Macro Theme:

Short Term Resistance: 4,500

Short Term Support: 4,425

Risk Pivot Level: 4,400

Major Range High/Resistance: 4,600 – 4,615 (SPY 460/SPX 4,600 Call Wall(s))

Major Range Low/Support: 4,300

‣ IV Ranking suggests many significant single stocks have their lowest IV’s in months, which may be an effective way to play directional movement out of 8/16 – 8/18 expiration**

‣ Current positioning suggests 4,400 would be a major interim low, with traders likely taking a directional cue from Jackson Hole on 8/24-8/26*

‣ We look for a strong directional move out of Jackson Hole on 8/24-8/26*

*updated 8/21

**updated 8/16

Founder’s Note:

ES futures are +50bps to 4,470, with NQ futures +120bps to 15,365 after NVDA’s earnings beat. Resistance above is at 4,450-4,460 (SPY445), with support at 4,430 then 4,400. Intraday volatility estimates remain at 0.79%.

In QQQ resistance is at 375, with support at 363.

Equities yesterday enjoyed some relief from lower rates, as yields came in with US 10 year declining from major highs of 4.35% to 4.2%. These lower rates are particularly well received in tech, which has an additional boost from NVDA’s ER beat (stock at the $500

Call Wall

pre-market). We’d expect NVDA vols to plummet today as the stock wrestles with that major 500 strike (see y’days report).

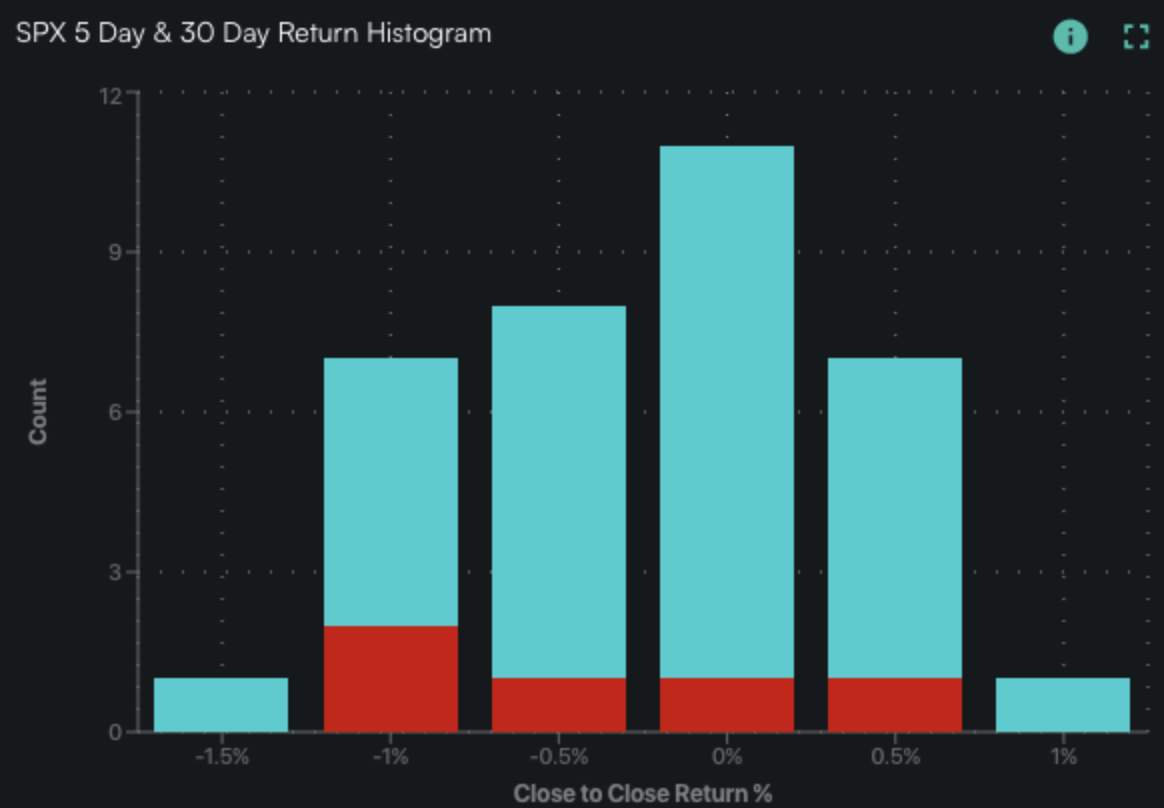

Traders now turn to Powell’s 10AM ET Jackson Hole appearance. As you can see below, there is a bit of event vol tied to the speech, which is against the backdrop of fairly benign IV’s.

If Powell fails to provoke markets, then there should be a decline in IV’s which is a tailwind for equities. Our vanna model depicts a light tailwind, which likely leads to the S&P testing 4,500. Additionally we do not see a significant macro data point until next Fridays NFP, which is then followed by the Labor Day weekend. This indicates that volatilty could slide for the remainder of August as the short vol crowd looks to extract any available premium.

If Powell sparks downside, we’d target 4,300 and high vol-of-vol. IV’s have been tethered to low realized volatility, and should Powell spark some hedging demand IV’s will likely pop higher both due to that demand, and a shift up in realized volatility. This could lead to a violent initial reaction with a 20 VIX , however we do not see fuel for downside much past 4,300.

This limited downside is best seen in our gamma model, wherein the gamma curve starts to flatten out/shift higher <4,300. This suggests that dealer hedging flows would lighten as the S&P breaks 4,300, which could reduce downside volatility. We discussed this model in depth last Friday, and the “limited downside” view outlined in that note remains in play.