Macro Theme:

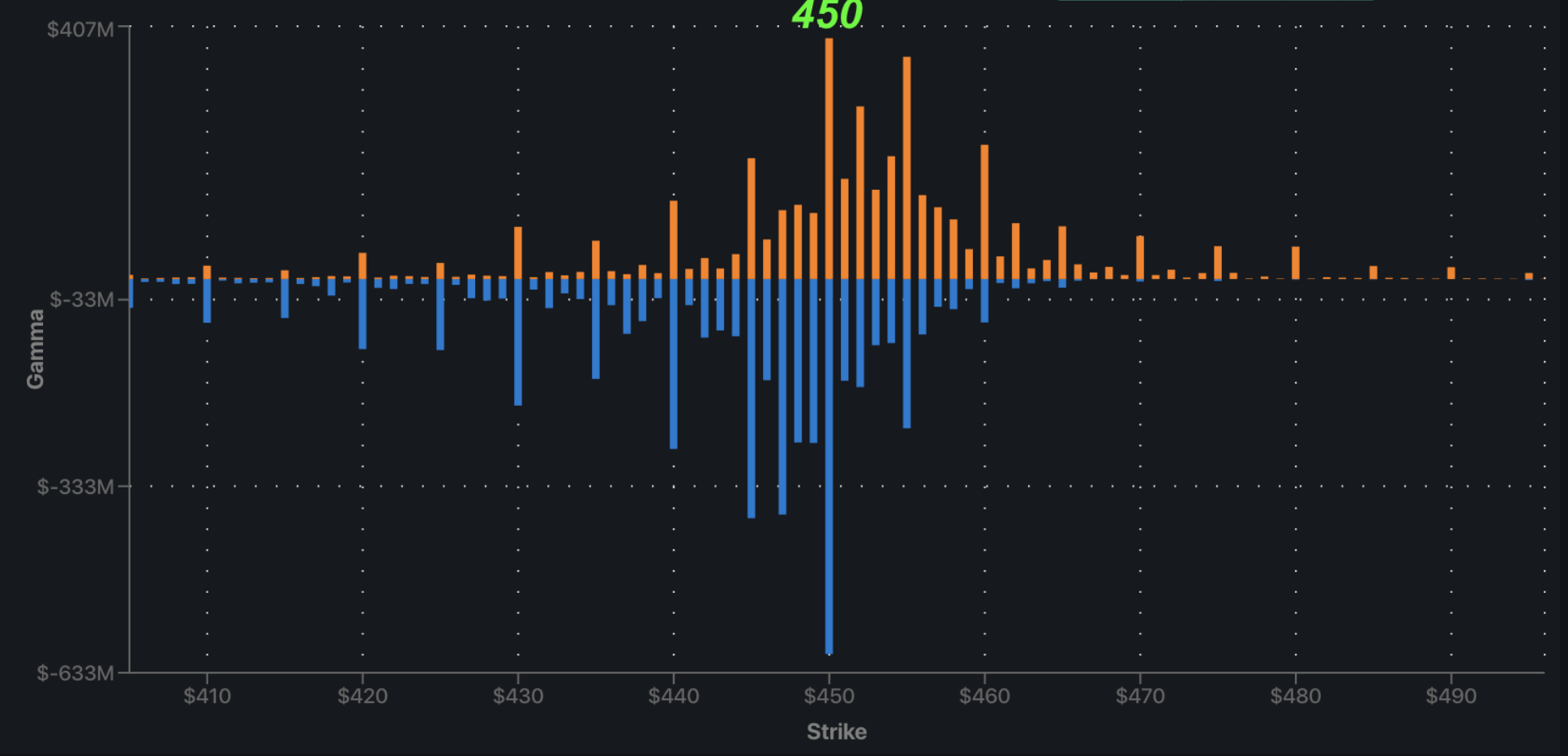

Short Term Resistance: 4,450

Short Term Support: 4,400

Risk Pivot Level: 4,400

Major Range High/Resistance: 4,500 SPX Call Wall

Major Range Low/Support: 4,300 SPX Put Wall

‣ From 8/29 – 9/8 there are a few data points (jobs, ISM) but, (based on IV’s) they are fairly low risk. Added into this window is the Labor Day holiday (next Monday). Entering into the week of 9/11, there are a litany of catalysts including: CPI, big Sep OPEX, VIX Exp & FOMC. This suggests to us vol may be under pressure another ~2 weeks, and then risks pick up. (see map here).*

‣ While we have no particular reason to be bearish, we note that a strong rally into OPEX/VIX Exp would certainly clear up the downside “padding” that we’ve been enjoying (and discussing) over the last few weeks. This could make downside into end of September/October “more available”.*

*updated 8/29

**updated 8/16

Founder’s Note:

Futures are flat to 4,445. We now see medium term resistance filling in around the 4,450 – 4,500 range. For today the resistance is at 4,450, 4,455 (SPY 445), 4,460 (SPY 446

Call Wall

). Support below is from 4,420, to 4,410 (SPY 440) & 4,400. Our range estimate remains at 0.77% (open/close).

In QQQ resistance is at the 370

Call Wall,

with support at 366 then 360.

Our view from last week was that should 4,400 hold, markets would shift higher due to a vanna tailwind into the a vacation-heavy, data-light market. The short term upside target for this week is & was 4,450 – 4,500.

We’re indeed seeing that implied volatility come down as shown by our fixed strike vol dashboard. This is comparing the volatility surface from last Thursday (pre-JHOLE) to today, and the sea of red tells us that IV’s are lower across the board.

The element that gave us some stickiness was (and likely continues to be) 0DTE. As shown below from

HIRO,

the 0DTE flows (teal) and All Expiration flows (purple) are almost perfectly overlaid. The implication for this is that the significant flows from yesterday were all 0DTE. Further, we add that 0DTE was ~54% of total SPX volume, which is nearly a record high (high = 56%). Like clockwork, these 0DTE flows consistently sell rips & buy dips. We highlight these flows often because we believe that one should not read too much into the price action of sessions wherein 0DTE is the bulk of flow.

Zooming out, the picture appears as follows:

From today until the end of next week, there are a few data points (jobs, ISM) but, (based on IV’s) they are fairly low risk. Added into this window is the Labor Day holiday (next Monday). Entering into the week of 9/11, there are a litany of catalysts including: CPI, large Sep OPEX, VIX Exp & FOMC. This suggests to us vol may be under pressure another ~2 weeks, and then risks pick up.

Lastly, while we have no particular reason to be bearish, we note that a strong rally into OPEX/VIX Exp would certainly clear up the downside “padding” that we’ve been enjoying (and discussing) over the last few weeks. This could make downside into end of September/October “more available”.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4433 |

$442 |

$15054 |

$366 |

$1869 |

$185 |

|

SpotGamma Implied 1-Day Move: |

0.77% |

0.77% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.10% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4420 |

$442 |

$14620 |

$366 |

$1850 |

$190 |

|

Absolute Gamma Strike: |

$4400 |

$440 |

$14625 |

$370 |

$1900 |

$185 |

|

SpotGamma Call Wall: |

$4500 |

$446 |

$14625 |

$370 |

$1860 |

$210 |

|

SpotGamma Put Wall: |

$4300 |

$430 |

$15175 |

$360 |

$1750 |

$185 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4441 |

$445 |

$14138 |

$369 |

$1980 |

$194 |

|

Gamma Tilt: |

0.977 |

0.744 |

1.41 |

0.834 |

0.725 |

0.449 |

|

SpotGamma Gamma Index™: |

-0.149 |

-0.288 |

0.045 |

-0.077 |

-0.028 |

-0.124 |

|

Gamma Notional (MM): |

‑$196.992M |

‑$1.286B |

$5.186M |

‑$466.12M |

‑$25.05M |

‑$1.27B |

|

25 Day Risk Reversal: |

-0.047 |

-0.047 |

-0.039 |

-0.037 |

-0.035 |

-0.044 |

|

Call Volume: |

385.282K |

1.547M |

8.682K |

831.468K |

14.85K |

154.78K |

|

Put Volume: |

769.102K |

2.804M |

13.574K |

1.116M |

19.789K |

451.346K |

|

Call Open Interest: |

6.281M |

6.623M |

61.41K |

4.786M |

223.47K |

3.483M |

|

Put Open Interest: |

12.681M |

14.117M |

79.738K |

9.654M |

399.566K |

7.416M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4500, 4450, 4400, 4300] |

|

SPY Levels: [450, 445, 442, 440] |

|

NDX Levels: [15500, 15000, 14625, 14000] |

|

QQQ Levels: [375, 370, 365, 360] |

|

SPX Combos: [(4651,87.63), (4602,94.50), (4575,84.82), (4549,92.69), (4526,92.98), (4509,81.78), (4500,97.10), (4491,82.54), (4487,78.62), (4482,86.82), (4473,91.42), (4469,88.39), (4464,79.68), (4460,89.18), (4455,88.76), (4451,91.36), (4447,74.89), (4416,81.98), (4407,89.39), (4398,95.97), (4385,75.64), (4376,92.00), (4367,77.87), (4358,87.02), (4349,93.88), (4345,79.18), (4340,77.04), (4327,92.18), (4318,74.94), (4305,91.74), (4300,96.92), (4278,77.02), (4256,75.98), (4252,93.64), (4225,83.27)] |

|

SPY Combos: [432.09, 436.96, 421.91, 439.62] |

|

NDX Combos: [14633, 14783, 14362, 14573] |

|

QQQ Combos: [359.07, 352.47, 362.74, 357.6] |

SPX Gamma Model

View All Indices Charts