Macro Theme:

Major Resistance: 4,400 – 4,410 (SPY 440 Call Wall)

Pivot Level: 4,300

Interim Support: 4,320

Range High: 4,410

Range Low: 4,000 Put Wall

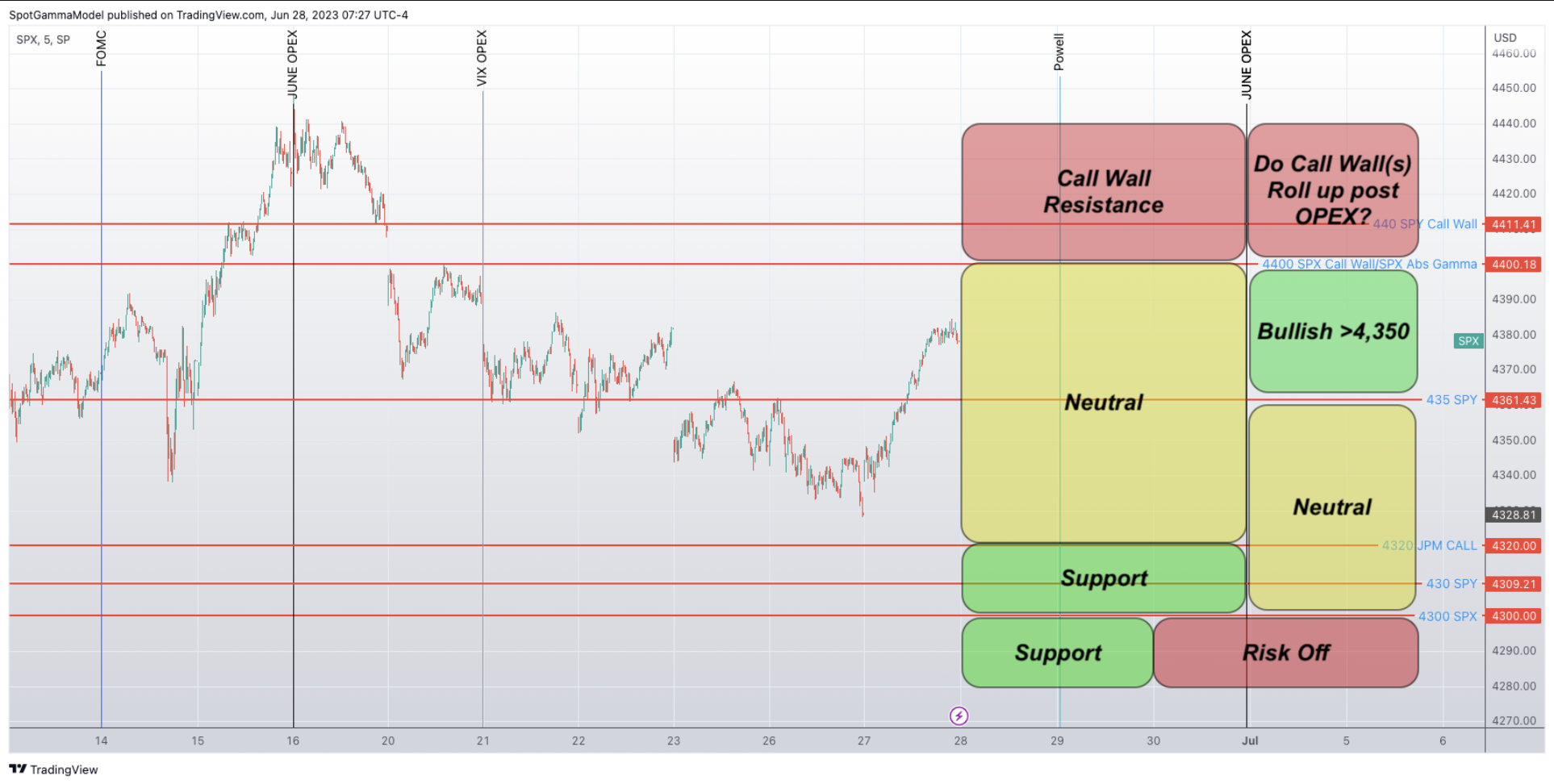

‣ We are neutral on the SPX, and looking for a window of weakness post 6/14 FOMC & 6/16 OPEX with a target of 4,320.

‣ A downside break of 4,300 after Friday, 6/30 is our “risk off” signal

Founders Note:

Futures are flat to last nights close, at 4412. Major SG levels continue to be unchanged, with major resistance at the 4400 – 4410 SPX/SPY Call Walls. Support below is at 4,365(SPY 435), then 4,350. Under that level we still see a cluster of support at 4,320/4,310(SPY4300)/4,300.

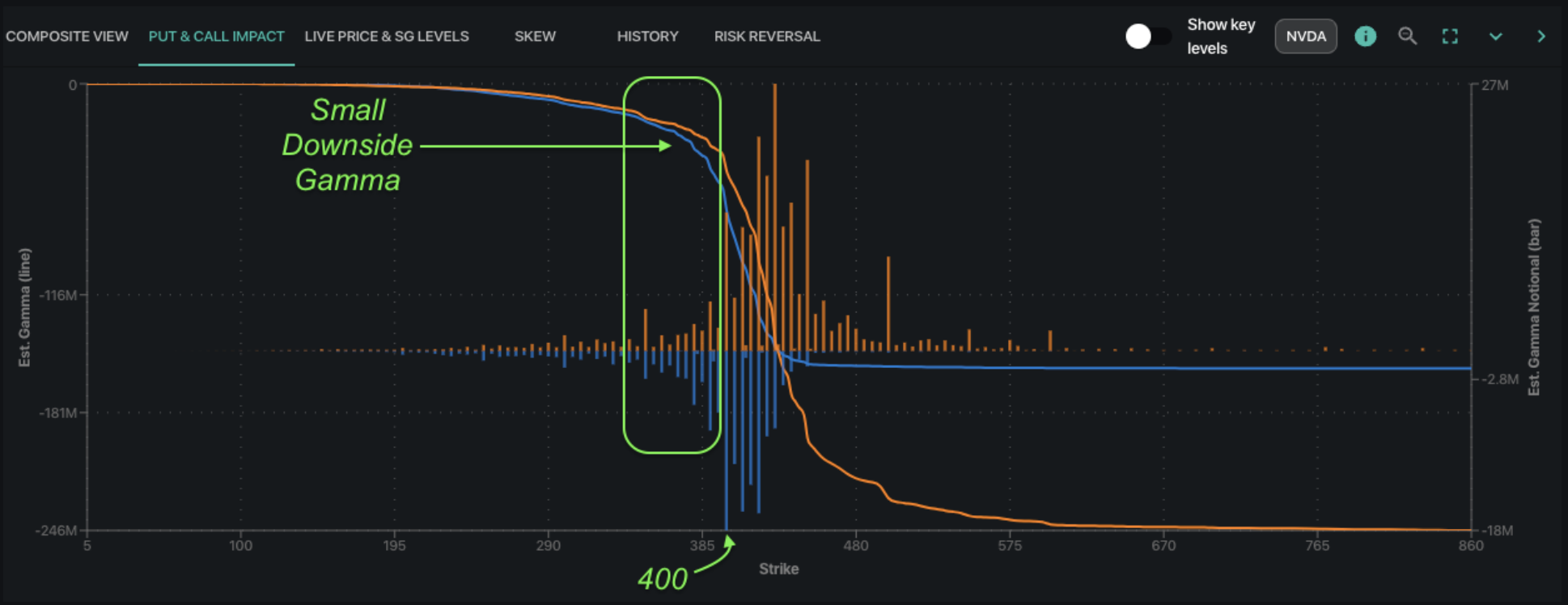

Equities launched higher yesterday after various pieces of positive economic data, however the mood was soured today with news that the US may limit chip sales to China. As a result the AI leaders down ~3% pre-market. This brings several names like NVDA, AMD to their final options support levels – the last of the large OI/gamma downside strikes.

You can see this below for NVDA, wherein there is huge interest at 400, but very little going on under there. Further you can see the gamma curves flatten out quickly <400, implying that there is not much downside hedging to do for the market maker/dealer community. Therefore we don’t currently see options pressure <400. Another way to look at this is that no one seems short these names – at least via puts.

If you break below these big gamma strikes it likely initiates put buyers (which should appear in HIRO), and rather quickly changes this dynamic.

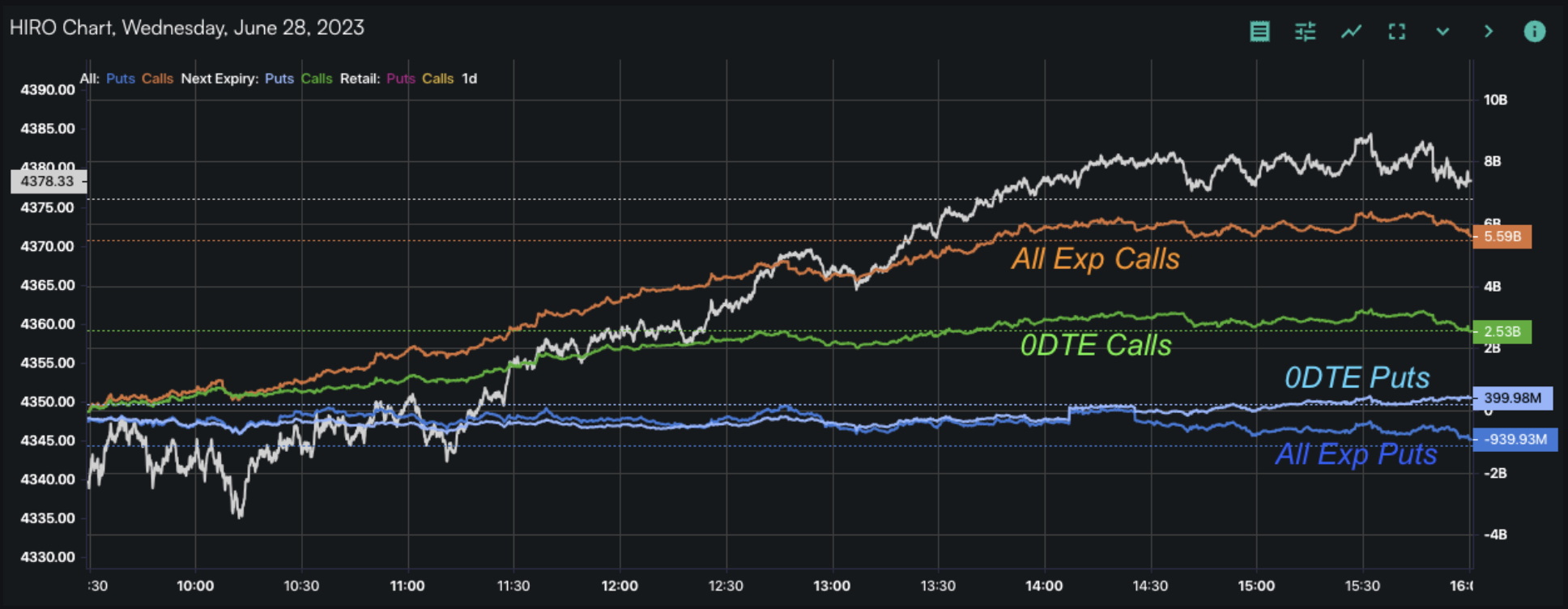

Back to the S&P – yesterday was a massive day of S&P500 complex call buying. It was one of the largest in the last 30 days, with 1/2 of that flow was from 0DTE. As you can see in the chart below, it was after 2pm that the call flow subsided (i.e. the orange & green lines flatten out), and with that, the market momentum waned. Recall that pre-open IV’s were pricing in ~70bps (11% IV) of S&P movement into the open, and so its likely that some of this flow was a short cover scramble after that positive economic data started to push volatility.

The key takeaway here is that this huge volume didn’t change SpotGamma levels indicating the flow was rather transient – it was not material in structural/long term call buyers. The SPX flow in particular was almost +80% 0DTE, with some SPY flow that appeared to be the rolling of positions from 430-435, up to 435-440.

This lack of a material change in OI combined with the AI news, may zap yesterdays momentum and suggests that we continue to tango with the 4,320-4,350 area into tomorrow.

Specifically, the failure of the Call Wall(s) to roll higher is a signal that the 4,400 area resistance should remain intact through Friday, and we believe that the 4,320 JPM call strike will continue to be an attractant in though tomorrow. Starting Friday, our major “risk off” level is a breach of 4,300 as we see negative gamma and a sharp increase in volatility coinciding with a downside break of that strike.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4378 |

$436 |

$14945 |

$363 |

$1849 |

$183 |

|

SpotGamma Implied 1-Day Move: |

0.81% |

0.81% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.22% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4250 |

$435 |

$14800 |

$363 |

$1850 |

$185 |

|

Absolute Gamma Strike: |

$4000 |

$435 |

$15200 |

$360 |

$1880 |

$200 |

|

SpotGamma Call Wall: |

$5000 |

$440 |

$15200 |

$370 |

$1880 |

$210 |

|

SpotGamma Put Wall: |

$3900 |

$430 |

$14475 |

$350 |

$1780 |

$180 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4224 |

$438 |

$13931 |

$366 |

$1873 |

$202 |

|

Gamma Tilt: |

1.199 |

0.825 |

2.317 |

0.894 |

0.828 |

0.680 |

|

SpotGamma Gamma Index™: |

0.199 |

-0.187 |

0.079 |

-0.041 |

-0.012 |

-0.001 |

|

Gamma Notional (MM): |

$104.047M |

‑$865.809M |

$10.234M |

‑$214.818M |

‑$11.53M |

‑$11.333M |

|

25 Day Risk Reversal: |

-0.038 |

-0.024 |

-0.032 |

-0.029 |

-0.025 |

-0.023 |

|

Call Volume: |

468.842K |

1.845M |

8.166K |

763.923K |

14.529K |

376.684K |

|

Put Volume: |

869.797K |

2.808M |

7.346K |

975.941K |

39.523K |

426.231K |

|

Call Open Interest: |

2.702M |

6.272M |

55.185K |

4.292M |

188.878K |

206.594K |

|

Put Open Interest: |

4.41M |

14.134M |

60.68K |

9.176M |

344.754K |

395.024K |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5000, 4400, 4300, 4000] |

|

SPY Levels: [440, 436, 435, 430] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [365, 363, 360, 350] |

|

SPX Combos: [(4501,81.37), (4435,76.28), (4418,86.21), (4400,81.24), (4317,90.84), (4216,77.15)] |

|

SPY Combos: [443.13, 434.84, 453.6, 440.95] |

|

NDX Combos: [15200, 15155, 14378, 14587] |

|

QQQ Combos: [376.71, 361.06, 362.15, 355.96] |