Macro Theme:

Major Resistance: 4,400 – 4,415 (SPY 440 Call Wall)

Pivot Level: 4,400

Interim Support: 4,320

Range High: 4,500

Range Low: 4,000 Put Wall

‣ An upside break of 4,400 is our “risk on” signal

‣ A downside break of 4,300 after Friday, 6/30 is our “risk off” signal

Founders Note:

Future’s are higher to 4,430 after clearing Powell’s overnight remarks. The SPX Call Wall has jumped higher to 4,500, but remains at 440 for SPY. This technically shifts the high end of our trading range up to 4,500, but we monitor 4,415 (SPY 440) for major resistance. Further, we now see 4,400 as the largest gamma level on the board which should provide local stability to S&P prices (pivot/pinning area). Said another way, this is likely not an area that is “run through”. Support below lies at 4,365 (SPY 435) – 4,350.

In QQQ the Call Wall remains at 370, with first resistance at 365. Support shows at 360.

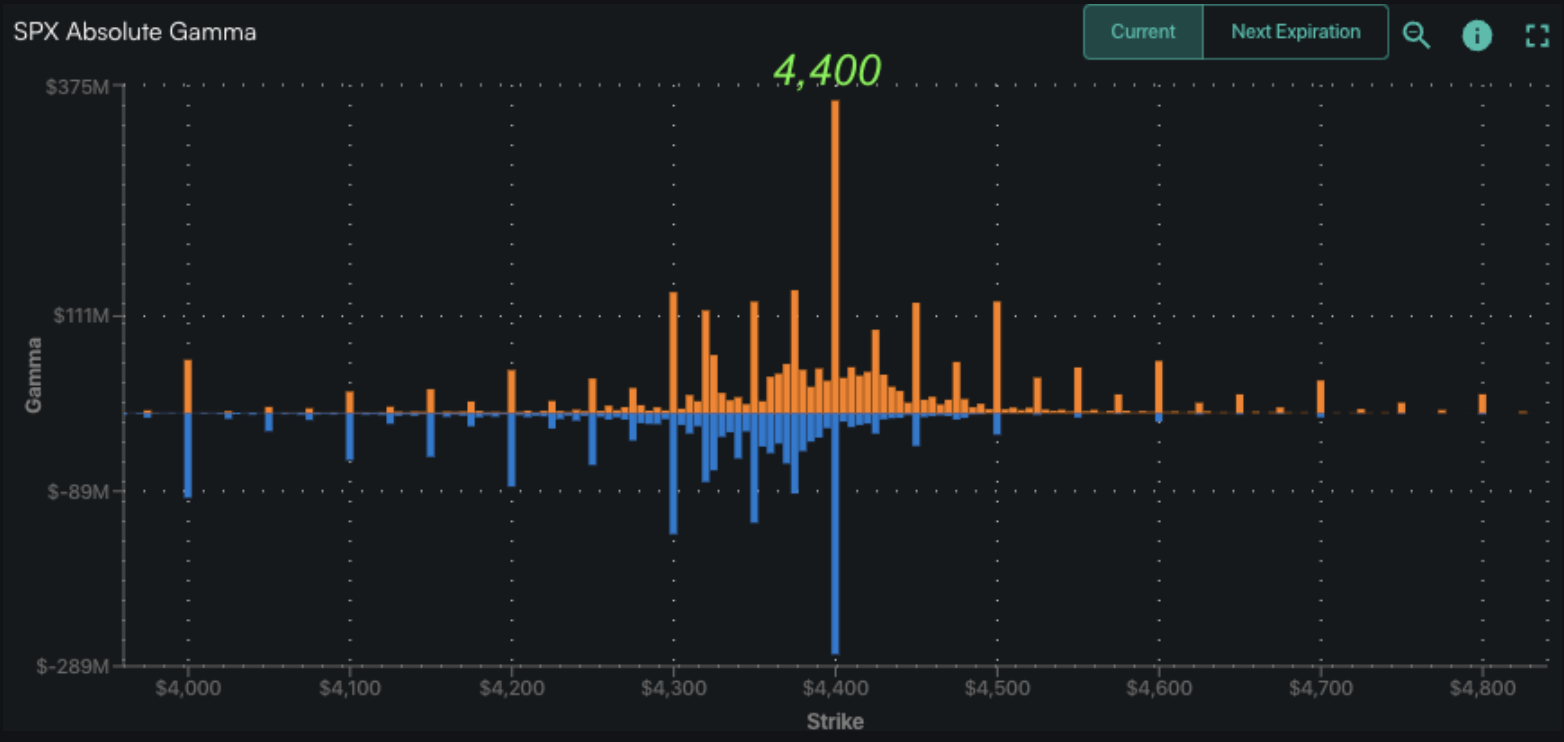

Shown below is gamma by strike, with calls in orange and puts in blue. As you can see, 4,400 is “a beast” and a level we think should act as resistance for today. If/when the S&P closes above this level it should offer strong support.

A heavy complacency remains in markets, as the recent equity consolidation has not invigorated any downside hedging demand.

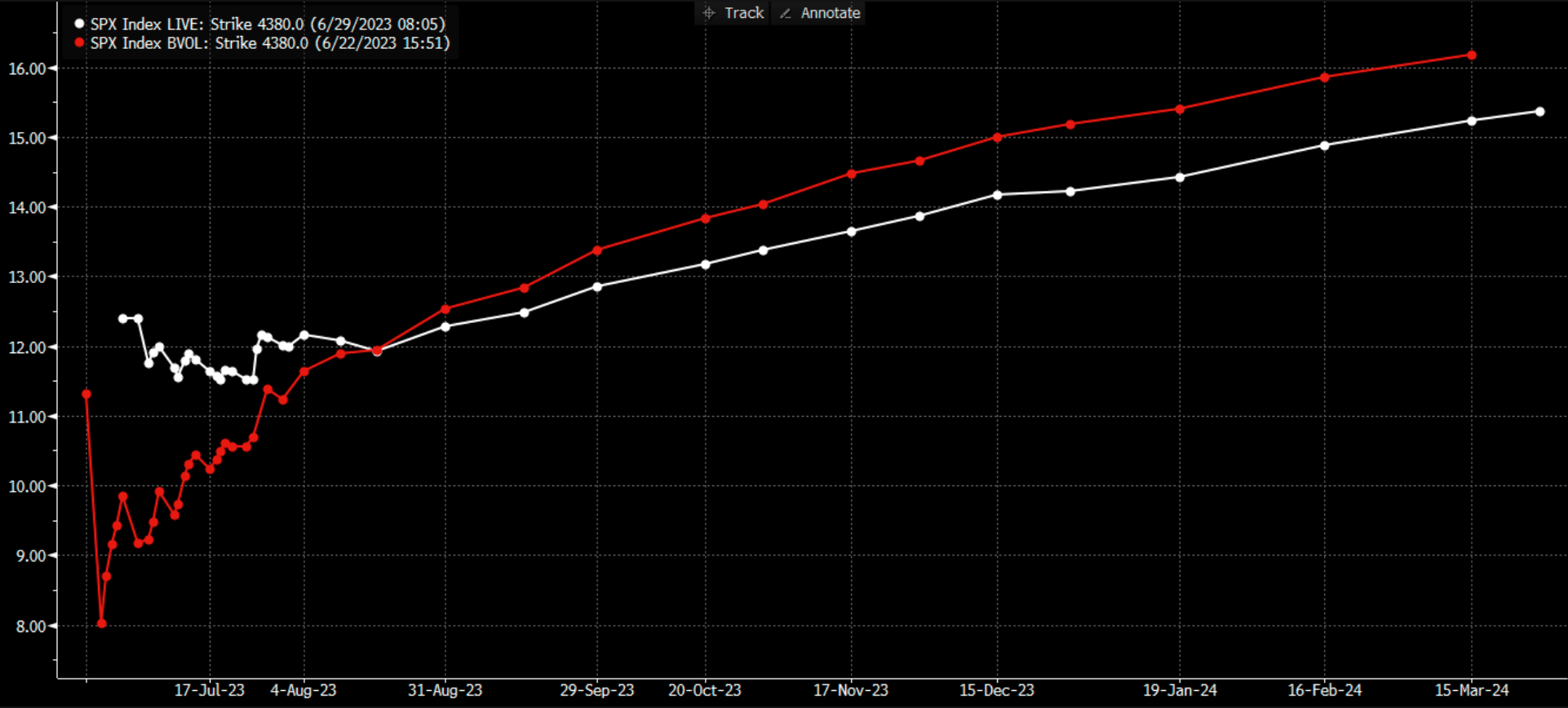

Shown here is the SPX term structure, and as you can see short dated IV’s (white) remain in the 11-12% IV area, which is right were 1 month realized volatility rests (11%).

From our perspective, the conditions for options hedging flows to drive downside volatility are not in place unless the S&P500 breaks 4,300 which is our major support level into tomorrow. While that level is currently ~1.5% away, we remain on watch for volatility due to tomorrows quarter end flows (JPM collar, equity rebalances).

Aside from these quarter end flows, one of our core themes has been that into June OPEX, extreme call IV’s were in need of retracement. Their IV’s were so extended it arguably made being long calls untenable. Call IV’s have cooled significantly, enough to possibly justify traders getting back into top names.

To illustrate this, we filtered our universe of all names down to equities with material open interest & call volume, which resulted in 818 stocks. We then compared the number of stocks that had a positive “risk reversal”[RR] (1 month 25 delta call – 1 month 25 delta put) on 6/15 vs 6/28.

On 6/15 the number of stocks having a positive RR was 283 vs just 26 today. We placed a list of these +RR names here, which includes many of the typical AI/megacap names such as: AMD, GOOGL, NVDA – but some other less “mainstream” names like TSM.

While before the call IV’s where extreme, but in this case we are looking for names with a “warm” bid to calls as there has been retracement, the apparent call bid may help accelerate upside.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4376 |

$436 |

$14964 |

$364 |

$1858 |

$184 |

|

SpotGamma Implied 1-Day Move: |

0.79% |

0.79% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.22% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4360 |

$437 |

$14800 |

$366 |

$1850 |

$183 |

|

Absolute Gamma Strike: |

$4400 |

$435 |

$15200 |

$365 |

$1880 |

$185 |

|

SpotGamma Call Wall: |

$4500 |

$440 |

$15200 |

$370 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4000 |

$430 |

$14475 |

$350 |

$1800 |

$180 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4351 |

$439 |

$13949 |

$366 |

$1868 |

$185 |

|

Gamma Tilt: |

1.281 |

0.806 |

2.318 |

0.847 |

0.873 |

0.800 |

|

SpotGamma Gamma Index™: |

1.427 |

-0.208 |

0.081 |

-0.06 |

-0.009 |

-0.033 |

|

Gamma Notional (MM): |

$363.813M |

‑$1.084B |

$9.597M |

‑$317.643M |

‑$8.898M |

‑$336.852M |

|

25 Day Risk Reversal: |

-0.025 |

-0.016 |

-0.009 |

-0.01 |

-0.015 |

-0.012 |

|

Call Volume: |

449.933K |

2.088M |

9.365K |

633.403K |

11.519K |

276.837K |

|

Put Volume: |

718.425K |

2.028M |

8.677K |

938.929K |

16.708K |

334.886K |

|

Call Open Interest: |

5.773M |

6.451M |

55.513K |

4.337M |

192.883K |

3.561M |

|

Put Open Interest: |

11.90M |

13.962M |

61.145K |

9.185M |

350.161K |

7.324M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4400, 4375, 4350, 4300] |

|

SPY Levels: [440, 437, 435, 430] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [370, 365, 360, 350] |

|

SPX Combos: [(4574,82.36), (4552,94.41), (4526,92.38), (4500,99.08), (4474,95.07), (4460,75.37), (4452,98.57), (4439,81.75), (4434,85.76), (4430,91.91), (4425,97.62), (4421,91.47), (4417,88.83), (4412,92.10), (4404,89.66), (4399,98.32), (4395,83.38), (4390,88.46), (4377,94.62), (4355,86.71), (4342,91.02), (4320,92.39), (4250,82.64), (4202,91.56)] |

|

SPY Combos: [448.61, 443.81, 438.57, 441.19] |

|

NDX Combos: [15204, 15189, 15144, 14366] |

|

QQQ Combos: [370.4, 369.31, 350.37, 355.47] |