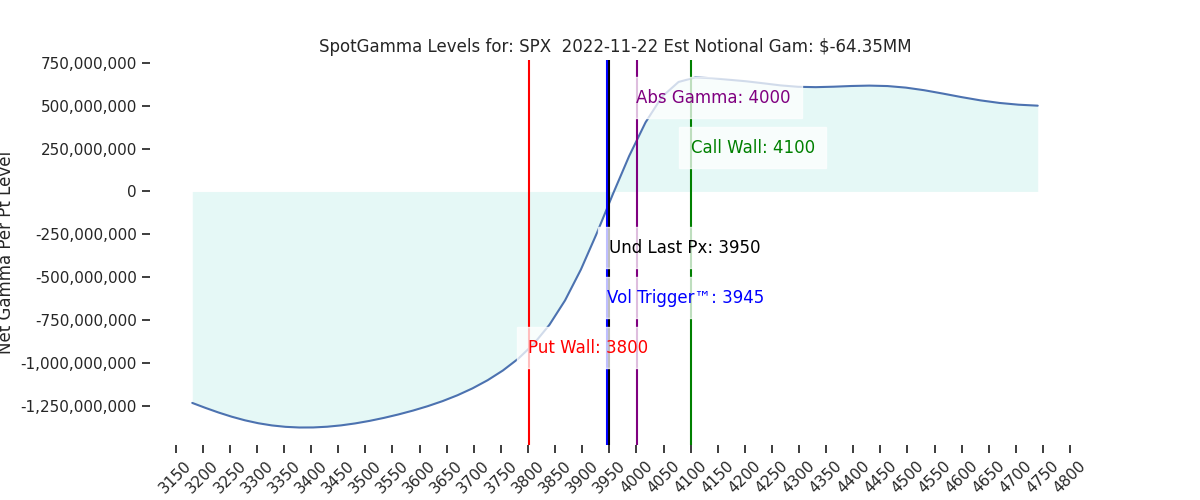

Futures are flat to 3960 after a quiet overnight session. There were two important shifts in SG data: both the Call Wall (4100) and Put Wall (3800) shifted higher, which is a bullish signal. Resistance shows at 4000, with support at 3960 (SPY395) to 3950. Below that level major support remains at 3900.

We see a positive tail wind in markets today, with pressure building to for a retest of 4000. The 3950-4000 range should continue to be well supported, with support underneath and resistance above.

As noted above, last nights shifts in SG levels were bullish. They obviously arrive in front of heavily anticipated data-day throughout tomorrow – capped by 2pm ET Fed Minutes. We anticipate this data being the trigger which ultimately gives markets a push out of the 3900-4000 range.

The state change in volatility from the massive movements post 11/8 Elections & 11/10 CPI to today is fairly remarkable. The volatility landscape is now recovering from those +2-5% moves, as shown by the VOLI index below (VOLI measures at-the-money SPY IV which we think is more of a direct reflection of how much movement traders are anticipating).

Unless tomorrows data is a downside shock, it’s likely that realized volatility continues lower, particularly with the US holiday. This likely keeps pressure on IV (i.e. VOLI index), which is a tail wind for equity markets.

Combining these volatility dynamics with higher key SG levels and the SPX > Vol Trigger (3945), we must assign a bullish edge to markets in the short term (into end of November).

We continue to be concerned about market weakness from the start of December, but no data is lined up in the immediate term (outside of tomorrow’s Fed mins) to suggest a large downside swing.

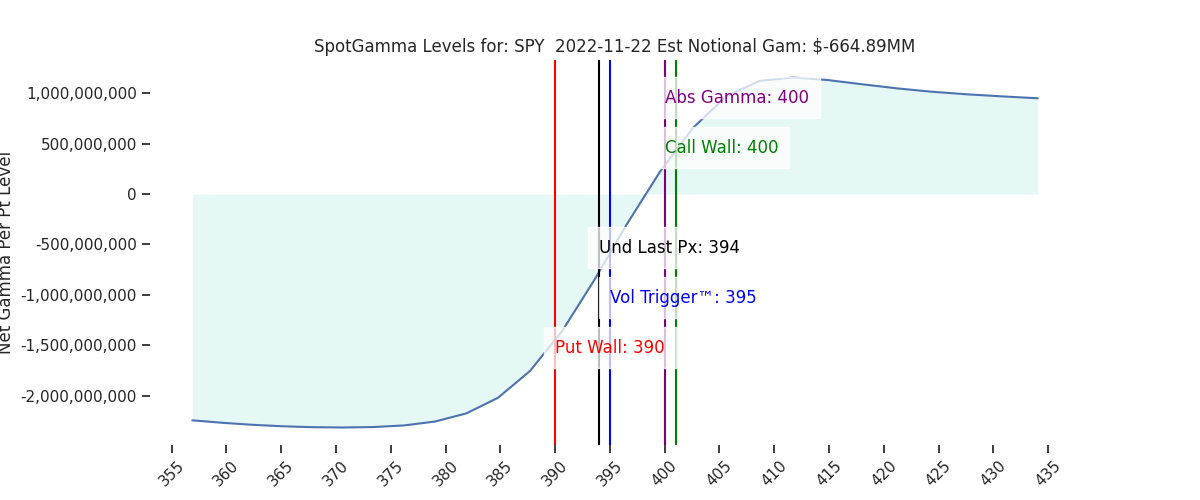

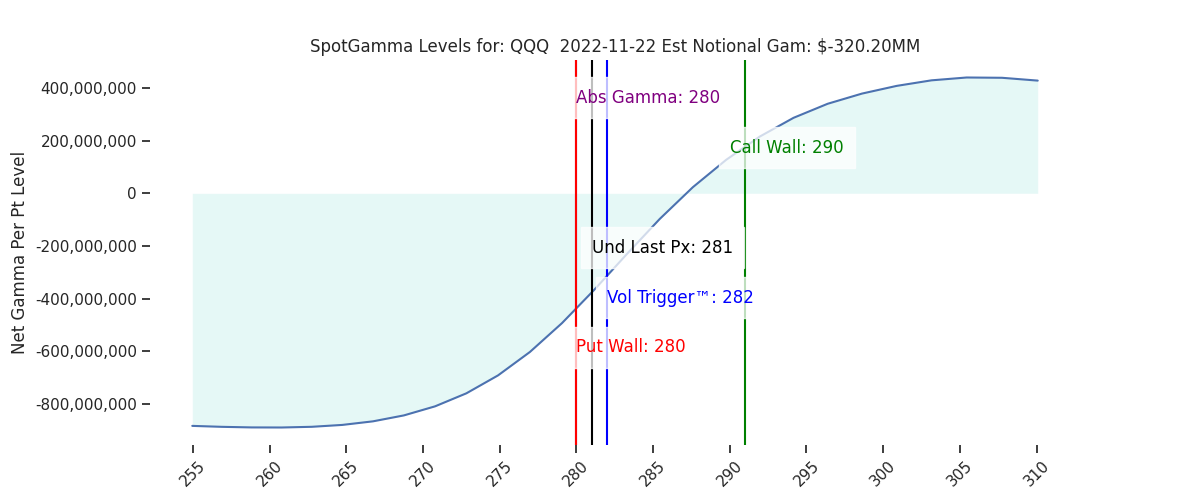

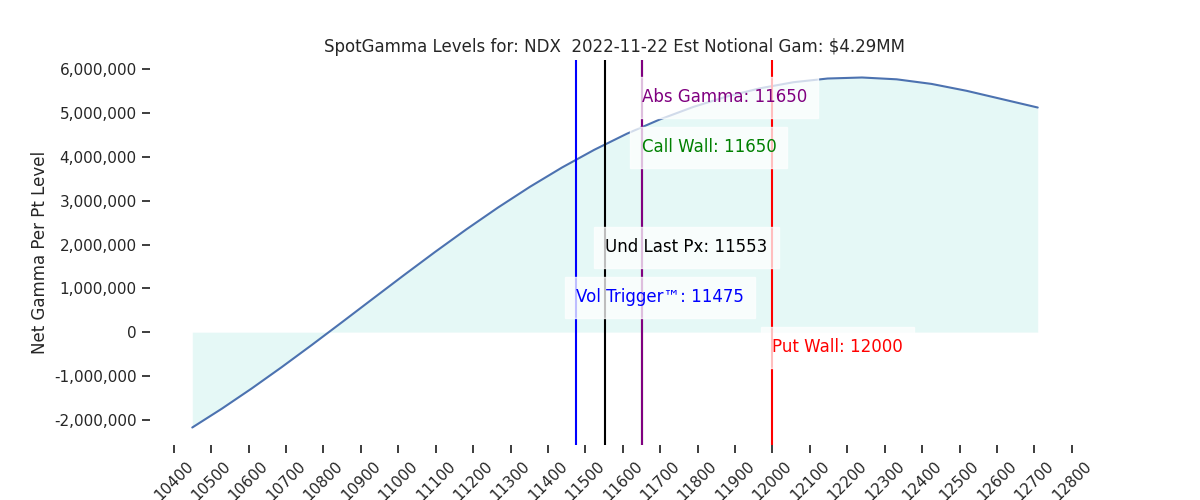

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 3950 | 3950 | 394 | 11553 | 281 |

| SG Implied 1-Day Move:: | 1.09%, | (±pts): 43.0 | VIX 1 Day Impl. Move:1.41% | ||

| SG Implied 5-Day Move: | 2.95% | 3967 (Monday Ref Price) | Range: 3850.0 | 4084.0 | ||

| SpotGamma Gamma Index™: | 0.14 | 0.35 | -0.13 | 0.03 | -0.05 |

| Volatility Trigger™: | 3945 | 3920 | 395 | 11475 | 282 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 400 | 11650 | 280 |

| Gamma Notional(MM): | -64.0 | -64.0 | -665.0 | 4.0 | -320.0 |

| Put Wall: | 3800 | 3600 | 390 | 12000 | 280 |

| Call Wall : | 4100 | 4000 | 400 | 11650 | 290 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 3965 | 3965 | 397.0 | 10777.0 | 293 |

| CP Gam Tilt: | 1.04 | 0.97 | 0.81 | 1.39 | 0.81 |

| Delta Neutral Px: | 3917 | ||||

| Net Delta(MM): | $1,721,083 | $1,707,017 | $173,669 | $46,959 | $95,029 |

| 25D Risk Reversal | -0.04 | -0.05 | -0.05 | -0.04 | -0.05 |

| Call Volume | 376,897 | 430,290 | 1,603,528 | 7,192 | 682,281 |

| Put Volume | 647,457 | 776,513 | 2,134,908 | 4,950 | 687,587 |

| Call Open Interest | 6,516,871 | 6,337,943 | 7,483,620 | 64,053 | 4,999,861 |

| Put Open Interest | 11,182,202 | 11,174,859 | 12,357,843 | 57,569 | 6,729,712 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4000, 3950, 3900, 3800] |

| SPY: [400, 395, 394, 390] |

| QQQ: [300, 290, 285, 280] |

| NDX:[12500, 12000, 11650, 11500] |

| SPX Combo (strike, %ile): [(4100.0, 92.6), (4077.0, 75.45), (4049.0, 90.55), (4025.0, 80.67), (4006.0, 80.55), (4002.0, 92.6), (3974.0, 77.56), (3970.0, 75.68), (3903.0, 80.89), (3899.0, 88.62), (3851.0, 79.91), (3836.0, 78.97), (3824.0, 74.44), (3800.0, 91.18)] |

| SPY Combo: [409.58, 399.72, 379.6, 404.45, 389.46] |

| NDX Combo: [11646.0, 11473.0, 11068.0, 11889.0] |