Macro Theme:

Short Term Resistance: 4,450 – 4,465 (SPY 445 Call Wall)

Short Term Support: 4,415 (SPY 440) – 4,400

Risk Pivot Level: 4,400

Major Range High/Resistance: 4,500 Call Wall

Major Range Low/Support: 4,200 Put Wall

‣ We maintain a bullish stance while the SPX is >4,400 and below the 4,500 Call Wall (updated: 7/3/23)

‣ We anticipate declining market volatility into 7/21 July OPEX (updated: 7/3/23)

‣ A downside break of 4,400 is our “risk off” signal (updated: 7/3/23)

Founder’s Note:

Futures are off 20 handles to 4,470. Resistance above lies at 4,450 & 4,465 (SPY 445 Call Wall). Support below shows at 4,415 (SPY 440) & 4,400. We continue to anticipate low volatility sessions (1 day SPX range <=88bps), however some movement may be sparked by today’s 2pm FOMC minutes.

In QQQ first resistance is at 370, then 372. Support is at 365.

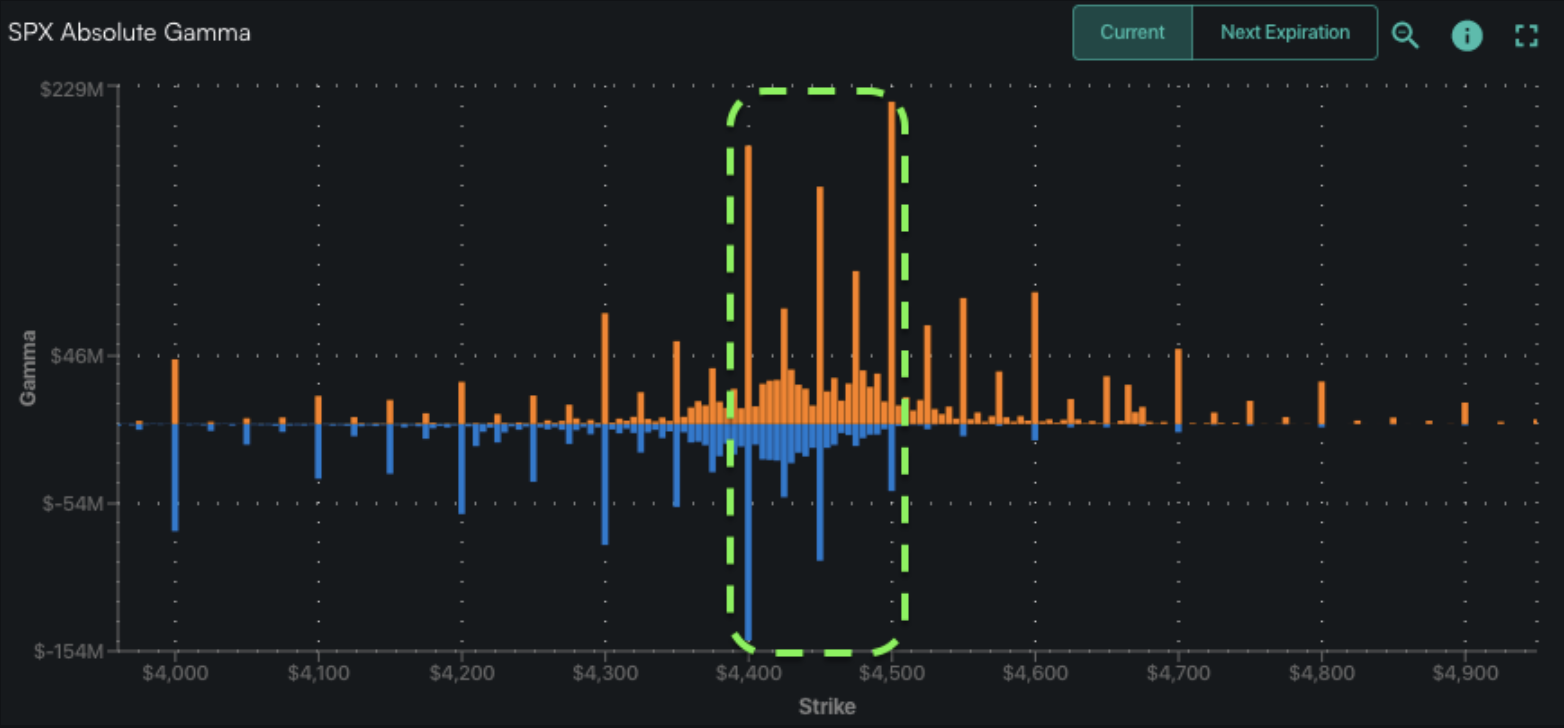

Positions have been filling in across the 4,400 – 4,500 range which should make this a sticky area for the remainder of the week. Coming out of the holiday weekend we see that volatility is mildly elevated (ex: VIX 14.5, +1pt vs Monday), and we would anticipate this being met will volatility sellers, which would add to equity support. In this environment we look for trade to mean revert off of large gamma strikes, which leads to tighter relative trading ranges (see Monday’s note).

While the setup in SPX seems clear, the dynamic in QQQ is a bit more interesting. As we discussed on Monday, there was a big seller on Friday which stuffed the Q’s at 370 – and this level was rejected again on Monday. This was an area that provided major resistance in early ’22 as shown below.

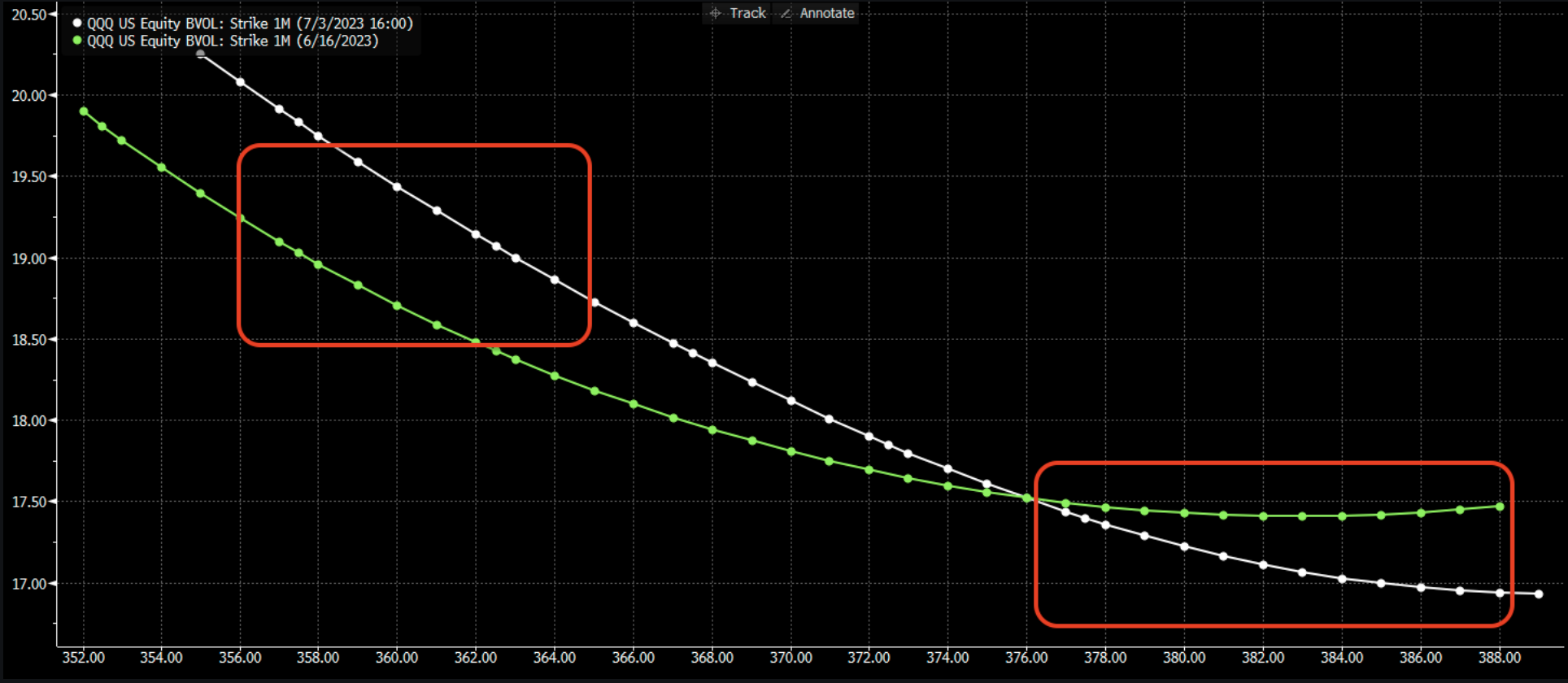

The most recent time this 370 area was tested was on June 16th OPEX, which was a major peak in call implied vol’s. Below we’ve plotted fixed strike IV’s below for 6/16 (green) vs today (white). While those same 370 area, 6/16 QQQ highs were being retested Monday, you can see that the upside strike IV is quite a bit lower (right red box). Further, we see that downside currently has a larger bid, too (left red box). Through this lens there is less relative upside demand with QQQ at these highs.

From an put open interest perspective, much of the QQQ put position (blue) was wiped out on that June 16th expiration. Put interest has increased higher over the last few sessions, and based on the put skew we believe much of this is long put buyers. We don’t have a handle on if these put buyers are re-hedging vs speculative shorts, but taken in context with the 370 area resistance this may be an important juncture for QQQ.

In this case what we think is setting up is some stronger performance of the broader equity space. Shown below is the outperformance of QQQ (blue) vs SPY (red) and the equal-weighted SPY (RSP, white). The changing skew may suggest that the relative performance of the “ex-MegaCap”/”ex-AI” starts to improve.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4455 |

$443 |

$15208 |

$370 |

$1896 |

$187 |

|

SpotGamma Implied 1-Day Move: |

0.88% |

0.88% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.13% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4395 |

$443 |

$14800 |

$369 |

$1850 |

$187 |

|

Absolute Gamma Strike: |

$4400 |

$440 |

$15200 |

$370 |

$1880 |

$190 |

|

SpotGamma Call Wall: |

$4500 |

$450 |

$15200 |

$375 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4200 |

$420 |

$14475 |

$330 |

$1820 |

$180 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4363 |

$443 |

$14070 |

$367 |

$1878 |

$187 |

|

Gamma Tilt: |

1.482 |

1.044 |

2.85 |

1.145 |

1.089 |

0.978 |

|

SpotGamma Gamma Index™: |

1.754 |

0.035 |

0.105 |

0.041 |

0.006 |

-0.003 |

|

Gamma Notional (MM): |

$782.685M |

$237.251M |

$12.956M |

$163.788M |

$6.26M |

‑$18.447M |

|

25 Day Risk Reversal: |

-0.033 |

-0.026 |

-0.025 |

-0.025 |

-0.027 |

-0.009 |

|

Call Volume: |

231.443K |

792.572K |

4.818K |

278.689K |

7.433K |

191.016K |

|

Put Volume: |

488.706K |

854.105K |

6.084K |

436.671K |

14.441K |

144.537K |

|

Call Open Interest: |

5.591M |

6.10M |

56.865K |

4.025M |

199.529K |

3.471M |

|

Put Open Interest: |

11.828M |

13.072M |

64.247K |

8.812M |

363.206K |

6.91M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4500, 4450, 4400, 4300] |

|

SPY Levels: [445, 443, 442, 440] |

|

NDX Levels: [15200, 15150, 15125, 15000] |

|

QQQ Levels: [370, 365, 360, 350] |

|

SPX Combos: [(4665,87.69), (4652,89.44), (4625,75.52), (4598,98.10), (4576,91.31), (4549,98.01), (4527,97.32), (4518,91.95), (4509,83.76), (4500,99.84), (4496,89.30), (4491,87.95), (4487,85.88), (4478,93.23), (4473,98.64), (4469,91.84), (4460,79.04), (4451,97.33), (4424,88.82), (4402,93.55), (4251,82.66)] |

|

SPY Combos: [448.47, 445.81, 458.24, 453.35] |

|

NDX Combos: [15193, 15406, 15285, 15604] |

|

QQQ Combos: [369.64, 374.82, 371.86, 379.63] |