Macro Theme:

Major Resistance: $4,250

Pivot Level: $4,200

Interim Support: $4,200

Range High: $4,300 Call Wall

Range Low: $4,000 Put Wall

‣ We are bullish on the S&P with a close >$4,200

‣ S&P500 may close its performance gap to Nasdaq based on IV and call positions

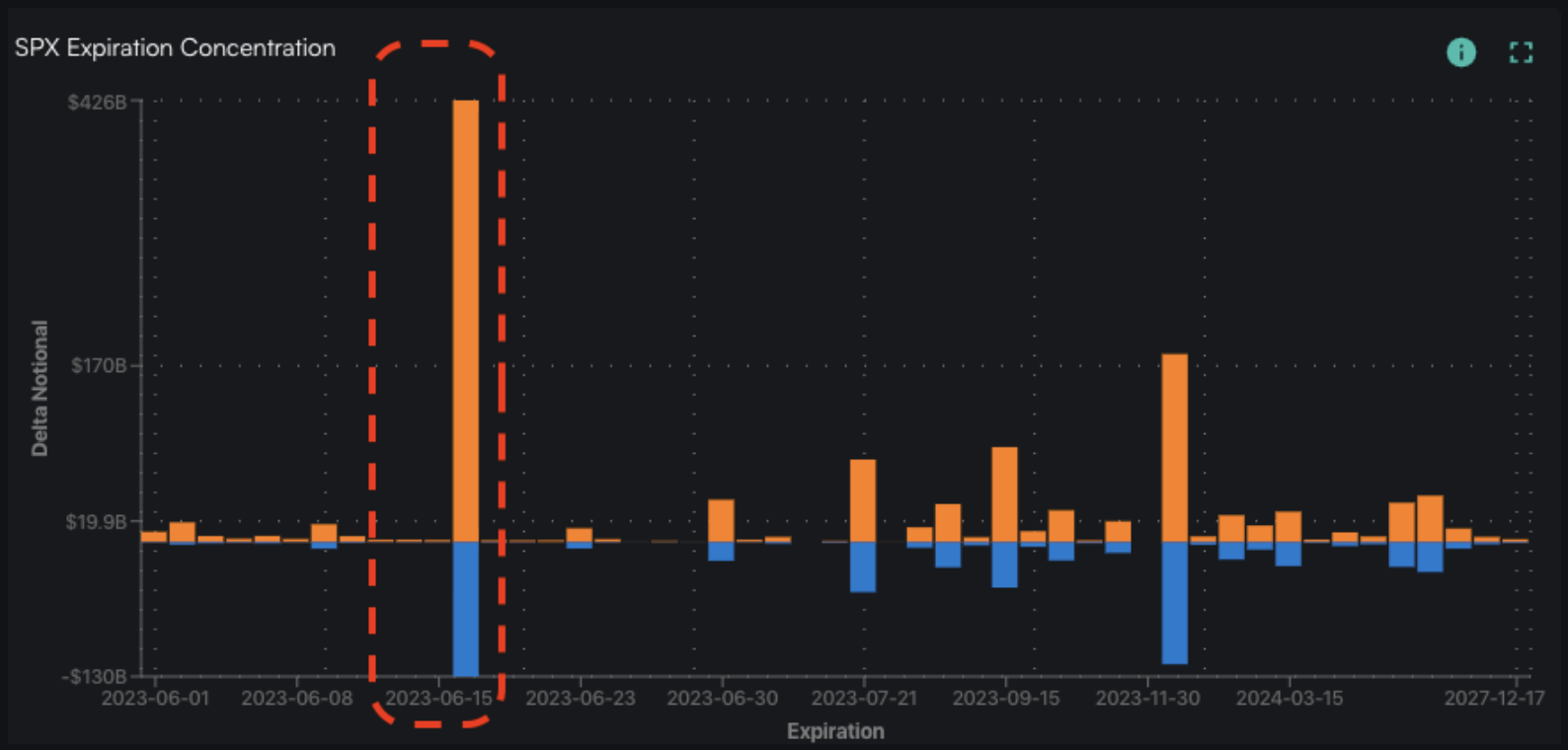

‣ June FOMC 6/14

‣ June OPEX 6/16

Founder’s Note:

Futures are 50bps higher to 4,250 as the Senate passed the debt ceiling. For today we see interim resistance at 4,250 – 4,255 (SPY 425), with long term resistance at the 4,300 Call Wall. Support is at 4,200. In QQQ resistance is at 355, with support at 350.

The SPY Call Wall has rolled higher to 430, after yesterdays 422 Call Wall held as resistance. We also note the strong AM bounce from yesterdays 4,170 Vol Trigger – a level which has now rolled higher to 4,190. These are bullish shifts as we believe they draw up & support higher prices. 430SPY/4300SPX is now the clear overhead target, and currently our long term range high.

4,200 is now major support, and a loss of that level removes the bullish condition.

The tricky part here is the 2 weeks of distance to June FOMC/OPEX, which is a fair amount of time to contain a market which has had a lot of upside momentum. Our current forecast is that upside volatility reduces into a grind as we approach the 4,300 Call Wall into 6/14 FOMC. We currently do not see much in the way of positioning >4,300 which may limit significant S&P gains from current levels. However, should those Call Walls roll higher it may unlock further upside potential. On this point we also note the JPM collar strike of 4,325 into 6/30 OPEX – this has shown to be a magnet level.

Positive gamma is now building rather substantially, and with that volatility should reduce. We think this is particularly true as we near 6/14 FOMC, wherein traders are likely to reduce activity in the days prior. Given this, we may see a final thrust next week into 4,300, and then churn into 6/14.

Consider August OPEX, which had a typical pattern we often see into positive-gamma expirations. This entailed a lot of momentum into the week of OPEX, and then price suddenly stuck.

While next week appears to be quiet, the second week of June is setting up to be an interesting turning point. Based on the current market sentiment, it appears we will hit FOMC with IV <= 1 year lows (VIX currently 15.4) and have a massive amount of options (particularly calls) expiring. These factors may contribute to a window of weakness and some price consolidation.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4220 |

$421 |

$14441 |

$352 |

$1767 |

$175 |

|

SpotGamma Implied 1-Day Move: |

0.85% |

0.85% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.34% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4190 |

$419 |

$13200 |

$349 |

$1770 |

$175 |

|

Absolute Gamma Strike: |

$4200 |

$420 |

$13850 |

$350 |

$1800 |

$175 |

|

SpotGamma Call Wall: |

$4300 |

$430 |

$13850 |

$360 |

$1790 |

$180 |

|

SpotGamma Put Wall: |

$4000 |

$400 |

$12000 |

$332 |

$1700 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4165 |

$421 |

$0 |

$348 |

$1845 |

$181 |

|

Gamma Tilt: |

1.447 |

0.995 |

2.859 |

1.061 |

0.746 |

0.618 |

|

SpotGamma Gamma Index™: |

2.016 |

-0.003 |

0.107 |

0.017 |

-0.023 |

-0.074 |

|

Gamma Notional (MM): |

$695.558M |

$25.623M |

$14.73M |

$92.54M |

‑$24.551M |

‑$801.399M |

|

25 Day Risk Reversal: |

-0.05 |

-0.056 |

-0.03 |

-0.03 |

-0.052 |

-0.048 |

|

Call Volume: |

600.677K |

2.249M |

11.214K |

792.382K |

12.056K |

294.132K |

|

Put Volume: |

985.289K |

3.043M |

9.576K |

1.10M |

28.409K |

661.151K |

|

Call Open Interest: |

6.445M |

6.261M |

73.50K |

4.812M |

208.946K |

3.548M |

|

Put Open Interest: |

12.492M |

12.365M |

65.217K |

10.021M |

365.468K |

7.69M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4250, 4200, 4150, 4000] |

|

SPY Levels: [425, 420, 415, 410] |

|

NDX Levels: [15125, 15100, 15000, 13850] |

|

QQQ Levels: [350, 345, 340, 330] |

|

SPX Combos: [(4398,98.27), (4373,81.17), (4352,97.89), (4326,94.42), (4318,96.03), (4309,77.93), (4301,99.87), (4288,82.39), (4284,81.86), (4280,91.97), (4276,97.85), (4271,93.46), (4263,91.00), (4259,94.74), (4255,93.87), (4250,99.62), (4246,89.60), (4238,93.64), (4233,88.13), (4229,91.40), (4225,97.56), (4221,93.66), (4208,88.10), (4200,96.94), (4149,77.86), (4124,75.08), (4098,84.40), (4048,86.82)] |

|

SPY Combos: [434.03, 428.97, 426.44, 423.91] |

|

NDX Combos: [13849, 15120, 15106, 14774] |

|

QQQ Combos: [341.9, 353.86, 364.06, 335.57] |