Macro Theme:

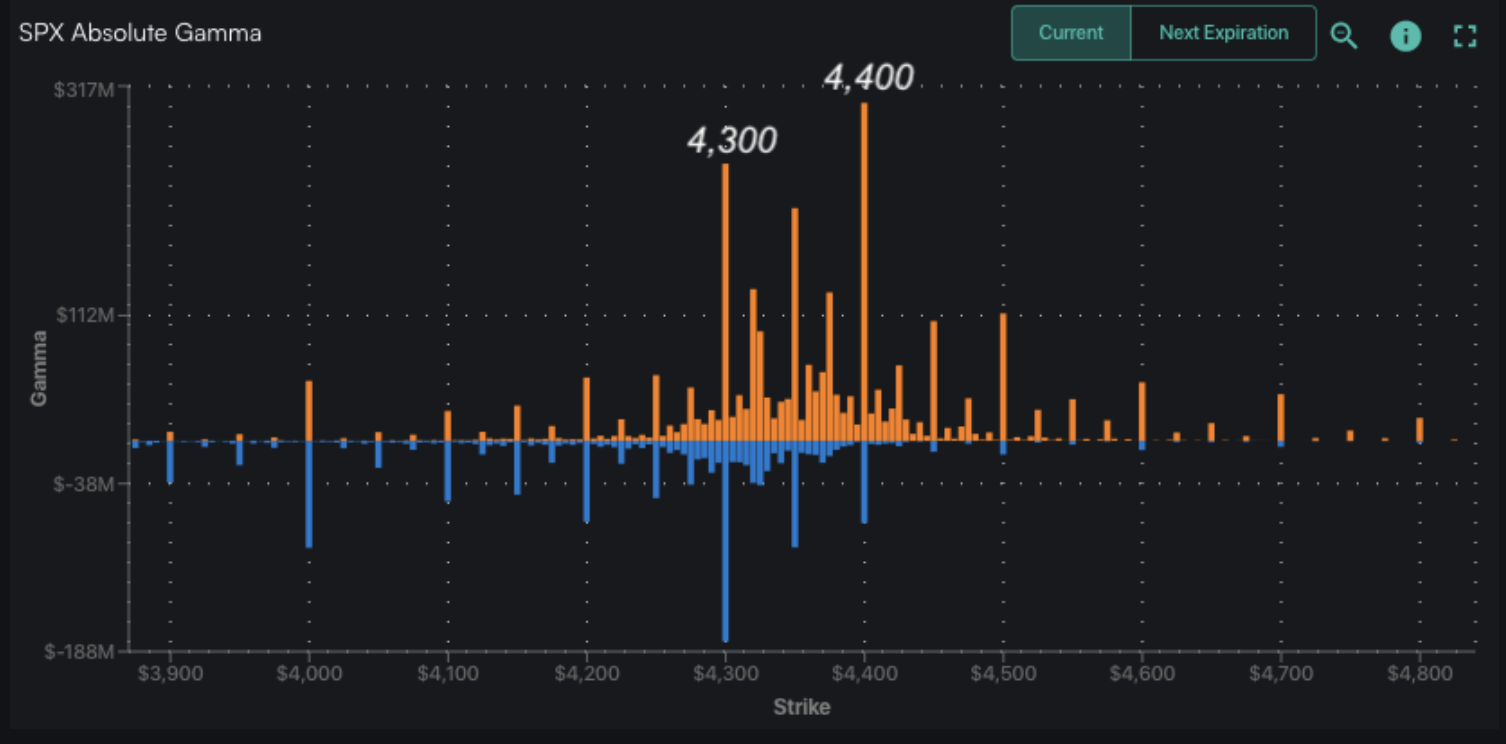

Major Resistance: $4,400 Call Wall

Pivot Level: $4,300

Interim Support: $4,300

Range High: $4,400 Call Wall

Range Low: $4,000 Put Wall

‣ We are neutral on the S&P, and looking for a window of weakness post 6/14 FOMC & 6/16 OPEX

Founder’s Note:

Futures have bumped higher, to 4,424 ahead of today’s 2pm ET FOMC. Key SG levels are unchanged, with first resistance at 4,373 then major resistance at 4,400. Support below shows at 4,350 then 4,300.

In QQQ the major levels remain: 360 Call Wall resistance, 355 first support, major support at 350.

We saw the addition of 30k calls to the 4,400 Call Wall yesterday, helping to fortify it as a resistance level above. There was no single expiration that accrued this 4400 call interest – they were small lots across many expirations. We are not seeing the equivalent flow in SPY, for which the Call Wall remains at 435.

The options structure remains rather unchanged throughout the 1.5% SPX rally over the past week:

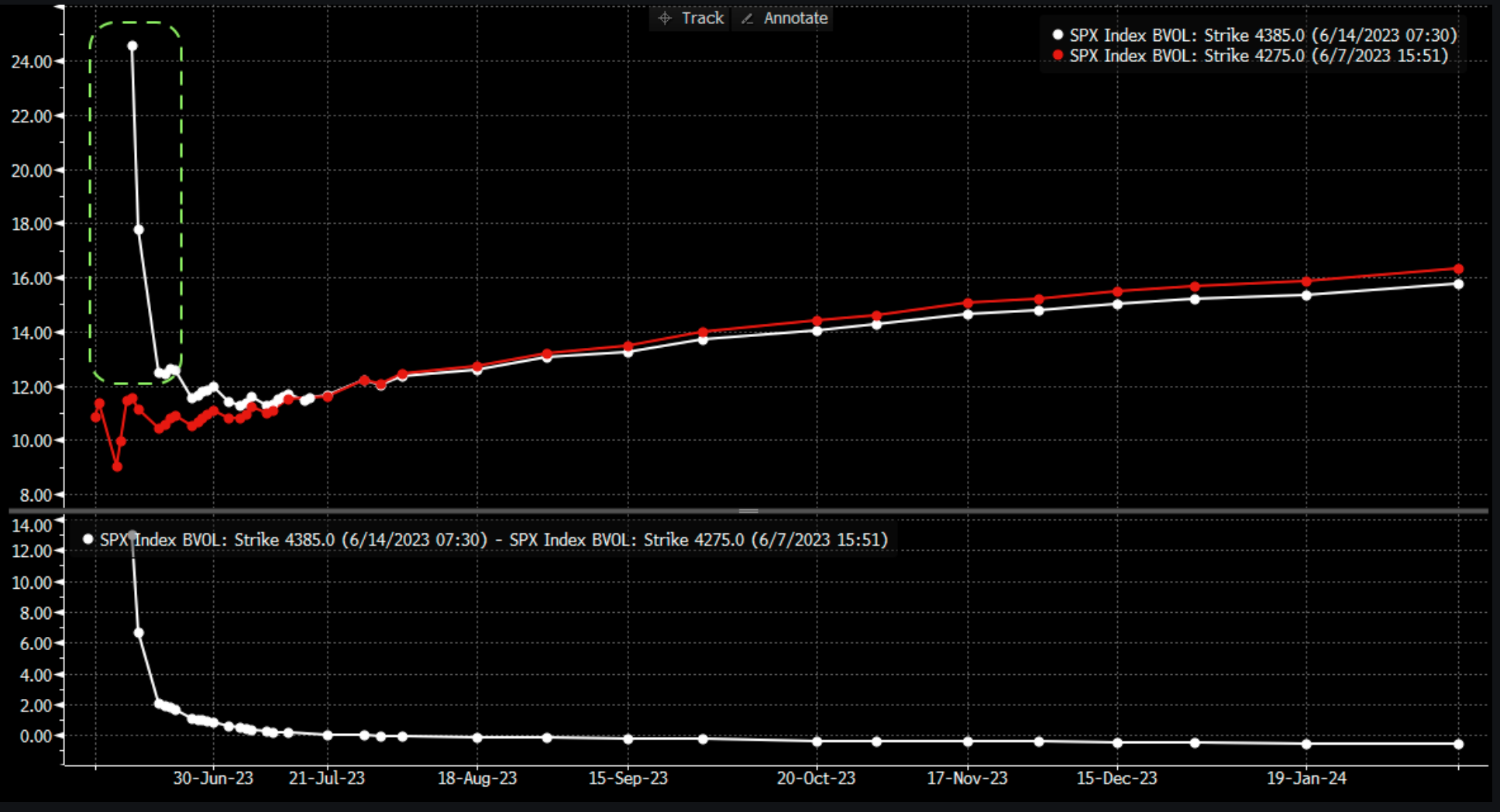

· Implied volatility remains “priced for perfection” with 11.5% 1 month ATM IV vs 11.1% 1 month realized. Through this lens there is no FOMC/Fed event premium

Expirations <1 week have mildly elevated FOMC event vol vs longer dated: 0DTE SPX straddle = $35 (ref 4,375, IV 30%). It won’t take much of a move to push 0DTE offsides · SPX Call Wall has been at 4,400 since 6/9, and is unchanged despite the rally · Yesterday fixed strike vol >4,400 started to shows signs of contraction (i.e. call sellers)

·QQQ Call Wall didn’t move despite the 360 breach yesterday

Arguably one of the best use cases for 0DTE is event hedging as you can slap on some low cost protection without having to mess with a longer dated position which needs management in the future. It seems as if the current equity environment is focused on finding the best bullish expression vs looking for any downside pocket. 0DTE hedges out a Powell “slip of the tongue”.

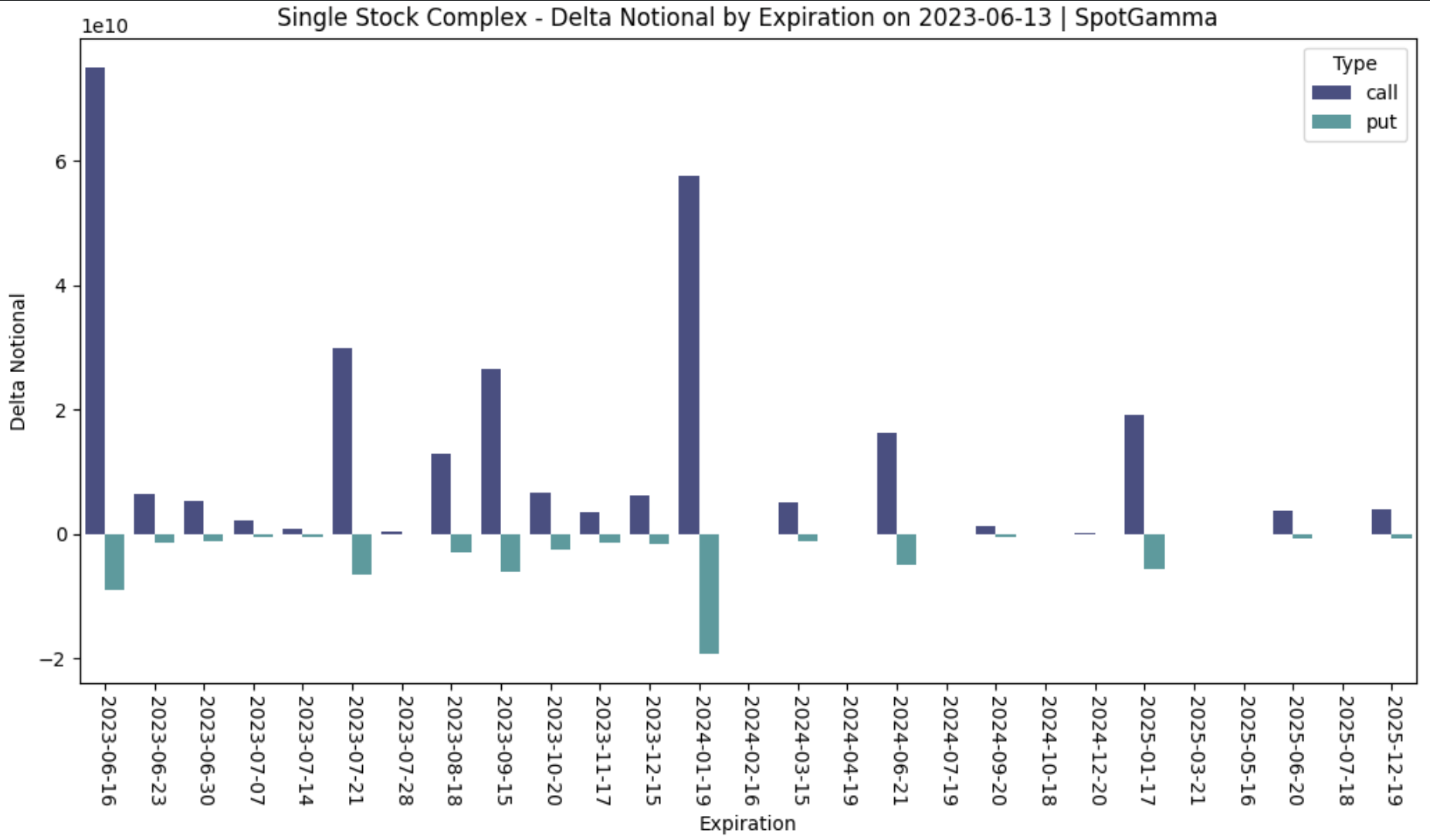

These increasing equity prices have driven call values even higher, with ~$70bn in single stock unsigned net call deltas set to expire on Friday (purple bars). Then you have to tack on another ~$700bn in Index/ETF call deltas (SPX, SPY, IWM, QQQ). To place this in context, on the single stock side its about 1/2 of the call size which appeared in Jan of ’22 (in our view causing in a major ~5% drawdown), however Jan ’22 had a small Index expiration. On the Index size this net call delta size is slightly larger than that of Jun ’21 (~$600bn), which occured in the midst of a major equity rally (shown below).

Please note these are absolute values and there is a degree of positions obviously offsetting – we are not suggesting there are hundreds of billions in long hedges which have to get sold. That being said, these large values do infer a large net market long which may result in downside pressure as long dealer hedges are removed.

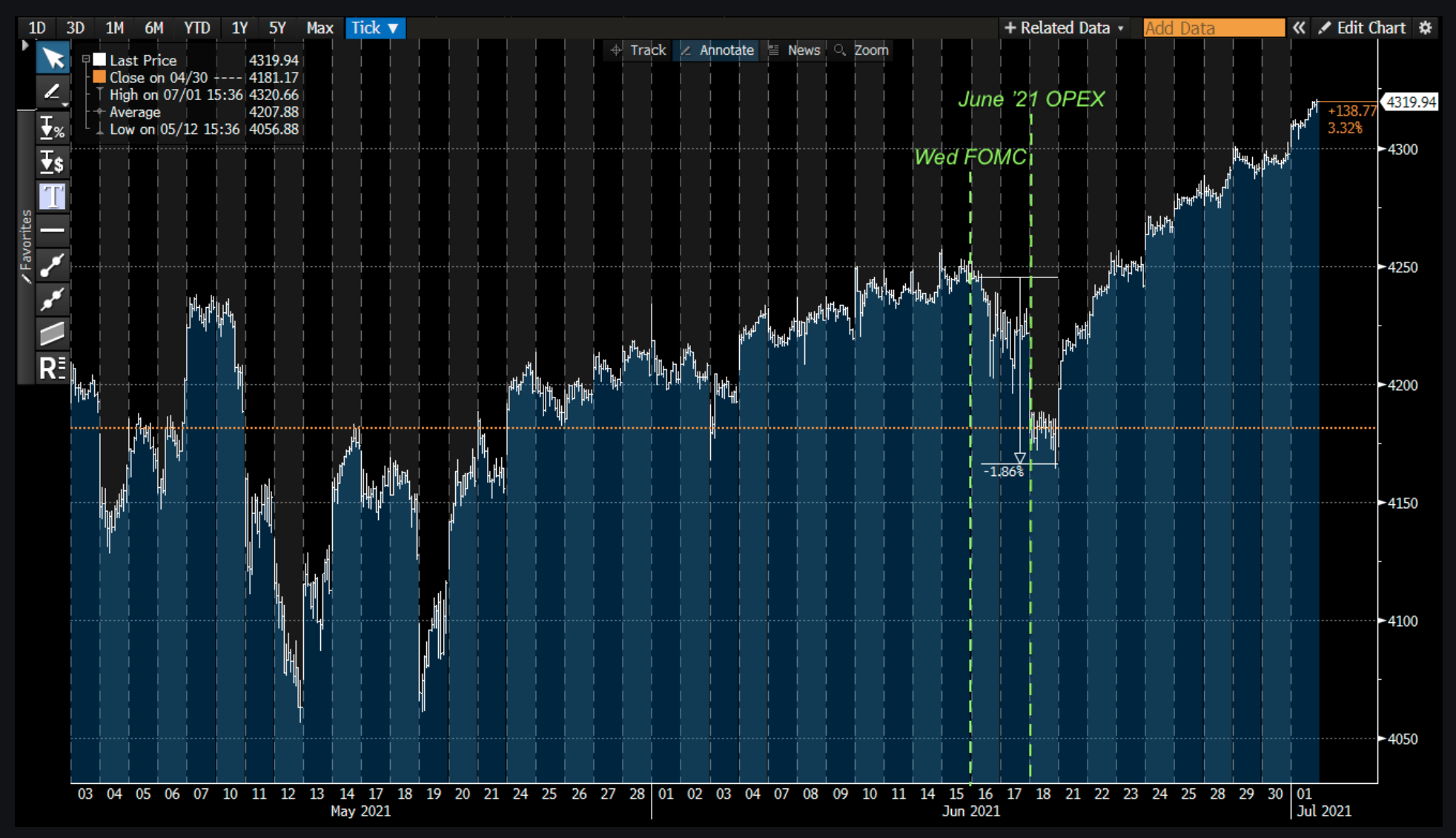

To this point, if you look back at June ’21 OPEX, its an interesting analogy as there was an FOMC 2 days prior to that call-heavy OPEX. As you can see, that Wednesday marked a ~1.8% drawdown into the following week. Ultimately, this was just a speedbump in the context of a much larger rally.

This well frames our view of the current setup, wherein OPEX triggers some consolidation/digestion of recent fast gains, and that forms a base for another leg higher. Further, we address all of this today as OPEX positions may start shifting due to FOMC.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4369 |

$429 |

$14528 |

$354 |

$1865 |

$185 |

|

SpotGamma Implied 1-Day Move: |

0.83% |

0.82% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.18% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4240 |

$429 |

$12425 |

$354 |

$1770 |

$181 |

|

Absolute Gamma Strike: |

$4300 |

$430 |

$13850 |

$350 |

$1800 |

$185 |

|

SpotGamma Call Wall: |

$4400 |

$435 |

$13850 |

$360 |

$1790 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$415 |

$12000 |

$332 |

$1750 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4215 |

$426 |

$0 |

$354 |

$1847 |

$183 |

|

Gamma Tilt: |

1.809 |

1.165 |

2.302 |

1.022 |

1.055 |

1.105 |

|

SpotGamma Gamma Index™: |

2.989 |

0.154 |

0.098 |

0.007 |

0.004 |

0.015 |

|

Gamma Notional (MM): |

$1.008B |

$571.093M |

$12.889M |

$19.117M |

$4.375M |

$105.503M |

|

25 Day Risk Reversal: |

-0.034 |

-0.051 |

-0.024 |

-0.038 |

-0.028 |

-0.028 |

|

Call Volume: |

674.201K |

2.035M |

13.188K |

718.447K |

17.435K |

350.291K |

|

Put Volume: |

1.054M |

2.778M |

9.547K |

1.116M |

28.186K |

431.179K |

|

Call Open Interest: |

6.995M |

7.312M |

73.315K |

5.053M |

228.697K |

4.017M |

|

Put Open Interest: |

13.65M |

14.336M |

74.665K |

10.424M |

393.476K |

8.15M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4400, 4350, 4320, 4300] |

|

SPY Levels: [435, 430, 428, 425] |

|

NDX Levels: [15125, 15100, 15000, 13850] |

|

QQQ Levels: [360, 355, 350, 340] |

|

SPX Combos: [(4574,87.44), (4548,90.99), (4526,87.24), (4500,99.11), (4474,95.88), (4452,99.12), (4439,77.21), (4430,88.98), (4426,96.72), (4421,97.77), (4417,75.36), (4413,77.57), (4408,93.57), (4404,83.93), (4400,99.96), (4391,95.43), (4386,82.28), (4382,92.28), (4373,99.37), (4369,95.66), (4365,90.03), (4360,94.69), (4352,99.25), (4347,88.69), (4325,96.19), (4321,98.76), (4308,82.81), (4299,97.17), (4199,79.00)] |

|

SPY Combos: [430.33, 440.65, 432.48, 432.91] |

|

NDX Combos: [14761, 14543, 13846, 15124] |

|

QQQ Combos: [355.94, 360.9, 369.75, 338.59] |